Bestow

Founded Year

2017Stage

Series C | AliveTotal Raised

$138.1MLast Raised

$70M | 4 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-76 points in the past 30 days

About Bestow

Bestow operates as an insurance technology company and develops products and software for insurance companies. It provides an application programming interface (API), enabling partners to offer life insurance coverage to customers. The company was formerly known as Coverlife. It was founded in 2017 and is based in Dallas, Texas.

Loading...

Bestow's Product Videos

ESPs containing Bestow

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The embedded insurance infrastructure market consists of tech vendors that offer products to enable insurance sales on third-party platforms via APIs (application programming interfaces). These companies sell their products to insurance providers or third-party platforms. Some embedded insurance infrastructure providers may also provide insurance (as a licensed carrier, managing general agent, or …

Bestow named as Challenger among 15 other companies, including Igloo, Cover Genius, and Qover.

Bestow's Products & Differentiators

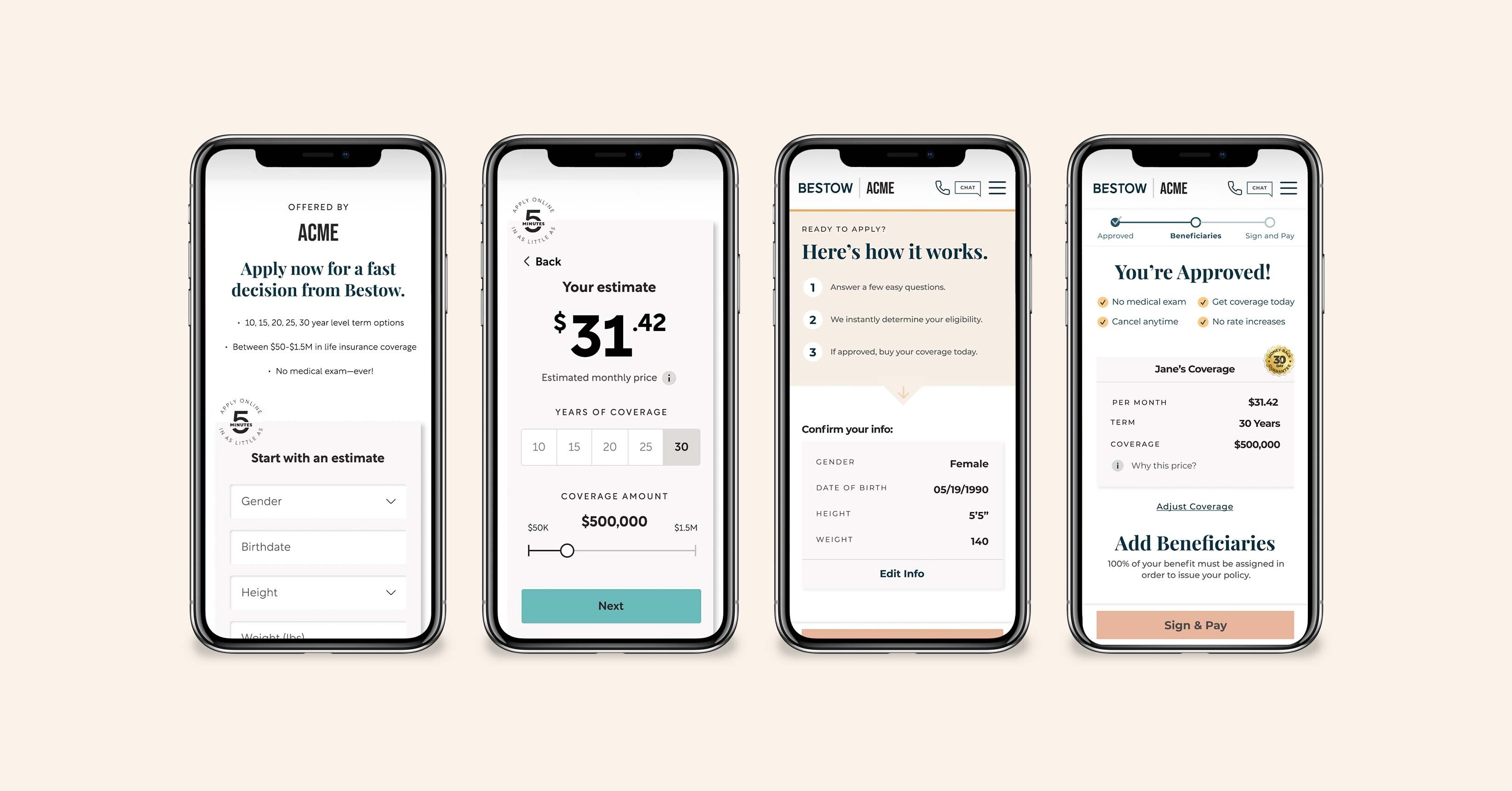

Enrollment

We deliver a clean, seamless, and fully integrated buying experience for agents and customers, allowing their brand to shine with a white-labeled look and feel. Includes rates and pricing, quoting, a branded website or embedded solution, a branded digital application, checkout, and e-delivery supporting multiple sales channels and multiple life insurance products.

Loading...

Research containing Bestow

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bestow in 2 CB Insights research briefs, most recently on Feb 23, 2024.

Feb 23, 2024

The B2C US insurtech market mapExpert Collections containing Bestow

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Bestow is included in 6 Expert Collections, including Insurtech.

Insurtech

3,243 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

500 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Insurtech 50

50 items

Report: https://app.cbinsights.com/research/report/top-insurtech-startups-2022/

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Artificial Intelligence

7,212 items

Bestow Patents

Bestow has filed 3 patents.

The 3 most popular patent topics include:

- artificial intelligence

- enterprise application integration

- workflow technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/22/2022 | Artificial intelligence, Enterprise application integration, Workflow technology, IPad, Multi-agent systems | Application |

Application Date | 12/22/2022 |

|---|---|

Grant Date | |

Title | |

Related Topics | Artificial intelligence, Enterprise application integration, Workflow technology, IPad, Multi-agent systems |

Status | Application |

Latest Bestow News

Jan 23, 2025

News provided by Share this article Share toX DALLAS, Jan. 23, 2025 /PRNewswire/ -- In a transformative collaboration, Nationwide has leveraged Bestow's technology platform to modernize and streamline term life insurance solutions, delivering substantial benefits to organizations and their customers. Since the launch of Nationwide® Life Essentials in April 2023, this partnership has significantly expanded access to life insurance, particularly in underserved markets, while driving a 20% increase in Nationwide's term life sales. Bestow's cutting-edge, user-friendly platform has enabled Nationwide to reach a broader customer base by providing seamless, fully digital processes that make life insurance more accessible and convenient. Nationwide® Life Essentials delivers instant quotes and automated underwriting, eliminating the need for medical exams and enabling customers to receive coverage decisions within minutes. These innovations have more than doubled application completion rates, helping families secure the necessary coverage. Notably, 69% of applicants over the past 18 months were first-time life insurance buyers, demonstrating the partnership's success in reaching traditionally underserved consumers. Since launch in April 2023, this partnership has driven a 20% increase in term life sales for Nationwide. "Nationwide is dedicated to protecting families and empowering consumers with innovative, accessible life insurance solutions," said Andrew Burge, Vice President of Life Business Development at Nationwide. "Our collaboration with Bestow has allowed us to modernize the customer experience, strengthen our market position, and reach more people with the protection they need. This partnership exemplifies how carriers and technology innovators with a shared vision can drive meaningful industry transformation." The partnership's success underscores the importance of collaboration between carriers and emerging technology providers to modernize the life insurance buying experience. Bestow enabled Nationwide to launch Nationwide® Life Essentials in just four months, with ongoing collaboration leading to over 30 product and experience enhancements in the first six months. These improvements highlight the agility and responsiveness of both organizations in adapting to consumer needs and market demands. "Our work with Nationwide exemplifies how technology-driven partnerships can deliver impactful results for carriers and their customers alike," said Melbourne O'Banion, CEO and co-founder of Bestow. "By combining Nationwide's industry expertise with Bestow's innovative platform, we've created a solution that expands access, drives growth, and redefines the life insurance experience. We look forward to continuing our collaboration to develop even more customer-focused solutions." By integrating AI and data modeling, Bestow and Nationwide have optimized the matching of customers with suitable solutions, reducing the inefficiencies of traditional underwriting processes. These digital advancements have lowered costs, improved placement rates, and enhanced customer satisfaction. Bestow and Nationwide are expanding access to life insurance and setting a new standard for customer-centric innovation in the industry. About Bestow Bestow built the leading end-to-end platform for life insurers to drive efficiency, reduce costs, and enhance profitability across the entire value chain. From product development and advanced underwriting to seamless policy administration, our solutions enable carriers to deliver exceptional products and experiences to agents and customers. Discover how Bestow is shaping the future of insurance at Bestow.com . About Nationwide Nationwide, a Fortune 100 company based in Columbus, Ohio, is one of the largest and strongest diversified insurance and financial services organizations in the United States. Nationwide is rated A+ by Standard & Poor's. An industry leader in driving customer-focused innovation, Nationwide provides a full range of insurance and financial services products including auto, business, homeowners, farm and life insurance; public and private sector retirement plans, annuities and mutual funds; excess & surplus, specialty and surety; and pet, motorcycle and boat insurance. SOURCE Bestow Inc.

Bestow Frequently Asked Questions (FAQ)

When was Bestow founded?

Bestow was founded in 2017.

Where is Bestow's headquarters?

Bestow's headquarters is located at 2700 Commerce Street, Dallas.

What is Bestow's latest funding round?

Bestow's latest funding round is Series C.

How much did Bestow raise?

Bestow raised a total of $138.1M.

Who are the investors of Bestow?

Investors of Bestow include Morpheus Ventures, New Enterprise Associates, Core Innovation Capital, 8VC, Valar Ventures and 5 more.

Who are Bestow's competitors?

Competitors of Bestow include Plum Life, Amplify, Pendella, PolicyGenius, Everyday Life Insurance and 7 more.

What products does Bestow offer?

Bestow's products include Enrollment and 3 more.

Who are Bestow's customers?

Customers of Bestow include Equitable, https://www.nationwide.com/ and https://www.sammonsfinancialgroup.com/.

Loading...

Compare Bestow to Competitors

Ethos provides life insurance solutions. It offers predictive analytics and data science technologies for life insurance policies. It covers expenses such as a home mortgage, debt, college tuition, and more. It was founded in 2016 and is based in Austin, Texas.

Ladder specializes in providing term life insurance through a digital platform within the insurance industry. The company offers affordable term life insurance policies with the flexibility to adjust coverage as the policyholder's life circumstances change. Ladder's services are designed to be accessible online, with a paperless application process and tools like an insurance calculator to help customers determine their coverage needs. It was founded in 2015 and is based in Palo Alto, California.

Wysh is a financial services company that provides life insurance products. The company offers term life insurance policies that do not require medical exams and allow for quick coverage decisions. Wysh primarily serves individual customers looking for financial protection for their families. It was founded in 2021 and is based in Milwaukee, Wisconsin.

New York Life Insurance Company operates as a financial services firm in the insurance and investment sectors. The company offers a range of insurance products, including term life, whole life, universal life, and long-term care insurance, as well as individual disability insurance. Additionally, it provides investment services such as mutual funds, exchange-traded funds, and annuities, along with retirement and wealth management advisory services. It was founded in 1845 and is based in New York, New York.

Asteya specializes in providing income insurance policies within the insurance sector. The company offers financial security through earnings replacement and disability coverage, with services that include monthly benefits and lump-sum payments for individuals unable to work due to illness or injury. Asteya's platform caters to a diverse clientele seeking to safeguard their income. It was founded in 2020 and is based in Miami, Florida.

AuguStar Life Insurance provides financial and insurance solutions within the life insurance and retirement sectors. The company offers life insurance products, including indexed universal life, term life, and whole life policies, as well as retirement planning products such as fixed indexed annuities and immediate annuities. AuguStar Life Insurance serves individuals and financial professionals seeking to plan for retirement and manage legacy planning. AuguStar Life Insurance was formerly known as Ohio National Life Insurance Company. It was founded in 1909 and is based in Cincinnati, Ohio.

Loading...