Viz.ai

Founded Year

2016Stage

Series D - II | AliveTotal Raised

$289.25MLast Raised

$40M | 2 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-2 points in the past 30 days

About Viz.ai

Viz.ai is a company that provides AI-powered care coordination solutions in the healthcare sector. Their services include analyzing medical imaging data with FDA-cleared algorithms to provide insights and assessments for diagnosis and treatment decisions. Viz.ai serves healthcare providers and collaborates with life sciences partners. It was founded in 2016 and is based in San Francisco, California.

Loading...

Viz.ai's Product Videos

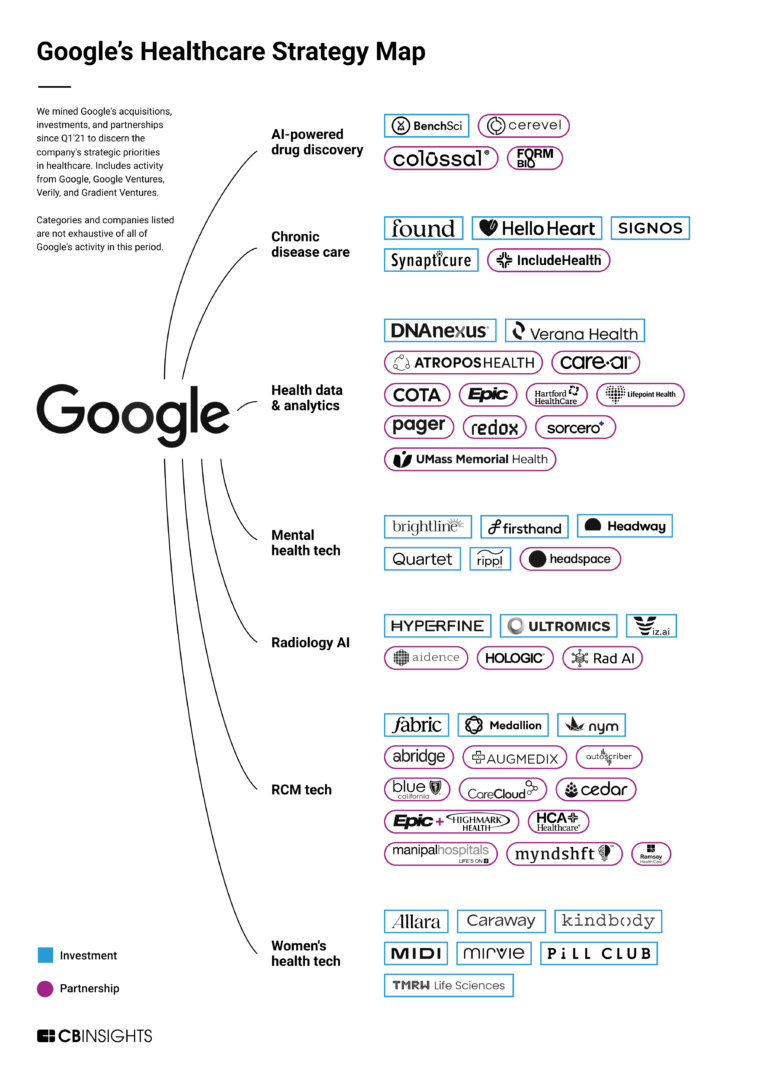

ESPs containing Viz.ai

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

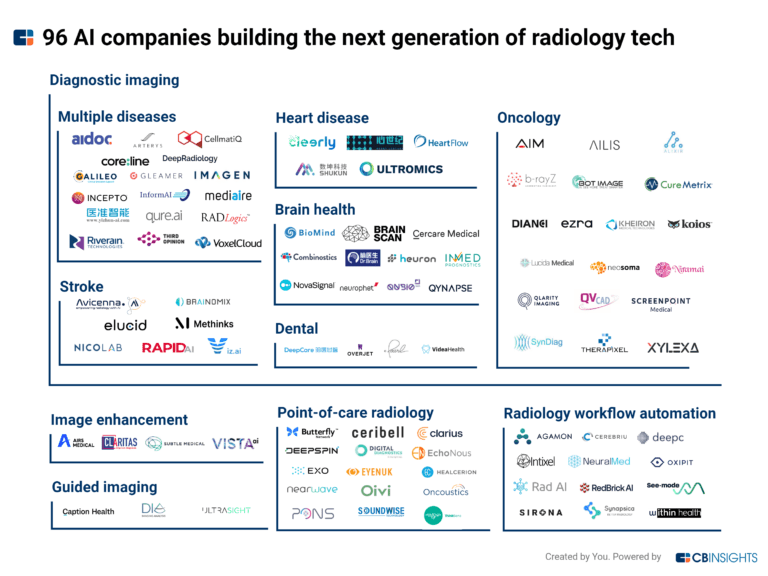

The radiology diagnostics (multiple modalities) market consists of solutions that offer various imaging modalities such as CT, MRI, ECG, Echo, and X-ray. The companies in this market leverage technology, including AI, in assisting with coordinating patient care, providing faster diagnoses, and improving radiologist efficiency and accuracy. It also offers insights into risk aspects of patient medi…

Viz.ai named as Leader among 15 other companies, including Aidoc, Butterfly Network, and Clarius Mobile Health.

Viz.ai's Products & Differentiators

Viz Neuro Suite

Viz Neuro Suite encompasses AI algorithms to detect suspected stroke, aneurysms, subdural hematomas and more.

Loading...

Research containing Viz.ai

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Viz.ai in 7 CB Insights research briefs, most recently on Apr 25, 2024.

Expert Collections containing Viz.ai

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Viz.ai is included in 5 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,261 items

AI 100

200 items

Digital Health 50

450 items

The most promising digital health startups transforming the healthcare industry

Digital Health

11,328 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Artificial Intelligence

7,222 items

Viz.ai Patents

Viz.ai has filed 24 patents.

The 3 most popular patent topics include:

- medical tests

- medical terminology

- emergency medicine

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

8/25/2022 | 8/20/2024 | Medical tests, Triage, Health informatics, Emergency medicine, Medical terminology | Grant |

Application Date | 8/25/2022 |

|---|---|

Grant Date | 8/20/2024 |

Title | |

Related Topics | Medical tests, Triage, Health informatics, Emergency medicine, Medical terminology |

Status | Grant |

Latest Viz.ai News

Feb 19, 2025

Follow Author Save Article Qventus In an unassuming corner of Silicon Valley, a quiet transformation is afoot. Qventus, a start-up led by Mudit Garg, has spent years applying sophisticated AI systems to the humdrum—but vital—business of hospital operations. Mr. Garg’s firm builds predictive models to help hospitals allocate resources, schedule surgeries, and ensure that patients receive prompt care. “We began by predicting what might happen,” he says. “But then, we found that people still often didn’t have time to process, therefore what I should do. So we built systems that can not only forecast but also recommend action.” This emphasis on “last-mile” execution—making AI not just prescient but practical—has enabled Qventus to carve out a distinct niche. At a time when large language models and other data-driven wonders appear to be sprouting everywhere, Qventus’s approach stands out as a model for other AI-driven start-ups seeking to prosper in a complex, risk-averse industry. Few sectors are as heavily regulated and operationally labyrinthine as healthcare. Yet Qventus’s experience reveals three guiding principles that are easily exportable to less complicated fields. A Problem Worth Solving Qventus began with a simple ambition: make healthcare run more smoothly. Hospitals excel at addressing medical challenges, but, as Mr. Garg observed, “the operational complexity was such that it was far from world class.” To a patient, this can be maddening. A surgical appointment is delayed, or staff are unaware of changes to medication instructions. In a 21st-century system replete with surgical robots and real-time analytics, how is it that many patients still arrive to find chaos? Part of the explanation is that the data in healthcare can be inconsistent. A good deal of it is entered manually, leaving more room for human error than the machine-gathered data one might see in, say, manufacturing. Health systems also vary enormously, even within the same region: an academic medical center in an urban hub is a very different beast from a rural hospital. Yet for Mr. Garg, the scope of operational problems only increased the appeal. “If we can drive reliability in this system,” he says, “we can unlock a lot more out of the clinical side.” The company’s operating philosophy rests on addressing discrete, high-value pain points—such as scheduling surgeries or optimizing care-transitions in an emergency department—rather than offering a nebulous “platform.” By excelling at these concrete tasks, Qventus wins trust from hospital staff, who in turn are more willing to adopt other AI-powered solutions. MORE FOR YOU Deep User Insight, Painstakingly Gathered This brand of credibility does not spring up overnight. Healthcare is a quintessential people business, requiring new tools to fit seamlessly into existing workflows. The Qventus team thus spends a great deal of time observing staff behavior, from nurses to administrative managers. Even the savviest algorithms are of no use if clinicians cannot integrate them into day-to-day routines. Certainly, the predictive analytics powering Qventus’s solutions are impressive; they go so far as to anticipate surges in Emergency Department arrivals after large concerts. Yet the more subtle achievement is bridging the gap between an accurate forecast and actionable advice. “We found that seeing what will happen is often not enough,” explains Mr. Garg. “It needs to be distilled into actual work.” That may mean automatically sending an operating-theater opening to a specialist or firing off a reminder to a nurse so he can inform a patient which pre-surgical medications to discontinue. This is a far cry from the typical “dashboard mania” afflicting many industries, where data visualizations may look splendid but inspire little change. The secret, Qventus found, lies in refining the product with pilot partners. “Even now, when we develop new solutions,” says Mr. Garg, “we build it with a handful of health systems that are diverse: academic, community, different geographies. We see how it really plays out on the ground.” Bet on Practical AI Qventus’s third principle centers on matching the right technology to the right job. While AI has wowed onlookers, it also introduces unpredictability: these models often offer startlingly good responses, punctuated by bizarre errors. Hence Qventus’s caution. Mr. Garg explains that his team experiments widely with new capabilities, yet holds off on “productionizing” them until they are reliable enough for real-world deployment. “The rate at which a feature can be built has accelerated,” he notes. “But the last mile is more complicated. Just because we can build a demo doesn’t mean we can roll out a high-trust product that hospitals rely on.” In a setting where mistakes can have serious consequences, being 90% right simply does not cut it. That means building robust guardrails. Qventus invests in data monitoring, model monitoring and outcomes assessment. If the system deviates from norms—perhaps because data quality has changed—the team investigates at once. By engineering such scaffolding, Qventus ensures its predictions and interventions maintain a high standard of accuracy. These pragmatic steps will resonate with start-ups in other industries struggling to find an edge in an increasingly crowded AI market. Big cloud vendors make it ever easier to whip up a “Minimum Viable Product,” but forging real operational transformation is tougher. It takes domain expertise and diligence. The old manufacturing adage—“You get what you inspect, not just what you expect”—holds doubly true in AI-driven businesses. Lessons from Another Ward To see how these themes translate beyond Qventus, consider Viz.ai, a venture that uses machine learning to identify stroke patients quickly. Its software sifts through medical images to detect signs of stroke and then alerts neurosurgeons, shaving precious minutes off the patient’s time to treatment. Here, too, forging close relationships with providers and meticulously validating the technology proved essential. By persisting through years of regulatory scrutiny and hospital trials, Viz.ai has demonstrated that cutting-edge AI can slot into routine clinical practice. Like Qventus, Viz.ai discovered that it was not enough to supply a neat algorithm. Indeed, doctors would only adopt the system if it integrated with existing radiology workflows and gave near-instant notifications. Viz.ai engineers similarly found themselves delving into the complexities of radiology data streams and coordinating with multiple electronic health-record platforms. While different from Qventus’s focus on operations, the principle of “constructing technology around the user” rather than forcing the user to bend to the technology remains constant. Widening the Moat The experiences of Qventus and Viz.ai suggest that, contrary to sometimes-expressed fears, the democratization of AI does not spell doom for specialized start-ups. The barrier to entry may be lower for building a prototype, but the bar remains high for delivering business results at scale—especially in conservative settings like healthcare. Like so many software segments in the digital age, success belongs to those who invest in unglamorous but critical details: integrating messy data, winning user buy-in, and policing model reliability. Mr. Garg reflects that, had he realized how formidable the road ahead would be, he might have hesitated. “Everything has taken longer than I thought it would,” he says. “But if I had known how much impact was possible, that would have given me even more of a spring in my step.” Judging by Qventus’s progress – with a $105 million Series D investment announced in January – that step is more than a mere hop. The firm is now drawing on fresh sources of AI innovation, broadening its suite of “care operations” products—and offering a glimpse of how thoughtful, grounded start-ups can use advanced technology to mend even the most recalcitrant of systems.

Viz.ai Frequently Asked Questions (FAQ)

When was Viz.ai founded?

Viz.ai was founded in 2016.

Where is Viz.ai's headquarters?

Viz.ai's headquarters is located at 548 Market Street, San Francisco.

What is Viz.ai's latest funding round?

Viz.ai's latest funding round is Series D - II.

How much did Viz.ai raise?

Viz.ai raised a total of $289.25M.

Who are the investors of Viz.ai?

Investors of Viz.ai include CIBC Innovation Banking, Kleiner Perkins, Susa Ventures, Charles River Ventures, Threshold Ventures and 15 more.

Who are Viz.ai's competitors?

Competitors of Viz.ai include Medical Brain, Quibim, Aidoc, Subtle Medical, AIRS Medical and 7 more.

What products does Viz.ai offer?

Viz.ai's products include Viz Neuro Suite and 4 more.

Loading...

Compare Viz.ai to Competitors

RADLogics is a healthcare software company that provides AI solutions for the medical imaging sector. The company offers machine-learning image analysis tools for the detection and report generation processes for imaging data such as CT and X-ray scans. RADLogics serves the healthcare industry, focusing on radiology departments that use AI technologies in their diagnostic workflows. It was founded in 2010 and is based in New York, New York.

EnvoyAI, now part of TeraRecon, focuses on advanced visualization and artificial intelligence in the medical imaging sector. The company offers AI-powered solutions to enhance medical imaging workflows, including tools for radiology, cardiology, and neurology. These solutions aim to improve patient care by providing insights and decision support to healthcare professionals. It was founded in 2016 and is based in Durham, North Carolina.

Qure.ai specializes in leveraging artificial intelligence to enhance healthcare accessibility and affordability and focuses on the healthcare sector. The company provides AI-powered tools for medical image analysis, including chest x-ray interpretation and management of various conditions such as lung nodules, strokes, and heart failure. Its solutions are designed to assist healthcare professionals in diagnosing and treating diseases, with a significant presence in the global healthcare AI market. It was founded in 2016 and is based in Mumbai, India.

Aidoc works as a clinical company that specializes in healthcare technology. The company offers solutions that integrate into existing healthcare infrastructure. Aidoc's products primarily serve the cardiovascular, neuro, and radiology sectors within the healthcare industry. It was founded in 2016 and is based in New York, New York.

Densitas provides artificial intelligence solutions within the breast cancer screening domain. The company offers products that automate breast density assessments, track mammography quality, and help in compliance with regulatory standards such as the Mammography Quality Standards Act (MQSA). It primarily serves the healthcare sector. The company was founded in 2011 and is based in Halifax, Canada.

Mirada Medical specializes in medical imaging software within the healthcare technology sector. The company offers software applications that facilitate image analysis for cancer diagnosis and treatment, incorporating AI and automation to enhance clinician productivity and patient care. Mirada Medical's products are primarily utilized in the radiation oncology, diagnostic imaging, and interventional radiology sectors. It was founded in 2000 and is based in Oxford, United Kingdom. Mirada Medical operates as a subsidiary of CTI Molecular Imaging.

Loading...