Whatnot

Founded Year

2019Stage

Series E | AliveTotal Raised

$749.15MValuation

$0000Last Raised

$265M | 2 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+48 points in the past 30 days

About Whatnot

Whatnot operates as a livestream shopping platform. It connects buyers and sellers in real-time for a variety of categories including collectibles, fashion, and sneakers. Primarily, Whatnot caters to the ecommerce industry. It was founded in 2019 and is based in Marina del Rey, California.

Loading...

ESPs containing Whatnot

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The livestream e-commerce market, or live video shopping, enables real-time online shopping experiences where influencers or salespeople promote products. It includes white label software providers, and brand-accessible marketplaces. Shoppable videos and one-to-one digital clienteling capabilities are features commonly offered by software providers. The goal is to help retailers and brands enhance…

Whatnot named as Highflier among 15 other companies, including ByteDance, Firework, and TalkShopLive.

Loading...

Research containing Whatnot

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Whatnot in 6 CB Insights research briefs, most recently on Feb 28, 2024.

Feb 28, 2024 report

The Celebrity VC Index

Dec 8, 2023 report

The top 25 most successful startup accelerators

May 25, 2023

Will livestream shopping ever take off globally?

Expert Collections containing Whatnot

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

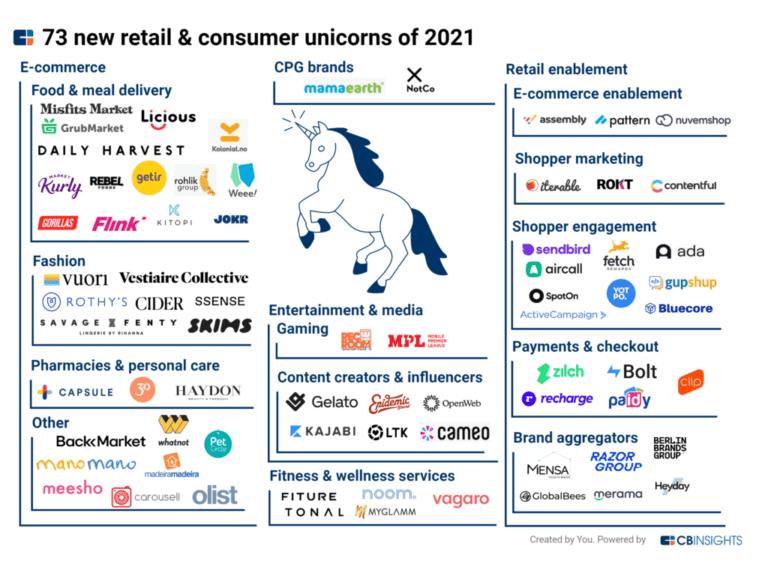

Whatnot is included in 3 Expert Collections, including E-Commerce.

E-Commerce

11,511 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,257 items

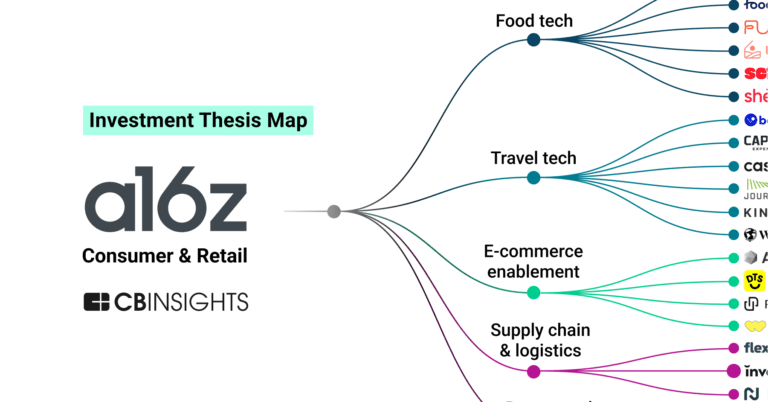

a16z Marketplace 100

200 items

The a16z Marketplace 100 is a ranking of the largest consumer-facing marketplace startups and private companies created by venture firm, Andreessen Horowitz.

Whatnot Patents

Whatnot has filed 9 patents.

The 3 most popular patent topics include:

- mobile computers

- network protocols

- graphical user interface elements

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/6/2021 | 6/14/2022 | Graphical user interface elements, Wireless networking, Network protocols, Thin clients, Mobile computers | Grant |

Application Date | 12/6/2021 |

|---|---|

Grant Date | 6/14/2022 |

Title | |

Related Topics | Graphical user interface elements, Wireless networking, Network protocols, Thin clients, Mobile computers |

Status | Grant |

Latest Whatnot News

Jan 13, 2025

From healthcare and agriculture to e-commerce and real estate, startups leveraging AI to solve critical challenges have captured the attention of global investors. The AI funding landscape saw massive capital inflows this week, as companies across sectors secured game-changing investments to drive innovation. From healthcare and agriculture to e-commerce and real estate, startups leveraging AI to solve critical challenges have captured the attention of global investors. DDN – $300 Million Blackstone Group has made a strategic $300 million investment into DDN (DataDirect Networks), valuing the California-based data storage company at $5 billion. This funding will enable DDN to expand its reach across industries such as healthcare and autonomous vehicles, while accelerating product innovation, particularly for its AI data intelligence platform. The investment underscores the growing demand for data storage and management solutions as businesses ramp up AI initiatives. Blackstone’s involvement in DDN complements its broader data sector strategy, which includes significant investments in AI infrastructure and data center developments, such as its partnership with Digital Realty and CoreWeave. Innovaccer – $275 Million Innovaccer, a San Francisco-based healthcare AI leader, has secured $275 million in a Series F funding round, bringing its total capital raised to $675 million and valuing the company at approximately $3.45 billion. This funding, led by key players like Kaiser Permanente, Banner Health, Danaher Ventures, and B Capital Group, underscores Innovaccer’s mission to tackle healthcare’s data fragmentation challenges. The new capital will fuel the development of AI-powered tools and expand partnerships, solidifying Innovaccer’s position as a transformative force in healthcare data integration and analytics. Whatnot – $265 Million Whatnot, the livestream shopping platform focused on collectibles and niche items, has successfully raised $265 million in Series E funding, bringing its valuation to $4.97 billion. The company plans to use the funds to expand into new categories such as art, golf, and vinyl, and to enhance seller tools for inventory and order management. Whatnot leverages AI to optimize its platform, helping personalize the shopping experience and streamline auction processes. With a growing presence in markets like the U.S., U.K., and Canada, Whatnot is also set to launch in Australia and expand further into Europe. Known for its unique “sudden death” auctions and flash sales, Whatnot continues to innovate in the livestream shopping space. The company’s GMV has surpassed $3 billion, further emphasizing its strong growth trajectory. Inari – $144 Million Inari, a Cambridge-based agricultural technology company, has raised $144 million in its latest funding round, reinforcing strong investor confidence in its innovative approach to seed technology. The company’s SEEDesign platform, powered by AI-driven predictive design, enables multiplex gene editing to optimize crops like soybeans, corn, and wheat for higher yields with fewer resources. This groundbreaking technology is poised to address global agricultural challenges, particularly in the face of climate change. With the new funding, Inari is set to scale its high-performance solutions and expand its impact across the agriculture sector worldwide. CEO Ponsi Trivisvavet highlighted that this investment will enable the company to further redefine the seed technology landscape. Hippocratic AI – $141 Million Hippocratic AI, a healthcare-focused generative AI startup, has raised $141 million in its Series B funding round, pushing its valuation to $1.64 billion and solidifying its status as a healthcare “unicorn.” The funding round saw participation from leading investors, including Kleiner Perkins, General Catalyst, Andreessen Horowitz, and NVIDIA, reflecting strong confidence in its mission to address the global healthcare staffing crisis. With a total of $278 million raised to date, Hippocratic AI is leveraging AI-driven tools to assist healthcare professionals with non-diagnostic, patient-facing tasks. The company’s rapid growth includes partnerships with 23 healthcare organizations and facilitating over 200,000 patient interactions. CEO Munjal Shah highlights the startup’s focus on safety and innovation, describing their efforts as a paradigm shift in healthcare delivery. Abstract – $4.8 Million Abstract, an AI-powered regulatory risk management platform, has raised $4.8 million in seed funding, co-led by Bonfire Ventures and Communitas Capital, bringing its total funding to over $9 million. Founded by CEO Pat Utz, the company addresses transparency gaps in legislative processes by leveraging AI and data from over 145,000 sources, including government bodies and social media, to provide tailored insights into regulatory risks and opportunities. The funding will accelerate Abstract’s mission to transform compliance into a strategic advantage, enhancing its platform’s ability to analyze draft legislation, public comments, and regulatory discussions in real time. Fazeshift – $4 Million Fazeshift, an AI-powered agent transforming the accounts receivable (AR) process, has raised $4 million in seed funding, with participation from Gradient, Google’s early-stage AI fund, Y Combinator, Wayfinder, Pioneer Fund, Ritual Capital, and Phoenix Fund, alongside prominent angel investors. Co-founded by Caitlin Leksana and Timmy during their MBA at Harvard, Fazeshift tackles inefficiencies in AR workflows by integrating data across platforms like QuickBooks, Stripe, and Salesforce, automating tasks such as invoice generation, payment reconciliation, and overdue account management. With businesses losing over $200 billion annually to AR inefficiencies, Fazeshift’s LLM-powered platform offers a transformative solution, handling complex workflows with precision. The funding will drive product development and customer acquisition as Fazeshift positions itself at the forefront of AI-driven financial operations. Unlisted – $2.25 Million Unlisted, a real estate technology startup, has raised $2.25 million in seed funding to transform how off-market homes are bought and sold. The platform, led by founder and CEO Katie Hill, leverages AI to match homeowners with potential buyers without the need for public listings. Unlisted operates as a neutral facilitator, charging a fee to buyers who initiate contact while remaining commission-free. The company’s approach addresses the real estate industry’s challenges, such as low inventory and shifting commission structures, by providing more options for homeowners and buyers. With support from HearstLab and Hearst Newspapers, Unlisted aims to enhance local real estate insights and expand its reach. Anshika Mathews Anshika is the Senior Content Strategist for AIM Research. She holds a keen interest in technology and related policy-making and its impact on society. She can be reached at anshika.mathews@aimresearch.co Subscribe to our Latest Insights Work Email Subscribe By clicking the “Continue” button, you are agreeing to the AIM Media Terms of Use and Privacy Policy. Recognitions & Lists

Whatnot Frequently Asked Questions (FAQ)

When was Whatnot founded?

Whatnot was founded in 2019.

Where is Whatnot's headquarters?

Whatnot's headquarters is located at 578 Washington Boulevard, Marina del Rey.

What is Whatnot's latest funding round?

Whatnot's latest funding round is Series E.

How much did Whatnot raise?

Whatnot raised a total of $749.15M.

Who are the investors of Whatnot?

Investors of Whatnot include Y Combinator, Andreessen Horowitz, CapitalG, DST Global, Bond and 27 more.

Who are Whatnot's competitors?

Competitors of Whatnot include BigStep Technologies, Hero, Courtyard, ShopShops, Firework and 7 more.

Loading...

Compare Whatnot to Competitors

ONLIVE.SITE provides video-enabled eCommerce tools and operates within the digital retail technology sector. The company offers virtual sales agents, live shopping, shoppable videos, and 3D immersive streaming to support customer engagement and sales conversion for businesses. ONLIVE.SITE serves sectors that use interactive and immersive shopping experiences, including automotive, consumer electronics, telecommunications, fashion and retail, real estate, and beauty and cosmetics. It was founded in 2020 and is based in Barcelona, Spain.

Immerss focuses on enhancing the online shopping experience by integrating personalization and live interaction capabilities into e-commerce platforms. The company offers digital clienteling and livestream shopping solutions that allow retail associates to engage with customers through one-on-one shoppable video calls, dynamic chat engagements, and live streaming events. Immerss primarily serves industries such as footwear, apparel, jewelry, home decor, accessories, beauty, electronics, and sporting goods. It was founded in 2015 and is based in Dallas, Texas.

buywith specializes in live commerce and operates within the social commerce industry. It offers a livestream shopping platform that transforms e-commerce into video shopping experiences, featuring shoppable videos, live event hosting, and social media multi-streaming. The platform primarily caters to brands looking to engage with the creator economy and modern consumers, particularly Gen Z and Millennials. It was founded in 2018 and is based in Tel Aviv, Israel.

Firework specializes in video commerce and live-streaming platforms within the digital marketing and e-commerce sectors. The company offers a suite of products that enable businesses to create interactive, shoppable video content and engage with customers through AI-driven experiences and live video chats. Firework's solutions cater to various industries, including automobiles, electronics, beauty, fashion, and home, providing tools to enhance online sales and customer engagement. Firework was formerly known as Loop. It was founded in 2017 and is based in San Mateo, California.

Oveit provides ticketing and payment solutions for events and attractions within the entertainment and tourism sectors. It offers services including event ticketing, cashless payments, smart tickets, and registration automation. Oveit's solutions cater to sectors such as conferences, theme parks, museums, and festivals, providing tools for access control and data analytics. It was founded in 2017 and is based in Austin, Texas.

SWIRL specializes in video commerce solutions within the digital marketing and e-commerce sectors. The company offers a platform for livestream shopping, shoppable video content, and personalized video shopping experiences designed to increase customer engagement and sales conversions. SWIRL's services are primarily utilized by businesses looking to enhance their online and omnichannel commerce strategies. It was founded in 2017 and is based in Vadodara, India.

Loading...