PolicyGenius

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$276.05MRevenue

$0000About PolicyGenius

PolicyGenius is an online insurance platform. The company provides a place to shop online for life, long-term disability, renters, and pet insurance through its quoting engines that offer comparisons of tailored policies. It was formerly known as KnowltOwl. The company was founded in 2014 and is based in New York, New York. In April 2023, PolicyGenius was acquired by Zinnia. The terms of the transaction were not disclosed.

Loading...

ESPs containing PolicyGenius

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The insurtech producers — auto market comprises insurtech agents, brokers, distributors, and other intermediaries that provide automotive insurance. Customer experience initiatives — particularly those focused on improving the ease of insurance sales and policy management for insureds — are often a focus of these companies. This market excludes managing general agents.

PolicyGenius named as Highflier among 15 other companies, including Qover, Insurify, and PolicyStreet.

PolicyGenius's Products & Differentiators

Life Insurance

Life insurance is an affordable way to provide financial support to the people you love after you die.

Loading...

Research containing PolicyGenius

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned PolicyGenius in 6 CB Insights research briefs, most recently on Mar 29, 2024.

Feb 23, 2024

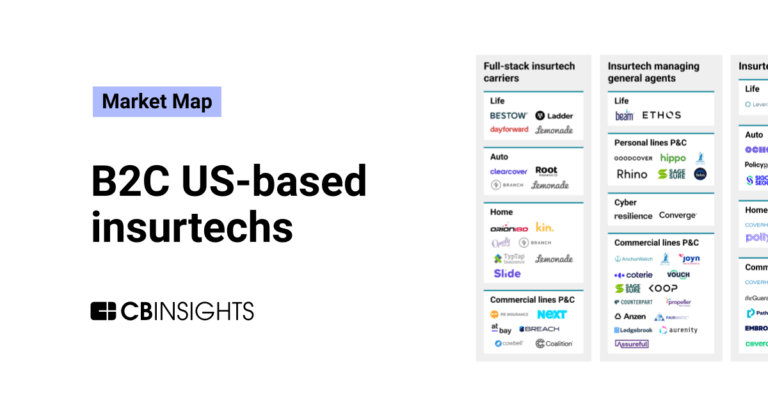

The B2C US insurtech market map

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023

Aug 8, 2023 report

State of Insurtech Q2’23 ReportExpert Collections containing PolicyGenius

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

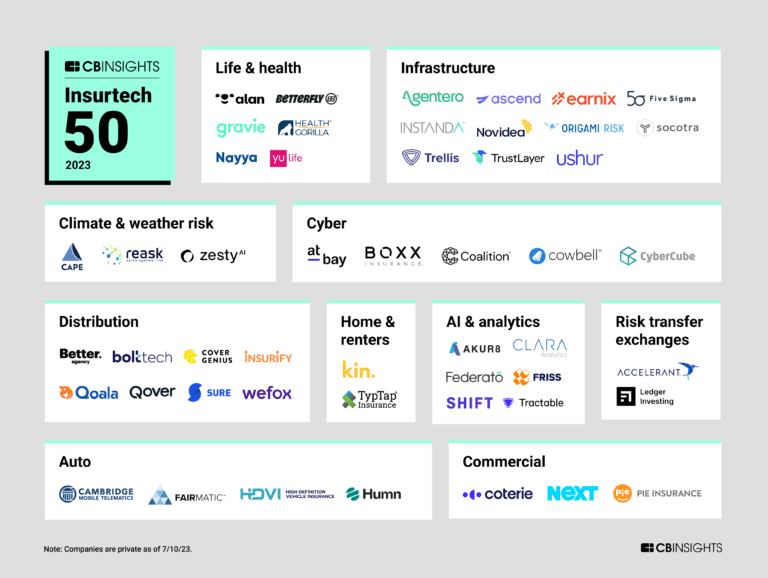

PolicyGenius is included in 4 Expert Collections, including Fintech 100.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech

3,243 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

Latest PolicyGenius News

Nov 13, 2024

Younger homeowners are more likely to have home insurance dropped Younger homeowners are more likely to have home insurance dropped A young woman looking up information on home contracts and insurance using a phone and a laptop. As climate change continues to worsen the severity of extreme weather and expensive property damage, home insurance companies in Florida, California, Louisiana, and other high-risk states have adopted stricter underwriting rules or are choosing to no longer sell policies in these states. Meanwhile, homeowners are left scrambling to find coverage after their policies are canceled or nonrenewed. Younger homeowners are feeling the effects more than others, according to the 2024 Policygenius Climate Change and Homebuying Survey. In fact, of younger U.S. homeowners (aged 18 to 34), 16% said that their policy was dropped because their insurer stopped offering coverage where they live, and 18% had their policy dropped due to living in an area at high risk of wildfires, hurricanes, and other natural disasters. Key Findings 16% of U.S. homeowners said their home insurance was nonrenewed or canceled by their insurance company between January 2021 and January 2024. Of those homeowners: 36% were dropped because they filed a claim or multiple claims. 35% were dropped because they live in a high-risk area. 34% were dropped because the insurer no longer offers coverage where they live. 33% were dropped because they failed a home inspection and didn’t make necessary home improvements. 19% were dropped for a different reason. 51% of younger homeowners (aged 18 to 34) had their home insurance nonrenewed or canceled versus 5% of homeowners over the age of 55. If U.S. homeowners were to buy a new home this year, 63% would be willing to make a sacrifice in order to find an affordable home. Of those homeowners: 48% would be willing to move to a different city or state where home prices are less expensive. 42% would be willing to purchase a home that doesn’t check all of their boxes. 29% would be willing to purchase a home that’s cheaper, but needs extensive renovations. 21% would be willing to purchase a home that’s not located in the school district they wanted. 26% would be willing to make another sacrifice. 18% of all homeowners would not consider moving to Florida, California, Texas, or Louisiana due to high home insurance costs and limited coverage options as a result of climate change. Home Insurance Policy Cancellations or Nonrenewals Hit Younger Adults Hardest Between 2021 and 2024, 16% of U.S. homeowners had their home insurance policy nonrenewed or canceled by their insurance company. Of those, 34% were dropped because the company no longer offers home insurance where they live, and 35% lost their coverage because they live in an area with a high risk of wildfires, hurricanes, or other natural disasters. What’s the Difference Between Cancellation and Nonrenewal? Cancellation: When an insurance company chooses to drop your policy in the beginning or middle of the term. If your policy has been in force for more than 60 days, the insurer can typically only cancel your policy if you failed to pay your premiums or misrepresented yourself or your home on your application. How much notice an insurer needs to give you before your policy is canceled depends on the laws of your state . Nonrenewal: When an insurance company chooses not to renew your policy at the end of your policy term. Depending on the state you live in, the insurer has to give you a certain number of days’ notice and explain the reason why they’re dropping you. Younger Homeowners Are 10 Times More Likely to Have Their Home Insurance Nonrenewed or Canceled Compared to Older Homeowners Fifty-one percent of younger homeowners (aged 18 to 34) had their home insurance nonrenewed or canceled in the last three years, compared to 15% of homeowners aged 35 to 54 and 5% of homeowners aged 55 or older. Among younger homeowners, the most commonly cited reasons for cancellation or nonrenewal were a failed home inspection (22%) and filing a claim or multiple claims (22%). Meanwhile, only 4% of all homeowners 35 and older said their policies were canceled due to a failed home inspection, and just 6% for filing a claim or multiple claims. Insurance companies conduct home inspections less often on properties that have had a policy in force for several years. This could account for the disparity between younger and older homeowners when it comes to inspection-related nonrenewals or cancellations. Younger homeowners were also four times more likely than older homeowners to have their policies dropped due to their insurance company no longer offering home insurance where they live or from living in an area at high risk of hurricanes, wildfires, or other natural disasters. Sixteen percent of younger homeowners said their insurer no longer offered coverage in their area, compared to 3% of homeowners 35 and older; and 18% of younger homeowners said that they lost their coverage because of their home’s natural disaster risk, again compared to just 3% of homeowners 35 and older who had their policy canceled or nonrenewed for the same reason. Policygenius Infographic showing percentage of people who had insurance policies canceled for these listed reasons. When asked if they’d consider moving to Florida , California , Texas , or Louisiana —four states that are either in the midst of a home insurance crisis or nearing one due to natural disasters brought on by climate change—around one in five homeowners (18%) said they would not move to any of these states because of rising insurance rates. From 2022 to 2023, premiums increased 35% in Florida, 27% in Texas and Louisiana, and 11% in California, according to the Policygenius 2023 Home Insurance Pricing Report . And premiums are expected to get more expensive as insurers continue to limit or no longer offer coverage in high-risk areas. Policygenius Homeowners Aren’t Afraid to Make Sacrifices in Order to Find More Affordable Housing—Including Moving Cities or States Infographic showing percentage of those willing to relocate to Florida, California, Texas, and Louisiana people with the rising cost of climate-change disasters. When asked if they’d be willing to make sacrifices, such as moving to a different city or buying a home that needs extensive renovations, in order to find an affordable home, 63% of homeowners said they would. Of those, nearly half (48%) are willing to move to a different city or state where home prices are less expensive, and 42% are willing to purchase a home that doesn’t check all of their boxes. Younger Homeowners Are More Willing to Make Sacrifices Than Older Ones There’s a generational divide between which homeowners are willing to give up the most to find an affordable home. Eighty-two percent of younger homeowners would be willing to make sacrifices versus 68% of homeowners aged 35 to 54 and 53% of homeowners aged 55 or older. Policygenius Methodology Infographic showing answers to question “If you were buying a new home this year, what sacrifices would you be willing to make to find an affordable home?” Policygenius commissioned YouGov Surveys to poll a nationally representative sample of 2,324 adults age 18 and older, with 1,286 being homeowners. The average margin of error for responses was +/-2%. For more details, see YouGov’s methodology . Respondents could select multiple answers for questions, so some totals may not add up to 100. This story was produced by Policygenius and reviewed and distributed by Stacker.

PolicyGenius Frequently Asked Questions (FAQ)

When was PolicyGenius founded?

PolicyGenius was founded in 2014.

Where is PolicyGenius's headquarters?

PolicyGenius's headquarters is located at 32 Old Slip, 30th Floor, New York.

What is PolicyGenius's latest funding round?

PolicyGenius's latest funding round is Acquired.

How much did PolicyGenius raise?

PolicyGenius raised a total of $276.05M.

Who are the investors of PolicyGenius?

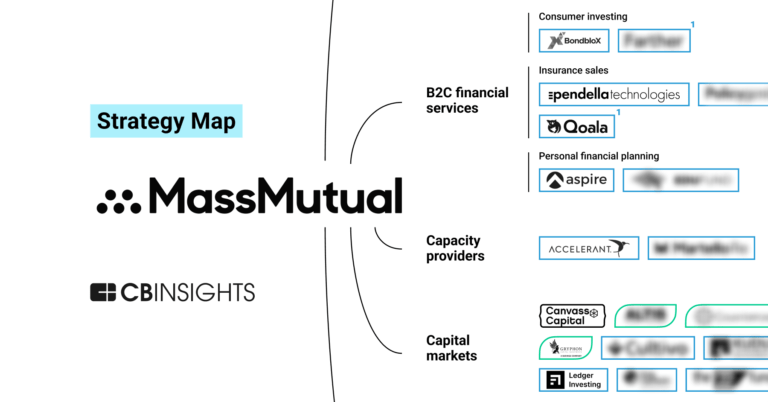

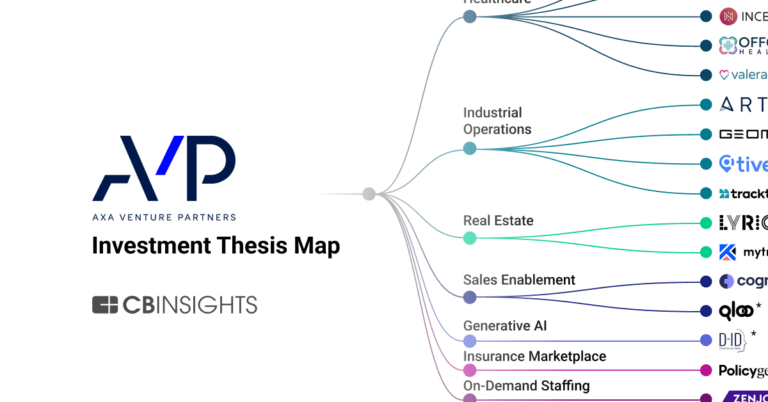

Investors of PolicyGenius include Zinnia, AVP, MassMutual Ventures, Norwest Venture Partners, Revolution Ventures and 19 more.

Who are PolicyGenius's competitors?

Competitors of PolicyGenius include NeueHealth, BIMA, Alan, Digit Insurance, Next Insurance and 7 more.

What products does PolicyGenius offer?

PolicyGenius's products include Life Insurance and 2 more.

Loading...

Compare PolicyGenius to Competitors

Snapsheet specializes in insurance technology solutions. It enables a claim process starting with virtual estimations all the way to final repairs and payment by generating communication between consumers, shops, and carriers. The company offers a range of services, including appraisals, claims management, and payments, all aimed at managing the insurance claims process. It primarily serves the insurance industry. It was founded in 2011 and is based in Chicago, Illinois.

NeueHealth operates within the medical sector, providing care through its owned and affiliated clinics. It offers arrangements and tools for independent providers and medical groups, focusing on performance and population health. The company serves health consumers, providers, and payors in the healthcare industry. NeueHealth was formerly known as Bright Health Group Inc. It was founded in 2015 and is based in Minneapolis, Minnesota.

BIMA provides mobile-delivered insurance and health services in the financial services sector. The company offers a range of life, accident, and health insurance products that are registered and paid for via mobile technology, ensuring a paperless experience. BIMA primarily serves underserved communities through partnerships with mobile operators and microfinance institutions. It was founded in 2010 and is based in Singapore.

Alan focuses on providing health insurance services and preventive health solutions within the healthcare industry. The company offers health insurance plans, a healthcare system navigation tool through Alan Clinic, and mental well-being support with Alan Mind, designed to improve the health and productivity of individuals and corporate employees. Alan primarily serves diverse sectors, including tech startups, hospitality, the public sector, retail, and industrial businesses. It was founded in 2016 and is based in Paris, France.

Ladder specializes in providing term life insurance through a digital platform within the insurance industry. The company offers affordable term life insurance policies with the flexibility to adjust coverage as the policyholder's life circumstances change. Ladder's services are designed to be accessible online, with a paperless application process and tools like an insurance calculator to help customers determine their coverage needs. It was founded in 2015 and is based in Palo Alto, California.

Bestow operates as an insurance technology company and develops products and software for insurance companies. It provides an application programming interface (API), enabling partners to offer life insurance coverage to customers. The company was formerly known as Coverlife. It was founded in 2017 and is based in Dallas, Texas.

Loading...