Clara

Founded Year

2020Stage

Series B - III | AliveTotal Raised

$470MLast Raised

$60M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-96 points in the past 30 days

About Clara

Clara operates a management platform in the business payments sector. It offers corporate credit cards, bill payment services, cross-border payments, and a software platform for expense management and financial operations. Clara primarily serves large and growing companies across various industries. The company was founded in 2020 and is based in Sao Paulo, Brazil.

Loading...

Clara's Product Videos

Clara's Products & Differentiators

Card

Clara-issued charge card (have premium, business, and virtual offerings)

Loading...

Research containing Clara

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Clara in 4 CB Insights research briefs, most recently on Aug 23, 2024.

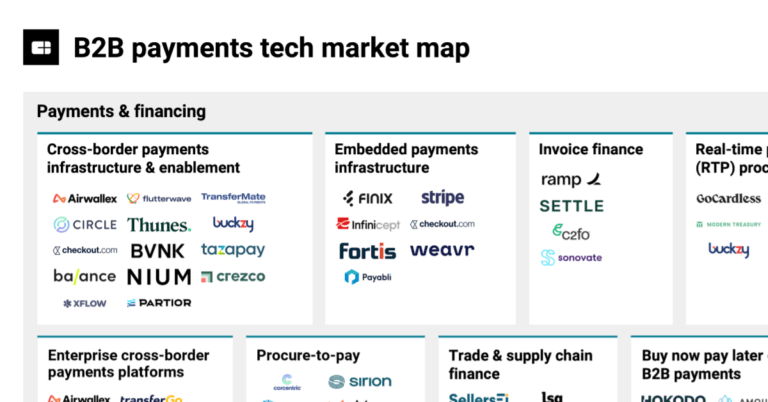

Aug 23, 2024

The B2B payments tech market map

Oct 5, 2023 report

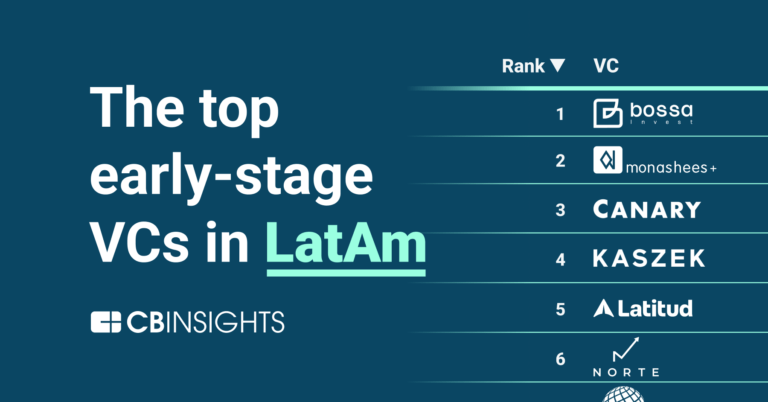

The top 25 early-stage LatAm VCs

Oct 3, 2023 report

Fintech 100: The most promising fintech startups of 2023Expert Collections containing Clara

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Clara is included in 3 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

100 items

Latest Clara News

Dec 10, 2024

Keep up to Date with Latin American VC, Startups News Latin American fintech Clara has just launched a tool that could be a game-changer for companies looking to optimize their expenses. “Insights,” powered by artificial intelligence, promises to unravel the mystery of corporate payments and help companies save money. How does it work? Imagine having a financial assistant that reviews thousands of transactions in seconds, identifying patterns and pointing out anomalies. That’s exactly what “Insights” does. It detects everything from duplicate subscriptions to unusual increases in specific expenses. Clara, founded in 2020, isn’t new to the game. It already operates in Brazil, Colombia, and Mexico, processing more than one transaction per second. With over 14,000 companies as clients, they’ve caught the attention of high-profile investors like Goldman Sachs. Juan Zuluaga, Clara’s Global Product Director, explains the goal: “We want to free financial teams from tedious tasks so they can focus on strategic work.” Worried about implementation? Clara has simplified it. Some companies can get started in less than 24 hours. Of course, if you’re a larger corporation, it might take a bit longer, but they have a team of 350 people in 15 countries ready to help. Security is paramount in the fintech world, and Clara knows it. They use Amazon Web Services and have PCI DSS certification. Plus, they encrypt data and perform regular audits. Clara isn’t just about technology. They’ve formed strategic alliances with names like Mastercard and offer extensive technical support, including an AI system available 24/7. How do they stay ahead of the curve? By constantly adapting. Clara customizes its services for each country where it operates, complying with local regulations. And it seems to be working – their client retention rate exceeds 90% after the first year. When it comes to attracting talent, Clara offers professional development, competitive salaries, and benefits focused on health and wellness. They also promote diversity with initiatives for women and the LGBT community. Looking to the future, Clara is focused on growing in its current markets and reaching financial equilibrium. They continue to explore new technologies to bring more financial clarity to businesses. In an increasingly competitive fintech market, Clara is betting on continuous innovation and service quality. Will it be enough to stay ahead? Only time will tell, but for now, they seem to be on the right track.

Clara Frequently Asked Questions (FAQ)

When was Clara founded?

Clara was founded in 2020.

Where is Clara's headquarters?

Clara's headquarters is located at Dr. Renato Paes de Barros St. 33, Sao Paulo.

What is Clara's latest funding round?

Clara's latest funding round is Series B - III.

How much did Clara raise?

Clara raised a total of $470M.

Who are the investors of Clara?

Investors of Clara include General Catalyst, Monashees+, Picus Capital, DST Global, Alter Global and 30 more.

Who are Clara's competitors?

Competitors of Clara include Tribal Credit and 6 more.

What products does Clara offer?

Clara's products include Card and 2 more.

Who are Clara's customers?

Customers of Clara include Banco Sabadell, Enseña por México, OnFly and Gulf.

Loading...

Compare Clara to Competitors

Mendel is a technology company that focuses on streamlining and optimizing financial management for large enterprises in the finance and technology sectors. The company offers an integrated solution for intelligent expense management and control, providing real-time reporting, automated workflows, and smart corporate Visa cards. Mendel primarily serves large corporations seeking to digitize their financial processes and increase payment transparency. It was founded in 2021 and is based in Mexico City, Mexico.

Jeeves operates a financial platform providing payment and expense management solutions within the financial services industry. The company offers a suite of tools that streamline global finance operations, including multi-currency accounts, corporate card issuance, cross-border payments, and integrated expense management. Jeeves primarily serves businesses looking to manage their financial operations across multiple countries. It was founded in 2019 and is based in Orlando, Florida.

Brex is a financial technology company that specializes in AI-powered spend management for businesses. The company offers corporate credit cards, automated expense management, and bill payment software, as well as banking and treasury services that include deposits and FDIC-insured accounts. Brex primarily serves startups, mid-size companies, and enterprises, providing them with tools to control and track company spending. Brex was formerly known as Veyond. It was founded in 2017 and is based in Salt Lake City, Utah.

Ramp specializes in spend management solutions within the financial technology sector. The company offers a suite of products that include corporate cards, expense management, and accounts payable automation designed to streamline finance operations and improve efficiency for businesses. Ramp's platform also provides features such as automated procurement, vendor management, and working capital solutions, catering to a diverse range of customer needs from startups to large enterprises. It was founded in 2019 and is based in New York, New York.

Pluto develops a finance workflow automation and spend management platform. The company offers a suite of tools including smart corporate cards, employee reimbursement systems, petty cash management solutions, procurement and account payables automation, as well as accounting integration capabilities. It primarily serves businesses ranging from small to medium-sized enterprises to large corporations across various sectors, including retail, electronic commerce, agencies, truck and fleet operations, consulting firms, and more. The company was founded in 2021 and is based in Dubai, United Arab Emirates.

Hombi is a social application designed for the management of apartment buildings within the real estate tech industry. The app provides a centralized platform for managing daily building operations, facilitating communication between tenant associations, management companies, and residents, and streamlining tasks such as maintenance tracking, financial reporting, and professional service coordination. Hombi primarily serves the real estate sector, focusing on improving the efficiency of building management for tenant associations and property managers. It was founded in 2015 and is based in Tel Aviv, Israel.

Loading...