Zopa

Founded Year

2005Stage

Series K - II | AliveTotal Raised

$941.92MLast Raised

$84.59M | 3 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+59 points in the past 30 days

About Zopa

Zopa is a financial services company that focuses on providing fair and honest financial products. The company offers lending, intelligent investments, fixed-term savings, and credit cards designed to empower customers to take control of their finances. Zopa primarily serves individuals seeking to borrow or save money. It was founded in 2005 and is based in London, United Kingdom.

Loading...

Zopa's Products & Differentiators

a

a

Loading...

Research containing Zopa

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Zopa in 2 CB Insights research briefs, most recently on Nov 17, 2022.

Expert Collections containing Zopa

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Zopa is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Fintech 100

248 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

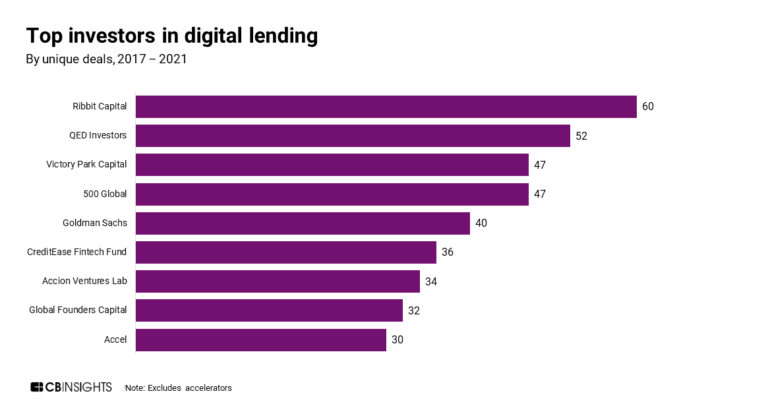

Digital Lending

2,334 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Fintech

13,559 items

Excludes US-based companies

Latest Zopa News

Dec 9, 2024

By Gloria Methri Share Zopa has raised €80 million ( GBP 68 million ) in an equity funding round led by A.P. Moller Holding, with participation from existing investors. The funding will support Zopa’s growth as it prepares to launch its flagship current account in 2025 and a GenAI proposition that aims to transform how people interact with their money. Some of Zopa’s innovations enable customers to improve their financial health, gain access to better-priced credit, access market-leading saving products, and transfer card balances in a way that helps pay down credit faster. It recently partnered with Britain’s largest electricity supplier, Octopus Energy, to enter the UK’s £23 billion renewable energy market and with retail giant John Lewis to offer personal loans directly to its 23 million customers. Jaidev Janardana, CEO at Zopa Bank, said, “Today’s fundraise validates our financial performance and growth potential. Since launching our bank in 2020, we’ve consistently offered financial products that offer great value and ease to our customers, supporting our vision to build Britain’s best bank. We are thrilled to have investors who share our excitement at the opportunity to serve more customers across more product categories as we aim to become the go-to bank for millions of consumers.” Chetan Mehta, Head of Growth Equity at A.P. Moller Holding, added, “We are excited to support Zopa on its journey to revolutionise the UK’s financial services industry. Zopa’s remarkable customer-centricity enables it to deliver lasting value and a positive impact on the financial lives of millions of UK consumers. Today’s investment also reflects our confidence in Zopa’s robust and profitable business model that aligns with our commitment to sustainable, long-term growth.” Zopa blends the agility of digital banking with 20 years of lending expertise, having lent more than £13 billion to consumers in the UK to date. Since launching its bank in 2020, Zopa has attracted more than £5 billion in deposits and currently has £3 billion in loans on its balance sheet. It has close to 850 employees and one of the highest employee satisfaction scores in the UK FinTech industry. Previous Article

Zopa Frequently Asked Questions (FAQ)

When was Zopa founded?

Zopa was founded in 2005.

Where is Zopa's headquarters?

Zopa's headquarters is located at Tooley Street, London.

What is Zopa's latest funding round?

Zopa's latest funding round is Series K - II.

How much did Zopa raise?

Zopa raised a total of $941.92M.

Who are the investors of Zopa?

Investors of Zopa include Augmentum Fintech, Silverstripe, Davidson Kempner Capital Management, Northzone, SoftBank and 18 more.

Who are Zopa's competitors?

Competitors of Zopa include Prosper and 6 more.

What products does Zopa offer?

Zopa's products include a.

Loading...

Compare Zopa to Competitors

Auxmoney offers a digital-lending platform operating in the consumer credit sector. The company offers a range of credit services, including personal loans and business loans, with a focus on providing affordable credit through digital processes. It primarily serves individuals and businesses seeking financial solutions. It was founded in 2007 and is based in Dusseldorf, Germany.

Avant is a financial technology company that specializes in providing personal loans and credit cards. The company offers a range of financial solutions designed to help individuals manage their finances and achieve their personal goals. Avant primarily serves consumers looking for credit and loan products to support their financial needs. It was founded in 2012 and is based in Chicago, Illinois.

Zirtue is a company that operates in the financial technology sector, focusing on relationship-based lending. It provides a platform for individuals to lend and borrow money from friends and family, facilitating loan requests and automated repayments, while offering a framework for managing personal loans. Zirtue serves the personal finance sector by allowing lending without traditional banks or predatory lenders. It was founded in 2018 and is based in Dallas, Texas.

Instacash is a fintech company specializing in peer-to-peer lending and investment opportunities within the financial services sector. The company offers a platform for personal loans secured by a variety of assets, including jewelry, appliances, salary advances, invoices, cryptocurrencies, and more, aimed at democratizing access to liquidity. Instacash primarily serves individuals seeking personal loans and investors looking for lending opportunities. It was founded in 2020 and is based in Lima, Peru.

Lendable is a lending platform that operates in the financial services industry. The company offers loans using technology to streamline the traditional loan application process, providing instant decisions, personalized rates, and fund transfers. It primarily serves individuals, including those with credit histories. Lendable was formerly known as Feather Media. It was founded in 2014 and is based in London, United Kingdom.

DianRong is a peer-to-peer (P2P) loan and financial services platform for small and medium enterprises in China.

Loading...