SumUp

Founded Year

2012Stage

Loan - III | AliveTotal Raised

$4.045BLast Raised

$1.608B | 10 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-15 points in the past 30 days

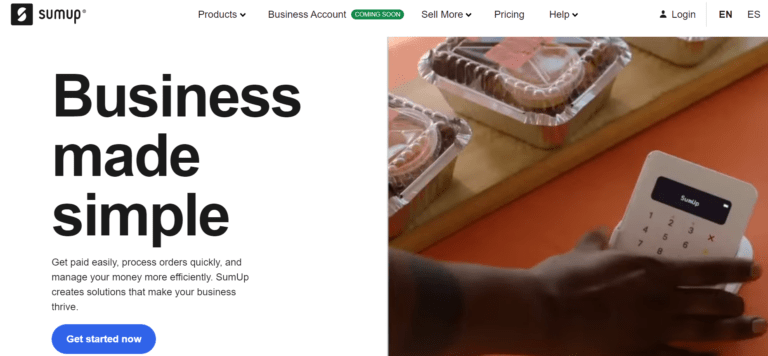

About SumUp

SumUp is a financial technology company that specializes in payment processing solutions and point-of-sale systems for small businesses. The company offers a range of products including mobile payment applications, card readers, and business bank accounts, designed to facilitate transactions and manage sales. SumUp's services cater to various sectors such as restaurants, salons, spas, and retail, providing tools for appointment management, loyalty rewards, and inventory management. SumUp was formerly known as Ka-Ching Payments. It was founded in 2012 and is based in Wilmington, Delaware.

Loading...

ESPs containing SumUp

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The virtual payment terminals market refers to a type of payment solution that allows merchants to accept payments through a web-based platform, without the need for a physical payment terminal. Virtual payment terminals are typically used by e-commerce businesses and other remote merchants who do not have a physical store or who need to accept payments from customers who are not present. The mark…

SumUp named as Challenger among 15 other companies, including Stripe, Fiserv, and Worldpay.

SumUp's Products & Differentiators

SumUp Solo Lite

Our card readers, like SOLO Lite, are also a major milestone. They’re portable, affordable, and designed for merchants who are always on the go. We’ve also developed business accounts that allow merchants to manage their finances, pay suppliers, and track income, all in one place.

Loading...

Research containing SumUp

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SumUp in 7 CB Insights research briefs, most recently on Jan 18, 2024.

Jan 18, 2024 report

State of Fintech 2023 Report

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022

Sep 13, 2022

3 retail tech trends to watch in Q3’22Expert Collections containing SumUp

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

SumUp is included in 7 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,739 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,258 items

SMB Fintech

1,648 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

249 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SumUp Patents

SumUp has filed 7 patents.

The 3 most popular patent topics include:

- payment systems

- banking technology

- banks

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/24/2021 | 9/17/2024 | Payment systems, Banking technology, Banks, Interbank networks, Circulating currencies | Grant |

Application Date | 9/24/2021 |

|---|---|

Grant Date | 9/17/2024 |

Title | |

Related Topics | Payment systems, Banking technology, Banks, Interbank networks, Circulating currencies |

Status | Grant |

Latest SumUp News

Jan 17, 2025

What's the advantage of cash in 2025? Read more to find out. Photo: Adobe Stock | by Bradley Cooper — Editor, ATM Marketplace & Food Truck Operator There's a lot of buzz around the topic of cash and whether it will survive as a payment method. In light of digital wallets, debit cards and other payments tools, many ask what are the advantages of using cash? This question is especially pertinent to those in the banking space considering investing in teller cash recyclers , or ATM operators looking to run a successful business. There are several key advantages for consumers to use cash. Here are three in particular. Cash advantage no. 1: It's not going anywhere While cash usage certainly has decreased, it has not disappeared completely, and data backs this up. The Federal Reserve Bank does an annual study called the Diary of Consumer Payment Choice . It found that monthly cash payments remained steady at seven cash payments per month. Interestingly enough, this trend has remained steady since 2020, which saw the biggest drop in cash usage in the U.S. due to concerns over cleanliness during the COVID 19 pandemic. Haley Gibson, senior manager of cash insights and policy analysis at the Federal Reserve Financial Services, said that 18-24-year-olds use cash four times monthly ; however, the vast majority do still plan to continue using cash in the future. In fact, only 16% said they plan to stop using cash. In addition, lower income households rely on cash more than other groups. Gibson believes the COVID data shows "there's a floor to cash usage in the U.S." and cash "isn't going away anytime soon." In addition, the diary showed that the amount of cash customers held on hand increased compared to before the pandemic. "Cash held in one's pocket, purse or wallet remained elevated at $74, compared to $60 before the pandemic," the Diary stated. As a result, cash will remain a viable payment tool for the foreseeable future. Cash advantage no 2: It's useful for budgeting Budgeting is a major issue in American households. In fact, many Americans hate the term itself. A report by CNBC states that although around 68% of customers want to budget, 40% say they never have had a budget. Sun Wealth Group Partners said that more than 60% of its clients "feel as if they're literally going to suffer" due to budgeting. It's best when tackling a complex subject like budgeting to use an easy tool, and cash has a big advantage here compared to other payment methods. By keeping a set amount of cash on hand and only using it for certain purchases, such as snacks, gas or groceries, customers can carefully budget, since they can only spend what they have on hand. One such method is called cash stuffing. With this technique, customers get together envelopes and label them with certain expenses, such as food, transportation, savings or fuel. They then put cash in those envelopes and use it for those purchases that month. "Because you're keeping all of your spending money in envelopes, it's easy to see how you're doing over the course of the month. If there's only a little money remaining in your food envelope but a lot of the month left, that's your cue to take it easy on the takeout," a blog post from Fidelity stated. "Inflation is driving higher withdrawal amounts. With the cost-of-living increase, consumers have become more reliant on cash to help them stay within their budget," Jodi Neiding, VP, Americas Banking Potfolio, Diebold Nixdorf said in an email interview. Canada's Financial Consumer Agency states that by using cash, customers can avoid interest or fees or even receive a discount from some merchants. Due to card fees, some merchants may either refuse to accept cards for smaller purchases or may put an upcharge on the purchase. Cash can circumnavigate that. In addition, by using cash, customers can avoid paying high interest rates or fees from credit cards. Cash advantage no 3: It's secure Customers want to have control over their purchases and not have undo oversight. Cash provides obvious security over card purchases or other tools, as it doesn't create a paper trail. Cash Matters points to a variety of reasons why someone would want to use cash such as: Avoiding data mining. Avoiding identity theft. However, its security goes beyond just privacy. It is a secure method of payment regardless of any infrastructure. For example, it does not rely on having any internet service, POS system or even electricity. Many businesses have had to switch to cash or close for the day when there is an outage with their payment systems. This is why some small businesses see cash as a major advantage. For example, farmer's market stalls, food trucks, street vendors or performers may operate on cash only to avoid having to install or utilize any complex payments systems, according to a blog post from Sumup. It also offers a secure payment method for those without access to banking services, both physical and digital. "Cash will remain essential for those without access to digital banking," Neiding said. This is especially the case in banking deserts where there are no major physical branches nearby. "As more non-traditional outlets for banking continue to rise, we still predict cash to serve as a trustworthy mode of payment for all consumers around the world, even as physical and digital channels continue to merge," Neiding said. Conclusion Of course cash does have its drawbacks. For example, some businesses may not accept cash, and it may not be convenient to carry large amounts of cash in your wallet or purse. However, cash remains advantageous for a variety of reasons. It is stable and will be around for a long time. It is useful for budgeting and it remains a secure form of payment even when other payment systems stop working. INCLUDED IN THIS STORY

SumUp Frequently Asked Questions (FAQ)

When was SumUp founded?

SumUp was founded in 2012.

Where is SumUp's headquarters?

SumUp's headquarters is located at 1209 Orange St, Wilmington.

What is SumUp's latest funding round?

SumUp's latest funding round is Loan - III.

How much did SumUp raise?

SumUp raised a total of $4.045B.

Who are the investors of SumUp?

Investors of SumUp include BlackRock, Oaktree Capital Management, Apollo Global Management, Vista Credit Partners, Goldman Sachs Asset Management and 33 more.

Who are SumUp's competitors?

Competitors of SumUp include CloudWalk, Melio, Tide, Zoop, Clip and 7 more.

What products does SumUp offer?

SumUp's products include SumUp Solo Lite and 4 more.

Who are SumUp's customers?

Customers of SumUp include Deb Dobney-Cobb, Aidan Conway and Arlene Wedgbury.

Loading...

Compare SumUp to Competitors

Worldpay is a payments technology company specializing in omni-commerce solutions across various business sectors. The company offers services that enable businesses to accept, manage, and make payments in-person, online, and across multiple channels, including embedded payments for software platforms. Worldpay primarily serves small businesses, enterprises, software platforms, and marketplaces across various industries such as financial services, retail, and travel. It was founded in 1993 and is based in London, England.

Stripe provides services for businesses to manage online and in-person payments. The company offers products including payment processing Application Programming Interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Hash operates a financial technology platform. It enables companies to create and test payment and other financial solutions. It provides non-financial business-to-business (B2B) enterprises wishing to offer banking services with payment infrastructure. The company was founded in 2017 and is based in Sao Paulo, Brazil.

Ingenico provides payment acceptance solutions within the financial technology sector. The company offers products and services such as payment terminals, cloud-based payment platforms, terminal management, and various payment services designed to cater to the needs of merchants, banks, and other entities in the commerce ecosystem. Its solutions are tailored to support industries such as retail, transportation, hospitality, healthcare, and non-profit organizations, among others. It was founded in 1980 and is based in Suresnes, France.

GoCardless specializes in online payment processing solutions. The company offers services to facilitate direct bank payments, including instant one-off payments, automated recurring payments, and access to bank account data for businesses. GoCardless primarily serves businesses looking to streamline their payment collection and reconciliation processes. It was founded in 2011 and is based in London, United Kingdom.

PayU provides global payments and financial technology, solutions. The company offers a global payment platform that enables merchants to process online payments, optimize transaction approval rates, and utilize advanced security and anti-fraud measures. PayU primarily serves the ecommerce industry, providing financial services and payment solutions to businesses looking to expand their reach in emerging markets. It was founded in 2002 and is based in Hoofddorp, Netherlands. PayU operates as a subsidiary of Naspers.

Loading...