Tradeshift

Founded Year

2009Stage

Series H | AliveTotal Raised

$1.173BLast Raised

$70M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+21 points in the past 30 days

About Tradeshift

Tradeshift operates as a supply chain network for e-invoicing and accounts payable automation. It provides accounts payable, e-procurement, and strategic finance. The company offers a business-to-business marketplace platform for e-procurement, an application programming interface, supplier collaboration and analytics, and more. It was founded in 2009 and is based in San Francisco, California.

Loading...

Loading...

Research containing Tradeshift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tradeshift in 5 CB Insights research briefs, most recently on Aug 23, 2024.

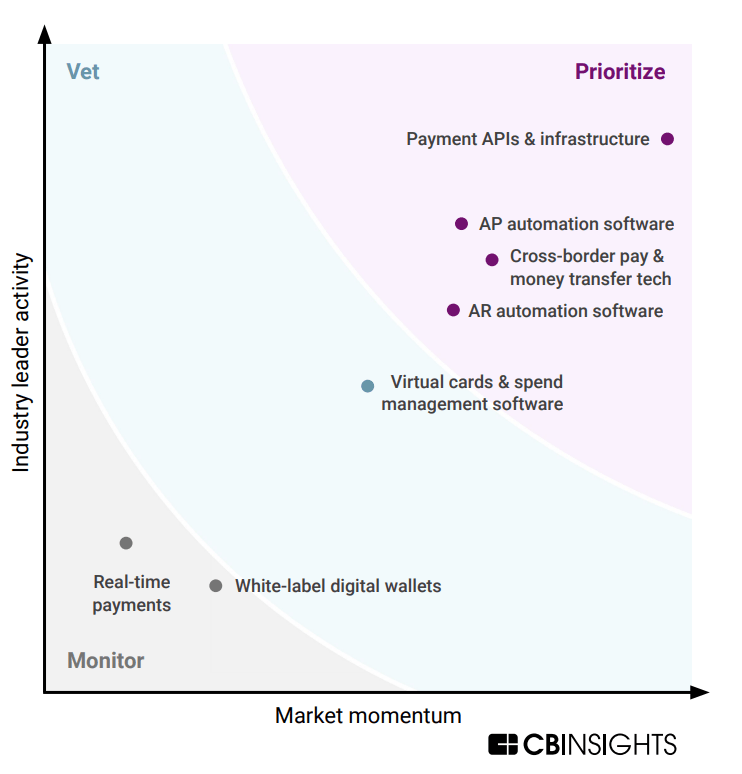

Aug 23, 2024

The B2B payments tech market mapExpert Collections containing Tradeshift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tradeshift is included in 8 Expert Collections, including Supply Chain & Logistics Tech.

Supply Chain & Logistics Tech

4,140 items

Companies offering technology-driven solutions that serve the supply chain & logistics space (e.g. shipping, inventory mgmt, last mile, trucking).

Unicorns- Billion Dollar Startups

1,258 items

Fintech 100

748 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,334 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

SMB Fintech

2,003 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Latest Tradeshift News

Jan 19, 2025

Revolutionize Your Global Payments with These Top FinTech Platforms Copied The corporate world never fails to find faster, cheaper, and secure ways to carry out trade with other businesses abroad. The best FinTech platforms are actually technology tools meant to make international trade easier and cheaper. This 2025 features some of the top FinTech platforms to revolutionize the global trade platform. Let's find out about the best. Payoneer is a well-known payment gateway that enables companies to send and receive payments anywhere in the world. It supports many currencies and covers more than 200 countries. Payoneer offers local receiving accounts, meaning that companies will not have to pay extra charges for converting the money into various currencies . It's very helpful to online sellers selling on websites such as Amazon and eBay, where it helps get paid quickly and cheaply. This service is notable for its clarity and affordability to send money globally. It empowers businesses using real-time currency exchange rates along with low and fixed fees with the ease and cost-effectiveness of global transactions. Wise handles more than 50 currencies as well as accepts and converts holding funds without having any hidden cost. This provides a great experience for businesses engaged with international trade. Revolut is a digital banking platform that lets businesses hold, exchange, and transfer money in more than 30 currencies. It also offers competitive exchange rates and lower fees. Companies can also use Revolut for automating payments and invoices to save time and effort. Due to its seamless integration with accounting systems, Revolut helps businesses deal with their finances smoothly, thus making it a great option for international traders. Tradeshift is the platform that incorporates blockchain technology into international trade, connecting buyers and suppliers with banks to make this process more efficient and transparent. Tradeshift reduces the fraud and mistake risk by digitizing invoicing, procurement, and payments. Through blockchain technology , transactions are safe and reliable. This is highly important for any business in the global supply chain. Veem is a platform that assists businesses in making international payments. It supports several currencies and makes sure that payments are fast, secure, and cost-effective. Veem allows businesses to settle payments in local currencies, which prevents high fees and sudden changes in exchange rates. It's great for companies that make regular international payments but do not want to lose money to currency fluctuations. Kontiki Finance is a blockchain-based platform that makes trade finance more efficient. It eliminates the old methods such as letters of credit and trade credit by using digital processes. The smart contracts and tokenization enable faster and cheaper trade finance. This platform is best suited for businesses that need real-time tracking and more transparency when dealing with global trade. Alipay, a payment platform under Alibaba's Ant Financial, has over one billion users. Businesses can collect payments from all over the world in any currency they choose. Alipay is famous for its robust fraud protection, so businesses, especially those in e-commerce, have no fear in receiving payments from international customers. Conclusion FinTech platforms represent the future of international trade as they are secure, transparent, and cost-effective. For example, Payoneer helps with payments, while Tradeshift will transform trade on a blockchain. This hence makes it easier for businesses to work with countries across the world in achieving overall speed in the global market pace. As more companies take up the use of these platforms, international trade shall become more efficient and effective. Join our WhatsApp Channel to get the latest news, exclusives and videos on WhatsApp

Tradeshift Frequently Asked Questions (FAQ)

When was Tradeshift founded?

Tradeshift was founded in 2009.

Where is Tradeshift's headquarters?

Tradeshift's headquarters is located at 447 Sutter Street, San Francisco.

What is Tradeshift's latest funding round?

Tradeshift's latest funding round is Series H.

How much did Tradeshift raise?

Tradeshift raised a total of $1.173B.

Who are the investors of Tradeshift?

Investors of Tradeshift include Notion Capital, Fuel Venture Capital, LUN Partners Capital, The Private Shares Fund, IDC Ventures and 31 more.

Who are Tradeshift's competitors?

Competitors of Tradeshift include JAGGAER, Coupa, Basware, Scanmarket, BirchStreet Systems and 7 more.

Loading...

Compare Tradeshift to Competitors

Varisource provides a technology buying and management platform. The company offers a platform for businesses for technology purchases, compare vendor options, and manage technology-spent data. It serves various sectors including information technology (IT), procurement, finance, and private equity. The company was founded in 2021 and is based in Orlando, Florida.

Coupa operates in the business technology sector and offers a platform that analyzes spending data and automates business decisions. The company serves businesses that manage their spending. It was founded in 2006 and is based in San Mateo, California. In February 2023 Coupa was acquired by Abu Dhabi Investment Authority and Thoma Bravo at a valuation of $8B.

GEP provides procurement and supply chain solutions. The company provides artificial intelligence (AI)-enabled software, strategy consulting, and managed services. Its main offerings include procurement software, supply chain management solutions, and strategic consulting services, all designed to help businesses streamline their operations and increase efficiency. It was founded in 1999 and is based in Clark, New Jersey.

Ivalua provides cloud-based procurement and spend management software within the technology sector. The company offers a source-to-pay platform that includes supplier management, spend analysis, strategic sourcing, contract management, eProcurement, invoicing, payments, and environmental impact initiatives. Ivalua's solutions serve industries such as automotive, construction, financial services, healthcare, manufacturing, and the public sector. It was founded in 2000 and is based in Redwood City, California.

Vroozi focuses on business spend management and accounts payable invoice automation within the financial technology sector. Its platform includes tools for procurement, supplier management, and digital payments, intended to assist in the purchase and payment processes for businesses. The company serves mid-market and enterprise organizations that aim to improve their spend management and procurement. It was founded in 2012 and is based in Los Angeles, California.

JAGGAER focuses on intelligent source-to-pay and supplier collaboration platforms. The company offers AI-powered tools designed to automate procurement processes, manage spend, and enhance supplier collaboration. JAGGAER's solutions cater to various industries, including education, manufacturing, healthcare, and more, providing analytics, strategic sourcing, spend management, and supply chain collaboration services. JAGGAER was formerly known as SciQuest. It was founded in 1995 and is based in Durham, North Carolina.

Loading...