Ramp

Founded Year

2019Stage

Series D - II | AliveTotal Raised

$1.827BValuation

$0000Last Raised

$150M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+35 points in the past 30 days

About Ramp

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Loading...

ESPs containing Ramp

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The automated payments reconciliation market provides a streamlined and efficient solution for reconciling payments. Auto reconciliation refers to the automated process of matching incoming payments with corresponding invoices or transactions, eliminating the need for manual reconciliation efforts. By automating the reconciliation process, businesses can save time, reduce errors, and improve finan…

Ramp named as Highflier among 15 other companies, including Stripe, Tipalti, and Flywire.

Ramp's Products & Differentiators

Ramp Card

Smart corporate cards - both physical and virtual - with embedded software controls.

Loading...

Research containing Ramp

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ramp in 21 CB Insights research briefs, most recently on Oct 9, 2024.

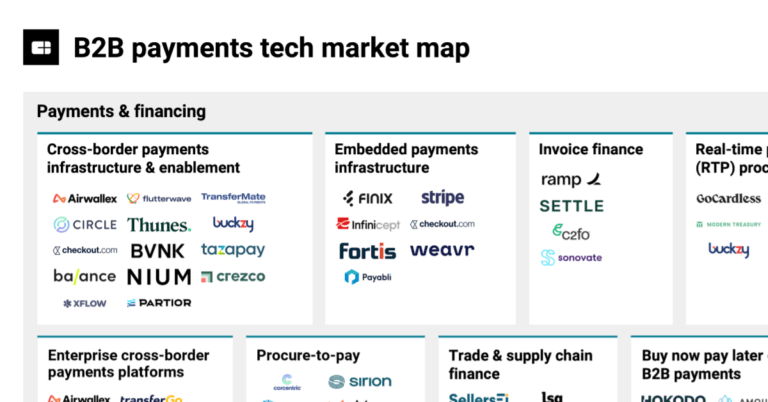

Aug 23, 2024

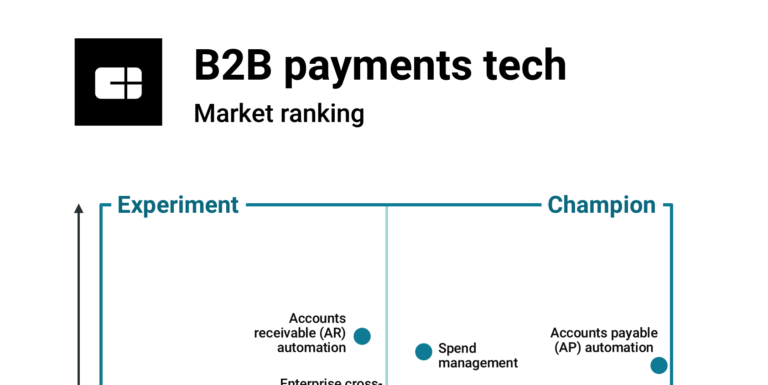

The B2B payments tech market map

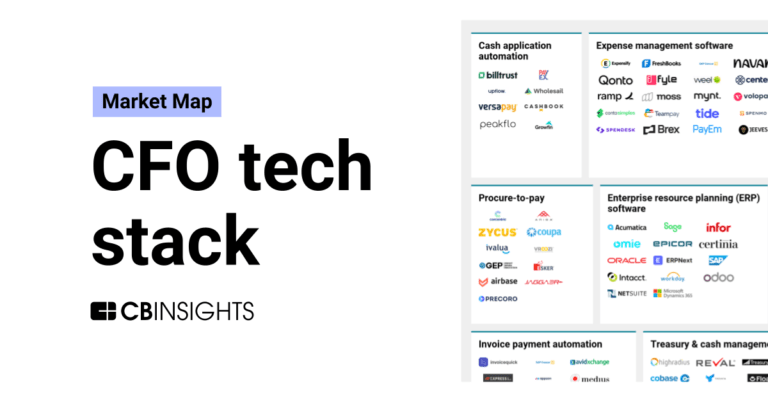

Oct 26, 2023

The CFO tech stack market map

Oct 18, 2023 report

State of Fintech Q3’23 Report

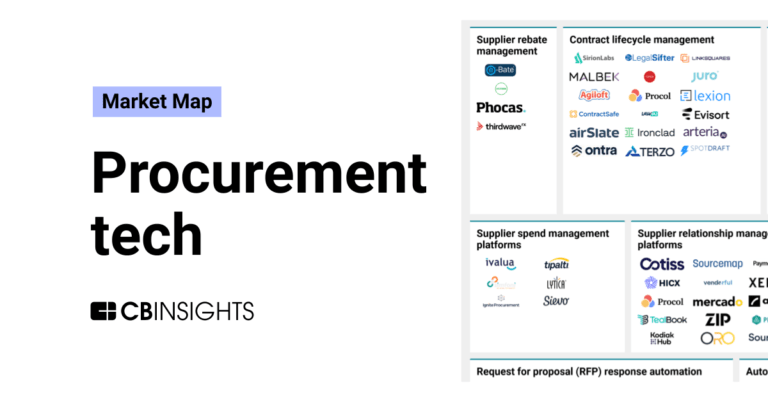

Oct 12, 2023

The procurement tech market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Ramp

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ramp is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

SMB Fintech

2,003 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

599 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Ramp News

Jan 24, 2025

Other news and construction management platform Tractics are partnering to integrate Sage Intacct Construction and the Tractics construction management platform, providing heavy civil contractors a comprehensive solution for managing financial and operational data from the field to the office. This integration offers real-time data visibility, streamlines workflows, and simplifies accounting processes for improved efficiency. … Business solutions provider Ben Plewes BA (Hons) LBIPP Spend management solution provider lets businesses store cash in a business account that earns 2.5% interest, or in an investment account with the potential for higher yields, all within the same platform they already use to pay their bills. Users can create as many business accounts as they need versus having to juggle multiple accounts and passwords. They can also set a target balance for their Ramp Business Account and top up from their checking account. Upon opening a Ramp Business Account, Ramp will pay users a monthly cash reward, calculated as a percentage of their deposited funds. They begin earning on the first dollar they deposit, and there is no cap to how much they can earn. Earnings are disbursed automatically by Ramp each month. Earnings are paid as cash, versus statement credits or rewards requiring redemption. Instead, the customer can transfer earnings from their Ramp Business Account to be used as cash elsewhere. Caseware buys AI document management startup Accounting and auditing analytics software company ) Extractly offers the ability to automatically extract and integrate data from digital or scanned documents, including handwritten notes, into one's workpapers and documents. It also features smart data linking to reduce the need for manual searching and data extraction. The program offers support for text in English, French, Spanish, Portuguese, Italian and German. Users have the ability to click on any cell in an Excel workpaper to navigate to the exact location in the linked document where the data originated. Users can redact sensitive information, highlight relevant links and flexibly restructure data. An AutoSum feature can automatically verify data within documents. Other features include analytics and metrics tracking; and varied permissions tailored to different roles within a team. FloQuast achieves ISO 42001 certification on AI systems The Muse , the globally recognized standard for establishing, implementing, maintaining, and continually improving an Artificial Intelligence Management System (AIMS). The certification provides a structured framework for organizations to govern AI development and use ethically, transparently, and in accordance with international best practices. FloQast's ISO 42001 certification was achieved following a rigorous external audit, where FloQast's AI systems, governance policies, and risk management practices were evaluated to ensure compliance with the standard. FloQast's ISO 42001 certification highlights the organization's investment in ethical AI development practices, risk management, and customer-centric innovation. CPAClub launches AI-powered CPAClub Coach Accounting talent solutions provider announced the release of its new CPAClub Coach, which is touted as an AI-powered advisor combined with live CPA expertise. CPAClub Coach is designed to bridge the talent gap in accounting by integrating artificial intelligence with live expert support, offering members personalized coaching as well as standards-based guidance on both accounting and audit-related questions. Members also have access to experienced professionals for more complex issues. Based on members' inquiries, CPAClub Coach may recommend specific nano-learning courses from a custom-developed, growing library, promoting professional growth and reducing the reliance on overburdened supervisors. CPAClub also touted its library of resources for complying with AICPA's Statement on Quality Management Standards (SQMS) and PCAOB QC 1000. Both the SQMS and PCAOB QC 1000 must be implemented by December 15, 2025, marking a significant shift in how firms approach quality management. CPAClub pointed to its expanded partnership with Caseware to author these resources to be integrated into the Caseware SQM application.

Ramp Frequently Asked Questions (FAQ)

When was Ramp founded?

Ramp was founded in 2019.

Where is Ramp's headquarters?

Ramp's headquarters is located at 28 West 23rd Street, New York.

What is Ramp's latest funding round?

Ramp's latest funding round is Series D - II.

How much did Ramp raise?

Ramp raised a total of $1.827B.

Who are the investors of Ramp?

Investors of Ramp include Founders Fund, D1 Capital Partners, Thrive Capital, General Catalyst, Lux Capital and 32 more.

Who are Ramp's competitors?

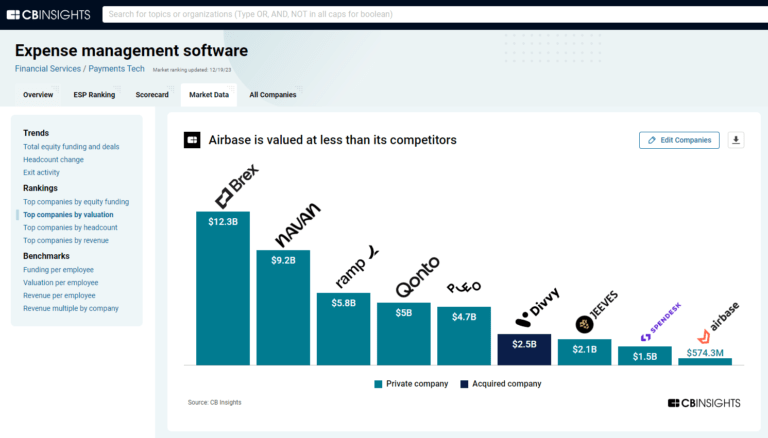

Competitors of Ramp include Brex, Extend, Tribal Credit, JustPaid, Procurify and 7 more.

What products does Ramp offer?

Ramp's products include Ramp Card and 4 more.

Who are Ramp's customers?

Customers of Ramp include Mode Analytics.

Loading...

Compare Ramp to Competitors

Brex is a financial technology company that specializes in AI-powered spend management for businesses. The company offers corporate credit cards, automated expense management, and bill payment software, as well as banking and treasury services that include deposits and FDIC-insured accounts. Brex primarily serves startups, mid-size companies, and enterprises, providing them with tools to control and track company spending. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Spendesk provides financial management tools for businesses. The company offers tools including corporate cards, automated invoice handling, procure-to-pay solutions, integrated budgeting features, virtual cards for payments, and expense claim management. It serves various sectors of the economy, including manufacturing, retail, green energy, and marketing. The company was founded in 2016 and is based in Paris, France.

Payhawk is a spend management platform that operates in the financial technology sector. The company offers a suite of tools for managing corporate expenses, including the issuance of corporate cards, automation of expense management, and comprehensive accounts payable software. Payhawk's solutions are designed to provide real-time visibility and control over business spending, streamline financial operations, and integrate with existing ERP and accounting systems. It was founded in 2018 and is based in London, United Kingdom.

Center specializes in expense management solutions within the financial technology sector. The company offers a connected corporate card and expense management software that provides visibility into employee spending and streamlines the expense reporting process. Center was formerly known as Touchstone ID. It was founded in 2017 and is based in Bellevue, Washington. In April 2024, Center was acquired by Direct Travel.

Loading...