Synctera

Founded Year

2020Stage

Series A - IV | AliveTotal Raised

$91.82MLast Raised

$12.82M | 3 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+17 points in the past 30 days

About Synctera

Synctera is a banking and payments platform that provides technology infrastructure and a compliance framework for companies to launch FinTech and embedded banking products. The company offers services including APIs for digital wallets, debit and charge cards, and money movement experiences, supporting financial solutions. Synctera primarily serves FinTechs, embedded banking providers, and banks looking to build their sponsor banking programs. It was formerly known as Entangle. It was founded in 2020 and is based in Palo Alto, California.

Loading...

Synctera's Product Videos

ESPs containing Synctera

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

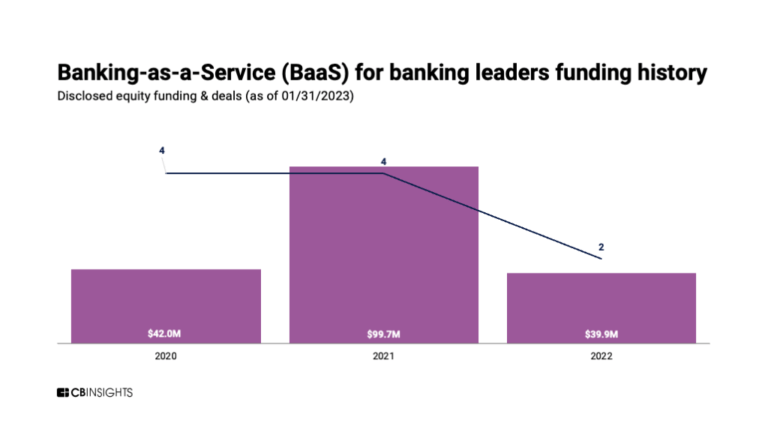

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to digitize their services and expand their customer base through embedded banking and payment options. This market also allows established non-fintech companies to add banking services to differentiate their offerings and generate new revenue streams. BaaS providers offer APIs that enable fintechs and …

Synctera named as Highflier among 15 other companies, including Stripe, Marqeta, and Solaris.

Synctera's Products & Differentiators

Banking as a Service platform

Enhance your value proposition and boost revenue by offering banking products and services to your customers. Synctera's Banking as a Service platform has everything you need to build, launch, and scale embedded banking and FinTech products.

Loading...

Research containing Synctera

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Synctera in 5 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

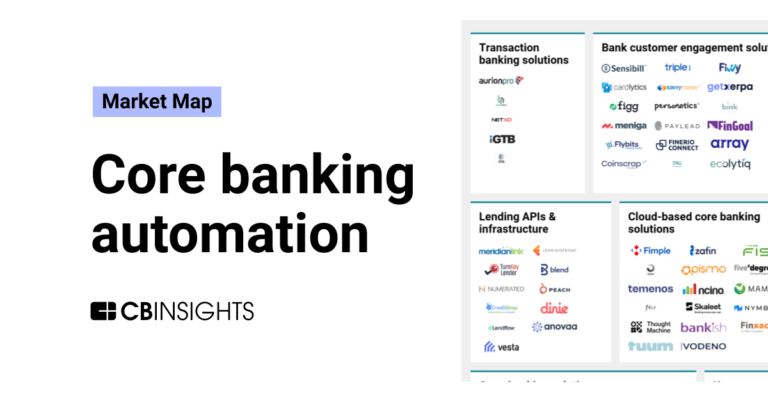

The core banking automation market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Synctera

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Synctera is included in 4 Expert Collections, including Fintech.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

922 items

Fintech 100

200 items

Fintech 100 (2024)

100 items

Latest Synctera News

Feb 20, 2025

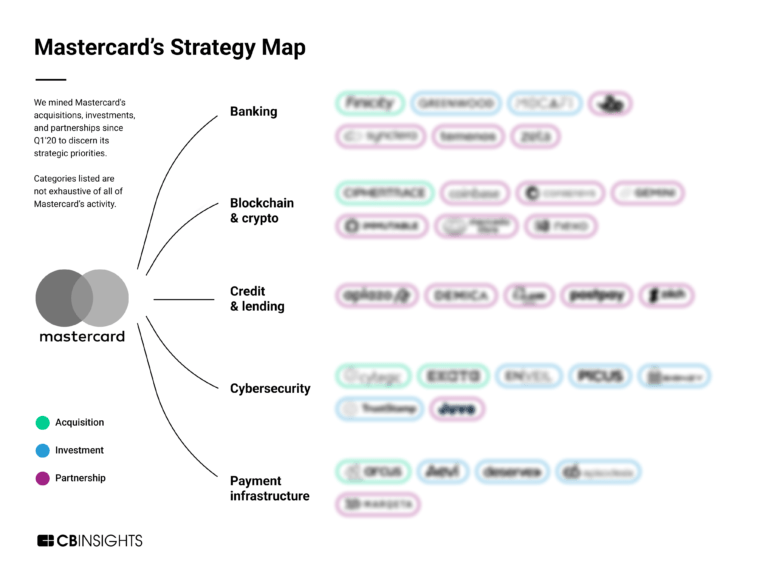

AUSTIN, TX, UNITED STATES, February 20, 2025 / EINPresswire.com / -- The Fintech-as-a-Service market , valued at USD 308.9 billion in 2023, is expected to reach USD 1305.7 billion by 2032, growing at a CAGR of 17.4% from 2024 to 2032. This report includes an analysis of adoption rates of emerging technologies, network infrastructure expansion by region, cybersecurity incidents (2020-2023), and cloud services usage by region. The market is driven by increasing demand for financial technology solutions and services, alongside advancements in cloud computing and cybersecurity practices. Get Sample Copy of Report: https://www.snsinsider.com/sample-request/3318 Keyplayers: PayPal Holdings, Inc. (PayPal) Block, Inc. (Square) Mastercard Incorporated (Mastercard Payment Gateway) Envestnet, Inc. (Envestnet | Yodlee) Upstart Holdings, Inc. (Upstart Platform) Rapyd Financial Network Ltd. (Rapyd Wallet) Solid Financial Technologies, Inc. (Solid API) Railsbank (Railsbank Banking Engine) Synctera Inc. (Synctera Platform) Braintree (Braintree Payments) Stripe, Inc. (Stripe Connect) Adyen N.V. (Adyen Payment Solutions) Dwolla, Inc. (Dwolla API) WePay (a JPMorgan Chase Company) (WePay Payments API) Finastra (FusionFabric.cloud) Plaid Inc. (Plaid Link) Tink (Tink Platform) N26 GmbH (N26 Banking App) Kabbage, Inc. (a subsidiary of American Express) (Kabbage Funding) Zelle (operated by Early Warning Services, LLC) (Zelle Payment Service) By Type, Payment Segment Holds Dominant Market Share with 42.23% in 2023, Fund Transfer Segment Expected to Experience Rapid Growth In 2023, the payment segment captured a significant market share of 42.23%, largely due to the increasing consumer preference for digital and cashless payments. This shift has prompted fintech companies to develop a variety of solutions, including mobile wallets, peer-to-peer transactions, and contactless payments. These innovations demonstrate the versatility of fintech, enabling individuals, businesses, and governments to benefit from the wide range of payment tools available in the market today. The fund transfer segment is expected to witness the fastest growth in the forecast period, as demand for cross-border money transfers and withdrawals increases. Fintech companies across the world are developing apps that simplify fund transfers with features such as easy-to-use interfaces and improved customer experiences. While as more businesses and users use the platforms to make and receive funds across the globe, the funds transfer segment can become a chief driver of fintech market size growth. Enquiry Before Buy: https://www.snsinsider.com/enquiry/3318 By Technology, Blockchain Segment Leads the Market with 38% Share in 2023, Artificial Intelligence Segment Set for Rapid Growth The blockchain segment accounted for the highest market share in 2023, at approximately 38%, led by growing demand from large-scale enterprises. Blockchain provides advantages such as transparency and automation, appealing to financial institutions for improved security and efficiency. The technology guarantees users exclusive ownership and control over their assets, minimizing the threat of unauthorized use. These benefits are likely to continue fueling the growth of the blockchain segment in the next few years. The artificial intelligence segment is expected to expand at the highest CAGR during the forecast period, driven by its extensive use in various industries. AI improves decision-making, solves queries quicker, and enhances efficiency in operations. It also leads to innovation, offering more customized, secure, and efficient services, enhancing customer satisfaction and global reach. As businesses continue to enhance their AI capabilities, the segment is set to experience considerable growth, supported by rising demand and competitive innovations. By Application, Compliance and Regulatory Support Segment Leads the Market with 34% Share in 2023, Fueling Growth in Response to Rising Fraud and Customer Demands The compliance and regulatory support segment was the market leader in 2023, capturing over 34.0% of global revenue. This dominance can be attributed to the growing importance of regulatory adherence among financial institutions, which are investing in customer support within their applications to streamline operations and enhance customer experience. Additionally, the rise in fraud and money laundering cases worldwide has prompted companies to strengthen their compliance measures and offer more robust customer support. As businesses continue to address these challenges, the segment is expected to see sustained growth throughout the forecast period, ensuring better service delivery globally. By End-Use, Insurance Segment Dominates the Market with 36% Share in 2023, Driven by Technological Advancements in Fintech Solutions The insurance segment led the market in 2023, accounting for approximately 36.0% of the total global revenue. This growth is largely driven by the increasing recognition of technology as a key factor in transforming and optimizing the insurance industry. Fintech solutions in this space provide a wide array of services, including digital underwriting, claim processing, policy management, and risk assessment. Leveraging modern data analytics, AI-driven algorithms, and automation, these solutions enhance the efficiency, quality, and user experience within insurance operations, positioning the segment for continued growth and innovation. North America Dominates the Market with 42% Share in 2023, Asia-Pacific Holds 25% Market Share in 2023 In 2023, North America held the largest market share of 42%, cementing its position as a highly competitive region. Home to major tech giants, it boasts a high degree of digitalization, with widespread use of cloud computing, AI, and blockchain driving innovation and efficiency. The region benefits from significant R&D spending and a supportive legal framework, fueling the development of new technologies and services, ensuring its continued market leadership and economic growth. Asia-Pacific is the second-largest market for Fintech-as-a-Service, with a 25% market share in 2023. Rapid economic growth and the increasing adoption of digital financial services in countries like China, India, and Japan are driving demand for FaaS. The region benefits from significant venture capital and government funding, fostering the growth of fintech companies. As more businesses recognize the advantages of FaaS platforms, the market is expected to expand, contributing to the region's growing fintech ecosystem. Access Complete Report: https://www.snsinsider.com/reports/fintech-as-a-service-market-3318 About Us: SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world. Jagney Dave SNS Insider Pvt. Ltd email us here Visit us on social media: Facebook X LinkedIn Instagram

Synctera Frequently Asked Questions (FAQ)

When was Synctera founded?

Synctera was founded in 2020.

Where is Synctera's headquarters?

Synctera's headquarters is located at 228 Hamilton Avenue, Palo Alto.

What is Synctera's latest funding round?

Synctera's latest funding round is Series A - IV.

How much did Synctera raise?

Synctera raised a total of $91.82M.

Who are the investors of Synctera?

Investors of Synctera include Diagram Ventures, Fin Capital, Lightspeed India Partners, Lightspeed Venture Partners, NAventures and 16 more.

Who are Synctera's competitors?

Competitors of Synctera include Sandbox Banking, BM Technologies, ASA, Bond, Rize and 7 more.

What products does Synctera offer?

Synctera's products include Banking as a Service platform.

Who are Synctera's customers?

Customers of Synctera include TipHaus, Float and Exo Freight.

Loading...

Compare Synctera to Competitors

Unit is a financial technology company that specializes in embedded finance and financial infrastructure within the banking and lending sectors. The company offers a platform that enables tech companies to integrate banking services, such as storing, moving, and lending money, into their products. Unit's services are designed to facilitate compliance and simplify technical integration for businesses looking to offer financial services. It was founded in 2019 and is based in New York, New York.

Treasury Prime is an embedded banking platform that specializes in connecting businesses with a network of banks and financial service providers. Its main offerings include API banking integrations that enable companies to develop and launch financial products such as FDIC-insured accounts, payment processing solutions, and debit card issuance. Treasury Prime's platform is designed to support compliance program integration and multi-bank operations, facilitating the creation of investment vehicles and instant payout ecosystems for various industries. It was founded in 2017 and is based in San Francisco, California.

Productfy is a platform that specializes in the embedding of financial products within various business sectors. The company offers a suite of services, including branded card programs, digital banking solutions, secured charge card issuance, and disbursement mechanisms, all designed to be integrated seamlessly into clients' applications. Productfy primarily serves sectors such as community banks, credit unions, real estate, financial services, and insurance. It was founded in 2018 and is based in San Jose, California.

NovoPayment specializes in providing Banking as a Service (BaaS) platforms and focuses on digital financial and transactional services. The company offers a suite of bank-grade solutions, including digital banking, payment processing, card issuing, and risk management services, all designed to integrate with existing systems for financial operations and customer experiences. NovoPayment primarily serves banks, financial institutions, merchants, and other financial service providers looking to digitize and modernize services. It was founded in 2007 and is based in Miami, Florida.

Hydrogen operates as a no-code embedded finance company. It offers United States dollar (USD) banking services, wealth management, personal financial management (PFM), and cryptocurrency payments solutions. The company was founded in 2017 and is based in Miami, Florida.

Agora Financial Technologies specializes in modular banking platforms and operates within the financial technology sector. The company provides digital banking solutions that allow banks, credit unions, and fintech companies to integrate new fintech products without overhauling their existing core banking systems. Agora's services include white-label solutions, APIs for developers, and a challenger bank platform. Agora Financial Technologies was formerly known as Agora Services. It was founded in 2018 and is based in New York, New York.

Loading...