Zepz

Founded Year

2010Stage

Series F | AliveTotal Raised

$959MLast Raised

$267M | 5 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+1 points in the past 30 days

About Zepz

Zepz is a company in the financial technology sector that facilitates international payments. It provides digital solutions for sending money across borders, including options for bank deposits, cash collections, and mobile money services. Zepz serves the ecommerce industry by offering online money transfers. It was founded in 2010 and is based in London, England.

Loading...

ESPs containing Zepz

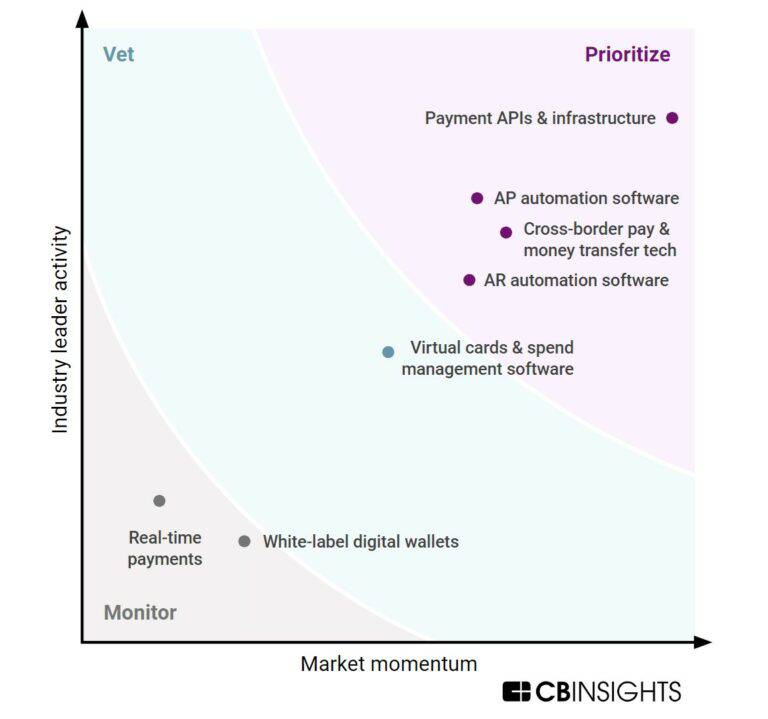

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The P2P (peer-to-peer) cross-border payments platforms market facilitates the direct transfer of funds between consumers located in different countries. Some providers specialize in remittances more broadly, while others target money movement between specific countries. Most offer accounts where users can hold their money as well.

Zepz named as Highflier among 15 other companies, including PayPal, Wise, and Remitly.

Loading...

Research containing Zepz

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zepz in 3 CB Insights research briefs, most recently on Dec 14, 2023.

Dec 14, 2023

Cross-border payments market mapExpert Collections containing Zepz

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zepz is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Latest Zepz News

Jan 20, 2025

Photo by Kurt Cotoaga/Unsplash Share E-commerce and digital marketplaces top the list of sectors with the most significant potential for growth in cross-border payments . With more people shopping internationally for better deals, platforms like AliExpress, Shein, and the latest Temu are thriving. They’ve simplified cross-border payments, breaking down barriers for buyers globally, including in Africa. Next is freelancing and remote work, which have reshaped global hiring. US and European companies hire from Africa’s talent pools, driving demand for effective cross border payroll systems. Travel and tourism are also booming. Tourists want payment options that work seamlessly across borders as travel rebounds, avoiding currency conversion headaches. This demand continues to grow as travel becomes more accessible. International Trade. Small and medium-sized enterprises (SMEs) are a major driver of cross-border payments. SMEs sourcing goods internationally rely on cheaper solutions to pay suppliers, especially in China and other global hubs. Addressing the high cost of remittance fees in Africa Remittance fees in Africa often exceed 8-10% of transaction values, far above the global average of 6%. These high costs burden millions who rely on remittances for daily expenses, education, and investments. Companies can address this challenge by focusing on technology, partnerships, and government collaboration. For instance, blockchain-based digital assets such as Bitcoin and stablecoins provide a more cost-effective way to transfer money by reducing traditional processing fees. Platforms like Bitnob enable users to send and receive funds at little to no cost by leveraging digital assets in the background. These platforms offer competitive exchange rates and instantly settle funds to mobile money wallets or bank accounts in the recipient’s local currency. Similarly, digital wallets and mobile money platforms like M-Pesa in Kenya and Paga in Nigeria reduce dependency on banks, allowing funds to be sent directly to recipients. This reduces costs and improves accessibility. Regulatory bottlenecks and high taxes contribute a lot to remittance costs. Companies can work with governments to advocate for reduced transaction taxes, streamlined licensing for money transfer operators, and policies that encourage open financial ecosystems. Serving the underbanked with cross-border solutions Underbanked and rural populations represent a largely untapped market for cross-border payment solutions, especially in emerging regions like Africa. Despite limited access to traditional banking, these communities are becoming active participants in the global economy through remittances, e-commerce, and small-scale trade. To capitalise on their growing economic role, solutions designed for small-scale transactions and local currencies can help reduce barriers, making international payments more accessible and less intimidating with features like dynamic currency conversion and real-time, affordable exchange rates. In regions with limited smartphone penetration, cross-border payments that function via SMS, USSD, or offline modes can further accelerate adoption. Providers can provide uninterrupted service by ensuring transactions auto-complete once connectivity is restored, even in low-tech environments. Complementing these with educational initiatives on currency exchange, digital wallets, and secure transactions builds trust and loyalty. Providers who educate users with knowledge alongside financial services will stand out and drive meaningful financial inclusion in these underserved markets. Infrastructure and cross-border payments Domestic payment rails form the backbone of any cross-border payment journey. Globally, systems like NIBSS (Nigeria Inter-Bank Settlement System) in Nigeria, PIX in Brazil, and UPI in India enable instant local transfers. When these domestic systems are optimised and connected to cross-border networks, they reduce friction, improve speed, and improve reliability. To make cross-border payments accessible for SMEs and underserved populations, domestic rails must support different financial institutions, including banks, fintechs, and mobile money operators. Small businesses risk being excluded from global markets without this foundation, stifling growth. Platforms like Paystack and Flutterwave exemplify how solid domestic systems can connect local merchants to international buyers, unlocking opportunities and bridging gaps between domestic and global economies. This demonstrates that a solid domestic infrastructure is essential for building a thriving cross-border payment ecosystem. The role of partnerships in expanding cross-border payment networks Cross-border payments span different markets, each with unique regulations, cultures, and technologies. In Africa alone, 54 countries use 42 different currencies. Strategic collaborations allow companies to leverage local expertise and infrastructure, helping them efficiently scale their offerings to new markets while navigating complex regulatory ecosystems like anti-money laundering (AML) and Know Your Customer (KYC) requirements. Partnerships also fuel innovation. Banks contribute regulatory knowledge and trust, while fintech brings agility and advanced technology, creating solutions like real-time payments and multi-currency wallets. Moreover, collaborations with global e-commerce platforms improve customer experiences, delivering faster, cheaper, and more transparent payment options. You can read the full report here . __________________ Osideinde Adebisi Adewale is the Chief Operating Officer (COO) at Bitnob, a pioneering fintech company that transforms financial services and cross-border payments across Africa and beyond. With over a decade of experience, Adewale is a dynamic business leader specialising in scaling businesses through strategic planning, innovative product development, operational excellence, and market expansion. Oluwaseyi Otunla , COO OneKard. Seyi is a finance professional with over 3 years of experience in consulting at PwC. BSc in Economics and Management from The University of Kent. Skilled in optimizing processes and delivering impactful results in dynamic, fast-paced environments. Nika Naghavi . Nika is an experienced fintech professional with background in mobile money, digital financial inclusion, and remittances. She has recently joined Zepz to lead strategic partnerships and complex commercial partnerships. Before Zepz, she was at Onafriq (formerly MFS Africa), where she held various roles, including providing strategic advisory support to the Founder and CEO, leading network expansion, and managing the remittances portfolio. Share this article

Zepz Frequently Asked Questions (FAQ)

When was Zepz founded?

Zepz was founded in 2010.

Where is Zepz's headquarters?

Zepz's headquarters is located at 62 Buckingham Gate, London.

What is Zepz's latest funding round?

Zepz's latest funding round is Series F.

How much did Zepz raise?

Zepz raised a total of $959M.

Who are the investors of Zepz?

Investors of Zepz include Accel, Technology Crossover Ventures, LeapFrog Investments, International Finance Corporation, Coller Capital and 8 more.

Who are Zepz's competitors?

Competitors of Zepz include MobiKwik, Ripple, AZA Finance, Ledger, BitGo and 7 more.

Loading...

Compare Zepz to Competitors

Airwallex develops a global financial platform that focuses on providing business payment solutions within the financial technology domain. The company offers an array of services including global business accounts for managing finances, international transfers, multi-currency corporate cards, and online payment processing capabilities. It primarily serves the payment industry. The company was founded in 2015 and is based in Melbourne, Australia.

AZA Finance specializes in cross-border payment solutions and foreign exchange services for the business-to-business (B2B) sector. The company offers an online payment platform that facilitates multi-currency transactions, Treasury management, and payment collections, designed to support businesses operating in Africa. AZA Finance primarily serves enterprises requiring financial services across multiple African and global markets. AZA Finance was formerly known as BitPesa. It was founded in 2013 and is based in Grand Duchy of Luxembourg City, Luxembourg.

Coins.ph is a cryptocurrency exchange and digital wallet provider in the financial technology sector. The company offers a platform for buying, selling, and storing various cryptocurrencies, as well as services for utility bill payments and mobile load purchases. Coins.ph primarily serves individual users and businesses looking to engage with digital assets and cryptocurrency trading. It was founded in 2014 and is based in Pasig City, Philippines. Coins.ph operates as a subsidiary of Wei Zhou.

MoMo is a financial technology company that specializes in digital payment solutions and super application development. The company offers a comprehensive ecosystem that allows users to perform various daily activities through their platform, as well as leveraging data analytics and AI to enhance user experience and merchant services. MoMo's products cater to various sectors, including financial services, e-commerce, and more. It was founded in 2007 and is based in Ho Chi Minh City, Vietnam.

Toss operates as a digital financial platform. It offers a range of financial services, including bank accounts, money transfers, a financial dashboard, credit score management, customized loans, insurance plans, and multiple investment services. It was founded in 2013 and is based in Seoul, South Korea.

Paga is a mobile money company that focuses on facilitating digital financial transactions. The company offers services that allow users to send and receive money, pay bills, and top up airtime and data. Paga primarily serves the financial technology sector by simplifying access to financial services for individuals. It was founded in 2009 and is based in Lagos, Nigeria.

Loading...