Thought Machine

Founded Year

2014Stage

Series D - II | AliveTotal Raised

$508.05MValuation

$0000Last Raised

$106M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-36 points in the past 30 days

About Thought Machine

Thought Machine specializes in core banking software and operates within the financial technology sector. The company offers a cloud-native core banking platform, Vault Core, and a payment processing platform, Vault Payments, which enable banks to create and manage a wide range of financial products and payment schemes. Thought Machine's products are designed to provide banks with flexibility, control, and the ability to deploy on any cloud infrastructure. It was founded in 2014 and is based in London, United Kingdom.

Loading...

Thought Machine's Product Videos

ESPs containing Thought Machine

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

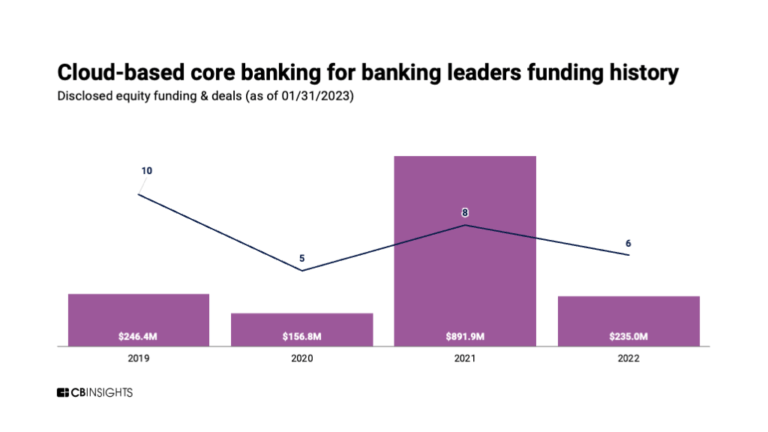

The cloud-based core banking solutions market offers financial institutions the opportunity to modernize outdated legacy systems and provide customers with personalized products and services. The market is competitive, with vendors offering cloud-native solutions that are scalable, secure, and cost-effective. The use of APIs and microservices architecture allows for quick integration with other sy…

Thought Machine named as Outperformer among 15 other companies, including Temenos, Oracle, and FIS.

Thought Machine's Products & Differentiators

Vault Core

https://www.thoughtmachine.net/vault-core

Loading...

Research containing Thought Machine

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Thought Machine in 4 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market mapExpert Collections containing Thought Machine

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Thought Machine is included in 6 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Future Unicorns 2019

50 items

Fintech

13,559 items

Excludes US-based companies

Fintech 100

599 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Banking

1,030 items

The open banking ecosystem is facilitated by three main categories of startups including those focused on banking-as-a-service, core banking, and open banking startups (i.e. data aggregators, 3rd party providers). These are primarily B2B companies, though some are also B2C.

Silicon Valley Bank's Fintech Network

88 items

We mapped out some of SVB's biggest clients, partnerships, and sectors that it serves using CB Insights’ business relationship data from SVB’s profile to uncover just how important it is to the fintech universe. The list is not exhaustive.

Latest Thought Machine News

Jan 5, 2025

Do analysts think you should buy shares in this big four bank like one of its insiders? Let's find out. Posted by James Mickleboro has been a Motley Fool contributor since late 2015. After studying economics at university back home in the United Kingdom, James came to live in Australia and managed to land a job at an Australian fund manager. This was the start of a love affair with Australian equities and he hasn't looked back since. James is part of the CFA Institute's Chartered Financial Analyst program and hopes it teaches him how to become an astute investor which allows him to help others with their own investing. Outside of reading and researching he spends many a late night watching the English Premier League and Seinfeld reruns. Published Image source: Getty Images You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More I always think that it can be useful for investors to keep an eye on which shares are experiencing meaningful insider buying. This is because insider buying is often regarded as a bullish indicator, as few people know a company and its intrinsic value better than its directors. If they are buying, it could be a sign that they are confident in the direction the company is heading and/or see value in its shares. With that in mind, let's look at some meaningful insider buying over at Westpac Banking Corp ( ASX: WBC ) and what that could mean for the big four bank's shares. Who is buying Westpac shares? According to a change of director's interest notice , Westpac's independent non-executive director, Andy Maguire, has picked up his first shares in the bank since joining the company in July 2024. Upon his appointment, Westpac noted that Maguire has more than 35 years' experience in financial services and began his career in banking at Lloyds Banking Group. From 2014 to 2020, he was group Chief Operating Officer at HSBC Holdings plc ( NYSE: HSBC ) with responsibility for operations, technology, real estate, change and transformation and operational resilience. He is currently chairman of UK banking software fintech Thought Machine Group and also an independent non-executive director of AIB Group plc. It is a financial services group operating predominately in the Republic of Ireland and the UK. Commenting on his appointment last year, Westpac's chairman, Steven Gregg, said: Andy is a highly respected global leader in digital transformation. His deep experience in technology infrastructure in the banking sector will further strengthen the Board and complement the skills of existing Directors. In particular, Andy's capabilities will be a valuable asset for Westpac as we execute our technology simplification through the UNITE program. Clearly Maguire knows a thing or two about the banking sector. So, his purchase of Westpac shares could be a positive signal for investors. What did he buy? The notice reveals that the independent non-executive director bought 6,615 Westpac shares for an average of $32.3978 per share. This equates to a total consideration of approximately $215,000. One broker that would be supportive of this purchase is UBS. Last month, its analysts put a buy rating and $37.00 price target on the big four bank's shares. This implies potential upside of 13% from current levels and would value those 6,615 Westpac shares at approximately $245,000. Time will tell if its shares get to that level. HSBC Holdings is an advertising partner of Motley Fool Money. Motley Fool contributor James Mickleboro has positions in Westpac Banking Corporation. The Motley Fool Australia's parent company Motley Fool Holdings Inc. has recommended HSBC Holdings. The Motley Fool Australia has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy . This article contains general investment advice only (under AFSL 400691). Authorised by Scott Phillips. More on Bank Shares

Thought Machine Frequently Asked Questions (FAQ)

When was Thought Machine founded?

Thought Machine was founded in 2014.

Where is Thought Machine's headquarters?

Thought Machine's headquarters is located at 5 New Street Square, London.

What is Thought Machine's latest funding round?

Thought Machine's latest funding round is Series D - II.

How much did Thought Machine raise?

Thought Machine raised a total of $508.05M.

Who are the investors of Thought Machine?

Investors of Thought Machine include Lloyds Banking Group, Eurazeo, J.P. Morgan Chase, Morgan Stanley, Intesa Sanpaolo and 16 more.

Who are Thought Machine's competitors?

Competitors of Thought Machine include Pismo, Tuum, FintechOS, Fimple, 10x Banking and 7 more.

What products does Thought Machine offer?

Thought Machine's products include Vault Core and 1 more.

Who are Thought Machine's customers?

Customers of Thought Machine include Standard Chartered, JP Morgan, Intesa Sanpaolo and Atom Bank.

Loading...

Compare Thought Machine to Competitors

Tuum offers core banking solutions within the financial technology sector. The company's main offering is a modular core banking platform that allows banks to update their systems and adapt to the digital environment. The platform supports various business lines such as accounts, lending, payments, and cards, and is structured for integration and deployment of new banking services. Tuum was formerly known as Modularbank. It was founded in 2019 and is based in Tallinn, Estonia.

10x Banking focuses on providing a cloud-native core banking platform, operating within the financial technology sector. The company offers a digital banking solution that enables banks to modernize their core banking systems, launch digital banks, and reduce operating costs. It was founded in 2016 and is based in London, United Kingdom.

Finastra provides a range of financial services, treasury, lending, and banking software solutions. The company offers a wide range of services, including lending and corporate banking, payments, treasury and capital markets, universal banking, and investment management. It primarily serves the financial technology industry. It was founded in 2017 and is based in London, United Kingdom.

Ohpen is a Netherlands-based company that has built cloud-based core banking software, targeting any large financial services provider that administrates retail investment and savings accounts.

Nymbus operates in the financial services industry and provides alternatives to traditional banking business models. The company offers products and solutions designed to enable financial institutions of all sizes to grow and serve their customers without the need for core conversion. Nymbus primarily caters to banks and credit unions looking to launch digital banking services, create niche financial brands, or deploy core banking platforms. It was founded in 2015 and is based in Jacksonville, Florida.

Architecht provides information technology services to financial institutions within the fintech sector. The company offers banking platforms, including core banking systems, digital banking solutions, and investment banking technology, as well as supplementary products such as payment systems infrastructure, finance systems, and security solutions like multi-factor authentication. It was founded in 2015 and is based in Istanbul, Turkey.

Loading...