LemFi

Founded Year

2020Stage

Series B | AliveTotal Raised

$86.86MLast Raised

$53M | 5 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+37 points in the past 30 days

About LemFi

LemFi specializes in international payment solutions. The company offers services such as international money transfers, multi-currency accounts, and cross-border card transactions. It serves the immigrant population, facilitating financial transactions across borders. LemFi was formerly known as Lemonade Finance. It was founded in 2020 and is based in Maidstone, United Kingdom.

Loading...

LemFi's Product Videos

ESPs containing LemFi

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

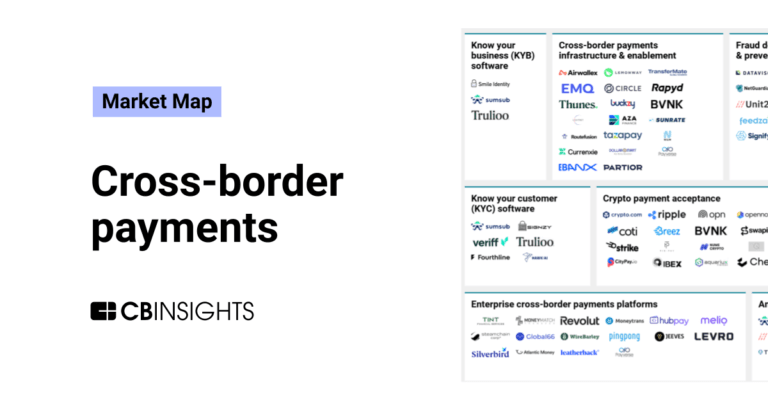

The P2P (peer-to-peer) cross-border payments platforms market facilitates the direct transfer of funds between consumers located in different countries. Some providers specialize in remittances more broadly, while others target money movement between specific countries. Most offer accounts where users can hold their money as well.

LemFi named as Challenger among 15 other companies, including PayPal, Wise, and Remitly.

LemFi's Products & Differentiators

Digital Wallets

We provide users with wallets/accounts in both their country of origin (ie Ghana, NG, KE) as well as their country of residence (NA, Europe)

Loading...

Research containing LemFi

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned LemFi in 2 CB Insights research briefs, most recently on Dec 14, 2023.

Dec 14, 2023

Cross-border payments market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing LemFi

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

LemFi is included in 2 Expert Collections, including Payments.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

100 items

Latest LemFi News

Jan 23, 2025

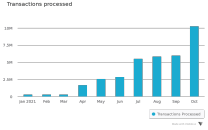

ImpactAlpha Editor Lucy Ngige Canada-based LemFi was founded in 2021 to give the growing population of African immigrants quick and affordable ways to send money back home. Traditional remittance channels like banks charge excessive fees to send small amounts. “We were told remittances had already been solved. But for too many people, it is still too slow, cumbersome and expensive,” said LemFi’s Ridwan Olalere. LemFi enables free international money transfers and competitive exchange rates from Europe, the US and Canada to banks and mobile wallets in Senegal, Kenya, India and other emerging market economies. African diaspora Remittances from Africans living abroad were estimated at more than $100 billion last year. LemFi says it handles more than $1 billion in monthly transactions. London-based venture capital firm Highland Europe led LemFi’s $53 million Series B round. Previous investors Left Lane Capital, Palm Drive Capital and Y-Combinator who participated in LemFi’s $33 million Series A in 2023, joined the latest round. Betting on remittances Investors are active in tech-enabled international money transfer and payment platforms. Tanzania’s Nala raised $40 million last year to support global expansion. London-based TerraPay secured $75 million from the International Finance Corp., ILX and other investors to expand in Africa. Zepz, founded by a Somali refugee, landed $267 million from LeapFrog Investments. HUB2 from Côte d’Ivoire raised $8.5 million to ease remittances in French-speaking West Africa. Stay up to date with what matters to you... Choose beats that you're interested in, and we'll show you more of them as you explore...

LemFi Frequently Asked Questions (FAQ)

When was LemFi founded?

LemFi was founded in 2020.

Where is LemFi's headquarters?

LemFi's headquarters is located at B7b St. Faiths Street, Maidstone.

What is LemFi's latest funding round?

LemFi's latest funding round is Series B.

How much did LemFi raise?

LemFi raised a total of $86.86M.

Who are the investors of LemFi?

Investors of LemFi include Y Combinator, Left Lane, Highland Europe, Palm Drive Capital, Endeavor Catalyst and 9 more.

Who are LemFi's competitors?

Competitors of LemFi include Chipper Cash and 1 more.

What products does LemFi offer?

LemFi's products include Digital Wallets and 3 more.

Loading...

Compare LemFi to Competitors

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, England.

KiaKiaFX is an online platform that allows users to buy and sell foreign exchange from their home or office via a computer, smartphone, or tablet. It specializes in foreign exchange (FX) transfers, FX intermediation, consulting, and more. The company was founded in 2017 and is based in London, United Kingdom.

Wave provides financial services and focuses on reinventing mobile money. It offers services such as depositing and withdrawing money, sending money to others, paying bills, and buying airtime, all primarily through a mobile application. It primarily serves the unbanked population. It was founded in 2017 and is based in Dakar, Senegal.

Travel Tao is a fintech company that provides currency exchange services for travelers. The company offers a currency exchange calculator and a currency tool that assists with currency conversion and calculation for travelers. Travel Tao serves the travel and tourism sector, addressing the financial needs of travelers. It was founded in 2018 and is based in Zhuhai, Guangdong.

Bunq focuses on providing financial services. The company offers a range of banking products, including savings accounts, full bank accounts, and multi-currency banking, all accessible through a mobile application. Bunq primarily serves individual consumers and businesses looking for modern, hassle-free banking solutions. It was founded in 2012 and is based in Amsterdam, Netherlands.

SUNRATE offers a global payment and treasury management platform that operates in the financial services industry. The company offers solutions for international payments, commercial card issuance, and treasury management, designed to facilitate cross-border transactions and manage financial risks. SUNRATE primarily serves businesses engaged in B2B trade, e-commerce, and online travel. It was founded in 2016 and is based in Singapore.

Loading...