Zilch

Founded Year

2018Stage

Line of Credit | AliveTotal Raised

$581.36MLast Raised

$64.8M | 4 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-15 points in the past 30 days

About Zilch

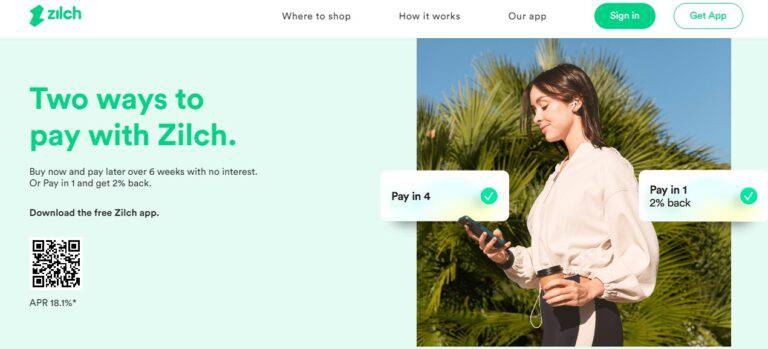

Zilch provides buy now pay later services across various online retail sectors. The company offers a payment solution that allows customers to make purchases and pay for them over six weeks. It primarily serves the ecommerce industry with its virtual Mastercard. The company was founded in 2018 and is based in London, United Kingdom.

Loading...

Zilch's Product Videos

ESPs containing Zilch

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

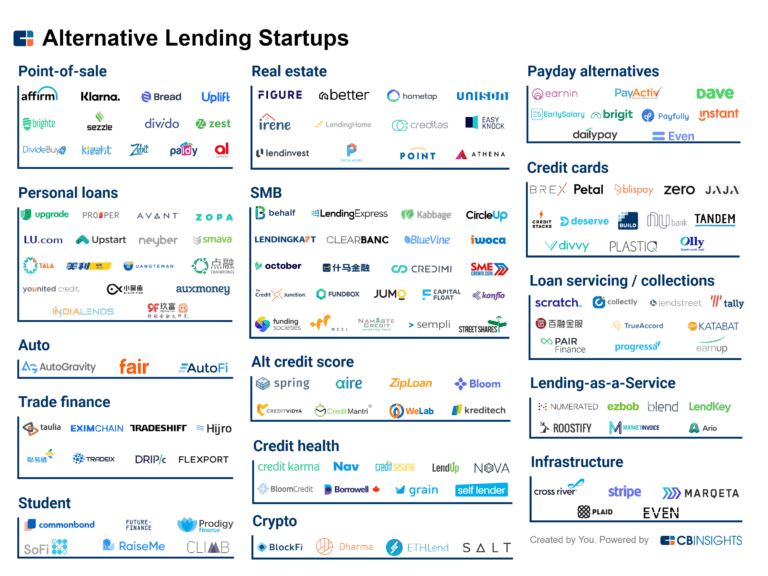

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Zilch named as Outperformer among 15 other companies, including PayPal, Affirm, and Klarna.

Zilch's Products & Differentiators

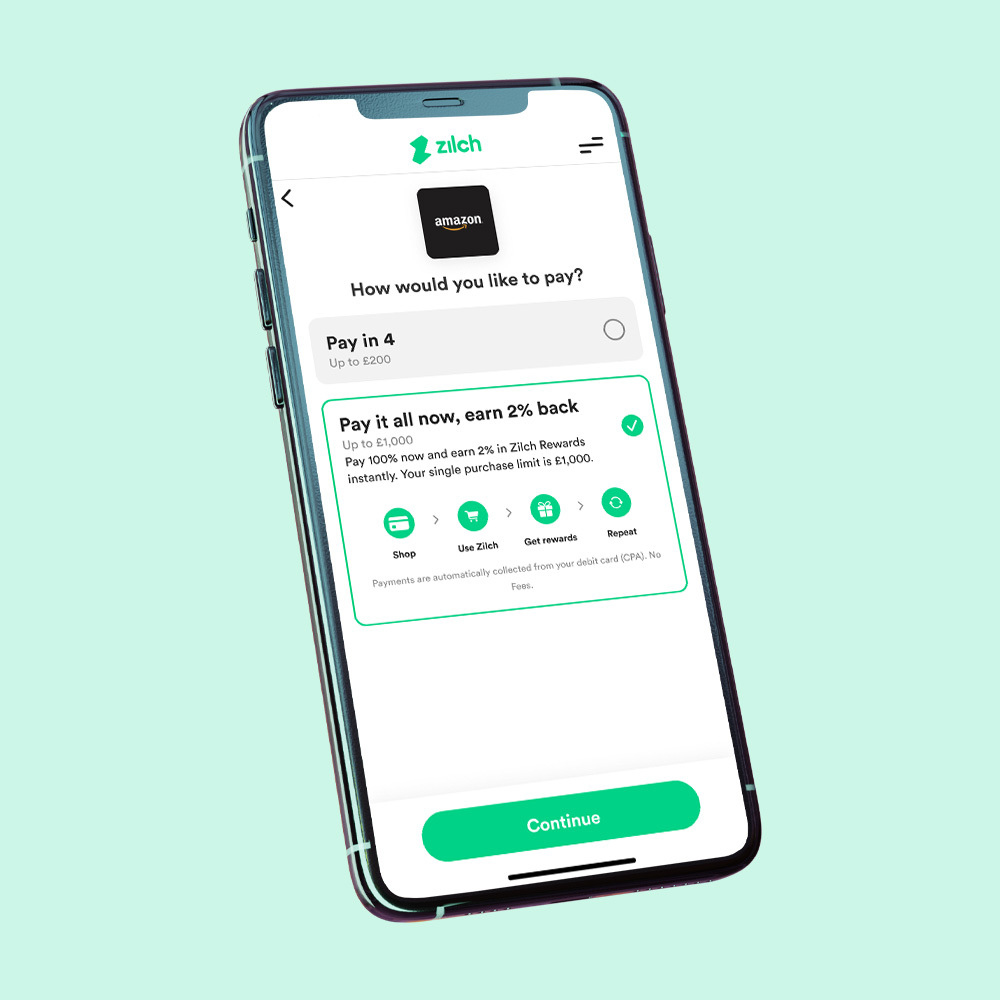

Pay in 1

Pay online or Tap & Pay anywhere in one and receive immediate cash back

Loading...

Research containing Zilch

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zilch in 4 CB Insights research briefs, most recently on Aug 22, 2022.

Expert Collections containing Zilch

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

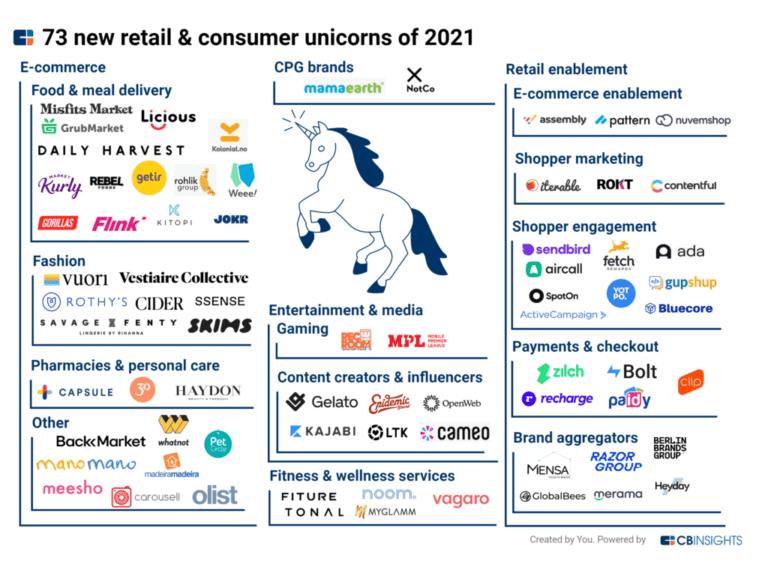

Zilch is included in 6 Expert Collections, including E-Commerce.

E-Commerce

11,359 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,257 items

Digital Lending

2,531 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Zilch Patents

Zilch has filed 5 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/4/2009 | 9/22/2009 | Grant |

Application Date | 3/4/2009 |

|---|---|

Grant Date | 9/22/2009 |

Title | |

Related Topics | |

Status | Grant |

Latest Zilch News

Jan 14, 2025

Tuesday 14 January 2025 15:04 CET | News Zilch has announced the launch of Zilch Travel, a service designed to make booking and paying for holidays more convenient and rewarding. The service, powered by lastminute.com, a European provider of Dynamic Holiday Packages, allows users to search, book, and pay for holidays, hotels, and flights directly through the Zilch app. Customers can earn up to 3% cashback on travel bookings or choose to spread the cost of their trips with interest-free payment plans over six weeks or three months. All transactions are fully transparent, with no hidden fees. A strategic expansion for Zilch Zilch’s entry into the travel sector builds on the success of its Pay over 3 Months product, which has driven significant growth for the platform. With the introduction of Zilch Travel, the company aims to further expand its share of wallets and meet customer demand for convenient, cost-effective travel solutions. This collaboration between Zilch and lastminute.com highlights the ongoing shift towards integrating fintech solutions with everyday expenses, offering consumers greater flexibility, and control over their finances. Meeting the growing demand for flexible travel solutions As travel spending continues to rise, becoming one of the largest household expenses, Zilch Travel addresses a growing need for smarter, flexible payment options. In 2024, travel spending hit an all-time high, driving a 140% year-on-year increase in the category for Zilch. Nearly half of families now plan their trips 5 to 12 weeks before departure , underscoring the demand for flexible financial solutions. Zilch Travel offers a simpler booking experience, allowing users to manage payments and earn rewards through a single platform. The partnership with lastminute.com combines its booking technology with Zilch’s payment solutions, making travel planning more accessible and rewarding. The future of fintech in travel The fintech sector is poised to transform the travel industry by offering innovative payment solutions and improving customer experiences. Consumers are seeking more transparent and adaptable financial solutions to fund their travel plans, with nearly 60% of millennials prioritising payment flexibility when booking trips. Platforms like Zilch are well-positioned to capitalise on this trend by integrating interest-free instalment plans and cashback rewards, catering to a cost-conscious yet experience-driven audience. As economic uncertainty continues to shape spending habits, the ability to spread travel costs while earning rewards could become a standard expectation among travellers. Personalisation and emerging technologies are set to play a pivotal role in the future of travel fintech. AI-driven tools, such as predictive analytics and dynamic pricing algorithms, are increasingly being adopted to refine these personalised experiences. Companies like Zilch could integrate AI to analyse user preferences and offer customised travel packages, improving both engagement and conversion rates. Additionally, leveraging AI to predict booking trends and adjust rewards dynamically could strengthen customer loyalty. As fintech continues to converge with travel technology, the industry is moving toward a simple, hyper-personalised ecosystem where payment flexibility and AI-powered recommendations drive the next phase of growth. Free Headlines in your E-mail Every day we send out a free e-mail with the most important headlines of the last 24 hours.

Zilch Frequently Asked Questions (FAQ)

When was Zilch founded?

Zilch was founded in 2018.

Where is Zilch's headquarters?

Zilch's headquarters is located at 111 Buckingham Palace Road, London.

What is Zilch's latest funding round?

Zilch's latest funding round is Line of Credit.

How much did Zilch raise?

Zilch raised a total of $581.36M.

Who are the investors of Zilch?

Investors of Zilch include Deutsche Bank, Leading European Tech Scaleups, eBay Ventures, Gauss Ventures, Ventura Capital and 7 more.

Who are Zilch's competitors?

Competitors of Zilch include Klarna, Hokodo, Mondu, Tabby, BharatX and 7 more.

What products does Zilch offer?

Zilch's products include Pay in 1 and 2 more.

Loading...

Compare Zilch to Competitors

Klarna is a financial technology company that provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. It was founded in 2005 and is based in Stockholm, Sweden.

PayItLater is a financial services company specializing in deferred payment solutions for the e-commerce sector. The company offers consumers the ability to make online purchases and pay for them over time through interest-free installment plans, with instant credit approvals and no impact on credit scores. PayItLater also provides merchants with plugins for major e-commerce platforms, enabling them to offer live deferred payments to customers. It is based in New South Wales, Australia.

SplitIt provides card-linked installment payment solutions within the financial technology sector. The company offers a platform that allows merchants to provide consumers with the ability to pay for purchases in installments using their existing credit cards, without the need for new loans or applications. SplitIt serves various industries, including automotive, consumer electronics, education, and healthcare, by providing services such as e-commerce installments, omnichannel payment solutions, and a 'pay after delivery' option. SplitIt was formerly known as PayItSimple. It was founded in 2012 and is based in Atlanta, Georgia.

Billie specializes in BNPL payment methods for the B2B sector and offers digital payment services. The company's main offerings include modern checkout solutions that enable businesses to pay and get paid on their terms, with features such as upfront payment for sellers and flexible payment terms for buyers. Billie's services cater to a variety of sectors, including e-commerce, telesales, and in-person sales channels. It was founded in 2016 and is based in Berlin, Germany.

Butter focuses on financial services in the e-commerce sector. It offers a service that allows customers to make online purchases and pay for them over time, including for items such as travel, fashion, tech, and home goods. The company primarily serves the e-commerce industry. Butter was formerly known as Awaymo. It was founded in 2017 and is based in London, United Kingdom.

Payl8r specializes in providing flexible payment options for customers, operating in the financial services sector with a focus on buy now, pay later (BNPL) solutions. The company offers a range of financing products that allow consumers to make purchases online and in-store and pay over time, including short-term interest-free loans and longer-term financing plans. Payl8r serves various industries, including eCommerce, beauty and aesthetics, fitness, and professional services, by offering tailored finance solutions. It was founded in 2014 and is based in Manchester, England.

Loading...