Snowflake

Founded Year

2012Stage

IPO | IPOTotal Raised

$1.387BDate of IPO

9/16/2020Market Cap

56.37BStock Price

170.79Revenue

$0000About Snowflake

Snowflake (NYSE: SNOW) focuses on data management and analytics. It provides a platform known as the Data Cloud, which allows organizations to consolidate their data, discover and securely share governed data, and perform diverse analytic tasks. The company primarily serves businesses across various sectors that require data warehouses, data engineering, data science, data application development, and data sharing. The company was formerly known as Snowflake Computing, Inc. and changed its name to Snowflake Inc. in April 2019. It was founded in 2012 and is based in Bozeman, Montana.

Loading...

ESPs containing Snowflake

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The metadata management market offers solutions that enable businesses to collect, organize, and maintain their metadata, i.e., structured information that describes and explains data assets. In addition to their metadata management offerings, companies in this market typically also offer data governance & privacy, data lineage, and data curation. The market enables firms to connect and visualize …

Snowflake named as Leader among 15 other companies, including Databricks, IBM, and Oracle.

Loading...

Research containing Snowflake

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Snowflake in 9 CB Insights research briefs, most recently on Nov 19, 2024.

Nov 19, 2024 report

15 tech trends to watch closely in 2025

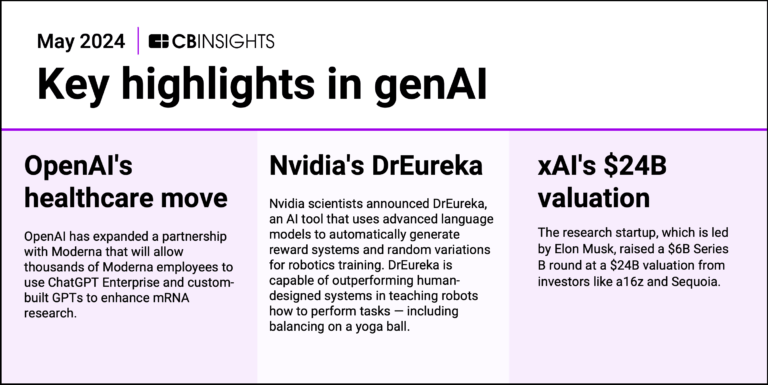

May 29, 2024

483 startup failure post-mortems

Feb 20, 2024

The hardware security market map

Sep 27, 2022

The Transcript from Yardstiq: Microsoft vs. everyoneExpert Collections containing Snowflake

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Snowflake is included in 6 Expert Collections, including Tech IPO Pipeline.

Tech IPO Pipeline

568 items

Conference Exhibitors

5,302 items

Targeted Marketing Tech

206 items

Retail Media Networks

467 items

Tech companies helping retailers build and operate retail media networks. Includes solutions like demand-side platforms, AI-generated content, digital shelf displays, and more.

ITC Vegas 2024 - Exhibitors and Sponsors

699 items

Created 9/9/24. Updated 10.22.24. Company list source: ITC Vegas. Check ITC Vegas' website for final list: https://events.clarionevents.com/InsureTech2024/Public/EventMap.aspx?shMode=E&ID=84001

NRF Big Show 2025: Exhibitors

959 items

Snowflake Patents

Snowflake has filed 1063 patents.

The 3 most popular patent topics include:

- data management

- database management systems

- databases

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

2/20/2023 | 12/3/2024 | Cryptography, Disk encryption, Key management, Cryptographic attacks, Database management systems | Grant |

Application Date | 2/20/2023 |

|---|---|

Grant Date | 12/3/2024 |

Title | |

Related Topics | Cryptography, Disk encryption, Key management, Cryptographic attacks, Database management systems |

Status | Grant |

Latest Snowflake News

Jan 19, 2025

Park Avenue Securities LLC Grows Position in Snowflake Inc. (NYSE:SNOW) Posted by MarketBeat News on Jan 19th, 2025 Park Avenue Securities LLC grew its holdings in Snowflake Inc. ( NYSE:SNOW – Free Report ) by 50.7% during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 13,000 shares of the company’s stock after acquiring an additional 4,373 shares during the period. Park Avenue Securities LLC’s holdings in Snowflake were worth $2,007,000 at the end of the most recent quarter. Several other large investors have also made changes to their positions in the business. Breakwater Capital Group boosted its holdings in Snowflake by 2.2% during the fourth quarter. Breakwater Capital Group now owns 2,938 shares of the company’s stock worth $454,000 after buying an additional 62 shares in the last quarter. Modus Advisors LLC raised its position in shares of Snowflake by 3.9% in the third quarter. Modus Advisors LLC now owns 2,491 shares of the company’s stock valued at $286,000 after buying an additional 94 shares during the last quarter. Catalyst Private Wealth LLC raised its position in shares of Snowflake by 3.2% in the third quarter. Catalyst Private Wealth LLC now owns 3,329 shares of the company’s stock valued at $382,000 after buying an additional 104 shares during the last quarter. Clear Creek Financial Management LLC raised its position in shares of Snowflake by 6.7% in the third quarter. Clear Creek Financial Management LLC now owns 1,829 shares of the company’s stock valued at $210,000 after buying an additional 115 shares during the last quarter. Finally, Covestor Ltd increased its position in Snowflake by 16.2% during the third quarter. Covestor Ltd now owns 827 shares of the company’s stock worth $95,000 after purchasing an additional 115 shares during the last quarter. 65.10% of the stock is owned by hedge funds and other institutional investors. Get Snowflake alerts: Insider Transactions at Snowflake In other news, CRO Christopher William Degnan sold 12,782 shares of the company’s stock in a transaction dated Thursday, January 2nd. The shares were sold at an average price of $157.24, for a total transaction of $2,009,841.68. Following the completion of the transaction, the executive now owns 311,999 shares of the company’s stock, valued at $49,058,722.76. This represents a 3.94 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link . Also, EVP Christian Kleinerman sold 15,000 shares of the stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $120.77, for a total transaction of $1,811,550.00. Following the transaction, the executive vice president now owns 706,755 shares in the company, valued at approximately $85,354,801.35. The trade was a 2.08 % decrease in their ownership of the stock. The disclosure for this sale can be found here . Insiders sold 376,904 shares of company stock valued at $62,545,855 in the last 90 days. 7.80% of the stock is currently owned by insiders. Snowflake Trading Up 1.9 % NYSE:SNOW opened at $170.89 on Friday. The company has a market capitalization of $56.41 billion, a PE ratio of -50.41 and a beta of 1.05. The company has a quick ratio of 1.88, a current ratio of 1.88 and a debt-to-equity ratio of 0.77. Snowflake Inc. has a 52-week low of $107.13 and a 52-week high of $237.72. The stock has a fifty day simple moving average of $161.11 and a 200-day simple moving average of $135.02. Analyst Upgrades and Downgrades Several equities research analysts recently issued reports on the stock. Oppenheimer raised their price objective on shares of Snowflake from $180.00 to $200.00 and gave the stock an “outperform” rating in a research report on Monday, January 13th. KeyCorp raised their price objective on shares of Snowflake from $185.00 to $210.00 and gave the company an “overweight” rating in a research note on Thursday, December 5th. TD Cowen raised their target price on shares of Snowflake from $180.00 to $190.00 and gave the company a “buy” rating in a report on Thursday, November 21st. Deutsche Bank Aktiengesellschaft raised their price objective on shares of Snowflake from $180.00 to $190.00 and gave the stock a “buy” rating in a report on Thursday, November 21st. Finally, Scotiabank lifted their target price on shares of Snowflake from $170.00 to $220.00 and gave the company a “sector outperform” rating in a report on Monday, December 9th. Two analysts have rated the stock with a sell rating, nine have given a hold rating, twenty-eight have given a buy rating and one has issued a strong buy rating to the company’s stock. Based on data from MarketBeat, the company presently has an average rating of “Moderate Buy” and an average price target of $188.06.

Snowflake Frequently Asked Questions (FAQ)

When was Snowflake founded?

Snowflake was founded in 2012.

Where is Snowflake's headquarters?

Snowflake's headquarters is located at 106 East Babcock Street, Bozeman.

What is Snowflake's latest funding round?

Snowflake's latest funding round is IPO.

How much did Snowflake raise?

Snowflake raised a total of $1.387B.

Who are the investors of Snowflake?

Investors of Snowflake include Redpoint Ventures, Sutter Hill Ventures, Altimeter Capital, Madrona Venture Group, ICONIQ Capital and 8 more.

Who are Snowflake's competitors?

Competitors of Snowflake include Databricks, RNV Analytics, Qlik, DataPelago, Talend and 7 more.

Loading...

Compare Snowflake to Competitors

Cloudera operates in the hybrid data management and analytics sector. Its offerings include a hybrid data platform that is intended to manage data in various environments, featuring secure data management and cloud-native data services. Cloudera's tools are used in sectors such as financial services, healthcare, and manufacturing, focusing on areas like data engineering, stream processing, data warehousing, operational databases, machine learning, and data visualization. It was founded in 2008 and is based in Santa Clara, California.

Databricks is a data and AI company that specializes in unifying data, analytics, and artificial intelligence across various industries. The company offers a platform that facilitates data management, governance, real-time analytics, and the building and deployment of machine learning and AI applications. Databricks serves sectors such as financial services, healthcare, public sector, retail, and manufacturing, among others. It was founded in 2013 and is based in San Francisco, California.

Microsoft Azure is a cloud computing service created by Microsoft for building, testing, deploying, and managing applications and services through Microsoft-managed data centers.

SAS is a company that focuses on advanced analytics, business intelligence, and data management. They provide software solutions that allow organizations to analyze data and support decision-making. The company serves sectors that require data-driven decision-making, including finance, healthcare, and education. It was founded in 1976 and is based in Cary, North Carolina.

Amazon Web Services specializes in cloud computing services, offering scalable and secure IT infrastructure solutions across various industries. The company provides a range of services including compute power, database storage, content delivery, and other functionalities to support the development of sophisticated applications. AWS caters to a diverse clientele, including sectors such as financial services, healthcare, telecommunications, and gaming, by providing industry-specific solutions and technologies like analytics, artificial intelligence, and serverless computing. It was founded in 2006 and is based in Duvall, Washington. Amazon Web Services operates as a subsidiary of Amazon.

Tableau specializes in business intelligence and analytics. The company offers a platform that allows users to connect to various databases, create visualizations, and share insights, making data more understandable and actionable. It primarily serves the business intelligence and data analytics industry. It was founded in 2003 and is based in Seattle, Washington.

Loading...