Socure

Founded Year

2012Stage

Unattributed VC | AliveTotal Raised

$743.25MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-18 points in the past 30 days

About Socure

Socure is a platform in the digital identity verification and trust sector, utilizing artificial intelligence and machine learning within the financial services, government, gaming, healthcare, telecom, and e-commerce industries. The company offers a predictive analytics platform that employs AI and machine learning techniques to verify identities in real time, using online and offline data intelligence such as email, phone, address, IP, device, and velocity. Socure's clientele includes a range of sectors, primarily focusing on financial services, government, and technology-driven industries. It was founded in 2012 and is based in Incline Village, Nevada.

Loading...

Socure's Product Videos

ESPs containing Socure

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The know your customer (KYC) software market offers solutions for streamlining and automating customer identification and due diligence processes. These solutions help companies verify customer identities, perform background checks, detect suspicious activity, and support regulatory compliance. Many vendors in this market utilize technologies such as artificial intelligence, machine learning, and …

Socure named as Leader among 15 other companies, including Onfido, Jumio, and Alloy.

Socure's Products & Differentiators

Socure KYC

Socure KYC automates customer identity verification, enabling businesses to auto-approve up to 98% of customers while satisfying compliance requirements. KYC is powered by the industry-leading ID graph and uses advanced ML and search analytics to achieve the highest match accuracy in the industry including Gen Z, millennials, credit invisible, new to country and thin file consumers. Socure offers the deepest multi-dimensional view of any consumer along with detailed risk and reason codes for each identity element that provide actionable intelligence.

Loading...

Research containing Socure

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Socure in 11 CB Insights research briefs, most recently on Jan 14, 2025.

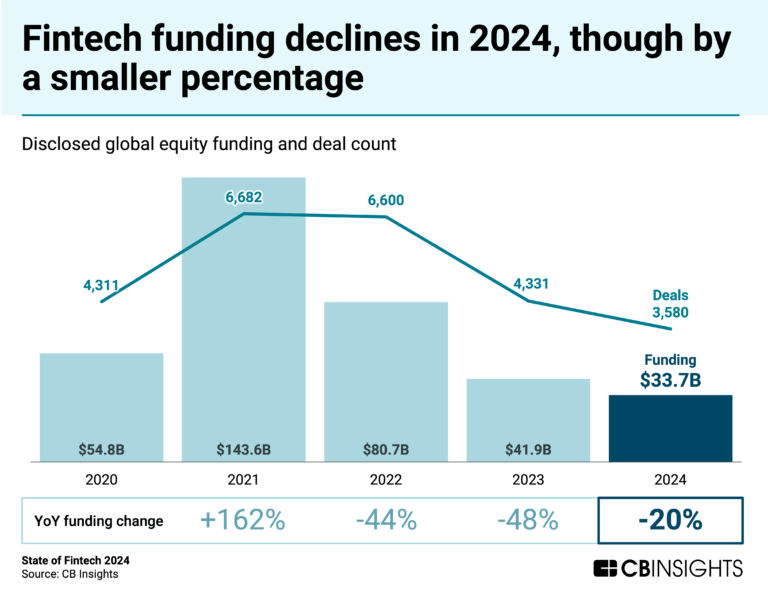

Jan 14, 2025 report

State of Fintech 2024 Report

Mar 14, 2024

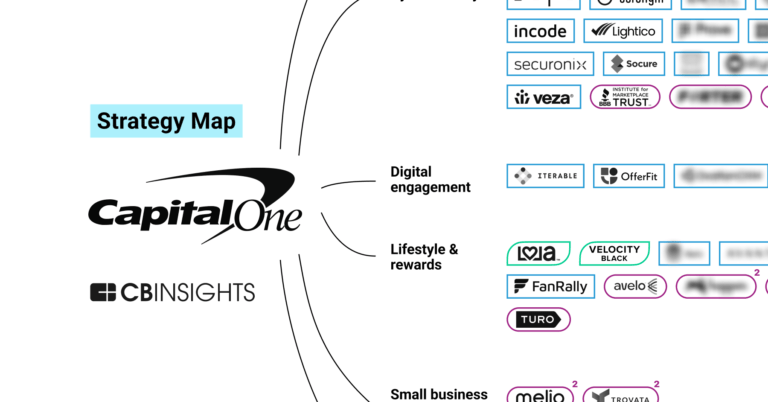

The retail banking fraud & compliance market map

Jan 4, 2024

The core banking automation market map

Aug 14, 2023

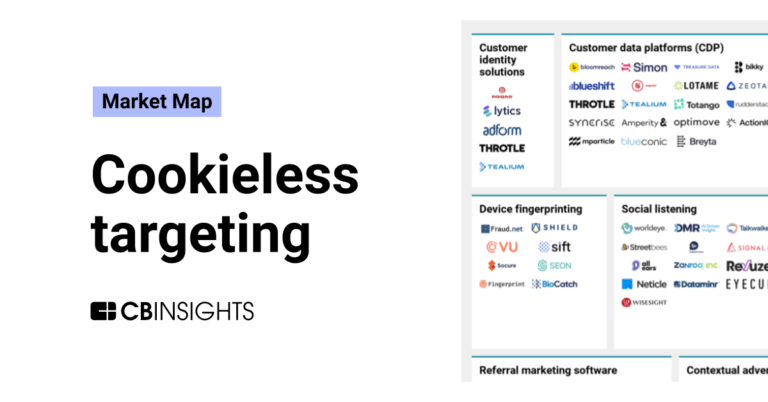

The cookieless targeting market mapExpert Collections containing Socure

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Socure is included in 13 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Regtech

1,921 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

AI 100

99 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

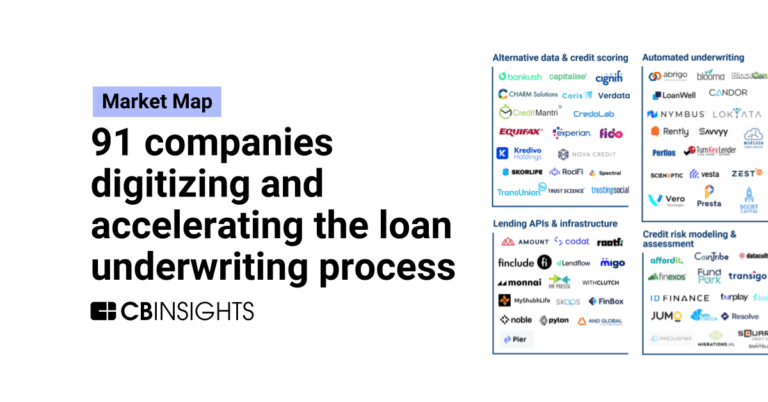

Digital Lending

2,531 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Socure Patents

Socure has filed 18 patents.

The 3 most popular patent topics include:

- payment systems

- machine learning

- data management

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

10/4/2023 | 1/16/2024 | Barcodes, Diagrams, Typography, Software design patterns, Identifiers | Grant |

Application Date | 10/4/2023 |

|---|---|

Grant Date | 1/16/2024 |

Title | |

Related Topics | Barcodes, Diagrams, Typography, Software design patterns, Identifiers |

Status | Grant |

Latest Socure News

Jan 16, 2025

News provided by Share this article Share toX One in eight Americans – and 40% of Gen Z – committed fraud over the holidays, according to new research from Socure INCLINE VILLAGE, Nev., Jan. 16, 2025 /PRNewswire/ -- Socure , the leading provider of artificial intelligence for digital identity verification, sanction screening and fraud prevention, today unveiled research revealing that one in eight Americans (13%) committed first-party fraud over the 2024 holiday shopping season. First-party fraud, sometimes referred to as "friendly fraud," occurs when consumers exploit return and refund policies for financial gain. These practices, such as disputing legitimate credit or debit card transactions, falsely claiming that a delivery has been lost or stolen to receive a refund or making purchases with through a credit card or Buy Now Pay Later (BNPL) lender with no intention of paying it back, costs businesses more than $100 billion annually, according to Socure. This includes $89 billion from chargebacks, promotional abuse and return fraud, and $18 billion in credit card fraud losses. Holiday Pressure Heightened consumer spending, gift-giving, lenient return policies and the rising cost of goods created a perfect storm this past November and December, as more than a quarter of Americans (27%) say that they were more likely to commit first-party fraud when purchasing holiday gifts. Nearly all offenders (90%) cited financial struggles as their motivation, including factors such as inflation and high credit card interest rates. Younger shoppers were the top offenders as 40% of Gen Z admitted to committing first-party fraud over the 2024 holidays – particularly worrisome as these consumers are highly coveted by financial institutions and retailers thanks to their growing spending power and influential online presence. Wealthier consumers were clearly comfortable with committing fraud. Those with household incomes of more than $100,000 were twice as likely to engage in first-party fraud compared to those with lower incomes (25% vs 11%). Fraudulent "porch pirate" claims, when a consumer falsely reports that a delivered package left outside was stolen, were three times more likely to occur over the holidays compared to any other time of year. Nearly half of those Americans who committed first-party fraud (49%) over the holidays did so because they had gotten away with it in 2023, indicating that the cycle is highly likely to continue without a deterrent. "The holiday shopping surge is one of the busiest times of year for financial institutions and retailers. Despite increased consumer spending, rampant first-party fraud is doing tremendous damage to their bottom lines – and ultimately the U.S. economy," said Ori Snir, Head of Product Management, Fraud and Identity Solutions at Socure. "Far too many shoppers are exploiting the system without consequences. Without action, this will only continue to get worse while destroying trust, damaging customer relationships and putting unnecessary strain on business operations." Year-Round First-Party Fraud Persists According to the data, this consumer behavior is not contained to a single season and has proven to be a pervasive, ongoing problem. Overall, a third of all Americans (34%) admit to committing first-party fraud, with over half (59%) of this activity occurring in the last year. Much like during the holidays, 60% of all offenders point to economic hardships as their primary reason. Buyer's remorse has become a significant driver. A large majority (82%) of Americans report experiencing purchase regret, and nearly half of these shoppers (43%) take action in the form of first-party fraud. There is a concerning willingness to engage in high-value fraud, as one in six (17%) offenses are related to transactions exceeding $500, and over half (59%) are over $100. The most prevalent types of first-party fraud in the U.S. were disputing legitimate financial transactions (12%), choosing not to pay off credit card bills (11%), claiming that an online purchase was lost even though it was received (11%) and falsely claiming that a delivered package was stolen or damaged (11%). The research report with additional data and analysis, America's Naughty List: How Consumers Bend the Rules During Holiday Shopping, can be found here . Methodology Socure conducted this research using an online survey prepared by Method Research and distributed by PureSpectrum among n=2,000 adult U.S. consumers (age 18+) who have made a purchase in the last six months. The sample was split equally between genders, with a spread of age groups, race groups, and geographies. Data was collected from December 6th to December 13th. About Socure Socure is the leading provider of AI-powered digital identity verification and fraud prevention solutions, trusted by the largest enterprises and government agencies to build trust and mitigate risk, anytime through the customer lifecycle. Extensively leveraging AI and machine learning, Socure's industry-leading platform achieves the highest accuracy, automation and capture rates in the world. With the acquisition of Effectiv, Socure expands its capabilities to offer end-to-end identity fraud and payment risk management, integrating advanced transaction monitoring, credit underwriting and know-your-business (KYB) solutions into its platform. Serving more than 2,800 customers across financial services, government, gaming, marketplaces, healthcare, telecom, and e-commerce, Socure's customer base includes 18 of the top 20 banks, the largest HR payroll providers, the largest sportsbook operators, 28 state agencies, four federal agencies, and more than 500 fintechs. Leading organizations including Capital One, Citi, Chime, SoFi, Green Dot, Robinhood, Dave, Gusto, Poshmark, Uber, DraftKings, PrizePicks, the State of California and many more trust Socure to deliver certainty in identity across onboarding, authentication, payments, account changes, and regulatory compliance. Learn more at www.socure.com . SOURCE Socure

Socure Frequently Asked Questions (FAQ)

When was Socure founded?

Socure was founded in 2012.

Where is Socure's headquarters?

Socure's headquarters is located at 885 Tahoe Boulevard, Incline Village.

What is Socure's latest funding round?

Socure's latest funding round is Unattributed VC.

How much did Socure raise?

Socure raised a total of $743.25M.

Who are the investors of Socure?

Investors of Socure include Liquid 2 Ventures, SVB Financial Group, KeyBanc Capital Markets, J.P. Morgan, Commerce Ventures and 27 more.

Who are Socure's competitors?

Competitors of Socure include Daon, Bureau, iDenfy, FiVerity, ZignSec and 7 more.

What products does Socure offer?

Socure's products include Socure KYC and 4 more.

Who are Socure's customers?

Customers of Socure include Betterment, Lili and Public.

Loading...

Compare Socure to Competitors

Veriff specializes in artificial intelligence-powered identity verification within the fraud prevention and compliance sectors. Their platform offers services to verify user identities, which are used to prevent fraud and ensure compliance with regulations. Its solutions are utilized across various industries including financial services, mobility, crypto, gaming, education, and healthcare. The company was founded in 2015 and is based in Tallinn, Estonia.

BIOWATCH focuses on wearable biometric authentication technology within the security and access control industry. Their product, LeBracelet, serves as an alternative to traditional forms of authentication like badges, cards, and passwords with a wrist-worn device that allows access to various systems and services. The company serves sectors that require secure access control solutions, including corporate environments, financial services, and personal security. It was founded in 2015 and is based in Lausanne, Switzerland.

Tactical Information Systems provides complete identity solutions that meet the needs of governments, law enforcement, border security and identity communities. BeehiveID is face recognition software for identity authentication & verification.

HYPR specializes in identity security and passwordless authentication solutions within the cybersecurity industry. The company offers an identity assurance platform that includes passwordless multi-factor authentication, risk policy orchestration, and identity verification services. HYPR's solutions cater to various sectors, including financial services, critical infrastructure, and retail, aiming to enhance security and user experience. It was founded in 2014 and is based in New York, New York.

Trulioo focuses on global online identity verification and operates within the technology and security sectors. The company offers services such as individual and business identity verification, watchlist screening, and identity document verification, all aimed at ensuring know-your-customer (KYC) and know-your-business (KYB) compliance. Trulioo primarily serves sectors such as banking, cryptocurrency, online trading, and wealth management. It was founded in 2011 and is based in Vancouver, Canada.

Prove Identity focuses on digital identity verification and authentication across several business sectors. The company provides services such as consumer verification, identity management, and passwordless authentication solutions. Prove's services are applicable to industries like banking, healthcare, insurance, and e-commerce. Prove Identity was formerly known as Payfone. It was founded in 2008 and is based in New York, New York.

Loading...