Spendesk

Founded Year

2016Stage

Incubator/Accelerator | AliveTotal Raised

$300.34MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+75 points in the past 30 days

About Spendesk

Spendesk provides financial management tools for businesses. The company offers tools including corporate cards, automated invoice handling, procure-to-pay solutions, integrated budgeting features, virtual cards for payments, and expense claim management. It serves various sectors of the economy, including manufacturing, retail, green energy, and marketing. The company was founded in 2016 and is based in Paris, France.

Loading...

Loading...

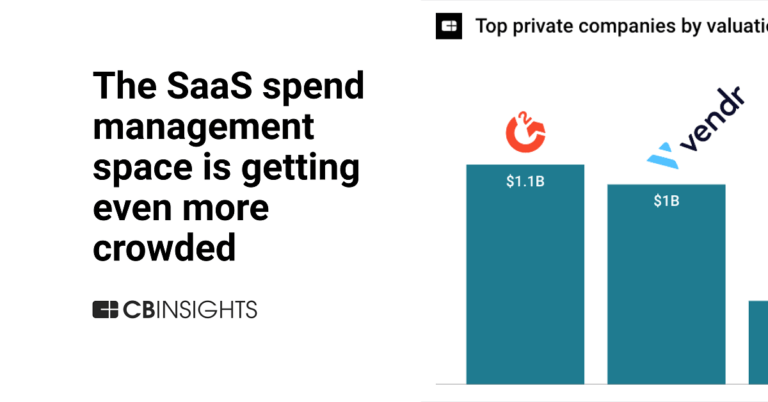

Research containing Spendesk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Spendesk in 10 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

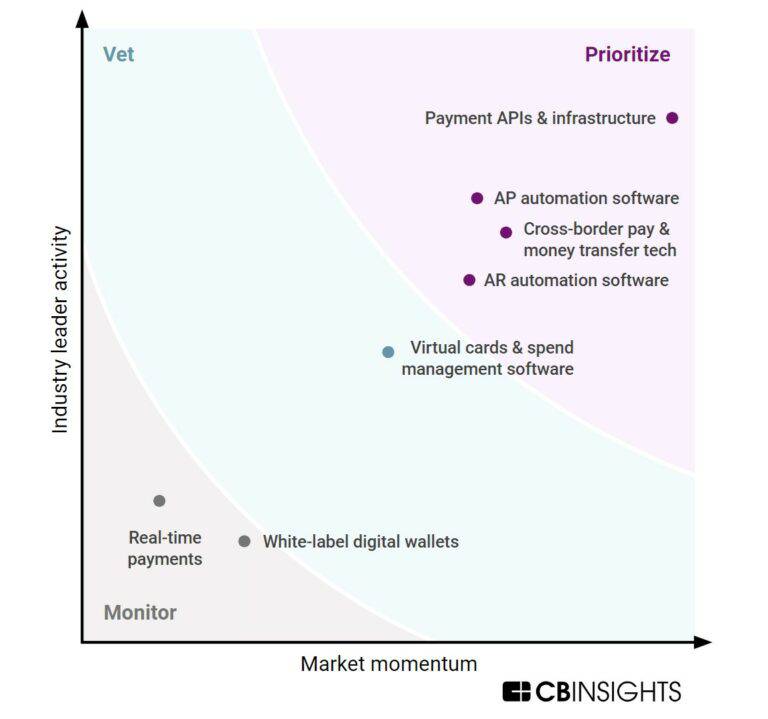

The B2B payments tech market map

Oct 26, 2023

The CFO tech stack market map

Oct 12, 2023

The procurement tech market map

Oct 25, 2022

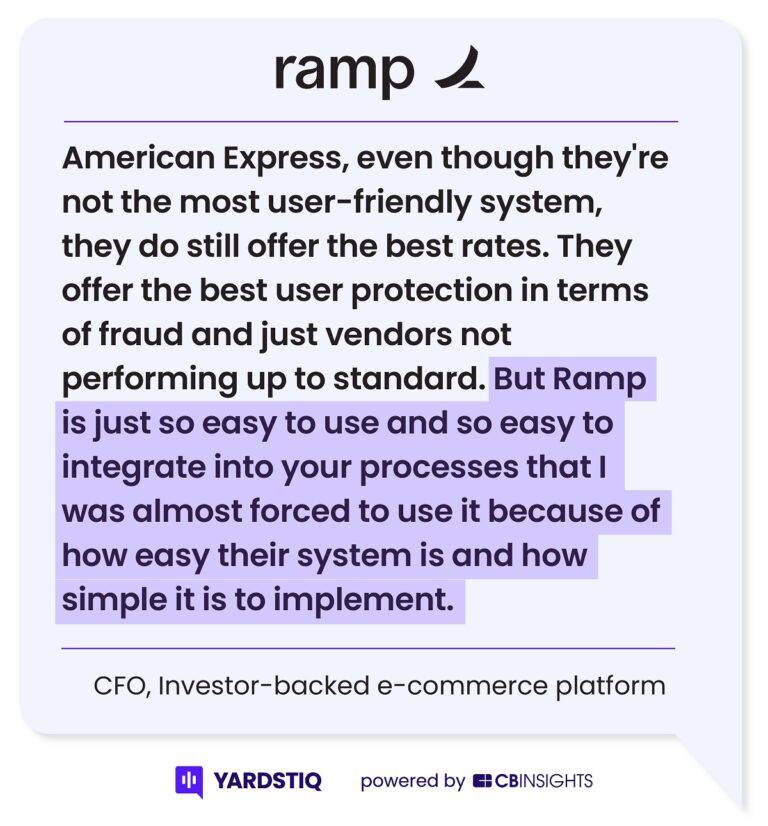

The Transcript from Yardstiq: Toppling Salesforce

Oct 4, 2022

The Transcript from Yardstiq: Ramp vs. BrexExpert Collections containing Spendesk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Spendesk is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Spendesk News

Dec 23, 2024

Fintech Trends for 2025: AI Innovation, Shifting Business Models, and Evolving Leadership Skills – by Axel Demazy, CEO of Spendesk Guest Post by Axel Demazy , CEO of Spendesk Making accurate forecasts for the year ahead is a tricky task for any business, but there is plenty of evidence to suggest that 2025 can be a bright one for the fintech sector. While there were challenges in 2024, with investment in the industry continuing to fall, there are many positive developments that fintech companies can use to their advantage in the months ahead. The ongoing push to accelerate digitalisation of European businesses is creating genuine opportunities for innovative financial institutions – and the rise of AI should raise the pace even more. Focusing on the creation of lean, future-proofed business models and investing in the right technologies will be key for fintechs that want to make a success of 2025. Here’s a look at the major trends that will shape the coming year for the sector. Innovation to the fore, driven by AI The increasing investment in AI by fintech organisations will continue in 2025, with projections indicating a compound annual growth rate (CAGR) of 19.72% for this market until 2032 – by which point investments will have reached a staggering $61.6 billion globally. In key markets such as the UK, the adoption rate for AI solutions among SMBs has grown more than 32 times in the two years from 2022 to 2024. AI is a loose term, covering many different technologies, but it can be applied to a variety of use cases across finance such as fraud detection, customer services, reducing risk and enabling better decision-making. This means there is great potential for innovation driven by fintech companies, as disruptive organisations seek to create tools that will help financial institutions meet the needs of their customers as well as regulatory demands. The application of AI to fraud detection is a particularly interesting area, with cybercrime on the rise and banks needing to ensure the security of transactions and customer data. Fintechs that are helping businesses adapt to changing regulation also have a big opportunity over the next year. For example, in France where the government is introducing laws to mandate e-invoicing between companies, fintechs (such as Spendesk) are becoming partner dematerialization platforms (PDPs) – and can establish themselves as key partners for businesses. Shifting business models As the fintech market becomes more crowded we will see increasing amounts of consolidation. Organisations that have built their business models around high interest rates will be forced to pivot as these rates come down. This means they may merge or partner with other fintech providers to broaden their services for clients. But another possibility for such fintechs lies in collaborating with large, established financial institutions. Big banks that have long innovation cycles due to internal bureaucracy and legacy infrastructure can quickly provide market-leading services to their customers by partnering with – or even acquiring – fintech companies. For example, Lloyds has recently partnered with PayPoint Group to expand its service offering for SMBs, while UniCredit this year acquired Banking-as-a-Service (BaaS) provider Vodeno to bolster its embedded finance offering. Speaking of embedded finance, this will be one of the key growth areas in fintech in 2025; consumers increasingly expect to be able to access financial services through the ecommerce platforms and other apps they use every day. With the rise of BaaS, more companies are able to offer customers financial services such as payments, loans, investments, and insurance. Platforms that offer white-label access to these services will be hot property over the coming year. Evolving your leadership skills The coming year will be a challenge for fast-growing fintech companies. There is a steep learning curve from building prototype products and rallying investors, to managing and scaling a profitable business day-to-day. It’s therefore vital that leaders evolve their skills and perspectives as fintech companies grow. It’s important to retain the agility that fosters innovation; but reaching the next level requires a focus on sustaining a business model fit for the longer term, and structures will need to be streamlined to keep the organisation fit for the challenges that lie ahead. Factors such as regulation and compliance must form a part of growth strategies, and the businesses that will be most successful are the ones that recognise the need for excellence in KYC, AML and data privacy processes, as their customers and partners will demand this. The best approach to compliance is to turn it into a selling point for your organisation; fintechs that treat regulation as an afterthought or see it as a blocker are setting themselves up for failure. Opportunities abound for fintech in 2025 – but so do risks While fintech investment seems likely to maintain a downward trajectory in 2025, there are some areas such as the UK that are bucking the trend . But more consolidation is highly likely in the coming year, and only the strongest business models will survive. Fintechs that recognise the value of closely conforming to regulations – and that can communicate this value clearly to customers and partners – have the best chance of getting themselves noticed, as will those that learn how to blend innovation with long-term thinking. And while artificial intelligence is likely to play a big part in enabling this innovation, it’s up to humans to display the strong leadership required to weather any storms ahead. Source: VCWire

Spendesk Frequently Asked Questions (FAQ)

When was Spendesk founded?

Spendesk was founded in 2016.

Where is Spendesk's headquarters?

Spendesk's headquarters is located at 51 rue de Londres, Paris.

What is Spendesk's latest funding round?

Spendesk's latest funding round is Incubator/Accelerator.

How much did Spendesk raise?

Spendesk raised a total of $300.34M.

Who are the investors of Spendesk?

Investors of Spendesk include Leading European Tech Scaleups, Index Ventures, Eight Roads Ventures, FundersClub, General Atlantic and 12 more.

Who are Spendesk's competitors?

Competitors of Spendesk include Yokoy, IPaidThat, Qonto, Pleo, Airbase and 7 more.

Loading...

Compare Spendesk to Competitors

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Payhawk is a spend management platform that operates in the financial technology sector. The company offers a suite of tools for managing corporate expenses, including the issuance of corporate cards, automation of expense management, and comprehensive accounts payable software. Payhawk's solutions are designed to provide real-time visibility and control over business spending, streamline financial operations, and integrate with existing ERP and accounting systems. It was founded in 2018 and is based in London, United Kingdom.

Brex is a financial technology company that specializes in AI-powered spend management for businesses. The company offers corporate credit cards, automated expense management, and bill payment software, as well as banking and treasury services that include deposits and FDIC-insured accounts. Brex primarily serves startups, mid-size companies, and enterprises, providing them with tools to control and track company spending. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Mooncard operates as a software-as-a-service (SaaS) company that focuses on business expenses and corporate spend management. The company offers smart payment cards linked to accounting and management software, which automate expense reports and simplify the daily lives of employees. It primarily serves companies of all sizes across various sectors. The company was founded in 2016 and is based in Paris, France.

Loading...