Worldpay

Founded Year

1993Stage

Acq - Fin - II | AliveValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+27 points in the past 30 days

About Worldpay

Worldpay is a payments technology company specializing in omni-commerce solutions across various business sectors. The company offers services that enable businesses to accept, manage, and make payments in-person, online, and across multiple channels, including embedded payments for software platforms. Worldpay primarily serves small businesses, enterprises, software platforms, and marketplaces across various industries such as financial services, retail, and travel. It was founded in 1993 and is based in London, England.

Loading...

ESPs containing Worldpay

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual payment terminals market refers to a type of payment solution that allows merchants to accept payments through a web-based platform, without the need for a physical payment terminal. Virtual payment terminals are typically used by e-commerce businesses and other remote merchants who do not have a physical store or who need to accept payments from customers who are not present. The mark…

Worldpay named as Leader among 15 other companies, including Stripe, Fiserv, and Block.

Loading...

Research containing Worldpay

Get data-driven expert analysis from the CB Insights Intelligence Unit.

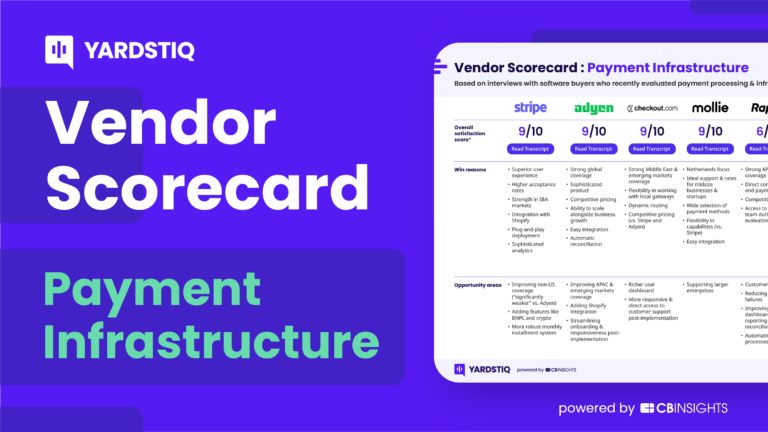

CB Insights Intelligence Analysts have mentioned Worldpay in 1 CB Insights research brief, most recently on Sep 21, 2022.

Sep 21, 2022 report

Top payment infrastructure companies — and why customers chose themExpert Collections containing Worldpay

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Worldpay is included in 5 Expert Collections, including SMB Fintech.

SMB Fintech

1,648 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Conference Exhibitors

5,302 items

Fintech

13,559 items

Excludes US-based companies

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

Worldpay Patents

Worldpay has filed 523 patents.

The 3 most popular patent topics include:

- payment systems

- payment service providers

- mobile payments

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/29/2020 | 12/3/2024 | Payment systems, Payment service providers, Banking technology, Credit cards, Electronic funds transfer | Grant |

Application Date | 9/29/2020 |

|---|---|

Grant Date | 12/3/2024 |

Title | |

Related Topics | Payment systems, Payment service providers, Banking technology, Credit cards, Electronic funds transfer |

Status | Grant |

Latest Worldpay News

Jan 22, 2025

Building a network of merchants is key to building a BNPL business, since have said consumers care more about the merchants offering installment plans than the actual BNPL provider. Klarna, for example, has divested its Checkout product and forged partnerships with payment companies such as Stripe, Worldpay, Adyen and other payment processors, enabling Klarna to add more than 100,000 new retailers in the past year. Klarna has added an updated Visa card, as has Affirm and Afterpay. Amazon, which has a partnership with Affirm, last week boosted its BNPL game by acquiring Axio, a Bengaluru, India-based fintech that offers installment lending and related technology. "Of course we're looking and keeping an eye on what the fintech sector is doing," Mani said. "We think we have a lot of digital-first products that we can transport over to Pay's case, it has pursued a strategy of partnering with fintechs — specifically, ChargeAfter, FreedomPay and Shopify. "We have seen Affirm's partnership with Apple to replace Apple Pay Later to extend its reach, and I think we will see more of these deals as BNPL providers work to enlarge their acceptance points," McPherson said. One challenge is the sheer proliferation of BNPL providers, and the risk that consumers may overextend themselves by taking on too many BNPL loans from different providers, who can't see each other's exposures, McPherson said, noting Pay does a credit pull before approving a line of credit, and reports to the credit bureaus, so this reduces its risk at the expense of losing some customers who may have a credit freeze in place. "As more BNPL providers do this, the overall risk should go down, and it will become more difficult to get financing, which is probably a good thing," McPherson said. What people want , American Banker's publisher, which notes 60% of Gen Z and 66% of millennial consumers are likely to use BNPL. Arizent also reports BNPL is one of the biggest reasons consumers are shifting away from traditional banks to fintechs. own research found 82% of Americans say pay-over-time products have benefits, 49% of Americans have used a pay-over-time product to make a purchase, and 68% of American consumers say not having flexible payment options is a deal breaker. "The consumer trends are well known," Mani said. "People want to choose how they pay." The banks are late to the game, and BNPL focused fintechs have grabbed the first mover advantage, said Aaron Press, research director of worldwide payment strategies for IDC. "This not only makes it hard to acquire consumer customers, but also to get space on increasingly crowded merchant payment pages. And for many consumers, association with a big bank can be a liability," Press said. Pay appears to be an interesting experiment, Press said, noting it's a hybrid with elements of both traditional and BNPL models. "It offers a BNPL type of experience but is doing a hard credit check and offering an open line of credit. It's also similar to private label programs, without requiring involvement of the networks."

Worldpay Frequently Asked Questions (FAQ)

When was Worldpay founded?

Worldpay was founded in 1993.

Where is Worldpay's headquarters?

Worldpay's headquarters is located at 25 Walbrook, London.

What is Worldpay's latest funding round?

Worldpay's latest funding round is Acq - Fin - II.

Who are the investors of Worldpay?

Investors of Worldpay include GTCR, FIS, Vantiv, Advent International, Bain Capital and 3 more.

Who are Worldpay's competitors?

Competitors of Worldpay include Clip, Sticky, Stripe, FlexM, Priority Payment Solutions and 7 more.

Loading...

Compare Worldpay to Competitors

Stripe provides services for businesses to manage online and in-person payments. The company offers products including payment processing Application Programming Interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

PayU provides global payments and financial technology, solutions. The company offers a global payment platform that enables merchants to process online payments, optimize transaction approval rates, and utilize advanced security and anti-fraud measures. PayU primarily serves the ecommerce industry, providing financial services and payment solutions to businesses looking to expand their reach in emerging markets. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

KB Kookmin Card is a payment solutions provider and a subsidiary of KB Financial Group. The company offers services including credit card issuance and payment processing solutions, as well as technology payment methods such as quick response (QR) codes and direct debit. KB Kookmin Card also provides white-label payment solutions and PaaS (Payment As A Service) for cross-border payments. It was founded in 2011 and is based in Seoul, South Korea. KB Kookmin Card operates as a subsidiary of KB Bukopin.

Moneris Solutions is a Canadian company specializing in payment processing and point-of-sale systems for various industries. Its offerings include POS systems, online payment gateways, and ecommerce solutions to facilitate transactions for businesses. Moneris Solutions provides merchant cash advances, gift card programs, and data analytics services. It was founded in 2000 and is based in Toronto, Canada.

BlueSnap provides flexible payment solutions and delivers a customizable platform to global online businesses such as software publishers, web hosting companies, and online retailers. BlueSnap builds and manages online businesses for software publishers, web hosting companies, and online retailers. A business can choose the BlueSnap hosted application that spans the entire e-commerce lifecycle, or it can deploy the BlueSnap API, which allows retailers to integrate the technology with existing solutions. Using BlueSnap software, retailers can deliver newsletters to customers, coupons and promotions, real-time reporting, and live chat, amongst other features. It was formerly known as Plimus. It was founded in 2001 and is based in Waltham, Massachusetts.

InComm Payments specializes in innovative payment technology solutions. The company offers a range of products including frictionless payment options, alternative payment methods like cryptocurrency, and management services for healthcare benefits. InComm Payments primarily serves sectors such as retail, healthcare, and e-commerce with its technology. It was founded in 1992 and is based in Atlanta, Georgia.

Loading...