TrueLayer

Founded Year

2016Stage

Series E - II | AliveTotal Raised

$321.8MValuation

$0000Last Raised

$50M | 5 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+80 points in the past 30 days

About TrueLayer

TrueLayer is an open banking platform that specializes in the financial services industry. The company offers a suite of products that enable instant bank payments, fast and verified payouts, streamlined user onboarding, and variable recurring payments, all designed to facilitate safer and more efficient financial transactions. TrueLayer primarily serves sectors such as e-commerce, gaming, financial services, travel, and cryptocurrency markets. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, United Kingdom.

Loading...

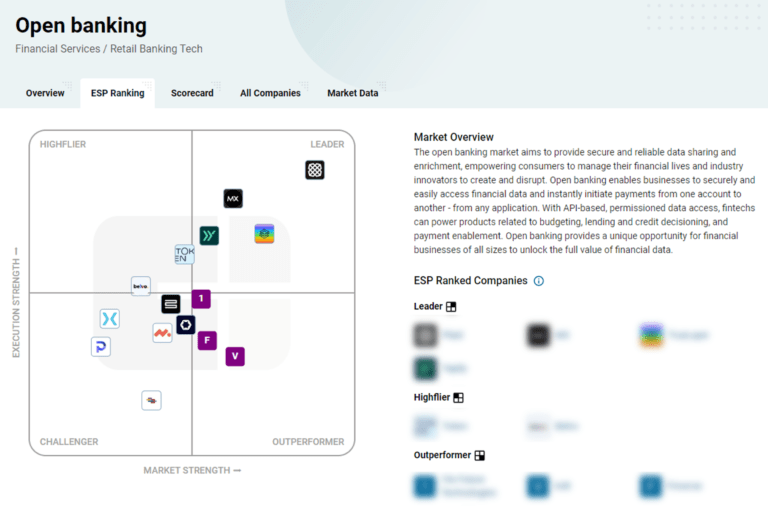

ESPs containing TrueLayer

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The anti-money laundering (AML) software market helps detect, prevent, and mitigate the risks associated with money laundering and financial crimes. Solutions in this market analyze large volumes of data and identify suspicious activity for further investigation. This allows financial institutions and other regulated entities to monitor transactions, screen customers and counterparties, and conduc…

TrueLayer named as Leader among 15 other companies, including NICE, Onfido, and ComplyAdvantage.

TrueLayer's Products & Differentiators

Data API

Connect an app to any bank account: delivering real-time access to account, balance, transaction, and identity data using open banking AIS.

Loading...

Research containing TrueLayer

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TrueLayer in 6 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Mar 14, 2024

The retail banking fraud & compliance market map

Jan 4, 2024

The core banking automation market map

Expert Collections containing TrueLayer

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TrueLayer is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Regtech

1,453 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Blockchain

8,796 items

Companies in this collection build, apply, and analyze blockchain and cryptocurrency technologies for business or consumer use cases. Categories include blockchain infrastructure and development, crypto & DeFi, Web3, NFTs, gaming, supply chain, enterprise blockchain, and more.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,559 items

Excludes US-based companies

Digital ID In Fintech

268 items

For this analysis, we looked at digital ID companies working in or with near-term potential to work in fintech applications. Startups here are enabling fintech companies to verify government documents, authenticate with biometrics, and combat fraudulent logins.

Latest TrueLayer News

Jan 15, 2025

YNAB Review 2025: Best Budgeting App for Detailed Money Management Get a handle on your spending with this popular budgeting app. David McMillin David McMillin writes about credit cards, mortgages, banking, taxes and travel. Based in Chicago, he writes with one objective in mind: Help readers figure out how to save more and stress less. He is also a musician, which means he has spent a lot of time worrying about money. He applies the lessons he's learned from that financial balancing act to offer practical advice for personal spending decisions. 5 min read Technology can make many areas of life easier, including making and sticking to a budget. A good budgeting app eliminates the tediousness of tracking your income and expenses, but a great budgeting app can also help you get better at managing your money. YNAB -- which stands for You Need a Budget -- is designed to force you into the driver's seat with your budget. Instead of simply scouring your transactions to automatically create spending categories, as a lot of budgeting apps do, YNAB makes you think about every dollar that comes in and goes out. Is it easy to use? That depends on your definition of "easy." Can it be a real difference-maker for your budgeting? Absolutely. 8.9 Doesn't identify ways to cut costs How does YNAB work? YNAB operates on the zero-based budgeting approach. Instead of using ballpark figures for different types of expenses, as you would with the 50-30-20 budgeting method , YNAB requires you to assign a job to every dollar in your account. When you sign up for YNAB, the app asks several questions about your lifestyle, such as whether you rent or own, if you have children, what savings goals you're working toward and how stressed you are about your finances. Once you've synced YNAB with your bank accounts, you'll need to begin thinking about all your upcoming expenses and set a spending amount for each category. Categories are divided into four main buckets: bills (housing payment, utilities, internet, insurance and others), needs (such as groceries, gas and childcare), wants (such as dining out, entertainment and travel) and savings. You can easily reassign your money to tweak your budget as you go. For example, if the month is almost up and you haven't spent your full budgeted amount on groceries, you can assign the difference to underfunded categories or move it to your savings. Since you can share a YNAB account with up to five people, it's also a great way to work toward common goals with a spouse or teach your child about financial discipline. YNAB has two pricing tiers: $15 per month or $109 per year. That may sound like a steep price tag compared with free and low-cost apps like Quicken Simplifi ($3 per month), but YNAB offers a generous 34-day free trial to test it out. If you'd like to get more granular with your spending, it can be well worth the cost. What we like Extended trial period: Many budgeting apps offer a week to test out their features, YNAB gives you 34 days of free use to make sure it's a good fit for you. Educational assistance: YNAB offers free Zoom workshops on how to maximize the app, along with other financial topics such as managing credit cards and building a budget as a couple. Account sharing: YNAB Together lets you share your account with up to five people for no additional fee, which can be a helpful way for couples to manage joint finances. No data sharing and no advertisements: You won't see advertisements for partner offers in your YNAB app -- the company isn't profiting off all the details it knows about your spending habits. What we didn't like Cost: YNAB isn't cheap compared to some other budgeting apps. Zero-based budgeting requires more work: YNAB isn't a "set it and forget it" tool -- you'll need to find time to regularly focus on your budget with this app. That might be a plus for those who want to keep a closer eye on their spending, but others might find it overwhelming or unnecessary. No automatic subscription management: Some budgeting apps analyze your transaction history to detect if you're overpaying for subscription services , but YNAB doesn't recommend any ways to lower your bills . You'll need to comb through your expenses to identify what you can cut from your life. Is YNAB safe? Yes, YNAB is safe. The company takes multiple security measures, including using 128-bit encryption, leveraging new security features to prevent certain types of attacks and offering a bug bounty program that rewards good hackers for proactively identifying security vulnerabilities. Additionally, the company never views or stores your account credentials. Instead, it uses MX, Plaid and TrueLayer to sync users' banking information with YNAB to import balances and transaction histories. YNAB's policy against ever selling user data -- including anonymized data -- also distinguishes it from apps that make money via advertising. Who is YNAB best suited for? YNAB is a good fit for anyone who isn't afraid to get deep into the details of their money. With YNAB, you must decide what every penny in your account is supposed to do. When I went over by 50 cents due to poor math skills, the app wouldn't let me budge until I made some adjustments in how I assigned my money. For me, YNAB is a perfect fit. Most budgeting apps haven't been that useful for my own finances because my irregular income stream as an independent contractor doesn't lend itself to smooth automated budgeting. Algorithms are built on predictability, and the ebbs and flows in my monthly income made me rely on a more old-school reconciliation process to try to curb my spending and set aside money for the future. For anyone who doesn't receive the same paycheck every two weeks, YNAB's alerts offer a helpful reminder of how much more money you need to make by a set deadline -- for example, before your next big bill is due. For me, that's a good way to push myself to accept more jobs or submit invoices on time. YNAB could also be a good fit for you if want to become more disciplined with your money. Manually assigning each dollar you earn to a budget category forces you to get deliberate about your spending and savings. Alternatives to the YNAB app The closest alternative to YNAB is EveryDollar, which also uses the zero-based budgeting method. There is a free version of EveryDollar, but if you want the full suite of features, EveryDollar Premium's monthly price tag is $18 -- slightly more than YNAB's monthly cost. The annual bundle is a better deal than YNAB at $80. If zero-based budgeting isn't your style, check out the options on our best budgeting apps list . Is YNAB legit? YNAB is one of the most well-respected budgeting apps out there. It's been around for 20 years, and plenty of people swear by it to make smart spending decisions. How much does YNAB cost? If you pay monthly, YNAB costs $15. If you decide to use the app long-term, you'll save some money by springing for the annual $109 plan. Is YNAB worth paying for? If you're willing to commit to zero-based budgeting, YNAB can be well worth the investment. According to the company's research, the average user saves $6,000 within the first year of using YNAB, and if you're working to get out of credit card debt, it can make an even bigger difference. According to YNAB, users paid off an average of $8,000 in one recent debt paydown challenge. Recommended budgeting articles

TrueLayer Frequently Asked Questions (FAQ)

When was TrueLayer founded?

TrueLayer was founded in 2016.

Where is TrueLayer's headquarters?

TrueLayer's headquarters is located at 40 Finsbury Square, London.

What is TrueLayer's latest funding round?

TrueLayer's latest funding round is Series E - II.

How much did TrueLayer raise?

TrueLayer raised a total of $321.8M.

Who are the investors of TrueLayer?

Investors of TrueLayer include Northzone, Temasek, Tiger Global Management, Stripe, Tencent and 15 more.

Who are TrueLayer's competitors?

Competitors of TrueLayer include Volt, Bud, Yaspa, Here, Vyne and 7 more.

What products does TrueLayer offer?

TrueLayer's products include Data API and 3 more.

Loading...

Compare TrueLayer to Competitors

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Meniga specializes in digital banking solutions within the financial technology sector. The company offers a suite of products that enhance digital banking experiences by leveraging data consolidation, customer engagement, and revenue generation strategies. Meniga primarily serves financial institutions looking to improve their digital services. It was founded in 2009 and is based in London, United Kingdom.

Here offers an enterprise browser that aims to improve productivity and security for various work applications without the need for technical knowledge. It primarily serves sectors such as the financial services industry, government agencies, and contact centers, providing tailored solutions for workflow and operational automation. It was formerly known as OpenFin. The company was founded in 2010 and is based in New York, New York.

Leveris has developed an end-to-end platform to allow financial institutions and fintech startups such as digital-only banks or challenger banks to run their services.

Trustly Group focuses on open banking solutions in the financial services and payment processing sectors. The company provides products that facilitate payments, consumer onboarding, and risk assessment using bank-validated financial data. Trustly Group serves sectors including billers, eCommerce, financial services, and gaming. It was founded in 2008 and is based in Stockholm, Sweden.

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Loading...