Bluecore

Founded Year

2013Stage

Series F | AliveTotal Raised

$263.07MLast Raised

$24.95M | 4 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+70 points in the past 30 days

About Bluecore

Bluecore specializes in retail marketing technology and focuses on shoppers identification and customer movement to drive incremental revenue for enterprise brands. The company offers solutions that enable retailers to convert anonymous shoppers into known customers and automate personalized marketing campaigns across email, mobile, site, and paid media. Bluecore was formerly known as TriggerMail. It was founded in 2013 and is based in New York, New York.

Loading...

Bluecore's Product Videos

ESPs containing Bluecore

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The marketing automation personalization market is focused on providing personalized and relevant experiences to customers across various digital channels. Vendors in this market offer solutions that use AI and data analytics to create personalized content and messaging for each customer, resulting in increased engagement, conversion rates, and customer loyalty. The market includes a range of prod…

Bluecore named as Challenger among 15 other companies, including Bloomreach, Oracle, and Attentive.

Bluecore's Products & Differentiators

Bluecore Site

Bluecore Site enables retailers to provide individualized and consistent experiences for consumers, moving beyond isolated website optimization to create a seamless partnership between email and website. Features include mirrored product recommendations, personalized email capture, promotion consistency from email to website, personalized on-site recommendations, and personalized exit prevention.

Loading...

Research containing Bluecore

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Bluecore in 5 CB Insights research briefs, most recently on Aug 14, 2023.

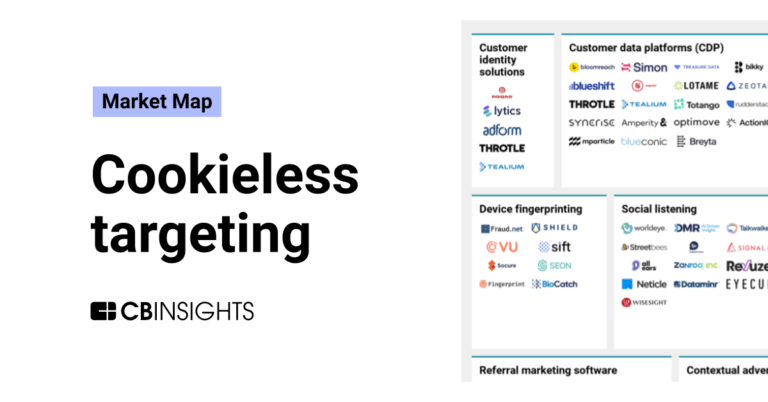

Aug 14, 2023

The cookieless targeting market map

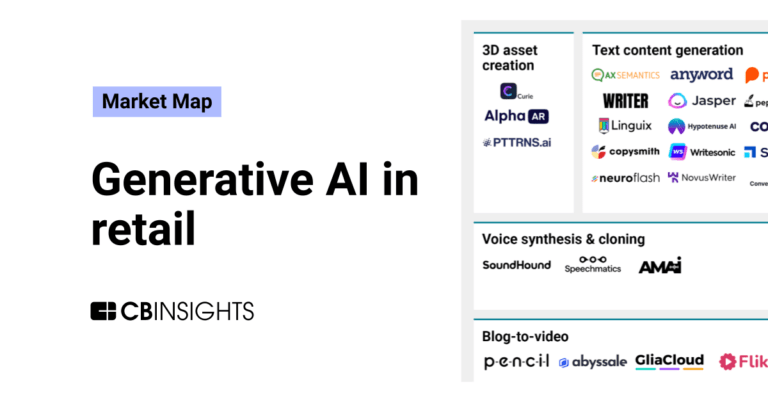

Aug 3, 2023

The generative AI in retail market map

Oct 25, 2022

The Transcript from Yardstiq: Toppling Salesforce

Oct 12, 2022 report

Top marketing automation companies — and why customers chose themExpert Collections containing Bluecore

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

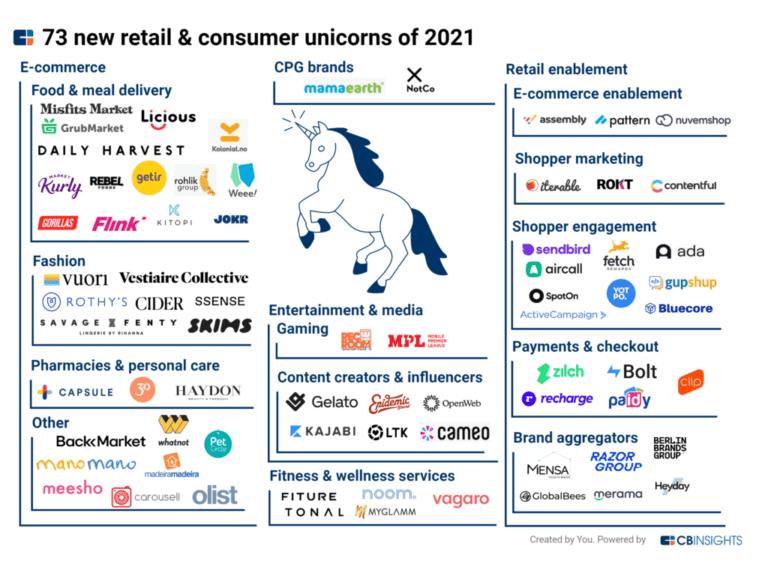

Bluecore is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Ad Tech

4,236 items

Companies offering tech-enabled marketing and advertising services.

Conference Exhibitors

5,302 items

Targeted Marketing Tech

453 items

This Collection includes companies building technology that enables marketing teams to identify, reach, and engage with consumers seamlessly across channels.

Retail Tech 100

100 items

The most promising B2B tech startups transforming the retail industry.

Loyalty & Rewards Tech

178 items

Bluecore Patents

Bluecore has filed 12 patents.

The 3 most popular patent topics include:

- hydraulic fracturing

- oil wells

- drilling technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/12/2020 | 12/19/2023 | Marketing strategy, Gate arrays, Diagrams, Promotion and marketing communications, Strategic management | Grant |

Application Date | 5/12/2020 |

|---|---|

Grant Date | 12/19/2023 |

Title | |

Related Topics | Marketing strategy, Gate arrays, Diagrams, Promotion and marketing communications, Strategic management |

Status | Grant |

Latest Bluecore News

Dec 2, 2024

On Dec 2, 2024 Bluecore’s 2024 Black Friday Data Reveals That Despite Influx of New Customers, Retailers Now Know Who Nearly 30% of Their Shoppers Are and an Overwhelming Two-Thirds of These Shoppers Shopped Their Black Friday Sales Sixty four percent (64%) of digital shoppers were new to retailers this Black Friday, according to new insights from Bluecore . The retail technology company reports that despite this influx of new customers, many retailers were focused on bringing back past customers and previously identified shoppers. Retailers now know who 30% of all their shoppers are (up from approximately 20% last year). And retailers that focused their efforts on getting existing shoppers to shop again were, for the most part, those that saw an increase in order values–some by as much as 10%. An overwhelming amount of Black Friday activity–up to 85% for Footwear retailers–took place on mobile. The complete report is available here. For the seventh year in a row, Bluecore looked at shoppers’ Black Friday shopping patterns and purchases, across 150 retail brands in seven retail categories: Apparel (51), Footwear (35), Sports & Hobbies (20), Home (12), Jewelry & Accessories (13), Health & Beauty (10) and Department Stores (9). The result is a comprehensive look at retailers’ 2024 Black Friday performance and how it compares to Black Friday 2023. Bluecore analyzed 251 million shopper events on brands’ ecommerce sites, including completed sale transactions and moments that retailers’ were able to transform into purchases (wishlists, abandoned carts, abandoned searches, new arrivals, replenished inventory and more). The resulting data was derived from 52 million first-party cookies, 3.7 million orders and $504 million in total sales. Key Finding from Bluecore’s Black Friday 2024 Report, Include: Some retailers saw increased Average Order Values (AOV). Other retailers saw higher order volumes. Only luxury retailers saw both. Average Order Value by Vertical: Health & Beauty (+10%), Luxury (+8%), Sports & Hobbies (+6%), Apparel (+0.3%), , Footwear (-3%), Accessories(-3%), Department Stores (-3%) and Home & Home Improvement (-2%). Order Volume by vertical: Accessories(+20%), Department Stores (+7%), Luxury (+5%), Footwear (+1%), Home & Home Improvement (-15%), Sports & Hobbies (-11%), Health & Beauty (-10%) and Apparel (-4%). Retailers now know who nearly 30% of their shoppers are. This is up from only 20% identified shoppers last year. Seventy percent (70%) of Black Friday shoppers, however, are still unknown to retailers. Retailers have seemingly different approaches to prioritizing new vs. repeat shoppers for Black Friday revenue. Some retailers disproportionately prioritized new shoppers 78% of all Accessories customers were first-time buyers. 72% of Footwear shoppers were first-time buyers. 71% of Home shoppers were first-time buyers. By contrast, some retailers focused their efforts on repeat customers: 56% of Department Store buyers were repeat customers. 46% of Apparel buyers were repeat customers. 42% of Health & Beauty buyers were repeat customers. 42% of Sporting & Hobbies buyers were repeat customers. Higher session volumes resulted in higher order volumes, but not higher order values. Accessory retailers saw nearly 24% more online sessions this year and department stores saw nearly 8% more sessions. While both experienced more traffic and orders, they both experienced decreased order values. This reveals that focusing on efforts to drive traffic should be complemented by efforts to deepen relationships with shoppers and, as a result, increase order sizes. Up to 85% of all Black Friday shopping took place on mobile devices. An overwhelming majority of shoppers viewed sites and made purchases via mobile this year, with Footwear retailers seeing the most mobile sessions (nearly 85%) and sporting goods retailers seeing the least, at a still high 59%. “This year’s data shows significant growth in mobile shoppers, as well as efforts by retailers to get existing shoppers to shop again,” said Jason Grunberg, CMO of Bluecore. “We can see in the numbers that this approach makes more business sense than strategies that solely focus on customer acquisition. For the most part, retailers that prioritized their known shoppers and existing customers were those that saw an increase in order values. Considering the skyrocketing costs of new customer acquisition, retailers who can identify shoppers and turn one-time buyers into repeat customers will ultimately spend less to make more. And now they have 64% more customers they can target with this goal in mind.” Bluecore’s advanced, AI-driven platform empowers retailers to launch completely personalized communications at scale by curating email, ecommerce, and paid media shopping experiences to each shopper’s individual and nuanced interaction with their brand, predicting their next steps. The company incorporates a deep understanding of shoppers’ ever-shifting behaviors with a comprehensive view of retailers’ live product catalogs for an integrated approach that delivers precision messages to shoppers when they are most likely to buy, no matter where they are. The world’s leading retailers, including Tapestry, Express, Teleflora, Alo Yoga, and Lulu and Georgia trust Bluecore to quickly turn their data into revenue-generating campaigns. Write in to psen@itechseries.com to learn more about our exclusive editorial packages and programs.

Bluecore Frequently Asked Questions (FAQ)

When was Bluecore founded?

Bluecore was founded in 2013.

Where is Bluecore's headquarters?

Bluecore's headquarters is located at 222 Broadway, New York.

What is Bluecore's latest funding round?

Bluecore's latest funding round is Series F.

How much did Bluecore raise?

Bluecore raised a total of $263.07M.

Who are the investors of Bluecore?

Investors of Bluecore include FirstMark Capital, Georgian, Norwest Venture Partners, Silver Lake, Felicis and 7 more.

Who are Bluecore's competitors?

Competitors of Bluecore include Brevo, Personify XP, Intellimize, Attentive, Persoo and 7 more.

What products does Bluecore offer?

Bluecore's products include Bluecore Site and 2 more.

Who are Bluecore's customers?

Customers of Bluecore include Lane Bryant and NoBull.

Loading...

Compare Bluecore to Competitors

ActiveCampaign focuses on customer experience automation, operating within the marketing automation, email marketing, and Customer Relationship Management (CRM) sectors. The company offers services, including email marketing, marketing automation, e-commerce marketing, and CRM tools designed to help businesses engage meaningfully with their customers. ActiveCampaign primarily serves businesses of all sizes across various sectors, with a particular emphasis on the e-commerce industry. It was founded in 2003 and is based in Chicago, Illinois.

Brevo provides customer relationship management and marketing services. The company offers tools for businesses to execute digital marketing campaigns, send transactional messages, and utilize marketing automation features. It primarily serves the marketing industry. Brevo was formerly known as SendinBlue. It was founded in 2012 and is based in Paris, France.

Attentive provides a personalized text messaging platform. It offers a short message service (SMS) marketing platform allowing retail and electronic commerce brands to connect with consumers, providing solutions such as marketing automation, growth marketing, retention marketing, audience management, messaging, and business intelligence. It offers its services to electronic commerce and the retail sector. The company was founded in 2016 and is based in Hoboken, New Jersey.

Rokt focuses on electronic commerce technology. The company offers solutions to increase revenue, acquire customers at scale, and form relationships with existing customers. Its solutions include optimizing and monetizing the checkout experience, providing payment providers during checkout, and offering premium post-purchase offers. The company operates in the e-commerce sector. It was founded in 2012 and is based in New York, New York.

ForMotiv specializes in behavioral analytics within the insurance sector and provides insights into the intent and risk associated with digital applicants. The company offers solutions that analyze behavioral data in real-time to predict user intent and assess risk, which aids in improving conversion rates and reducing fraud. ForMotiv's services are primarily utilized by the insurance industry, enhancing digital experiences and decision-making processes for life, home, auto, and commercial insurance providers. It was founded in 2018 and is based in Philadelphia, Pennsylvania.

Konnecto focuses on partnership intelligence in the affiliate marketing sector. The company provides services such as affiliate discovery, performance monitoring, competitive benchmarking, and fraud detection. It primarily serves consumer brands aiming to enhance online sales through strategic collaborations. It was founded in 2018 and is based in Tel Aviv, Israel.

Loading...