Upgrade

Founded Year

2016Stage

Series F | AliveTotal Raised

$562.5MValuation

$0000Last Raised

$280M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-55 points in the past 30 days

About Upgrade

Upgrade is a financial technology company that operates in the consumer credit sector. The company offers services such as personal loans, credit lines, rewards checking, and savings accounts, all aimed at helping customers access and manage credit. Its primary market includes families across America. It was founded in 2016 and is based in San Francisco, California.

Loading...

ESPs containing Upgrade

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The home improvement financing market encompasses a variety of financial solutions designed to fund home renovation, remodeling, or improvement projects. It offers homeowners the means to enhance the value, functionality, and aesthetics of their properties without depleting their savings. Home improvement financing solutions may include home equity loans, lines of credit, personal loans, or specia…

Upgrade named as Challenger among 12 other companies, including SoFi, LendingClub, and Prosper.

Upgrade's Products & Differentiators

Upgrade Card

Upgrade Card is the only credit card that is "good for you": it comes with low-cost credit and helps consumers pay down their balance faster

Loading...

Research containing Upgrade

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Upgrade in 3 CB Insights research briefs, most recently on Oct 3, 2023.

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023

Expert Collections containing Upgrade

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Upgrade is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

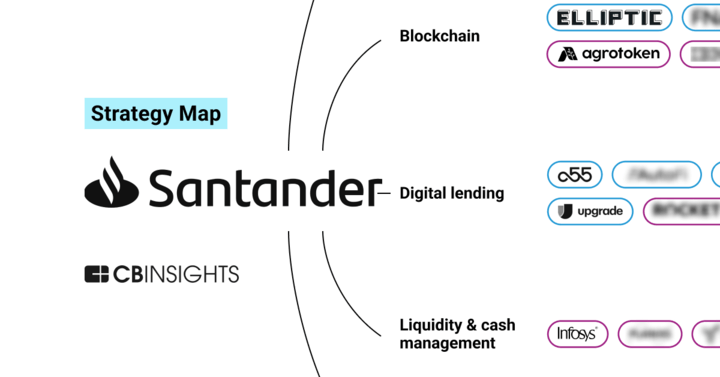

Digital Lending

2,334 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Tech IPO Pipeline

825 items

Future Unicorns 2019

50 items

Upgrade Patents

Upgrade has filed 4 patents.

The 3 most popular patent topics include:

- assisted reproductive technology

- battery charging

- battery electric cars

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/20/2022 | 9/17/2024 | Fertility medicine, Fertility, Assisted reproductive technology, Obstetrics, Human reproduction | Grant |

Application Date | 10/20/2022 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Fertility medicine, Fertility, Assisted reproductive technology, Obstetrics, Human reproduction |

Status | Grant |

Latest Upgrade News

Jan 15, 2025

Kollmorgen , a global leader in motion control systems, has announced the latest update to its SafeMotion Monitor (SMM) firmware: SMM2.0. This upgrade allows OEMs to leverage SMM functional safety features with more encoder and motor types to support a wider range of applications such as material forming, multi-axis measurement equipment, food processing and food packaging. Originally standard for the 2G Motion System , SMM2.0 will now be compatible with all motors that feature any HIPERFACE-DSL rotary-safe feedback system. This includes the AKM2G and AKMA motor lines, which now feature a wider range of feedback system options. SMM2.0 also enables a second instance of Safe Operating Stop (SOS) for greater design flexibility. As a result of updated regulations related to functional safety enacted by the EU, customers across the globe, in a wide range of industries, are seeking upgrades to meet these new standards. SMM2.0 makes compliance easier, with a comprehensive set of 16 safety features, including SafePosition, SafeStop and SafeSpeed. “As the demand for functional safety increases, we want to make it easier for our customers to build this capability into their machine designs,” said Christopher Cooper, product management senior director. “We’re excited to announce that SMM2.0 provides easy, drive-resident functional safety for a wider range of motors, for even more demanding applications."

Upgrade Frequently Asked Questions (FAQ)

When was Upgrade founded?

Upgrade was founded in 2016.

Where is Upgrade's headquarters?

Upgrade's headquarters is located at 275 Battery Street, San Francisco.

What is Upgrade's latest funding round?

Upgrade's latest funding round is Series F.

How much did Upgrade raise?

Upgrade raised a total of $562.5M.

Who are the investors of Upgrade?

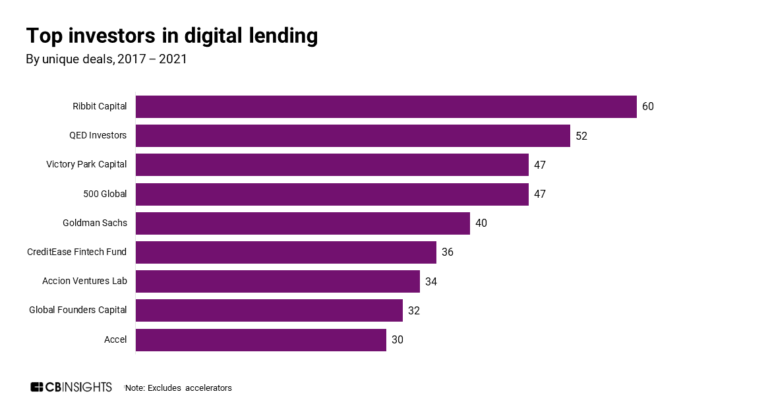

Investors of Upgrade include VY Capital, Ribbit Capital, Sands Capital, Ventura Capital, G Squared and 19 more.

Who are Upgrade's competitors?

Competitors of Upgrade include Best Egg, Kissht, Prodigy Finance, Tala, Conductiv and 7 more.

What products does Upgrade offer?

Upgrade's products include Upgrade Card and 2 more.

Loading...

Compare Upgrade to Competitors

Tala serves as a financial platform focused on providing digital financial services across multiple sectors. The company offers instant access to credit, payments, savings, and transfer services through its app, utilizing AI for personalized financial solutions. Tala primarily serves individuals who seek to manage their finances with innovative technology. Tala was formerly known as InVenture. It was founded in 2011 and is based in Santa Monica, California.

Branch International is a fintech company that provides digital banking services. The company offers financial products including loans, money transfers, bill payments, investments, and savings, accessible through a smartphone app. Branch serves individuals in emerging markets. It was founded in 2015 and is based in San Francisco, California.

Prodigy Finance specializes in education loans for international students pursuing master's degrees. The company offers collateral-free loans to cover tuition and living expenses, aimed at students who wish to study abroad without the need for a co-signer or collateral. Prodigy Finance primarily serves the higher education sector, facilitating access to top-tier educational institutions globally. It was founded in 2007 and is based in London, United Kingdom.

Brighte is a financial services company that offers financing solutions for solar panels, energy-efficient home products, and electrification services, serving homeowners interested in sustainable energy technologies. It was founded in 2015 and is based in Sydney, Australia.

Kissht is a financial technology platform that provides personal and business loans. The company uses a digital loan process that requires no physical documentation, allowing for the disbursement of funds to customers' bank accounts. Kissht's services are aimed at consumers looking for financial solutions. It was founded in 2015 and is based in Mumbai, India.

Avant is a financial technology company that specializes in providing personal loans and credit cards. The company offers a range of financial solutions designed to help individuals manage their finances and achieve their personal goals. Avant primarily serves consumers looking for credit and loan products to support their financial needs. It was founded in 2012 and is based in Chicago, Illinois.

Loading...