Tabby

Founded Year

2019Stage

Debt - IV | AliveTotal Raised

$1.644BValuation

$0000Last Raised

$700M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-5 points in the past 30 days

About Tabby

Tabby focuses on reshaping consumer shopping experiences. The company offers a 'buy now, pay later' service, allowing customers to split their purchases into four interest-free payments, both online and in-store. Tabby primarily serves the retail industry, with a wide range of businesses from global brands to small enterprises utilizing its technology. It was founded in 2019 and is based in Dubai, United Arab Emirates.

Loading...

Tabby's Product Videos

ESPs containing Tabby

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The buy now pay later (BNPL) — B2C payments market offers a flexible payment solution for consumers, allowing shoppers to make purchases and split the cost into multiple installments, typically interest-free. BNPL solutions provide an alternative to traditional credit cards and enable customers to make purchases without upfront payment or the need for a credit check. BNPL solutions typically offer…

Tabby named as Outperformer among 15 other companies, including PayPal, Affirm, and Klarna.

Tabby's Products & Differentiators

Split in 4

Provide customers the freedom to split their purchase into 4 equal payments billed every month at no interest.

Loading...

Research containing Tabby

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Tabby in 7 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

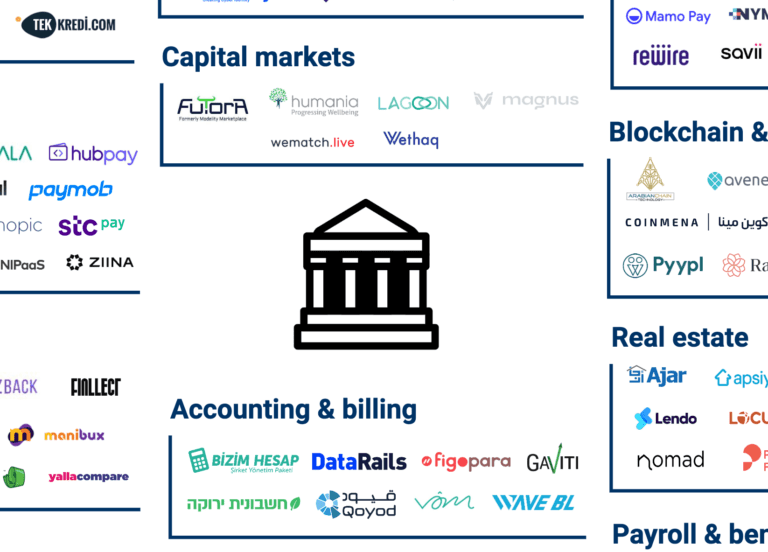

The embedded banking & payments market map

Jan 31, 2024

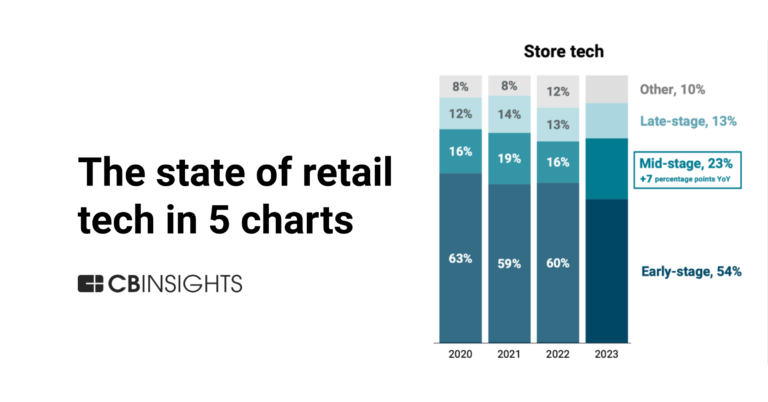

Retail tech in 5 charts: 2023

Jan 18, 2024 report

State of Fintech 2023 Report

Jan 4, 2024 report

State of Venture 2023 Report

May 10, 2022

130+ startups driving the Middle East’s fintech boomExpert Collections containing Tabby

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Tabby is included in 7 Expert Collections, including E-Commerce.

E-Commerce

11,359 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Store tech (In-store retail tech)

1,739 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,258 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Digital Lending

197 items

Track and capture company information and workflow.

Latest Tabby News

Nov 12, 2024

Customers can now enjoy Tabby’s flexible payment solutions across all Brands For Less stores in the UAE Press Release PHOTO Dubai, UAE: BFL Group, one of the leading off-price retailers in the Middle East is pleased to announce its new partnership with Tabby, the MENA’s leading shopping and financial services app. With this collaboration, customers can now enjoy Tabby’s flexible payment solutions across all Brands For Less stores in the UAE, offering greater convenience and flexibility to their shopping experience. Through Tabby, shoppers at Brands For Less stores can now take advantage of interest-free payment plans, allowing them to split their purchases into four easy payments with no added interest or fees. While Tabby has already been available online, this marks the first time it is being introduced in stores. The new addition enhances the treasure hunt shopping experience, making it even more convenient and enjoyable for customers. This partnership taps into the latest retail trends in the UAE, where consumers are increasingly seeking flexible payment solutions. The collaboration reflects BFL Group’s ongoing commitment to continuously enhancing customer satisfaction by offering services that align with their needs and meeting the evolving needs of today's shoppers Toufic Kreidieh, Executive Chairman of the Board, and Group CEO of BFL Group, commented on the partnership: “At BFL Group, we have always prioritised making shopping flexible for our customers. By partnering with Tabby, we’re taking this a step further by introducing the flexible payment option in our stores, giving customers the ability to buy what they need without worrying about paying everything upfront. We’re making in-store shopping more accessible and enjoyable for our consumers, and this is just one more way we’re making sure our customers have the best experience with us.” Hosam Arab, CEO and Co-founder of Tabby added, “At Tabby, we are committed to empowering customers with flexible payments and more control over their spending – working alongside retail partners like Brands For Less makes us proud and enables us to bring this mission to life." Customers are encouraged to stop by any of the Brands For Less UAE stores to explore the newly introduced BNPL service powered by Tabby, and discover how it can enhance their shopping experience. For more information about Brands For Less and their products, please visit https://bflgroup.ae/ Send us your press releases to pressrelease.zawya@lseg.com Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release. The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk. To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages. © ZAWYA 2024 ZAWYA NEWSLETTERS Get insights and exclusive content from the world of business and finance that you can trust, delivered to your inbox. Subscribe to our newsletters:

Tabby Frequently Asked Questions (FAQ)

When was Tabby founded?

Tabby was founded in 2019.

Where is Tabby's headquarters?

Tabby's headquarters is located at Building: In5 Tech, Dubai.

What is Tabby's latest funding round?

Tabby's latest funding round is Debt - IV.

How much did Tabby raise?

Tabby raised a total of $1.644B.

Who are the investors of Tabby?

Investors of Tabby include J.P. Morgan Chase, Arbor Ventures, Mubadala Capital, STV, Peak XV Partners and 20 more.

Who are Tabby's competitors?

Competitors of Tabby include MNT Halan and 6 more.

What products does Tabby offer?

Tabby's products include Split in 4 and 4 more.

Loading...

Compare Tabby to Competitors

Tamara serves as a shopping and payment platform. It operates in the financial technology sector. The company provides a mobile application offering flexible payment solutions and allows customers to divide their bills into multiple installments without delay fees, in compliance with Islamic law. Tamara primarily serves the e-commerce industry, with global and regional brands to local small and medium businesses. It was founded in 2020 and is based in Riyadh, Saudi Arabia.

MNT Halan operates as a fintech company that focuses on digitizing traditional banking and cash-based markets. The company offers a range of services, including digital payment solutions, lending services to the unbanked and underbanked, and an e-commerce platform. It primarily serves the financial sector and the e-commerce industry. It was founded in 2017 and is based in Cairo, Egypt.

Khazna is a financial technology company specializing in digital financial services. The company offers a financial super app that provides underbanked Egyptians with access to smartphone-based financial services. Khazna primarily serves the corporate sector by offering financial solutions to employees through a mobile application that allows them to access a portion of their earned salary as needed. It was founded in 2019 and is based in Giza, Egypt.

Postpay is a financial services company that provides buy now pay later solutions. The company offers a service that allows customers to make purchases and pay for them in three installments without interest. Postpay primarily serves the retail sector and partners with various brands to provide payment options to consumers. It was founded in 2019 and is based in Dubai, United Arab Emirates.

Cashew specializes in flexible payment solutions within the financial services sector. The company offers a range of products including buy now pay later options, interest-free installment plans, and comprehensive financial management services. Cashew primarily caters to individual consumers seeking manageable payment options for their purchases. It was founded in 2020 and is based in Dubai, United Arab Emirates.

Shahry is a digital financial services company that specializes in buy-now-pay-later (BNPL) solutions within the consumer finance sector. The company provides a mobile credit card and wallet that enables consumers to purchase goods and services in installments over a period of up to 36 months. Shahry primarily serves individual consumers looking for payment options and merchants aiming to increase sales through BNPL services. It was founded in 2019 and is based in cairo, Egypt.

Loading...