Treasury Prime

Founded Year

2017Stage

Series C - II | AliveTotal Raised

$103.19MLast Raised

$40M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-83 points in the past 30 days

About Treasury Prime

Treasury Prime is an embedded banking platform that specializes in connecting businesses with a network of banks and financial service providers. Its main offerings include API banking integrations that enable companies to develop and launch financial products such as FDIC-insured accounts, payment processing solutions, and debit card issuance. Treasury Prime's platform is designed to support compliance program integration and multi-bank operations, facilitating the creation of investment vehicles and instant payout ecosystems for various industries. It was founded in 2017 and is based in San Francisco, California.

Loading...

ESPs containing Treasury Prime

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

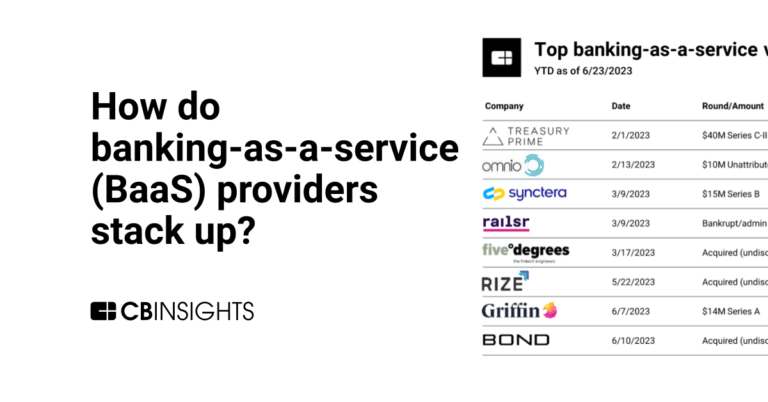

The banking-as-a-service (BaaS) market provides infrastructure platforms for banks and fintechs to digitize their services and expand their customer base through embedded banking and payment options. This market also allows established non-fintech companies to add banking services to differentiate their offerings and generate new revenue streams. BaaS providers offer APIs that enable fintechs and …

Treasury Prime named as Challenger among 15 other companies, including Stripe, Marqeta, and Solaris.

Treasury Prime's Products & Differentiators

Treasury Prime API Platform

Treasury Prime API Platform enables companies to embed a full range of banking services into their product or application from cards to opening accounts to payments. Our easy-to-use API provides the scale and security required for the most sensitive and demanding applications. The Treasury Prime Platform is fully integrated into core banking systems so developers can launch new offerings in days, not months. Treasury Prime’s experience with banking requirements and its range of bank partners have helped dozens of fintechs get to market fast.

Loading...

Research containing Treasury Prime

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Treasury Prime in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Treasury Prime

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Treasury Prime is included in 3 Expert Collections, including Fintech.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Digital Banking

1,030 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Treasury Prime News

Jan 6, 2025

SOPA Images/Photographer: SOPA Images/LightR Unless the new administration squashes it, soon banks and fintechs will need to work with the FDIC's so-called Synapse rule, which would require them to ensure that the balances of custodial deposit accounts are accurate and reconciled on a daily basis. "The majority of responsible, embedded finance and innovative banks are doing that today, or they're in the process of making sure that they're able to do that," said Phil Goldfeder, chief executive officer of the American Fintech Council. "The fundamental responsibility of the bank partnering with a fintech company is reconciliation and ensuring that they know what money is coming and going. In bank-fintech partnerships, the buck stops with the regulated entity." For some smaller banks, this will be a tall order, said Konrad Alt, co-founder of Klaros Group. "But it's not unreasonable for regulators to expect this," Alt said. "If you put your money in your bank, you want to be absolutely sure that your bank always knows where it is. That's part of the deal when you give your money to a bank." This requirement is one of several challenges banks will need to cope with in the new year, as the ongoing dispute between Synapse and its partner banks, and approximately $65 million to $95 million of missing customer money, cast a shadow on bank-fintech partnerships. The need for daily reconciliation Banks' core systems track most transactions that happen throughout the institution – in mobile and online banking, branches, ATMs and more – on a daily basis. Most U.S. banks use core systems from FIS, Fiserv and Jack Henry. (The three companies did not respond immediately to requests for interviews.) To synchronize these systems with fintech partners' daily transaction ledgers, a small cottage industry has emerged: companies that offer technology that can sit on top of a bank's current core platform to track transactions to and from fintech partners. Treasury Prime, Unit and the now-bankrupt Synapse are all in this category. Treasury Prime says it has been doing daily reconciliation between banks and fintechs for seven years. It connects directly with banks' core systems and has active integrations with FIS, Fiserv, Jack Henry and COCC cores, according to Jeff Nowicki, chief banking officer. These integrations allow for real balancing between the end user accounts and "for benefit of" accounts with backing deposits, he said. The company also maintains a separate FBO account for each fintech, rather than commingling accounts as Synapse did. It provides a bank console with views at the individual end user level and at aggregate program levels, updated several times a day, Nowicki said. Some people (mostly vendors of blockchain technology) think distributed ledgers would be a good answer to the reconciliation issue. Over the years, banks have made many attempts to share distributed ledgers (colloquially known as blockchains). But most have fallen apart over issues of control and not wanting to share data with competitors. Future of banking as a service One question about the future of banking as a service is whether or not the current regulatory crackdown will continue. "I can't think of a time when a particular corner of the banking system has been so thoroughly papered with enforcement actions," Alt said. "It's unusual by historical standards, and it's obviously had a huge impact on these banks and a pretty big impact on their fintech partners." Some bankers and fintechs are hopeful this will change under the new administration, which is likely to be more friendly to non-traditional financial businesses, like fintechs and their partner banks. But Alt, who was formerly the second-ranking executive at the Office of the Comptroller of the Currency, pointed out that enforcement actions typically don't start with the leaders of regulatory agencies. "You don't start out as an agency head saying I want to bring an action against Bank X," said Alt. "What happens is your supervisory staff and legal team work together to develop findings and propose an appropriate order. By the time it works its way up to senior levels of the agency, it's a well-documented case, and unless a staff member has committed a very clear error, which doesn't often happen, intervening to stop a well-documented enforcement action from going forward means taking a ton of political risk." Alt expects to continue to see a disproportionate level of enforcement activity in banking as a service for at least another couple of years. "It's clear that the regulators have got a well founded-belief at the staff level that many of the banks in this space don't manage risks very well," Alt said. "That's a bona fide, old-fashioned safety and soundness problem that these agencies are well within bounds to worry about." Yet because of the Republican administration coming in, Klaros has been fielding calls from community bankers who are thinking about dusting off plans to get into or expand banking as a service activity. "If they're asking us for advice, we would say there might well be opportunity there," Alt said. "But unless you're prepared to invest, and you have the capital to invest in building really strong risk management and compliance, it is probably not a great idea. You will end up out over your skis, and you will eventually get into trouble." Most community banks are not flush with cash, Alt pointed out. Banks are also becoming more cautious about choosing fintech partners, especially fintechs that are the subject of an enforcement order. "Why would you take on that additional scrutiny?" Alt said. "Why would you bring in a new fintech partner that's clearly got a regulatory target on its back? It's just going to invite more regulatory scrutiny of your own risk management skills." On the other side of the equation, fintechs are getting choosier about their bank partners, too. A handful, including Block, Brex, Mercury, Relay, Rho, and Stripe, recently joined the Coalition for Financial Ecosystem Standards. "We've seen a need on the fintech side for increased clarity and better standards on how fintech-bank partnerships operate right now," said Mercury's chief counsel, Robert Gonzalez. Written rules are sparse in this area, he noted. And when banks receive guidance from their regulators, that guidance is not communicated to fintechs openly, he said. "Because of the confidential supervisory information rules, the banks are receiving the guidance from their examiners, and then they have to play this game of telephone to the fintechs to get the fintechs to make changes on how they do things, without telling them exactly why or what the regulator said or what the discussion was about," Gonzalez said. The Coalition for Financial Ecosystem Standards is like a SOC II standard for fintechs, Gonzalez said. The group will agree on compliance standards for fintechs. "Once this is up and running, there'll be a mechanism to audit fintechs against those requirements, and someone could be CFES certified," Gonzalez said. "So as a bank partner, if you're going to work with a fintech, you know this fintech has passed some universally accepted, industry-leading benchmarks."

Treasury Prime Frequently Asked Questions (FAQ)

When was Treasury Prime founded?

Treasury Prime was founded in 2017.

Where is Treasury Prime's headquarters?

Treasury Prime's headquarters is located at 2261 Market Street , San Francisco.

What is Treasury Prime's latest funding round?

Treasury Prime's latest funding round is Series C - II.

How much did Treasury Prime raise?

Treasury Prime raised a total of $103.19M.

Who are the investors of Treasury Prime?

Investors of Treasury Prime include QED Investors, Deciens Capital, SaaStr Fund, BAM Elevate, Invicta Growth and 9 more.

Who are Treasury Prime's competitors?

Competitors of Treasury Prime include Sandbox Banking, Infinant, Synctera, Moov, Rize and 7 more.

What products does Treasury Prime offer?

Treasury Prime's products include Treasury Prime API Platform.

Who are Treasury Prime's customers?

Customers of Treasury Prime include MaxMyInterest, Brex, Bench, Alto IRA and Challenger Finance.

Loading...

Compare Treasury Prime to Competitors

Unit is a financial technology company that specializes in embedded finance and financial infrastructure within the banking and lending sectors. The company offers a platform that enables tech companies to integrate banking services, such as storing, moving, and lending money, into their products. Unit's services are designed to facilitate compliance and simplify technical integration for businesses looking to offer financial services. It was founded in 2019 and is based in New York, New York.

Synctera is a banking and payments platform that provides technology infrastructure and a compliance framework for companies to launch FinTech and embedded banking products. The company offers services including APIs for digital wallets, debit and charge cards, and money movement experiences, supporting financial solutions. Synctera primarily serves FinTechs, embedded banking providers, and banks looking to build their sponsor banking programs. It was formerly known as Entangle. It was founded in 2020 and is based in Palo Alto, California.

Productfy is a platform that specializes in the embedding of financial products within various business sectors. The company offers a suite of services, including branded card programs, digital banking solutions, secured charge card issuance, and disbursement mechanisms, all designed to be integrated seamlessly into clients' applications. Productfy primarily serves sectors such as community banks, credit unions, real estate, financial services, and insurance. It was founded in 2018 and is based in San Jose, California.

NovoPayment specializes in providing Banking as a Service (BaaS) platforms and focuses on digital financial and transactional services. The company offers a suite of bank-grade solutions, including digital banking, payment processing, card issuing, and risk management services, all designed to integrate with existing systems for financial operations and customer experiences. NovoPayment primarily serves banks, financial institutions, merchants, and other financial service providers looking to digitize and modernize services. It was founded in 2007 and is based in Miami, Florida.

Alviere offers an enterprise-embedded finance platform operating in the financial services industry. It offers financial products, including accounts, payments, branded cards, and global money transfers, all designed to be integrated into clients' existing business models. It primarily serves sectors such as travel and hospitality, retail, marketplaces, financial services, and telecommunications. It was formerly known as Mezu. It was founded in 2020 and is based in Denver, Colorado.

Nymbus operates in the financial services industry and provides alternatives to traditional banking business models. The company offers products and solutions designed to enable financial institutions of all sizes to grow and serve their customers without the need for core conversion. Nymbus primarily caters to banks and credit unions looking to launch digital banking services, create niche financial brands, or deploy core banking platforms. It was founded in 2015 and is based in Jacksonville, Florida.

Loading...