Viva Wallet

Founded Year

2010Stage

Shareholder Liquidity | AliveTotal Raised

$287.53MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-64 points in the past 30 days

About Viva Wallet

Viva Wallet is a cloud-based neo-bank using Microsoft Azure with branches in twenty-three countries in Europe. It is a principal member of Visa and Mastercard for acquiring and issuing services with direct connectivity to the card schemes, providing processing services through its own platform. Viva Wallet provides businesses of all sizes with card acceptance services through POS terminals and the new Android Viva Wallet POS app, as well as through advanced payment gateways in online stores. It also offers business accounts with local IBAN and business Viva Wallet Mastercard cards. The company was founded in 2010 and is based in Athens, Greece.

Loading...

Viva Wallet's Product Videos

ESPs containing Viva Wallet

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

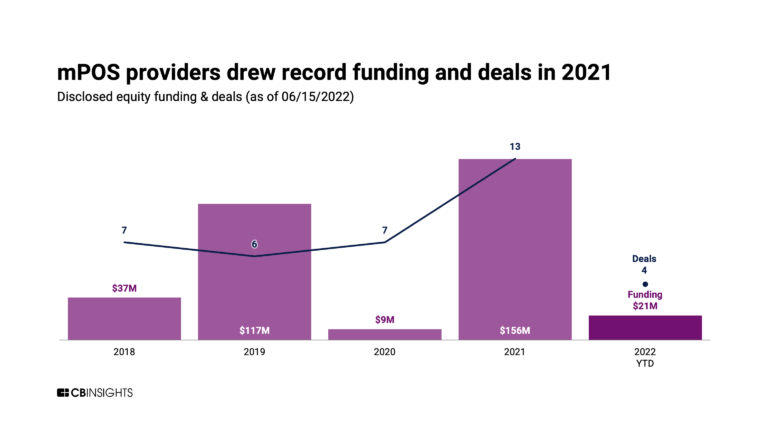

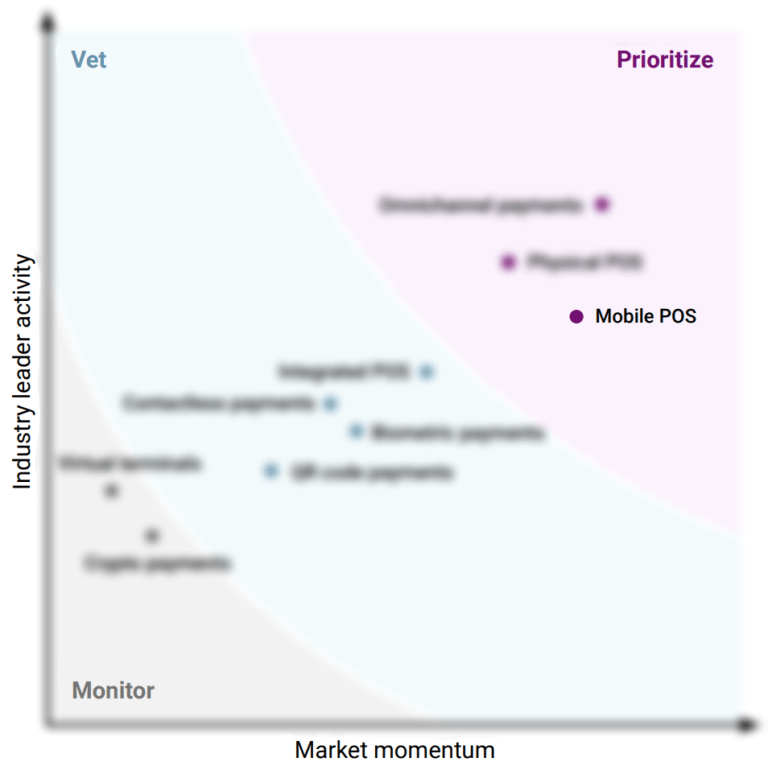

The mobile point-of-sale (mPOS) market offers a range of solutions for merchants to accept payments and engage with customers through mobile devices. These solutions include ordering, payment, and loyalty programs, as well as the ability to accept new payment form factors such as contactless and mobile wallets. The market also offers solutions for legacy POS systems to integrate with mobile platfo…

Viva Wallet named as Leader among 15 other companies, including Fiserv, FIS, and Block.

Viva Wallet's Products & Differentiators

Independent Hardware Vendor & Independent Software Vendor Partnership Programs

We enable payments on any smart device and we can integrate with any software or hardware provider through our cutting-edge software platform. We enable consolidation and less hassle for all businesses that accept payments, while introducing new innovative payment use cases across any industry. All that harnessing the power of our in-house omnichannel technologies, namely Viva Terminal App and Smart Checkout payment gateway.

Loading...

Research containing Viva Wallet

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Viva Wallet in 3 CB Insights research briefs, most recently on Sep 13, 2022.

Jun 2, 2022 report

Why vendors are prioritizing mobile point-of-sale (mPOS) systemsExpert Collections containing Viva Wallet

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Viva Wallet is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Viva Wallet News

Jan 9, 2025

Highlights: The dispute centers around service fees and operational terms. The legal action highlights the growing tension in the fintech sector. JPMorgan has initiated legal proceedings against Viva Wallet, alleging breaches of contract and disputes over service fees. This lawsuit underscores significant issues surrounding operations in the rapidly evolving fintech landscape as major banks and tech firms continue to navigate their partnerships amidst a competitive atmosphere. Tags

Viva Wallet Frequently Asked Questions (FAQ)

When was Viva Wallet founded?

Viva Wallet was founded in 2010.

Where is Viva Wallet's headquarters?

Viva Wallet's headquarters is located at Avenue Halandri Maroussi 18-20, Athens.

What is Viva Wallet's latest funding round?

Viva Wallet's latest funding round is Shareholder Liquidity.

How much did Viva Wallet raise?

Viva Wallet raised a total of $287.53M.

Who are the investors of Viva Wallet?

Investors of Viva Wallet include J.P. Morgan Chase, DECA Investments, Hedosophia, Latsis Family, Tencent and 5 more.

Who are Viva Wallet's competitors?

Competitors of Viva Wallet include SumUp and 7 more.

What products does Viva Wallet offer?

Viva Wallet's products include Independent Hardware Vendor & Independent Software Vendor Partnership Programs and 2 more.

Loading...

Compare Viva Wallet to Competitors

ECOMMPAY is an international payment service provider for mid-sized and large businesses. Its list of services include payment aggregation and mass-payouts, multi-currency transactions, and online payment solutions for clients worldwide.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Opn provides payment processing solutions and digital transformation services. The company offers products that enable businesses to accept payments, issue virtual cards, manage transactions, and automate payouts, all designed to facilitate seamless financial operations. It provides payment infrastructure for banks and platforms, as well as professional consulting services to help brands optimize their payment systems. It was founded in 2013 and is based in Bangkok, Thailand.

Mollie specializes in payment processing and money management for businesses. The company offers a suite of products that enable online and in-person payments, subscription management, fraud prevention, and financial reporting. It provides solutions that cater to the needs of businesses ranging from startups to enterprises, aiming to simplify the complexities of financial transactions and support business growth. The company was founded in 2004 and is based in Amsterdam, Netherlands.

Ingenico provides payment acceptance solutions within the financial technology sector. The company offers products and services such as payment terminals, cloud-based payment platforms, terminal management, and various payment services designed to cater to the needs of merchants, banks, and other entities in the commerce ecosystem. Its solutions are tailored to support industries such as retail, transportation, hospitality, healthcare, and non-profit organizations, among others. It was founded in 1980 and is based in Suresnes, France.

Worldpay is a payments technology company specializing in omni-commerce solutions across various business sectors. The company offers services that enable businesses to accept, manage, and make payments in-person, online, and across multiple channels, including embedded payments for software platforms. Worldpay primarily serves small businesses, enterprises, software platforms, and marketplaces across various industries such as financial services, retail, and travel. It was founded in 1993 and is based in London, England.

Loading...