Uniswap

Founded Year

2017Stage

Unattributed VC | AliveTotal Raised

$178.83MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-31 points in the past 30 days

About Uniswap

Uniswap is a decentralized finance platform that operates in the cryptocurrency sector. It provides a protocol for trading, earning, and liquidity provision without a central intermediary. The platform supports a growing network of DeFi applications and offers tools for developers to build on its protocol. It was founded in 2017 and is based in Brooklyn, New York.

Loading...

ESPs containing Uniswap

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

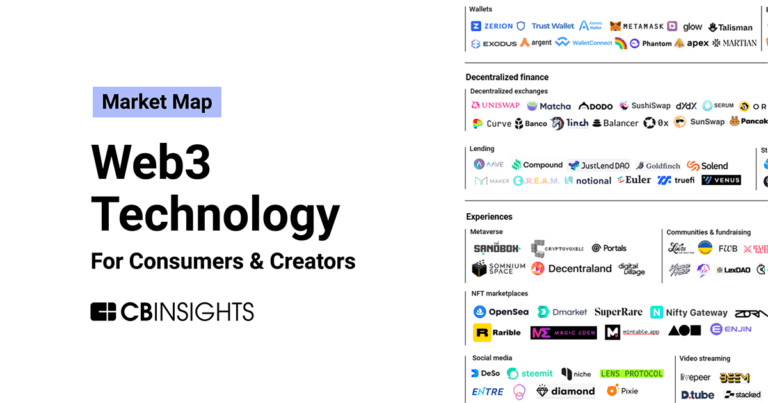

The decentralized crypto exchanges market refers to a segment of the cryptocurrency industry that aims to provide individuals with access to trading digital assets without the need for centralized entities or KYC disclosures. These exchanges offer professional trading tools for institutions and professional traders while allowing users to maintain custody of their own funds, which is unique compar…

Uniswap named as Leader among 8 other companies, including dYdX, 1inch Network, and Balancer.

Loading...

Research containing Uniswap

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Uniswap in 2 CB Insights research briefs, most recently on Nov 11, 2022.

Oct 15, 2022

What is institutional staking?Expert Collections containing Uniswap

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Uniswap is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Blockchain

13,177 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Blockchain 50

50 items

Latest Uniswap News

Jan 17, 2025

Seychelles VICTORIA, Seychelles, Jan. 17, 2025 (GLOBE NEWSWIRE) -- Bitget , the leading cryptocurrency exchange and Web3 company has added its native Bitget Token (BGB) on a liquidity pool on Uniswap, a leading decentralized exchange. This strategic move enables users to trade BGB directly on the Ethereum blockchain, enhancing its accessibility within the decentralized finance (DeFi) ecosystem. Uniswap operates on an automated market maker (AMM) model, utilizing liquidity pools to facilitate token swaps without relying on traditional order books. In this system, liquidity providers contribute pairs of tokens to pools, allowing traders to execute transactions based on the ratio of tokens available. This mechanism ensures continuous liquidity and efficient price discovery. The integration of BGB into Uniswap's liquidity pools signifies Bitget's efforts to expand the token's utility beyond its centralized platform. By enabling on-chain trading, BGB holders can now engage in decentralized transactions, aligning with the broader trend towards DeFi solutions. This development follows Bitget's recent strategic initiatives to enhance the value and utility of BGB. On December 30, 2024, Bitget completed its first-ever token burn, permanently removing 800 million BGB from circulation, effectively reducing the total supply by 40%. This action aimed to increase the token's scarcity and long-term value. Looking ahead, Bitget plans to implement a quarterly BGB burn mechanism starting in 2025. Under this plan, 20% of quarterly profits from exchange and wallet operations will be allocated to repurchase and burn BGB tokens. This approach underscores Bitget's strategy to create a sustainable and impactful token economy for BGB. The addition of BGB to Uniswap's liquidity pools broadens the avenues for trading and integrates BGB into the wider DeFi landscape. This move is expected to attract a diverse group of users seeking decentralized trading options, thereby fostering the growth and adoption of BGB within the crypto community. Bitget's integration of BGB into Uniswap's liquidity pools represents a significant step in enhancing the token's utility and accessibility. Coupled with strategic initiatives like token burns and profit allocations for repurchases, Bitget is actively working towards strengthening the BGB ecosystem and its position within the decentralized finance sector. To check out the BGB liquidity pool on Uniswap, please visit here . About Bitget Established in 2018, Bitget is the world's leading cryptocurrency exchange and Web3 company. Serving over 45 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions, while offering real-time access to Bitcoin price , Ethereum price , and other cryptocurrency prices. Formerly known as BitKeep, Bitget Wallet is a world-class multi-chain crypto wallet that offers an array of comprehensive Web3 solutions and features including wallet functionality, token swap, NFT Marketplace, DApp browser, and more. Bitget is at the forefront of driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World's Top Football League, LALIGA, in EASTERN, SEA and LATAM market, as well as a global partner of Turkish National athletes Buse Tosun Çavuşoğlu (Wrestling world champion), Samet Gümüş (Boxing gold medalist) and İlkin Aydın (Volleyball national team), to inspire the global community to embrace the future of cryptocurrency.

Uniswap Frequently Asked Questions (FAQ)

When was Uniswap founded?

Uniswap was founded in 2017.

Where is Uniswap's headquarters?

Uniswap's headquarters is located at 181 North 11th Street, Brooklyn.

What is Uniswap's latest funding round?

Uniswap's latest funding round is Unattributed VC.

How much did Uniswap raise?

Uniswap raised a total of $178.83M.

Who are the investors of Uniswap?

Investors of Uniswap include FJ Labs, Paradigm, SV Angel, Variant Fund, A16z Crypto and 11 more.

Who are Uniswap's competitors?

Competitors of Uniswap include vlayer, LunarCrush, Vertex Protocol, Injective, DODO Exchange and 7 more.

Loading...

Compare Uniswap to Competitors

Curve Finance creates an exchange liquidity pool on Ethereum designed for: extremely efficient stablecoin trading, low risk, supplemental fee income for liquidity providers, without an opportunity cost.

GMX is a decentralized perpetual exchange operating in the cryptocurrency sector. The company enables trading of spot or perpetual contracts for top cryptocurrencies like BTC, ETH, and AVAX with leverage options up to 50x, directly from a user's wallet on the Arbitrum and Avalanche networks. It was founded in 2021 and is based in Singapore, Singapore.

GMX is an internet company that focuses on providing email services. The company offers free email accounts that are designed for both personal and professional use. Its primary sector is the internet services industry. It is based in Karlsruhe, Germany.

Primex Finance is a non-custodial prime brokerage protocol operating in the decentralized finance sector. The company offers leveraged spot trading on decentralized exchanges (DEXs) with advanced trading tools and cross-chain balance transfer capabilities, without the need for traditional intermediaries. Primex Finance integrates with multiple DEXs and provides a platform for users to trade a variety of assets using leverage backed by lenders. It was founded in 2021 and is based in Tallinn, Estonia.

ZKX is a company that focuses on decentralized finance, specifically in the domain of perpetual futures trading. The company offers a decentralized exchange (DEX) on Starknet that allows users to trade perpetual futures securely while retaining ownership of their funds. Users can also earn rewards by trading and staking on ZKX, and the platform features community governance. The company primarily serves the financial technology industry. It was founded in 2021 and is based in Dubai, United Arab Emirates.

BitGo provides solutions for the digital asset economy within the financial technology sector. Its offerings include custody, digital asset wallets, and financial services such as trading, borrowing, lending, and staking, which are used to manage digital assets. BitGo serves institutional clients, cryptocurrency exchanges, and investment platforms with services designed for the crypto space. It was founded in 2013 and is based in Palo Alto, California.

Loading...