WEX

Founded Year

1983Stage

PIPE | IPOMarket Cap

7.31BStock Price

183.79Revenue

$0000About WEX

WEX is a global commerce platform specializing in operational solutions for businesses across various sectors. The company offers a suite of products including fuel cards, fleet management tools, employee benefits administration, and business payment services. WEX primarily serves industries such as fuel and energy, business and commerce, financial services and technology, and the public sector. It was founded in 1983 and is based in Portland, Maine.

Loading...

Loading...

Research containing WEX

Get data-driven expert analysis from the CB Insights Intelligence Unit.

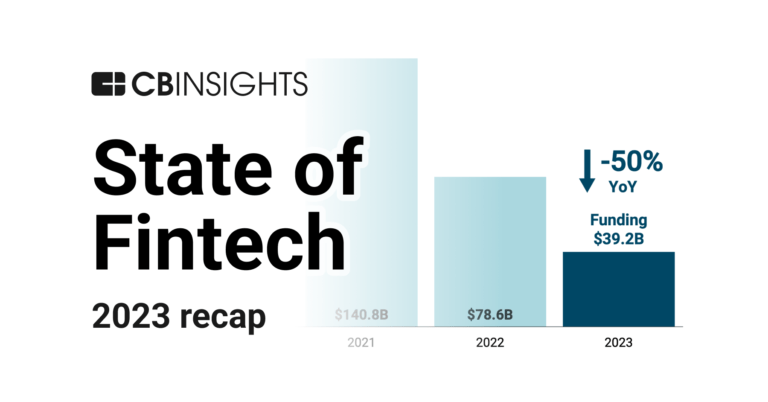

CB Insights Intelligence Analysts have mentioned WEX in 1 CB Insights research brief, most recently on Jan 18, 2024.

Jan 18, 2024 report

State of Fintech 2023 ReportExpert Collections containing WEX

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

WEX is included in 2 Expert Collections, including Conference Exhibitors.

Conference Exhibitors

5,302 items

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

WEX Patents

WEX has filed 8 patents.

The 3 most popular patent topics include:

- data management

- database management systems

- diagrams

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/26/2020 | 5/30/2023 | Environmental engineering, Sewerage, Sanitation, Water pollution, Sewerage infrastructure | Grant |

Application Date | 10/26/2020 |

|---|---|

Grant Date | 5/30/2023 |

Title | |

Related Topics | Environmental engineering, Sewerage, Sanitation, Water pollution, Sewerage infrastructure |

Status | Grant |

Latest WEX News

Jan 19, 2025

Burney Co. Sells 15,263 Shares of WEX Inc. (NYSE:WEX) Posted by MarketBeat News on Jan 19th, 2025 Burney Co. lessened its stake in shares of WEX Inc. ( NYSE:WEX – Free Report ) by 92.4% during the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,264 shares of the business services provider’s stock after selling 15,263 shares during the period. Burney Co.’s holdings in WEX were worth $222,000 at the end of the most recent reporting period. A number of other hedge funds have also recently added to or reduced their stakes in the stock. Janus Henderson Group PLC increased its stake in WEX by 0.6% during the 3rd quarter. Janus Henderson Group PLC now owns 4,163,678 shares of the business services provider’s stock worth $873,251,000 after acquiring an additional 25,365 shares during the period. FMR LLC increased its stake in shares of WEX by 8.8% in the 3rd quarter. FMR LLC now owns 1,555,507 shares of the business services provider’s stock valued at $326,237,000 after purchasing an additional 125,262 shares during the last quarter. State Street Corp increased its stake in shares of WEX by 0.3% in the 3rd quarter. State Street Corp now owns 1,240,953 shares of the business services provider’s stock valued at $260,265,000 after purchasing an additional 3,882 shares during the last quarter. River Road Asset Management LLC increased its stake in shares of WEX by 5.0% in the 3rd quarter. River Road Asset Management LLC now owns 720,465 shares of the business services provider’s stock valued at $151,103,000 after purchasing an additional 34,264 shares during the last quarter. Finally, Dimensional Fund Advisors LP increased its stake in shares of WEX by 34.3% in the 2nd quarter. Dimensional Fund Advisors LP now owns 495,527 shares of the business services provider’s stock valued at $87,772,000 after purchasing an additional 126,663 shares during the last quarter. Institutional investors own 97.47% of the company’s stock. Get WEX alerts: WEX Price Performance Shares of WEX opened at $184.40 on Friday. The stock has a market cap of $7.34 billion, a PE ratio of 23.40, a price-to-earnings-growth ratio of 1.23 and a beta of 1.58. The company has a debt-to-equity ratio of 1.87, a quick ratio of 1.04 and a current ratio of 1.04. WEX Inc. has a fifty-two week low of $165.51 and a fifty-two week high of $244.04. The firm’s 50-day simple moving average is $178.78 and its two-hundred day simple moving average is $186.07. Want More Great Investing Ideas? Insiders Place Their Bets In other news, COO Robert Joseph Deshaies sold 175 shares of the firm’s stock in a transaction on Friday, November 29th. The shares were sold at an average price of $189.44, for a total transaction of $33,152.00. Following the sale, the chief operating officer now directly owns 7,582 shares in the company, valued at $1,436,334.08. This trade represents a 2.26 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink . Insiders own 1.10% of the company’s stock. WEX Company Profile WEX Inc operates a commerce platform in the United States and internationally. The Mobility segment offers fleet vehicle payment solutions, transaction processing, and information management services; and provides account activation and account retention services; authorization and billing inquiries, and account maintenance services; account management; credit and collections services; merchant services; analytics solutions; and ancillary services and offerings. Featured Articles

WEX Frequently Asked Questions (FAQ)

When was WEX founded?

WEX was founded in 1983.

Where is WEX's headquarters?

WEX's headquarters is located at One Hancock Street, Portland.

What is WEX's latest funding round?

WEX's latest funding round is PIPE.

Who are the investors of WEX?

Investors of WEX include Warburg Pincus.

Who are WEX's competitors?

Competitors of WEX include First Dollar, Elevate, AtoB, Benepass, Fillip and 7 more.

Loading...

Compare WEX to Competitors

Haitong Futures operates in the brokerage industry and focuses on financial derivatives. The company offers futures brokerage and margin trading services, along with investment advisory and market research for financial instruments. Haitong Futures serves clients in the financial services and investment sectors. It was founded in 2005 and is based in Shanghai, China.

HSA Bank provides healthcare finance and benefits administration within the financial services industry. The company offers tax-advantaged accounts and administrative solutions, such as Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs), and Commuter Benefits. HSA Bank's services aim to assist individuals with healthcare costs, provide employers with benefit packages, and support brokers and partners. It was founded in 1997 and is based in Sheboygan, Wisconsin.

Provider of fleet fueling and maintenance programs that provide customer-oriented programs to assist businesses in cost management. The company develops business applications based on individual fuel and maintenance needs including onsite inventory control and data management. The company aims to decrease its customers paperwork.

Coast specializes in providing fleet fuel cards and expense management solutions for various industries. Its main offerings include fuel cards that enable businesses to control and monitor fuel and other expenses with transaction alerts and customizable spending limits. It primarily serves sectors such as HVAC, plumbing, construction, pest control, roofing, solar, transportation, and landscaping. It was founded in 2020 and is based in New York, New York.

Stripe is a financial infrastructure platform that provides services for businesses to manage online and in-person payments. The company offers products including payment processing Application Programming Interface (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as ecommerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Lynx is a fintech company that operates within the financial technology and healthcare sectors. The company provides APIs for integrating healthcare financial services into various platforms, serving sectors that require healthcare financial solutions, such as insurance companies, healthcare providers, and e-commerce platforms specializing in medical products. It was founded in 2021 and is based in Boston, Massachusetts.

Loading...