Singlife

Founded Year

2014Stage

Acquired | AcquiredTotal Raised

$365.1MValuation

$0000About Singlife

Singlife operates in the insurance and investment sectors. The company offers a range of insurance products including life, medical, critical illness, disability, maternity, accident, car, travel, and home insurance, as well as investment-linked plans and savings accounts. Its primary customers are individuals seeking insurance coverage and investment opportunities. It was founded in 2014 and is based in Singapore. In December 2023, Sumitomo Life acquired a majority stake in Singlife for $1.21B.

Loading...

Loading...

Research containing Singlife

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Singlife in 1 CB Insights research brief, most recently on Feb 9, 2024.

Feb 9, 2024 report

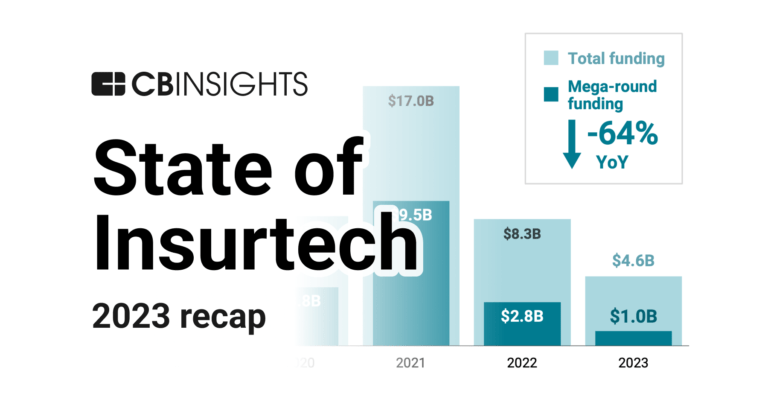

State of Insurtech 2023 ReportExpert Collections containing Singlife

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Singlife is included in 2 Expert Collections, including Insurtech.

Insurtech

3,243 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Fintech

13,559 items

Excludes US-based companies

Latest Singlife News

Jan 23, 2025

The Singapore Home Insurance Market was valued at USD 0.70 Billion in 2024, and is expected to reach USD 1.14 Billion by 2030, rising at a CAGR of 4.56%. The Singapore Home Insurance market is driven by the increasing value of property, rising natural disaster risks, and the need for financial protection. As property prices rise, homeowners seek insurance to safeguard their investments against fire, flood, or other damage. Also, the risk of natural disasters, such as floods and storms, prompts homeowners to secure comprehensive coverage. Home insurance also protects against theft, vandalism, and accidental damage, providing financial relief in case of unforeseen events. Also, home insurance offers liability coverage, ensuring homeowners are protected if someone is injured on their property. The desire for peace of mind and financial security in a rapidly urbanizing environment also significantly drives the demand for home insurance in Singapore. Key Market Trends Rising Trend of Bundled Insurance The rising trend of bundled insurance policies is significantly shaping the Singapore home insurance market. Homeowners are increasingly opting for comprehensive insurance packages that combine home, contents, and personal liability coverage. These bundled policies offer a more convenient and cost-effective solution, as they typically come with discounts compared to purchasing individual policies. Bundling also simplifies the insurance process, allowing homeowners to manage multiple policies under one plan. This trend is appealing to a broad range of consumers, from first-time homeowners to those seeking more comprehensive protection. Insurers are responding by offering tailored packages that address a variety of needs, including protection for high-value assets or additional coverage for natural disasters. As the demand for convenience and value grows, bundled insurance products are expected to continue gaining traction in the Singapore market. Rising Demand for Customization The rising demand for customization is a prominent trend in the Singapore home insurance market. Homeowners are increasingly seeking personalized policies that cater to their specific needs, such as coverage for high-value items like jewelry, artwork, or electronics. With the growing adoption of smart home technology, consumers also desire policies that cover smart devices and home automation systems against risks like damage or theft. Insurers are responding by offering flexible coverage options that allow homeowners to select add-ons or adjust their premiums based on individual preferences and risk profiles. This trend toward customization reflects a shift from one-size-fits-all policies to more tailored solutions that align with homeowners' unique lifestyles and assets. As consumers become more discerning, the ability to provide personalized home insurance is becoming a key competitive advantage for insurers in Singapore. Key Market Players Etiqa Insurance

Singlife Frequently Asked Questions (FAQ)

When was Singlife founded?

Singlife was founded in 2014.

Where is Singlife's headquarters?

Singlife's headquarters is located at 4 Shenton Way, Singapore.

What is Singlife's latest funding round?

Singlife's latest funding round is Acquired.

How much did Singlife raise?

Singlife raised a total of $365.1M.

Who are the investors of Singlife?

Investors of Singlife include Sumitomo Life, Aviva Singlife, Aflac, Ion Pacific, Abrdn Property Income Trust and 6 more.

Who are Singlife's competitors?

Competitors of Singlife include New York Life Insurance Company, Insurance 360, AIA Group, Tokio Marine, MetLife and 7 more.

Loading...

Compare Singlife to Competitors

Zurich Santander is a financial services company that offers insurance and retirement products. It offers products such as life insurance, pension plans, and investment management services. Zurich Santander serves individual and corporate clients focused on financial planning. It was founded in 1975 and is based in Sao Paulo, Brazil.

Mutual of Omaha is a Fortune 300 company that provides various products such as medicare supplement insurance, life insurance, annuities, and investments. The company serves individuals, businesses, and groups. Mutual of Omaha was formerly known as Mutual Benefit Health & Accident. It was founded in 1909 and is based in Omaha, Nebraska.

New York Life Insurance Company operates as a financial services firm in the insurance and investment sectors. The company offers a range of insurance products, including term life, whole life, universal life, and long-term care insurance, as well as individual disability insurance. Additionally, it provides investment services such as mutual funds, exchange-traded funds, and annuities, along with retirement and wealth management advisory services. It was founded in 1845 and is based in New York, New York.

ABC Life focuses on providing insurance services within the financial sector. The company offers a range of products including life insurance, accident insurance, and healthcare insurance, as well as wealth management and retirement planning services. ABC Life primarily serves individual and corporate clients with a variety of insurance and financial planning needs. It was founded in 2005 and is based in Dongcheng, China.

State Farm Insurance provides various insurance and financial services. The company offers products such as auto, homeowners, and life insurance, along with financial services like investment planning and retirement savings. State Farm Insurance serves individual customers and small businesses with their insurance and financial needs. It was founded in 1922 and is based in Bloomington, Illinois.

Frontline Insurance provides home and commercial property insurance. The company offers insurance solutions focused on state-specific coverage options. Frontline Insurance serves coastal homeowners and commercial property owners in the Southeast United States. It was founded in 1998 and is based in Lake Mary, Florida.

Loading...