Payhawk

Founded Year

2018Stage

Series B - II | AliveTotal Raised

$236.5MValuation

$0000Last Raised

$100M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-68 points in the past 30 days

About Payhawk

Payhawk is a spend management platform that operates in the financial technology sector. The company offers a suite of tools for managing corporate expenses, including the issuance of corporate cards, automation of expense management, and comprehensive accounts payable software. Payhawk's solutions are designed to provide real-time visibility and control over business spending, streamline financial operations, and integrate with existing ERP and accounting systems. It was founded in 2018 and is based in London, United Kingdom.

Loading...

Payhawk's Product Videos

ESPs containing Payhawk

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

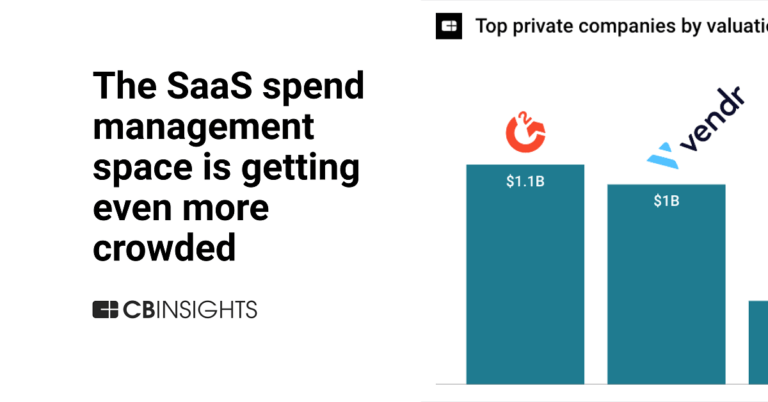

The spend management market enable businesses to efficiently manage and control their expenditures through a suite of integrated software solutions, including virtual corporate cards, expense management systems, procurement software, budget tracking tools, and supplier management platforms. Vendors use APIs and cloud-based platforms to integrate these solutions into existing financial and operatio…

Payhawk named as Outperformer among 15 other companies, including Coupa, Ramp, and Brex.

Payhawk's Products & Differentiators

Payhawk

• Integrated global solution for managing company spending • Corporate bank accounts in multiple currencies with dedicated IBANs • Global company cards • Mobile app for employees • Powerful and flexible software for the finance accounting team • Best-in-class direct integrations with ERP mean no manual data transfer (especially Xero and Oracle NetSuite)

Loading...

Research containing Payhawk

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Payhawk in 11 CB Insights research briefs, most recently on Aug 23, 2024.

Aug 23, 2024

The B2B payments tech market map

Oct 11, 2022

The Transcript from Yardstiq: Klarna vs. Afterpay

Oct 4, 2022

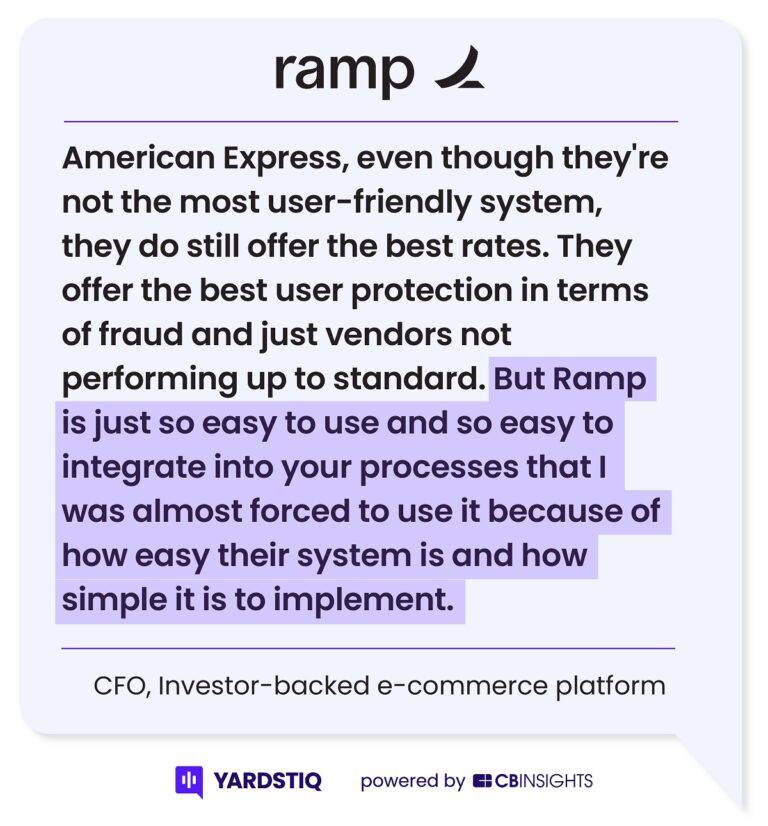

The Transcript from Yardstiq: Ramp vs. BrexExpert Collections containing Payhawk

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Payhawk is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

SMB Fintech

1,648 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

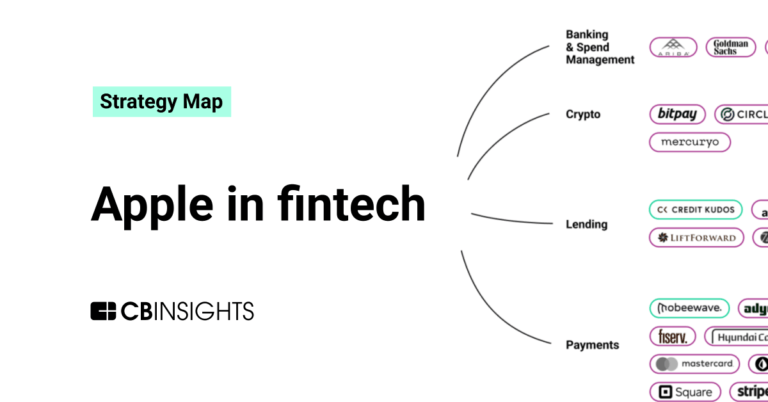

Fintech

13,559 items

Excludes US-based companies

Fintech 100

449 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech 100 (2024)

100 items

Latest Payhawk News

Jan 20, 2025

Outfindo, a Prague-based startup transforming online shopping, has raised €1.2 million in a late-seed funding round to accelerate growth and expand into its go-to-market channels. The round was led by Eleven Ventures with participation from Dronamics, Payhawk, NitroPack, as well as Lighthouse Ventures and Borovicka Capital. Eleven Ventures shared the announcement on their website. About Outfindo Founded in 2020 by Jan Mateju, Ondrej Bouda and Martin Chrz, Outfindo is an AI-tech startup focused on simplifying the online selection of complex products. Its flagship product, the Product Guide, seamlessly integrates with merchants' websites, helping customers navigate the decision-making process through a series of intuitive questions. This allows users to narrow down product choices to the most suitable options for their needs. Outfindo’s technology is powered by two AI models: Outfindo Beacon, which analyzes customer behavior to deliver personalized recommendations, and Outfindo Diver, which processes product data to ensure the highest level of accuracy. “Our vision is that AI will reshape how we shop and how we select the right products for our needs. Outfindo’s value proposition is perfectly aligned in that direction, and they allow e-commerce stores to provide great user experience and continue to compete with the big guys,” says Ivaylo Simov, Partner at Eleven Ventures. Outfindo supports over 20 product verticals and plans to expand into categories like electronics, home appliances, sports equipment, and childcare products. The company also aims to launch a self-service solution, enabling smaller e-commerce retailers to implement its tools more easily. Investment details The round was led by Eleven Ventures, a Bulgarian-based CEE-focused VC fund, with participation from Dronamics, Payhawk, NitroPack and Czech VC firms Lighthouse Ventures and Borovicka Capital. Eleven Ventures is a Sofia-based CEE early-stage venture capital firm. Its investments typically range from €250,000 to €1 million, with potential for follow-on funding up to €2.5 million. Eleven Ventures supports tech companies in four priority verticals – Fintech, Healthcare, Future of Work, and Sustainable Food. Before the current round, Outfindo secured €900,000 in a seed round led by Presto Ventures in 2023. AIN featured the startup in our Startup of the Day column. The funding will enable Outfindo to expand into new markets and product categories like air conditioners, gaming consoles, and digital cameras. It will also support scaling operations, improving product data, and enhancing the 'Beacon' model for deeper AI-driven customer behavior analysis. Earlier in January, Eleven Ventures led a €500,000 investment for Bulgarian LAM’ON to develop bio and compostable laminating and packaging films.

Payhawk Frequently Asked Questions (FAQ)

When was Payhawk founded?

Payhawk was founded in 2018.

Where is Payhawk's headquarters?

Payhawk's headquarters is located at Chancery House, 53-64 Chancery Lane, London.

What is Payhawk's latest funding round?

Payhawk's latest funding round is Series B - II.

How much did Payhawk raise?

Payhawk raised a total of $236.5M.

Who are the investors of Payhawk?

Investors of Payhawk include Bek Venture, QED Investors, Greenoaks Capital Management, Sprints Capital, Lightspeed Venture Partners and 12 more.

Who are Payhawk's competitors?

Competitors of Payhawk include Brex, Yokoy, Spendesk, Pleo, Airbase and 7 more.

What products does Payhawk offer?

Payhawk's products include Payhawk and 4 more.

Who are Payhawk's customers?

Customers of Payhawk include ATU, Luxair, Heroes, Payflow and Gtmhub.

Loading...

Compare Payhawk to Competitors

Pleo focuses on business spend management within the financial technology sector. The company offers company cards with individual spending limits and provides a platform to manage expenses, reimbursements, invoices, and budgets. It serves businesses looking to manage their spending and financial processes. The company was founded in 2015 and is based in København N, Denmark.

Soldo provides spend management solutions within the financial services sector. The company offers a platform that connects with financial systems to manage corporate spending through company cards, a mobile app for tracking expenses, and tools for financial compliance. Soldo serves businesses that need to manage their expense processes and gain insights into their spending. Soldo was formerly known as PX Technology. It was founded in 2014 and is based in London, United Kingdom.

Moss is a spend management platform that operates in the financial technology sector. The company provides solutions for corporate credit card issuance, expense management, and accounts payable automation, designed to streamline financial processes and enhance control over company spending. Moss's platform is tailored to the needs of modern SMB finance teams, offering features such as real-time budget tracking, receipt capture, and seamless integrations with accounting software. Moss was formerly known as Vanta. It was founded in 2019 and is based in Berlin, Germany.

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Spendesk provides financial management tools for businesses. The company offers tools including corporate cards, automated invoice handling, procure-to-pay solutions, integrated budgeting features, virtual cards for payments, and expense claim management. It serves various sectors of the economy, including manufacturing, retail, green energy, and marketing. The company was founded in 2016 and is based in Paris, France.

Yokoy provides spend management solutions for medium to large enterprises. The company offers products that assist with expense management, invoice processing, and corporate card transactions. Yokoy's platform integrates with existing financial systems to provide spend data, compliance, and analytics, primarily serving sectors including technology, financial services, business services, manufacturing, automotive, and construction. Yokoy was formerly known as Expense Robot. It was founded in 2019 and is based in Zurich, Switzerland.

Loading...