Trade Republic

Founded Year

2015Stage

Series C - II | AliveTotal Raised

$1.255BValuation

$0000Last Raised

$268.01M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-24 points in the past 30 days

About Trade Republic

Trade Republic is a financial technology company that focuses on providing easy access to the stock markets and democratizing investment for individuals across Europe. The company offers services that allow users to invest, save, and spend, with a user-friendly platform designed to simplify the investment process for everyday people. Trade Republic primarily serves individual investors looking to engage with the capital markets. It was founded in 2015 and is based in Berlin, Germany.

Loading...

Loading...

Research containing Trade Republic

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Trade Republic in 5 CB Insights research briefs, most recently on May 16, 2023.

Expert Collections containing Trade Republic

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

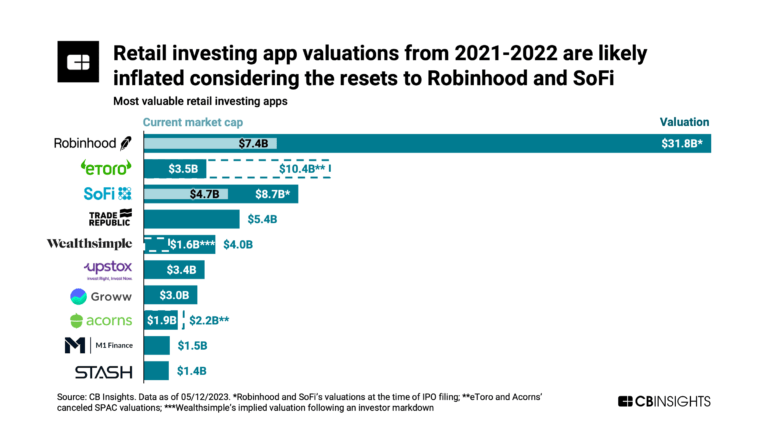

Trade Republic is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,261 items

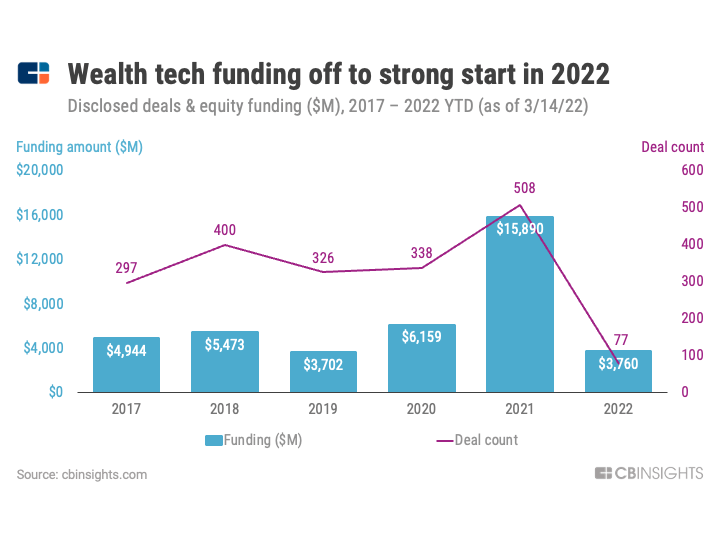

Wealth Tech

2,335 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

849 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Trade Republic News

Mar 3, 2025

Consumo F. P.NOTICIA03.03.2025 - 05:45h Carlos Gámez El Banco Central Europeo (BCE) continúa en el arranque de 2025 con su política de recorte de los tipos de interés. Este hecho está empujando a la baja la remuneración que recibimos por parte de nuestro banco en los productos más conservadores, por lo que es complicado encontrar rentabilidades atractivas. Aún así, el mes de marzo se presenta como una buena oportunidad para ganar dinero con tus ahorros antes de que sigan cayendo más los tipos. Si no estás interesado en un depósito bancario porque no te convencen las condiciones que ofrece o careces del dinero necesario para obtener un buen pellizco, los bancos disponen de otros productos que ofrecen atractivos intereses, incluso sin tener que domiciliar tus ingresos ni pagar ningún tipo de comisión o suscripción. Es el caso de las cuentas remuneradas , una especie de depósito que ofrece cierta rentabilidad por el ahorro y que permite tener el saldo siempre disponible. En la práctica supone que no te penalizarán si decides recuperar tus ahorros en un momento determinado. Con este producto de ahorro, en términos generales, se pueden hacer transferencias, recibir tu nómina o domiciliar los recibos de agua, luz o telefonía. Además, este producto dispone de la protección del Fondo de Garantía de Depósitos (FGD), que permite al titular, en caso de que una entidad quiebre, recuperar hasta 100.000 euros de tu dinero. 20minutos ha recopilado a continuación las mejores cuentas bancarias remuneradas que existen sin comisiones de mantenimiento, sin la necesidad de domiciliar la nómina y sin tener que pagar cantidad mensual o anual alguna para poder acceder a sus ventajas. Las cuentas remuneradas son una especie de huchas que permiten ahorrar. Pixabay/Tirelire_Avenue Trade Republic: 2,79% TAE La cuenta de ahorro de esta entidad con licencia bancaria alemana supone una de las opciones más atractivas al ofrecer una remuneración de un 2,79% TAE para un saldo de hasta 50.000 euros, por lo que puedes ganar hasta 1.375 euros en un año. Esta cuenta no requiere tener una nómina domiciliada y tampoco tiene comisiones. Las transferencias son gratuitas. B100: 2,70% TAE El neobanco de la entidad gallega Abanca tiene la denominada Cuenta Save, una cuenta remunerada al 2,70%TAE hasta un máximo de 50.000 euros. Para disfrutar de ella hay que abrirse primero la Cuenta B100, que no tiene comisiones de mantenimiento ni de administración. Tampoco hay que pagar por las transferencias en euros dentro de la zona euro. Cetelem-Raisin: gana hasta 2.470 euros El banco Cetelem ha llegado a un acuerdo con la plataforma Raisin para comercializar una nueva cuenta de ahorros que ofrece una remuneración por los saldos depositados del 2,5% TAE. El mínimo para obtener esta remuneración es de 1.000 euros y el banco remunerará los saldos depositados hasta un máximo de 100.000 euros. Se pueden ganar hasta 2.470 euros. La apertura de la cuenta es 100% 'online' y los intereses se abonan de manera mensual. Openbank: puedes lograr 1.125 euros Con el banco digital del Santander puedes ganar hasta 1.125 euros debido a que la rentabilidad que ofrece es del 2,27% TAE con un importe máximo a remunerar de 100.000 euros. Los intereses se abonan de forma mensual y carece de cualquier tipo de comisión. Evo Banco: más de 560 euros Ofrece una rentabilidad del 2% TAE para importes de hasta 30.000 euros. Con este producto podrás lograr ahorrar hasta 564 euros el primer año. De igual forma puedes abrir un depósito a seis meses con el mismo beneficio para rentabilizar el resto de su dinero. Banco Sabadell: gana hasta 400 euros La cuenta online da ahora a sus nuevos clientes un 2% TAE el primer año para un importe de hasta 20.000 euros, por lo que podrás ganar hasta 400 euros en intereses. Este producto está libre de comisiones de emisión y mantenimiento, tiene una tarjeta de débito gratuita y te permite realizar una gran cantidad de operaciones bancarias desde la app y sin coste.

Trade Republic Frequently Asked Questions (FAQ)

When was Trade Republic founded?

Trade Republic was founded in 2015.

Where is Trade Republic's headquarters?

Trade Republic's headquarters is located at Köpenicker Strasse 40c, Berlin.

What is Trade Republic's latest funding round?

Trade Republic's latest funding round is Series C - II.

How much did Trade Republic raise?

Trade Republic raised a total of $1.255B.

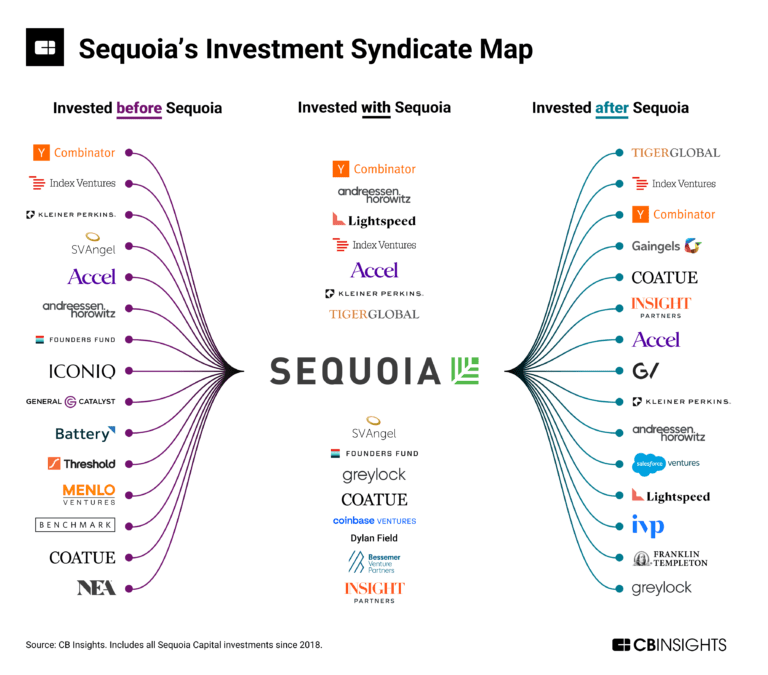

Who are the investors of Trade Republic?

Investors of Trade Republic include Ontario Teachers' Pension Plan, Creandum, Project A Ventures, Founders Fund, Accel and 5 more.

Who are Trade Republic's competitors?

Competitors of Trade Republic include Bitwala, Scalable Capital, Flink, Toro Investimentos, eToro and 7 more.

Loading...

Compare Trade Republic to Competitors

Bitpanda focuses on providing an investment platform. The company offers investment options including stocks, cryptocurrencies, and precious metals, serving individuals with different investment budgets. It operates in the financial technology sector. The company was founded in 2014 and is based in Vienna, Austria.

Scalable Capital is a financial technology company that specializes in digital wealth management and brokerage services. The company offers a platform for trading stocks, exchange-traded funds, and other financial instruments, as well as automated wealth management services using globally diversified exchange-traded fund portfolios. Scalable Capital primarily serves private individuals looking to invest and manage their assets. It was founded in 2014 and is based in Munich, Germany.

N26 is a digital bank that offers mobile banking services in the financial sector. The company provides a platform for personal finance management, enabling users to manage their money and conduct financial transactions. N26 primarily serves individual consumers. It was founded in 2013 and is based in Berlin, Germany.

Axend is a marketplace focused on connecting investors with private companies and projects, operating within the financial technology sector. The company offers a platform that allows investors to analyze and access a variety of investment opportunities, providing tools to create a solid investment portfolio. Axend primarily serves individuals and institutions looking to invest in alternative investment opportunities. It was founded in 2017 and is based in Mexico City, Mexico.

Ahrvo is a company focused on providing payment and compliance solutions in the fintech industry. The company offers a range of services including user and business verification, transaction monitoring, document solutions, and payment products that help businesses optimize their payment and banking processes, ensure regulatory compliance, and streamline operations. Ahrvo primarily sells to sectors such as banking, payments, blockchain/crypto, marketplaces, wealth management, brokerage and trading, real estate, and gaming and gambling. It was founded in 2018 and is based in Minneapolis, Minnesota.

Quantfury is a global brokerage that provides trading and investing services in the financial markets. The company offers access to a range of financial instruments including stocks, cryptocurrencies, ETFs, futures, and currency pairs, at real-time spot prices with no commissions or hidden fees. It was founded in 2017 and is based in Nassau, Bahamas.

Loading...