Investments

1172Portfolio Exits

168Funds

17Partners & Customers

2Service Providers

1About Tiger Global Management

Tiger Global Management is an investment firm that invests in public and private companies that utilize technological innovation. The company employs public equity strategies including long/short, long-focused, and crossover strategies, as well as private equity investments in companies at various stages. Tiger Global primarily operates within sectors that are influenced by technological advancements and growth. It was founded in 2001 and is based in New York, New York.

Expert Collections containing Tiger Global Management

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Tiger Global Management in 4 Expert Collections, including Direct-To-Consumer Brands (Non-Food).

Direct-To-Consumer Brands (Non-Food)

37 items

Startups selling their own branded products directly to consumers via online/mobile channels, rather than relying on department stores or big online marketplaces.

E-Commerce

22 items

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Digital Lending

34 items

This collection contains alternative means for obtaining a loan for personal or business use. Companies included in the application, underwriting, funding, or collection process is included in the collection.

Research containing Tiger Global Management

Get data-driven expert analysis from the CB Insights Intelligence Unit.

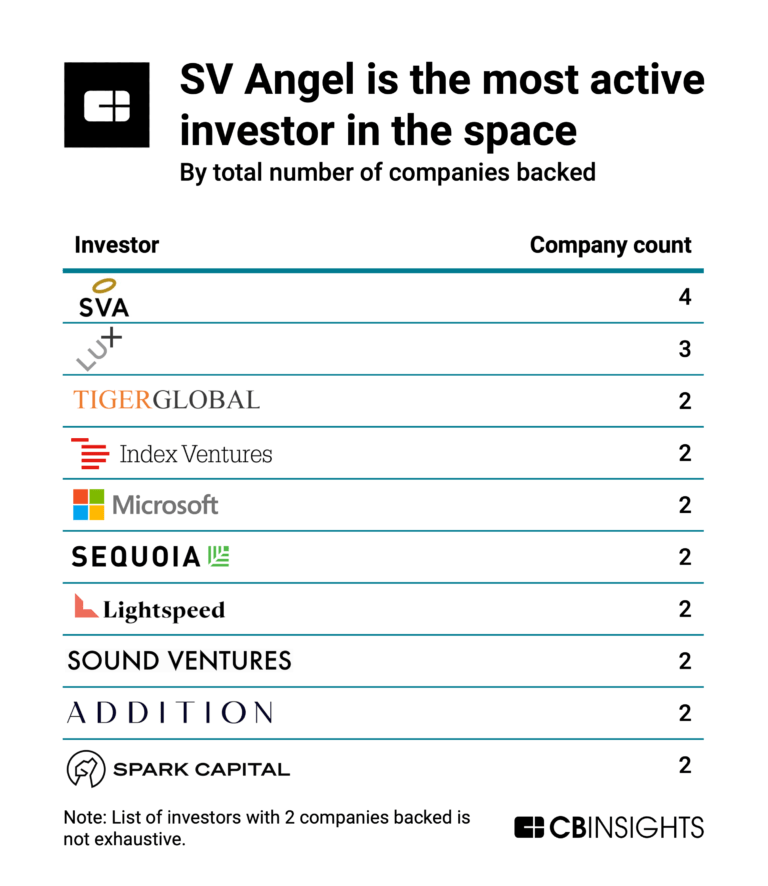

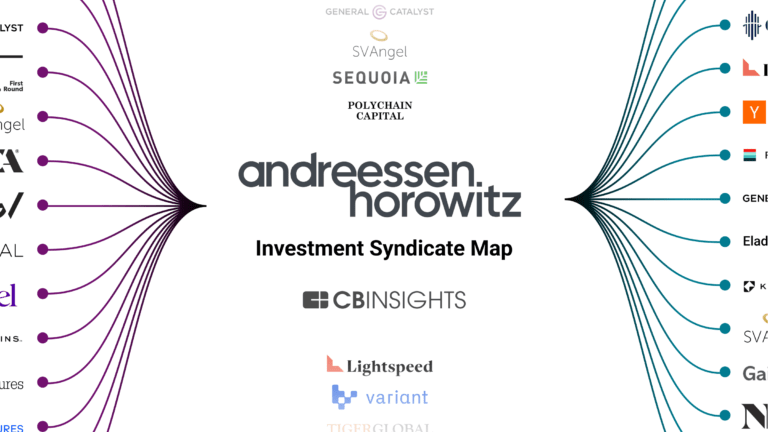

CB Insights Intelligence Analysts have mentioned Tiger Global Management in 9 CB Insights research briefs, most recently on Mar 26, 2024.

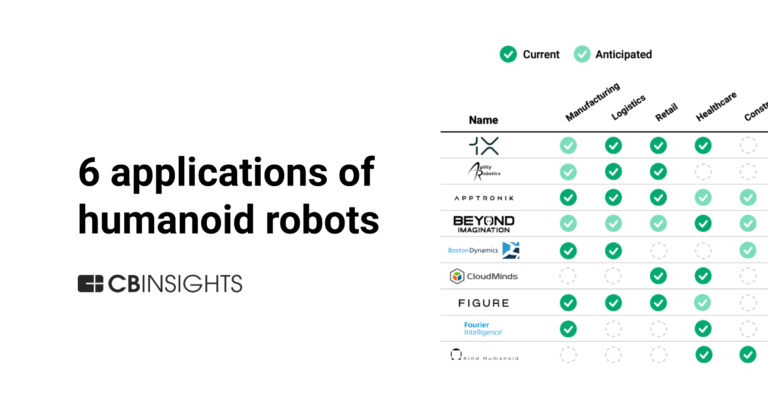

Mar 26, 2024

6 applications of humanoid robots across industries

Jan 4, 2024 report

State of Venture 2023 Report

Nov 20, 2023 report

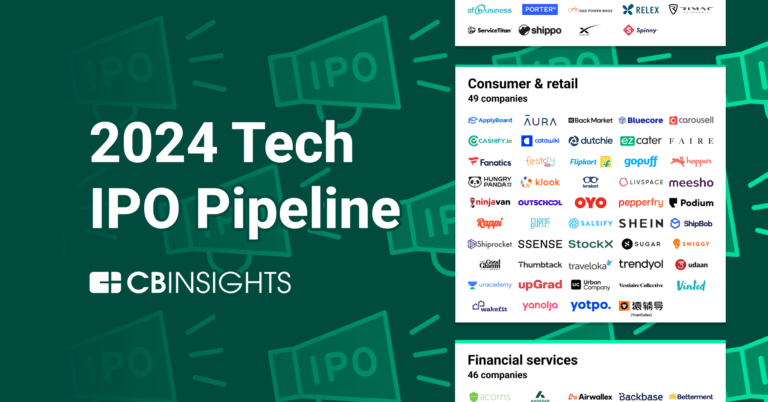

The 2024 Tech IPO Pipeline

Jul 14, 2023

The state of LLM developers in 6 charts

Latest Tiger Global Management News

Feb 28, 2025

NEW YORK--(BUSINESS WIRE)--Taktile – eine kategoriedefinierende Plattform zur Entscheidungsautomatisierung – hat in einer Finanzierungsrunde der Serie B 54 Millionen US-Dollar aufgebracht, um Teams in Fintech-Unternehmen und Finanzinstituten weiterhin in die Lage zu versetzen, ihre Risikomanagementstrategien über den gesamten Kundenlebenszyklus hinweg zu optimieren. Die Finanzierungsrunde wurde von Balderton Capital angeführt, mit Beteiligung der bestehenden Investoren Index Ventures, Tiger Glo

Tiger Global Management Investments

1,172 Investments

Tiger Global Management has made 1,172 investments. Their latest investment was in Taktile as part of their Series B on February 27, 2025.

Tiger Global Management Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

2/27/2025 | Series B | Taktile | $54M | No | 3 | |

2/13/2025 | Series B - II | EnCharge AI | $100M | Yes | ACVC, AlleyCorp, Anzu Partners, Capital TEN, Constellation Technology Ventures, CTBC VC, HH-CTBC, In-Q-Tel, Maverick Capital, Morgan Creek Digital, RTX Ventures, S5 Partners, Samsung Ventures, Scout Ventures, SIP Global Partners, Vanderbilt University, VentureTech Alliance, and Zero Infinity Partners | 6 |

2/13/2025 | Series C | ICON | $56M | No | 2 | |

1/31/2025 | Series C - VII | |||||

1/27/2025 | Series G - II |

Date | 2/27/2025 | 2/13/2025 | 2/13/2025 | 1/31/2025 | 1/27/2025 |

|---|---|---|---|---|---|

Round | Series B | Series B - II | Series C | Series C - VII | Series G - II |

Company | Taktile | EnCharge AI | ICON | ||

Amount | $54M | $100M | $56M | ||

New? | No | Yes | No | ||

Co-Investors | ACVC, AlleyCorp, Anzu Partners, Capital TEN, Constellation Technology Ventures, CTBC VC, HH-CTBC, In-Q-Tel, Maverick Capital, Morgan Creek Digital, RTX Ventures, S5 Partners, Samsung Ventures, Scout Ventures, SIP Global Partners, Vanderbilt University, VentureTech Alliance, and Zero Infinity Partners | ||||

Sources | 3 | 6 | 2 |

Tiger Global Management Portfolio Exits

168 Portfolio Exits

Tiger Global Management has 168 portfolio exits. Their latest portfolio exit was Greenscreens.ai on February 26, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

2/26/2025 | Acquired | 2 | |||

2/10/2025 | Acquired | 9 | |||

2/10/2025 | Merger | 3 | |||

Date | 2/26/2025 | 2/10/2025 | 2/10/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Merger | ||

Companies | |||||

Valuation | |||||

Acquirer | |||||

Sources | 2 | 9 | 3 |

Tiger Global Management Acquisitions

2 Acquisitions

Tiger Global Management acquired 2 companies. Their latest acquisition was Cobone on March 11, 2013.

Date | Investment Stage | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Total Funding | Note | Sources |

|---|---|---|---|---|---|---|

3/11/2013 | Acq - Fin | 1 | ||||

6/30/2007 | Other |

Date | 3/11/2013 | 6/30/2007 |

|---|---|---|

Investment Stage | Other | |

Companies | ||

Valuation | ||

Total Funding | ||

Note | Acq - Fin | |

Sources | 1 |

Tiger Global Management Fund History

17 Fund Histories

Tiger Global Management has 17 funds, including Tiger Private Investment Partners Fund XVI.

Closing Date | Fund | Fund Type | Status | Amount | Sources |

|---|---|---|---|---|---|

4/2/2024 | Tiger Private Investment Partners Fund XVI | $2,200M | 2 | ||

6/16/2023 | Tiger Global Private Investment Partners XVI | $622.65M | 2 | ||

2/3/2022 | Tiger Private Investment Partners XV | $11,000M | 1 | ||

5/4/2021 | Tiger Global Tech Venture Fund | ||||

3/31/2021 | Tiger Global Private Investment Partners XIV |

Closing Date | 4/2/2024 | 6/16/2023 | 2/3/2022 | 5/4/2021 | 3/31/2021 |

|---|---|---|---|---|---|

Fund | Tiger Private Investment Partners Fund XVI | Tiger Global Private Investment Partners XVI | Tiger Private Investment Partners XV | Tiger Global Tech Venture Fund | Tiger Global Private Investment Partners XIV |

Fund Type | |||||

Status | |||||

Amount | $2,200M | $622.65M | $11,000M | ||

Sources | 2 | 2 | 1 |

Tiger Global Management Partners & Customers

2 Partners and customers

Tiger Global Management has 2 strategic partners and customers. Tiger Global Management recently partnered with Evercore on May 5, 2023.

Date | Type | Business Partner | Country | News Snippet | Sources |

|---|---|---|---|---|---|

5/19/2023 | Vendor | United States | 1 | ||

Vendor |

Date | 5/19/2023 | |

|---|---|---|

Type | Vendor | Vendor |

Business Partner | ||

Country | United States | |

News Snippet | ||

Sources | 1 |

Tiger Global Management Service Providers

1 Service Provider

Tiger Global Management has 1 service provider relationship

Service Provider | Associated Rounds | Provider Type | Service Type |

|---|---|---|---|

Counsel | General Counsel |

Service Provider | |

|---|---|

Associated Rounds | |

Provider Type | Counsel |

Service Type | General Counsel |

Partnership data by VentureSource

Tiger Global Management Team

12 Team Members

Tiger Global Management has 12 team members, including , .

Name | Work History | Title | Status |

|---|---|---|---|

Chase Coleman | Founder | Current | |

Name | Chase Coleman | ||||

|---|---|---|---|---|---|

Work History | |||||

Title | Founder | ||||

Status | Current |

Compare Tiger Global Management to Competitors

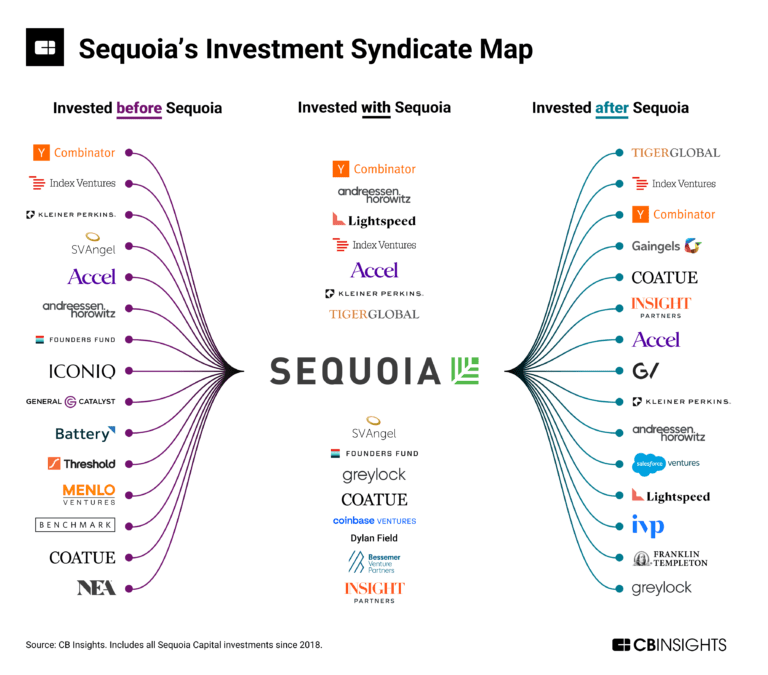

Sequoia Capital is a venture capital firm that focuses on supporting startups from inception to initial-public offering (IPO) within sectors. They provide investment funding and strategic support to help companies grow and succeed. Sequoia Capital primarily serves technology-driven sectors and businesses aiming to become market leaders. It was founded in 1972 and is based in Menlo Park, California.

Battery Ventures operates as a technology-focused investment firm operating across sectors, including application software, infrastructure software, consumer internet, and industrial technologies. The firm provides capital and support services, including business development and talent recruitment, to its portfolio companies. Battery Ventures invests in businesses at stages, from seed to growth and private equity, with a global investment strategy. It was founded in 1983 and is based in Boston, Massachusetts.

Accel is a venture capital firm that invests in and partners with teams from the inception of private companies through their growth phases, primarily in the technology sector. Accel was formerly known as Accel Partners. It was founded in 1983 and is based in Palo Alto, California.

Coatue works as a lifecycle investment platform specializing in technology sector investments. The company offers venture, growth, thematic, and structured capital strategies to support technology companies. Coatue primarily serves the technology industry, with a focus on supporting innovative tech startups and growth-stage companies. It was founded in 1999 and is based in New York, New York.

Warburg Pincus is a private equity firm that focuses on growth investing. The company provides capital and expertise to management teams across various sectors. Warburg Pincus' investments include private equity, real estate, and capital solutions, with a portfolio that includes companies in business services, consumer goods, energy transition, financial services, healthcare, industrials, real estate, and technology. It was founded in 1966 and is based in New York, New York.

Greylock Partners operates as a venture capital firm with a focus on the technology sector. The company primarily invests in disruptive, market-transforming enterprise and consumer software companies, with a particular interest in areas such as AI, cybersecurity, infrastructure, SaaS, consumer products, marketplaces and commerce, and financial technology and cryptocurrency. It primarily serves the technology industry. It was founded in 1965 and is based in Menlo Park, California.

Loading...