TouchBistro

Founded Year

2011Stage

Private Equity | AliveTotal Raised

$319.22MLast Raised

$110M | 2 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-6 points in the past 30 days

About TouchBistro

TouchBistro focuses on providing an all-in-one point of sale (POS) and restaurant management system in the restaurant industry. The company offers a range of services, including front-of-house, back-of-house, and guest engagement solutions, which help restaurateurs streamline their operations, manage their menu, sales, staff, and more. Its services are designed to increase sales, improve guest experiences, and save time and money. It was founded in 2011 and is based in Toronto, Canada.

Loading...

ESPs containing TouchBistro

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

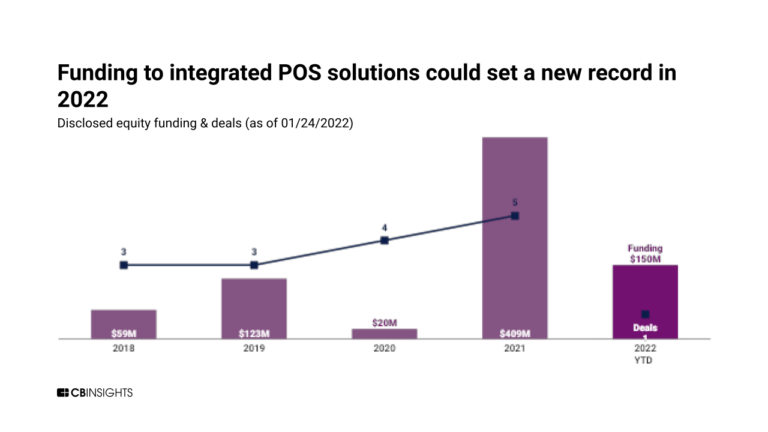

The physical point-of-sale market refers to the range of hardware and software solutions used to process transactions at retail and other physical locations. Physical point-of-sale systems typically include a combination of hardware components, such as a terminal, card reader, and cash drawer, and software that allows for transaction processing, inventory management, and other business functions. …

TouchBistro named as Challenger among 15 other companies, including Fiserv, Block, and PayPal.

TouchBistro's Products & Differentiators

POS

TouchBistro Point- of- Sale is a powerful platform built specifically for restaurants. Fast, reliable, and easy-to-use, TouchBistro POS has all the features needed to streamline operations and boost the bottom line

Loading...

Research containing TouchBistro

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned TouchBistro in 1 CB Insights research brief, most recently on Sep 21, 2022.

Expert Collections containing TouchBistro

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

TouchBistro is included in 5 Expert Collections, including Restaurant Tech.

Restaurant Tech

1,075 items

Hardware and software for restaurant management, bookings, staffing, mobile restaurant payments, inventory management, cloud kitchens, and more. On-demand food delivery services are excluded from this collection.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

500 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,559 items

Excludes US-based companies

Canadian fintech

345 items

TouchBistro Patents

TouchBistro has filed 2 patents.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

12/28/2011 | 12/6/2016 | Han character input, Input methods, Input/output, GPS navigation devices, Personal computers | Grant |

Application Date | 12/28/2011 |

|---|---|

Grant Date | 12/6/2016 |

Title | |

Related Topics | Han character input, Input methods, Input/output, GPS navigation devices, Personal computers |

Status | Grant |

Latest TouchBistro News

Jan 16, 2025

size is expected to reach USD 200.4 million by 2030, registering a CAGR of 9.7% from 2025 to 2030. The adoption of modern payment methods and the need to manage orders, inventory, customers, employees, and accounting information are the factors driving the demand for POS software. Moreover, the growing hospitality industry in South Africa is providing an impetus to the rising demand for hospitality POS solutions. The other factor expected to drive the demand is the need for tracking and managing online food orders and delivery facilities to sustain and grow the business. Consumers are resorting to online delivery and payment methods. Furthermore, staycations became a trend in South Africa when the government relaxed the lockdown restrictions, which allowed hotels to generate significant revenue when the tourism industry witnessed a decline in the country. These new trends in the hospitality industry have further helped the POS vendors to understand changing scenarios and offer a suitable solution. South Africa Hospitality Point Of Sale Software Market Report Highlights The open-circuit SCBA segment accounted for the largest revenue share of 68.0% in the North America self-contained breathing apparatus industry in 2024. The Type III segment accounted for the largest revenue share in the North American market for SCBAs in 2024. Type III cylinders consist of a steel or aluminum liner wrapped in composite materials such as fiberglass or carbon fiber. The fire services segment accounted for the leading revenue share in the North America self-contained breathing apparatus industry in 2024. These operations are crucial to the regional public safety infrastructure and are responsible for fire prevention, firefighting, rescue operations, and emergency medical services. The U.S. self-contained breathing apparatus market accounted for a dominant revenue share of 83.6% in 2024. Continued developments in end-use industries such as chemicals, oil & gas, and fire services in the economy have generated a strong demand for solutions that can ensure worker safety. Why should you buy this report? Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments. Competitive Landscape: Explore the market presence of key players worldwide. Future Trends: Discover the pivotal trends and drivers shaping the future of the global market. Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions. This report addresses: Market estimates and forecasts from 2018 to 2030 Growth opportunities and trend analyses Segment and regional revenue forecasts for market assessment Competition strategy and market share analysis Product innovation listing for you to stay ahead of the curve Key Attributes:

TouchBistro Frequently Asked Questions (FAQ)

When was TouchBistro founded?

TouchBistro was founded in 2011.

Where is TouchBistro's headquarters?

TouchBistro's headquarters is located at 85 Richmond Street W, Toronto.

What is TouchBistro's latest funding round?

TouchBistro's latest funding round is Private Equity.

How much did TouchBistro raise?

TouchBistro raised a total of $319.22M.

Who are the investors of TouchBistro?

Investors of TouchBistro include Francisco Partners, Kensington, BDC Venture Capital, Napier Park Global Capital, OMERS Ventures and 14 more.

Who are TouchBistro's competitors?

Competitors of TouchBistro include Satispay, Klarna, Revel Systems, Stripe, PayNearMe and 7 more.

What products does TouchBistro offer?

TouchBistro's products include POS and 4 more.

Who are TouchBistro's customers?

Customers of TouchBistro include El Alatkat, Katty Chavez and Crosstown Grill, Jim Nichols.

Loading...

Compare TouchBistro to Competitors

Stripe provides services for businesses to manage online and in-person payments. The company offers products including payment processing Application Programming Interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

Pine Labs is a merchant platform that provides payment solutions across various business sectors. The company offers services, including in-store and online payment processing, customer loyalty programs, prepaid and gifting services, and analytics. Pine Labs serves sectors such as electronics, lifestyle, automobile, grocery, healthcare, and hospitality. It was founded in 1998 and is based in Noida, India.

PayNearMe develops technology to facilitate the end-to-end customer payment experience. It offers a billing and payment platform. Its platform helps users pay with cash for a range of goods and services from companies in e-commerce, property management, consumer finance, and transportation, enabling businesses and government agencies as well as retail stores to digitize cash collection processes. PayNearMe was formerly known as Handle Financial. The company was founded in 2009 and is based in Santa Clara, California.

Cellulant develops an electronic payment service connecting customers with banks and utility services to create a payment ecosystem. It offers a single application program interface payments platform that provides locally relevant and alternative payment methods for global, regional, and local merchants. Its platform enables businesses to collect payments online and offline while allowing anyone to pay from their mobile money, local and international cards, and directly from their bank. It was founded in 2004 and is based in Nairobi, Kenya.

Previse specializes in accelerating B2B payments through data-driven solutions in the financial technology sector. The company offers services that enable instant invoice payments and supply chain payment optimization using artificial intelligence to assess invoices and facilitate early payments. Previse's solutions cater to large enterprises looking to improve their working capital efficiency and supplier payment processes. It was founded in 2016 and is based in London, England.

Loading...