Wave

Founded Year

2017Stage

Loan | AliveTotal Raised

$305.24MValuation

$0000Last Raised

$91.44M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-81 points in the past 30 days

About Wave

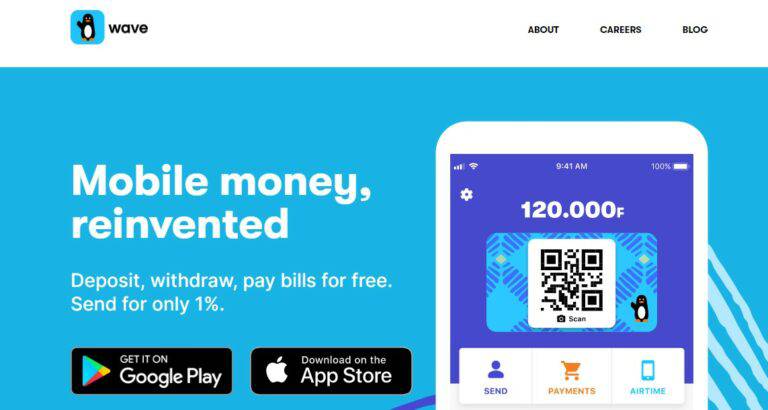

Wave provides financial services and focuses on reinventing mobile money. It offers services such as depositing and withdrawing money, sending money to others, paying bills, and buying airtime, all primarily through a mobile application. It primarily serves the unbanked population. It was founded in 2017 and is based in Dakar, Senegal.

Loading...

Loading...

Research containing Wave

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Wave in 1 CB Insights research brief, most recently on Jul 8, 2022.

Expert Collections containing Wave

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Wave is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Digital Banking

814 items

Latest Wave News

May 1, 2024

By | May 1, 2024 Y Combinator’s annual unveiling of its top revenue-generating companies for 2024, the second list of this kind, has once again captured the attention of the global tech community. For the second consecutive year, mobile money startup Wave emerges as the lone African representative among the top-earning companies. Wave’s rise to prominence in the mobile money sector has been notable, particularly in Senegal and neighbouring countries. With a valuation exceeding USD 1.7 billion and boasting over 10 million customers across six nations, Wave has demonstrated significant growth since its inception. The company’s unique flat fee structure, charging just 1 percent on transfers, has disrupted traditional models and contributed to its rapid expansion. Despite facing challenges that led to layoffs and a possible valuation adjustment, Wave reported revenue exceeding USD 100 million in 2022, further solidifying its position as a key player in the fintech industry. The San Francisco-based accelerator, YC, renowned for backing Airbnb, Doordash, Reddit, Coinbase and many other prominent companies named in the latest top-earners list, has over the past year put the spotlight on revenue as a core metric for gauging success in the startup world. “Revenue is the clearest indicator of a startup’s success, and we’re excited to see so many different types of companies represented,” the accelerator notes while announcing the 2024 YC Top Companies list .

Wave Frequently Asked Questions (FAQ)

When was Wave founded?

Wave was founded in 2017.

Where is Wave's headquarters?

Wave's headquarters is located at Liberté VI Extension Immeuble Namer 1, Dakar.

What is Wave's latest funding round?

Wave's latest funding round is Loan.

How much did Wave raise?

Wave raised a total of $305.24M.

Who are the investors of Wave?

Investors of Wave include International Finance Corporation, Finnish Fund for Industrial Cooperation, Norfund, Lendable, responsAbility Investments and 13 more.

Who are Wave's competitors?

Competitors of Wave include MobiKwik and 7 more.

Loading...

Compare Wave to Competitors

AZA Finance specializes in cross-border payment solutions and foreign exchange services for the business-to-business (B2B) sector. The company offers an online payment platform that facilitates multi-currency transactions, Treasury management, and payment collections, designed to support businesses operating in Africa. AZA Finance primarily serves enterprises requiring financial services across multiple African and global markets. AZA Finance was formerly known as BitPesa. It was founded in 2013 and is based in Grand Duchy of Luxembourg City, Luxembourg.

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, England.

Opay is a digital payment platform that provides financial services. The company allows fund transfers, cashback on airtime and data top-ups, and has a savings account with daily interest. Opay provides a debit card that can be used for online transactions and offers customer service support. It was founded in 2018 and is based in Lagos, Nigeria.

PalmPay develops a secure, digital payment experience in an effort to promote financial inclusion and enhance consumer experiences. The company improves its users' digital payment experiences by offering financial account creation, money transfers, bill payments, and instant access to credit services. It was founded in 2019 and is based in Lagos, Nigeria.

Lianlian Pay operates a network of agents in China where consumers can convert cash into mobile-phone minutes. It allows customers to purchase airline tickets, video gaming credits, and utility bills with its network. It was founded in 2003 and is based in Hangzhou, China.

FairMoney is a fintech company focused on providing digital banking and financial services. The company offers instant personal loans, savings and investment products, and convenient bill payment options through its mobile application. FairMoney primarily serves individuals and small businesses seeking accessible financial services. FairMoney was formerly known as Predictus. It was founded in 2017 and is based in Ikeja, Nigeria.

Loading...