Behalf

Founded Year

2012Stage

Debt - II | AliveTotal Raised

$325MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-72 points in the past 30 days

About Behalf

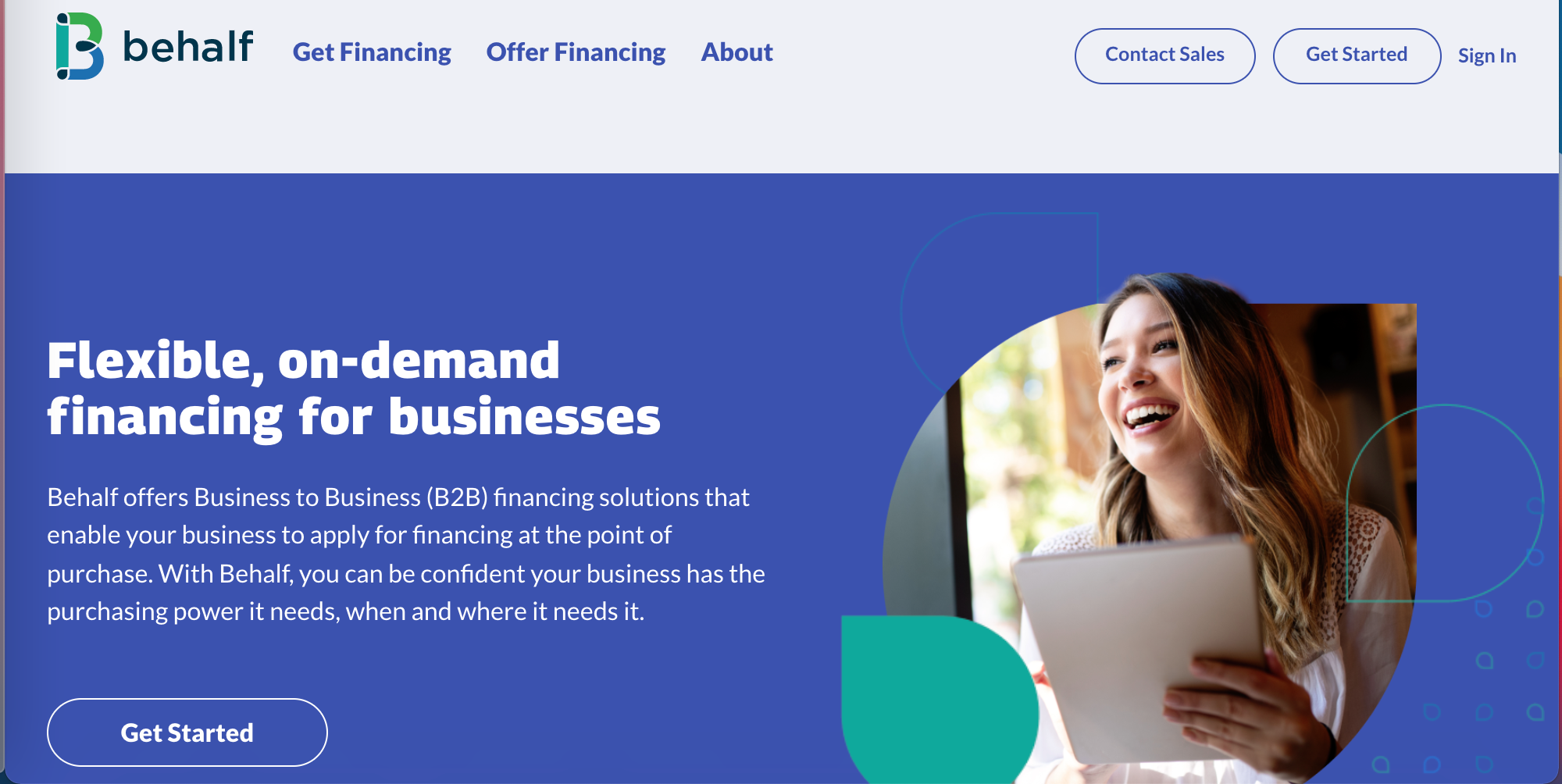

Behalf provides sales and cash flow solutions within the B2B payments sector. The company offers a solution that allows merchants to provide their business customers with net terms and financing options, thereby enabling purchasing power and payment flexibility. Behalf's services are designed to integrate into eCommerce platforms, automating the payment process across various B2B sales channels, including invoicing and managed sales. It was founded in 2012 and is based in New York, New York.

Loading...

Behalf's Product Videos

Loading...

Research containing Behalf

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Behalf in 1 CB Insights research brief, most recently on Mar 9, 2023.

Expert Collections containing Behalf

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Behalf is included in 5 Expert Collections, including Fintech 100.

Fintech 100

498 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,334 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

2,003 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Behalf Patents

Behalf has filed 4 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/24/2014 | 5/12/2020 | Credit, Loans, Personal finance, Mortgage, Debt | Grant |

Application Date | 12/24/2014 |

|---|---|

Grant Date | 5/12/2020 |

Title | |

Related Topics | Credit, Loans, Personal finance, Mortgage, Debt |

Status | Grant |

Latest Behalf News

Aug 30, 2023

News provided by Share this article Share toX NEW YORK, Aug. 30, 2023 /PRNewswire/ -- Monteverde & Associates PC has filed a class action lawsuit in the United States District Court for the Northern District of California, Case No. 5:23-cv-3665, on behalf of former public common shareholders of Sumo Logic, Inc. ("Sumo Logic" or the "Company") who held Sumo Logic securities as of the record date, April 3, 2023 (the "Class Period"), and who were harmed by Sumo Logic and its officers' alleged violations of Sections 14(a) and 20(a) of the Securities Exchange Act of 1934 (the "Exchange Act"), in connection with the acquisition of Sumo Logic by an affiliate of Francisco Partners Management, L.P. (the "Merger"). Under the terms of the Merger, each share of Sumo Logic common stock owned was converted into the right to receive $12.05 in cash per share (the "Merger Consideration"). The Complaint alleges that the Merger Consideration was inadequate and that the Definitive Proxy Statement issued by the Company with the U.S. Securities and Exchange Commission on April 5, 2023, provided stockholders with materially incomplete and misleading information in violation of Sections 14(a) and 20(a) of the Exchange Act. The Merger was completed on May 12, 2023. Mr. Juan Monteverde is available to personally discuss this case with you, and if you wish to serve as lead plaintiff, you must move the Court no later than September 26, 2023. Any member of the putative class may move the Court to serve as lead plaintiff through counsel of their choice or may choose to do nothing and remain an absent class member. Click here for more information: https://www.monteverdelaw.com/case/sumo-logic-inc . It is free and there is no cost or obligation to you. Monteverde & Associates PC is a national class action securities and consumer litigation law firm that has recovered millions of dollars for shareholders and is committed to protecting investors and consumers from corporate wrongdoing. Monteverde & Associates lawyers have significant experience litigating Mergers & Acquisitions and Securities Class Actions, whereby they protect investors by recovering money and remedying corporate misconduct. Mr. Monteverde, who leads the legal team at the firm, has been recognized by Super Lawyers as a Rising Star in Securities Litigation in 2013, 2017-2019 and a Super Lawyers Honoree in Securities Litigation in 2022-2023. He has also been selected by Martindale-Hubbell as a 2017-2022 Top Rated Lawyer. Our firm's recent successes include changing the law in a significant victory that lowered the standard of liability under Section 14(e) of the Exchange Act in the Ninth Circuit. Thereafter, our firm successfully preserved this victory by obtaining dismissal of a writ of certiorari as improvidently granted at the United States Supreme Court. Emulex Corp. v. Varjabedian, 139 S. Ct. 1407 (2019). Also, over the years the firm has recovered or secured over a dozen cash common funds for shareholders in mergers & acquisitions class action cases. Contact:

Behalf Frequently Asked Questions (FAQ)

When was Behalf founded?

Behalf was founded in 2012.

Where is Behalf's headquarters?

Behalf's headquarters is located at 100 William St, New York.

What is Behalf's latest funding round?

Behalf's latest funding round is Debt - II.

How much did Behalf raise?

Behalf raised a total of $325M.

Who are the investors of Behalf?

Investors of Behalf include Viola Credit, MissionOG, Vintage Investment Partners, Migdal Insurance, La Maison Partners and 11 more.

Who are Behalf's competitors?

Competitors of Behalf include Funding Societies, axio, Fundbox, First Circle, Prospa and 7 more.

Loading...

Compare Behalf to Competitors

Bluevine is a financial technology company that specializes in providing business banking solutions. The company offers business checking accounts with high-yield interest, accounts payable automation, and extensive FDIC insurance, as well as business loans and credit cards designed to meet the needs of small businesses. Bluevine primarily serves the small business sector with its suite of financial products. It was founded in 2013 and is based in Jersey City, New Jersey.

Fundbox provides an embedded working capital platform for small businesses and operates within the financial services industry. It offers services such as business loans and lines of credit, which are designed to help businesses manage their cash flow and cover expenses. It primarily serves the small business sector. The company was founded in 2013 and is based in San Francisco, California.

C2FO focuses on providing working capital solutions in the financial sector. The company offers services that allow businesses to get their invoices paid early, providing flexible access to low-cost capital. It helps eliminate the need for loans, paperwork, or other hassles, allowing businesses to control their cash flow and unlock potential in their balance sheets. C2FO was formerly known as Pollenware. It was founded in 2008 and is based in Leawood, Kansas.

First Circle is a fintech company specializing in providing non-collateral business loans to Small and Medium Enterprises (SMEs). The company offers a revolving credit line that businesses can access anytime for working capital needs, alongside other financial products designed to support business growth and project acquisition. First Circle primarily serves SMEs looking for accessible financing solutions to manage cash flow and fund expansion. It was founded in 2016 and is based in Taguig City, Philippines.

Funding Societies is a digital financing platform that provides short-term loans to SMEs within the financial services industry. The company offers financial products including micro loans, business term loans, and trade finance solutions, to address the financing needs of small and medium-sized enterprises. Funding Societies serve the SME sector, facilitating access to credit and investment opportunities for individuals and institutional investors. It was founded in 2015 and is based in Singapore.

Noumena specializes in providing alternative financing solutions within the financial services sector, focusing on a growing segment of freelancers and solopreneurs. The company offers a threaded finance platform and methodology to evaluate the financial potential of independent workers, thereby facilitating access to capital for business growth and reducing cash flow uncertainty. Noumena primarily serves the digital economy, connecting capital providers with freelancers and small businesses in need of funding. It was founded in 2019 and is based in Miami, Florida.

Loading...