Uplift

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$292.7MValuation

$0000About Uplift

Uplift develops a fintech marketing platform for traveling purposes. The platform offers a buy now pay later scheme for travel through its partner websites and avails a range of payment plans. The company was founded in 2014 and is based in Sunnyvale, California. In July 2023, Uplift was acquired by Upgrade.

Loading...

Uplift's Product Videos

ESPs containing Uplift

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Uplift named as Challenger among 15 other companies, including PayPal, Affirm, and Klarna.

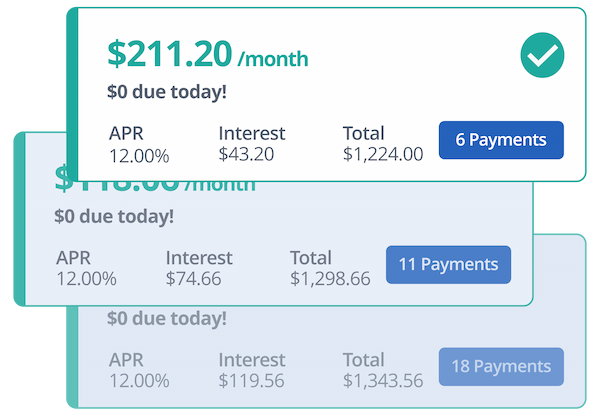

Uplift's Products & Differentiators

Pay Over Time

Monthly installment plan from 3 - 24 months with consumer funded interest from 7% - 36%. Min installment amount $100, maximum installment amount $25,000.

Loading...

Research containing Uplift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uplift in 1 CB Insights research brief, most recently on Oct 3, 2023.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Uplift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uplift is included in 5 Expert Collections, including Travel Technology (Travel Tech).

Travel Technology (Travel Tech)

2,715 items

The travel tech collection includes companies offering tech-enabled services and products for tourists and travel players (hotels, airlines, airports, cruises, etc.). It excludes financial services and micro-mobility solutions.

Digital Lending

2,531 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Uplift Patents

Uplift has filed 13 patents.

The 3 most popular patent topics include:

- analog circuits

- electric power conversion

- electronic amplifiers

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

4/15/2021 | 9/3/2024 | Semiconductor lasers, Total solar eclipses, Solar phenomena, Machine learning, Irregular military | Grant |

Application Date | 4/15/2021 |

|---|---|

Grant Date | 9/3/2024 |

Title | |

Related Topics | Semiconductor lasers, Total solar eclipses, Solar phenomena, Machine learning, Irregular military |

Status | Grant |

Latest Uplift News

Dec 17, 2024

by Sabarna December 17th, 2024 Too Long; Didn't Read Uplift Modeling is a way to model the impact of marketing campaigns on customer conversion. It aims to identify the customers that are the most incremental for an ad campaign. Uplift models the effect treatment has on conversion. When faced with the problem of trying to influence prospective customers into buying your product an obvious choice is to run precisely targeted Marketing campaigns. Now what do the words precise targeting mean. In the Universe of prospective customers there are only so many types. Sure Things : These customers will buy whether or not they receive an ad impression. They are your loyal, brand aware customers that don’t need any convincing to buy from you Lost Causes : These customers are the exact opposite of Sure Things. They will not buy no matter how many ad impressions you target them with. They are probably aware of your brand but are committed to a different vendor or just don’t have a need for the product you sell. Persuadables : These are the customers you want to work with. While they might be initially uncommitted to your brand they will change their mind when exposed to the right kind of ad-messaging. Much of Uplift Modeling is about finding these customers in your population. Sleeping Dogs : Now these are the bunch of customers you do not want to impress with an ad. Theoretically they are the people that, while otherwise a paying customer, would become non-committal when exposed to an ad. Think of suddenly becoming conscious of your automatic payment to Netflix, when shown an ad about a new release and deciding to cancel it. The following is a nice visualization of the different types and their response to treatment(ad exposure) Problem Formulation Imagine you are a Data Scientist working for an e-commerce company, tasked with the objective of identifying the customers that are the most incremental for an ad campaign, to ensure that the campaign budget is spent in the most optimal fashion. The keyword here is incremental. Drawing from our discussions so far, we could define incrementality by looking at the difference between the effect treatment has on customer conversion versus control. That is : Uplift = P(Conversion|Treatment) - P(Conversion|Control) i.e., what is the incremental probability that a customer will convert when shown an ad versus not. Let’s further understand what this metric means for the different types of entities in our Universe of customers. Sure Things : uplift=u.predictUplift(df_test) References [1] Athey, S., & Imbens, G. W. (2015). Machine learning methods for estimating heterogeneous causal effects. stat, 1050(5). [2]Nicholas J Radcliffe and Patrick D Surry. Real-world uplift modelling with significance based uplift trees. White Paper TR-2011–1, Stochastic Solutions, 2011. [3]Gutierrez, P., & Gérardy, J. Y. (2017, July). Causal Inference and Uplift Modelling: A Review of the Literature. In International Conference on Predictive Applications and APIs (pp. 1–13). [4]Piotr Rzepakowski and Szymon Jaroszewicz. Decision trees for uplift modeling with single and multiple treatments. Knowledge and Information Systems, 32(2):303–327, 2012 [5]Leo Guelman, Montserrat Guill´en, and Ana M P´erez-Mar´ın. Uplift random forests. Cybernetics and Systems, 46(3–4):230–248, 2015. Acknowledgements A big thanks to Robert Yi and Will Frost for their package (Pylift) and our discussions that helped me understand Uplift modeling better. Also thanks to Kaashyap Thiyagaraj helping me test CHUC and provide crucial feedback. L O A D I N G . . . comments & more!

Uplift Frequently Asked Questions (FAQ)

When was Uplift founded?

Uplift was founded in 2014.

Where is Uplift's headquarters?

Uplift's headquarters is located at 440 N. Wolfe Road, Sunnyvale.

What is Uplift's latest funding round?

Uplift's latest funding round is Acquired.

How much did Uplift raise?

Uplift raised a total of $292.7M.

Who are the investors of Uplift?

Investors of Uplift include Upgrade, Atalaya Capital Management, Paycheck Protection Program, PAR Capital, DNX Ventures and 11 more.

Who are Uplift's competitors?

Competitors of Uplift include Kadogo and 7 more.

What products does Uplift offer?

Uplift's products include Pay Over Time and 1 more.

Loading...

Compare Uplift to Competitors

Zilch provides buy now pay later services across various online retail sectors. The company offers a payment solution that allows customers to make purchases and pay for them over six weeks. It primarily serves the ecommerce industry with its virtual Mastercard. The company was founded in 2018 and is based in London, United Kingdom.

Klarna is a financial technology company that provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. It was founded in 2005 and is based in Stockholm, Sweden.

PayItLater is a financial services company specializing in deferred payment solutions for the e-commerce sector. The company offers consumers the ability to make online purchases and pay for them over time through interest-free installment plans, with instant credit approvals and no impact on credit scores. PayItLater also provides merchants with plugins for major e-commerce platforms, enabling them to offer live deferred payments to customers. It is based in New South Wales, Australia.

Anyday provides payment splitting services within the financial services sector. It offers consumers the ability to split their online shopping payments into interest-free installments, enhancing the shopping experience with flexible payment options. The company primarily caters to the e-commerce industry, offering a payment solution that allows shoppers to buy now and pay later without incurring additional fees. It was founded in 2020 and is based in Aarhus N, Denmark.

Butter focuses on financial services in the e-commerce sector. It offers a service that allows customers to make online purchases and pay for them over time, including for items such as travel, fashion, tech, and home goods. The company primarily serves the e-commerce industry. Butter was formerly known as Awaymo. It was founded in 2017 and is based in London, United Kingdom.

Partial.ly is a company specializing in payment plan software within the e-commerce and invoicing sectors. They provide a platform that enables merchants to offer flexible, automated installment payments for products and services, catering to both e-commerce businesses and service providers with large invoices. The software integrates with various e-commerce and invoicing systems, allowing businesses to offer custom payment terms to their customers. It was founded in 2015 and is based in Tampa, Florida.

Loading...