TradingView

Founded Year

2011Stage

Series C | AliveTotal Raised

$339.37MValuation

$0000Last Raised

$298M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-36 points in the past 30 days

About TradingView

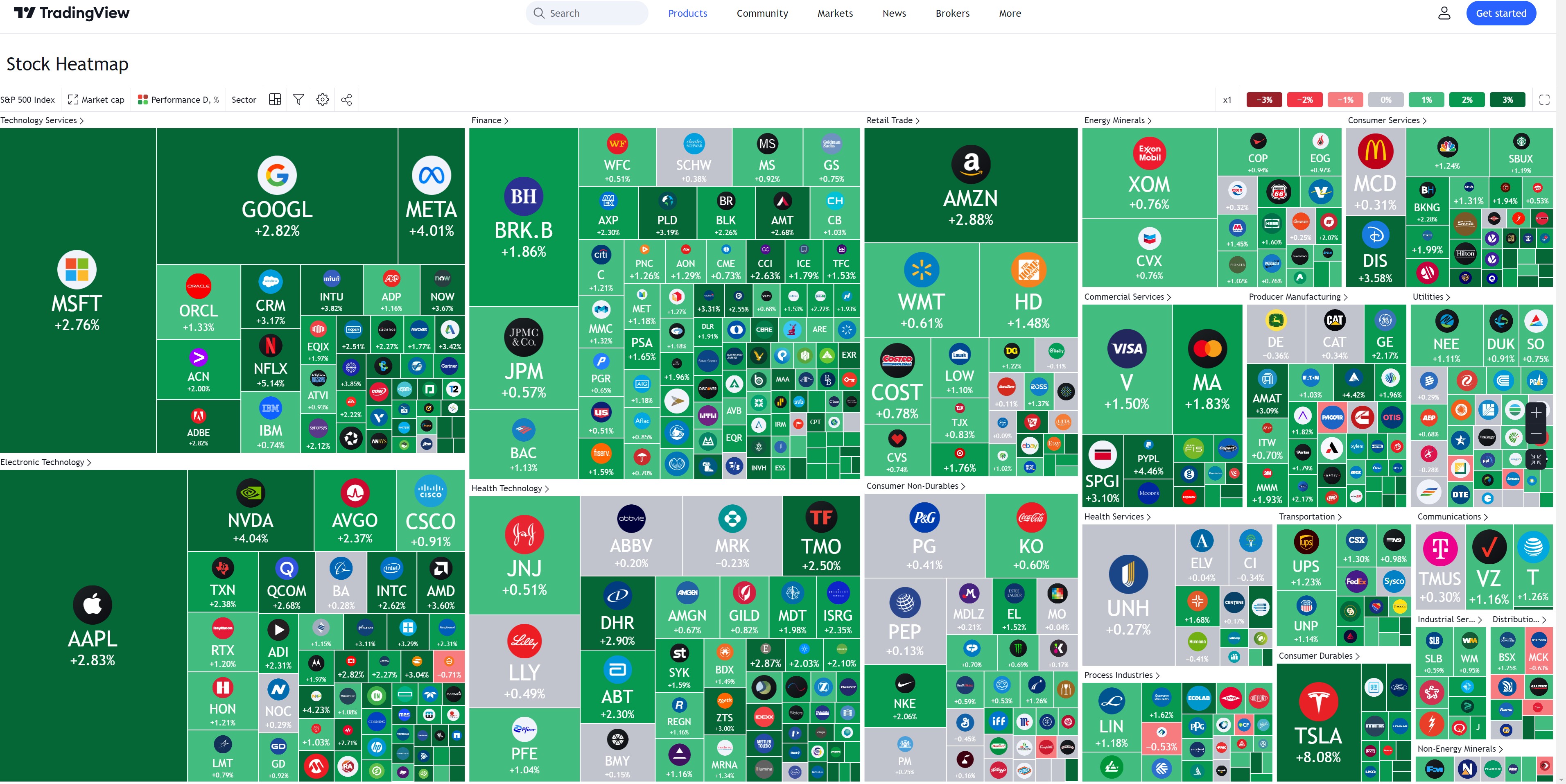

TradingView is a financial charting platform and social network for traders and investors. The company provides tools for real-time market data analysis, enabling users to share and discuss trading strategies within an investment community. TradingView offers a suite of market analysis tools, including access to an economic calendar, collaborative trading ideas, and a custom scripting language for advanced charting. It was founded in 2011 and is based in Westerville, Ohio.

Loading...

TradingView's Product Videos

ESPs containing TradingView

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The digital assets market data & insights market provides comprehensive data and insights into blockchain networks, crypto markets, and decentralized finance. It empowers financial institutions with historical and real-time fundamental (on chain) and market data for research, trading, risk analytics, reporting, and compliance. The market is fragmented and lacks standardization, making it complex a…

TradingView named as Leader among 14 other companies, including Coin Metrics, Nansen, and Kaiko.

TradingView's Products & Differentiators

Charts

Best in class charts enabling comprehensive technical analysis of the markets

Loading...

Research containing TradingView

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TradingView in 2 CB Insights research briefs, most recently on Nov 11, 2022.

Nov 11, 2022

3 capital markets trends to watchExpert Collections containing TradingView

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TradingView is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

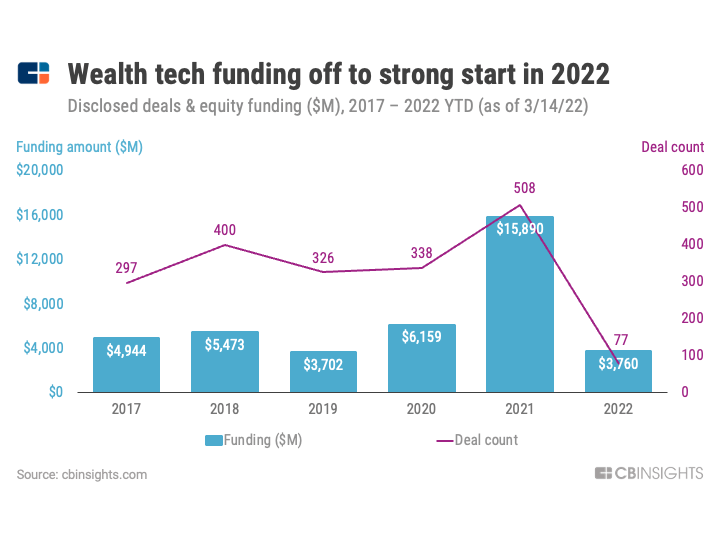

Wealth Tech

2,335 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

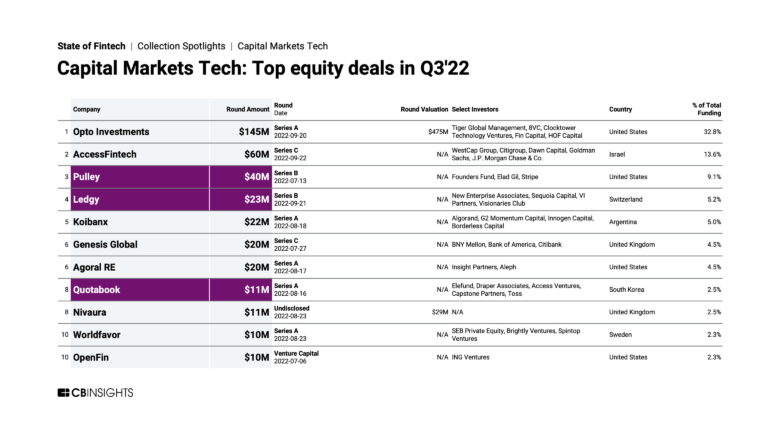

Capital Markets Tech

1,030 items

Companies in this collection provide software and/or services to institutions participating in primary and secondary capital markets: institutional investors, hedge funds, asset managers, investment banks, and companies.

Financial Wellness

245 items

Track startups and capture company information and workflow.

Latest TradingView News

Jan 18, 2025

Bitcoin (BTC) has seen a steady price recovery following the recent release of the US Consumer Price Index (CPI) report. It is now trading above $103,000. This marks an 8% gain over the past week, driven by growing interest from large investors and a shift in market dynamics. According to the latest insights from CryptoQuant Analysts, some underlying whale activity factors might be influencing Bitcoin’s current trajectory . Related Reading Bitcoin Price Rebounds Amid Growing Whale Activity CryptoQuant QuickTake Platform contributor Joao Wedson has recently highlighted a noteworthy trend in whale behavior on Binance, the world’s largest crypto exchange. In a recent analysis, Wedson examined the Exchange Whale Ratio, which measures the share of Bitcoin’s largest inflow transactions relative to the total exchange volume. Bitcoin Exchange Whale Ratio. | Source: CryptoQuant This metric, according to the analyst has now reached historical highs, signaling that large holders—often referred to as whales—are transferring significant amounts of Bitcoin to the exchange. The increased movement of Bitcoin by whales may indicate that they are preparing for substantial buy or sell actions , potentially amplifying market volatility. Wedson added: Stay alert! Intense movements by major players can bring volatility risks but also unique opportunities for those closely monitoring the market. Understanding New Whale Movements and Market Cycles In addition to whale activity on Binance, another CryptoQuant contributor, KriptoBaykusV2, provided insights into the emergence of new large investors in the market. According to KriptoBaykusV2, the “New Whales” indicator highlights the influx of previously inactive large investors acquiring Bitcoin. Over the past three years, this metric has grown steadily , suggesting heightened interest in the cryptocurrency market. However, the entry and exit of new whales often coincide with price swings, making it a key factor for understanding market cycles. Related Reading 1 day ago Historical data shows that peaks in new whale activity often align with periods of price volatility. For example, during 2021 and 2023, sharp increases in the number of new large investors were followed by significant price corrections. KriptoBaykusV2 wrote: Understanding whether the market is in a bull or bear phase is crucial for investors. Increases in the number of new whales often signal the start of bull markets, while the sharp corrections that follow these movements can indicate the onset of bear markets. This is especially evident from 2021 onwards, where these fluctuations are clearly visible Meanwhile, Bitcoin is currently trading at a price of $103,985, at the time of writing marking not only a 4.9% increase in the past day but also a nearly 10% surge in the past two weeks. BTC price is moving upwards on the 2-hour chart. Source: BTC/USDT on TradingView.com Featured image created with DALL-E, Chart from TradingView Meet Samuel Edyme, Nickname - HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others. Read more Edyme’s foray into the crypto universe is nothing short of cinematic. His journey began not with a triumphant investment, but with a scam. Yes, a Ponzi scheme that used crypto as payment roped him in. Rather than retreating, he emerged wiser and more determined, channeling his experience into over three years of insightful market analysis. Before becoming the voice of reason in the crypto space, Edyme was the quintessential crypto degen. He aped into anything that promised a quick buck, anything ape-able, learning the ropes the hard way. These hands-on experience through major market events—like the Terra Luna crash, the wave of bankruptcies in crypto firms, the notorious FTX collapse, and even CZ’s arrest—has honed his keen sense of market dynamics. When he isn’t crafting engaging crypto content, you’ll find Edyme backtesting charts, studying both forex and synthetic indices. His dedication to mastering the art of trading is as relentless as his pursuit of the next big story. Away from his screens, he can be found in the gym, airpods in, working out and listening to his favorite artist, NF. Or maybe he’s catching some Z’s or scrolling through Elon Musk’s very own X platform—(oops, another screen activity, my bad…) Well, being an introvert, Edyme thrives in the digital realm, preferring online interaction over offline encounters—(don’t judge, that’s just how he is built). His determination is quite unwavering to be honest, and he embodies the philosophy of continuous improvement, or “kaizen,” striving to be 1% better every day. His mantras, “God knows best” and “Everything is still on track,” reflect his resilient outlook and how he lives his life. In a nutshell, Samuel Edyme was born efficient, driven by ambition, and perhaps a touch fierce. He’s neither artistic nor unrealistic, and certainly not chauvinistic. Think of him as Bruce Willis in a train wreck—unflappable. Edyme is like trading in your car for a jet—bold. He’s the guy who’d ask his boss for a pay cut just to prove a point—(uhhh…). He is like watching your kid take his first steps. Imagine Bill Gates struggling with rent—okay, maybe that’s a stretch, but you get the idea, yeah. Unbelievable? Yes. Inconceivable? Perhaps. Edyme sees himself as a fairly reasonable guy, albeit a bit stubborn. Normal to you is not to him. He is not the one to take the easy road, and why would he? That’s just not the way he roll. He has these favorite lyrics from NF’s “Clouds” that resonate deeply with him: “What you think's probably unfeasible, I've done already a hundredfold.” PS—Edyme is HIM. HIM-buktu. Him-mulation. Him-Kardashian. Himon and Pumba. He even had his DNA tested, and guess what? He’s 100% Him-alayan. Screw it, he ate the opp. Close Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk. Related News Email* Name Δ About Us NewsBTC is a cryptocurrency news service that covers bitcoin news today, technical analysis & forecasts for bitcoin price and other altcoins. Here at NewsBTC, we are dedicated to enlightening everyone about bitcoin and other cryptocurrencies. We cover BTC news related to bitcoin exchanges, bitcoin mining and price forecasts for various cryptocurrencies. Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk. Company

TradingView Frequently Asked Questions (FAQ)

When was TradingView founded?

TradingView was founded in 2011.

Where is TradingView's headquarters?

TradingView's headquarters is located at 470 Olde Worthington Rd, Westerville.

What is TradingView's latest funding round?

TradingView's latest funding round is Series C.

How much did TradingView raise?

TradingView raised a total of $339.37M.

Who are the investors of TradingView?

Investors of TradingView include Tiger Global Management, Jump Capital, Insight Partners, DRW Venture Capital, Techstars Ventures and 8 more.

Who are TradingView's competitors?

Competitors of TradingView include TakeProfit, TipRanks, MacroMicro, Atom Finance, StockViva and 7 more.

What products does TradingView offer?

TradingView's products include Charts and 4 more.

Loading...

Compare TradingView to Competitors

Seeking Alpha is a financial services company that provides stock market analysis and investment tools. The company has a platform for investors to access investment research, including stock ideas, market news, and analysis of various financial instruments such as stocks, ETFs, and mutual funds. Seeking Alpha serves individual investors by offering tools and resources for making investment decisions. It was founded in 2004 and is based in New York, New York.

MetaTrader 5 is a trading platform for Forex, stocks, and futures markets within the financial services industry. The platform includes tools for technical and fundamental analysis, trading alerts, and automated trading, designed for individual traders and financial institutions. MetaTrader 5 provides services such as virtual hosting, mobile and web trading applications, and access to a marketplace for trading robots and indicators. It is based in Limassol, Cyprus.

Koyfin is a financial data and analytics platform that focuses on equipping investors with comprehensive market insights and analysis tools across various asset classes. The company offers live market data, advanced graphing, customizable dashboards, and a suite of features to support investment decisions for a range of financial instruments, including stocks, mutual funds, and more. Koyfin primarily serves independent investors, financial advisors, traders, research analysts, students, and enterprise clients with its data-driven solutions. It was founded in 2016 and is based in Miami, Florida.

MarketSeer provides fundamental market research solutions for investments using its integrated platform. It provides benefits such as real-time market data and analysis, breaking news and expert commentary, in-depth research reports, investment ideas, interactive tools, and financial calculators. The company was founded in 2019 and is based in Johannesburg, South Africa.

Simply Wall St focuses on financial data simplification and investment research tools within the financial services sector. The company offers a platform that provides visual financial reports, fundamental analysis, portfolio tracking, and stock screening tools. It is based in Sydney, New South Wales.

Stock Target Advisor specializes in financial analysis and investment decision-making tools within the financial services sector. The company offers automated calculations, analyst ratings, and market insights to assist investors in building robust investment portfolios. Stock Target Advisor primarily serves individual investors and investment professionals seeking to make informed decisions without the need for deep financial expertise. It was founded in 2018 and is based in Waterloo, Ontario.

Loading...