Sift

Founded Year

2011Stage

Secondary Market | AliveTotal Raised

$156.52MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-96 points in the past 30 days

About Sift

Sift provides real-time machine learning fraud prevention solutions for online businesses. Its machine-learning software automatically learns and detects fraudulent behavioral patterns and alerts businesses before they or their customers are defrauded. It provides its services in a wide range of industries, such as financial technology, retail, payment service providers, and more. It was formerly known as Sift Science. It was founded in 2011 and is based in San Francisco, California.

Loading...

ESPs containing Sift

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

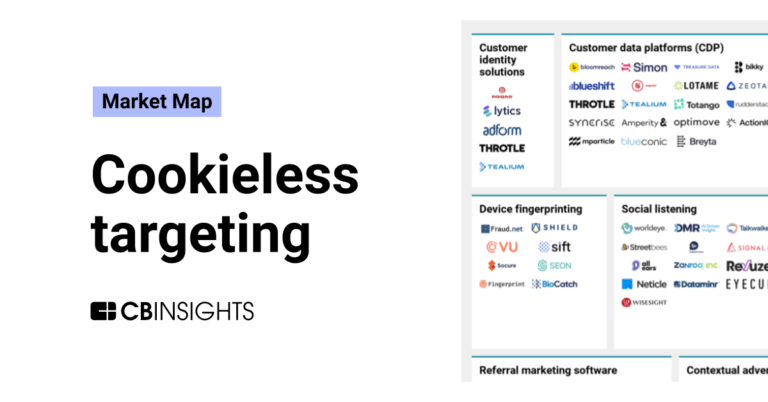

The device fingerprinting market, also referred to as device intelligence, offers customers a tool for identifying and authenticating devices accessing their systems or platforms. Device fingerprinting involves creating unique digital profiles based on various device attributes such as hardware, software, network configuration, and behavior patterns. This helps enhance security measures by detecti…

Sift named as Outperformer among 12 other companies, including Socure, Signifyd, and SEON Technologies.

Loading...

Research containing Sift

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Sift in 6 CB Insights research briefs, most recently on Mar 14, 2024.

Mar 14, 2024

The retail banking fraud & compliance market map

Aug 14, 2023

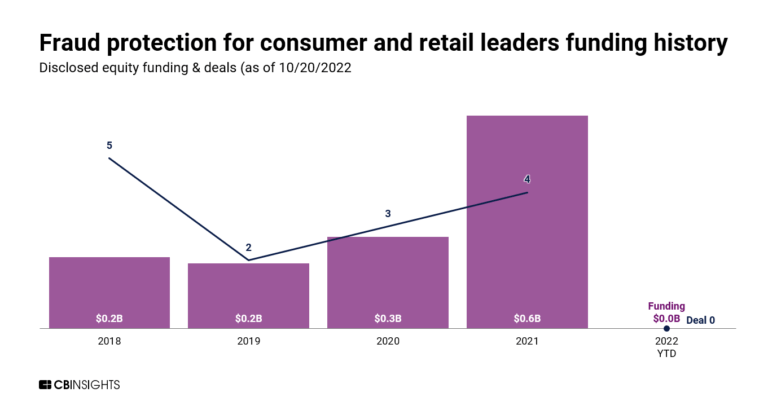

The cookieless targeting market map

Feb 27, 2023 report

Top fraud prevention companies — and why customers chose themExpert Collections containing Sift

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Sift is included in 12 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Regtech

1,721 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Digital Lending

2,437 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

250 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Tech IPO Pipeline

568 items

Sift Patents

Sift has filed 45 patents.

The 3 most popular patent topics include:

- social networking services

- computer security

- machine learning

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/18/2024 | 11/12/2024 | Natural language processing, Artificial intelligence, Online service providers, Social networking services, Machine learning | Grant |

Application Date | 1/18/2024 |

|---|---|

Grant Date | 11/12/2024 |

Title | |

Related Topics | Natural language processing, Artificial intelligence, Online service providers, Social networking services, Machine learning |

Status | Grant |

Latest Sift News

Nov 20, 2024

Wednesday 20 November 2024 14:37 CET | News Sift , an AI-powered fraud detection platform, has announced that Hertz started utilising its AI-enabled fraud prevention platform to deliver optimised customer experiences and mitigate fraud. As part of the collaboration, Hertz, which is a car rental company operating both on and offline, leverages Sift to protect payment details from being illicitly used and to prevent trusted customer loyalty accounts from being compromised by bad actors to steal cars. In addition, the company focuses on the prevention of payment abuse and account takeover (ATO) while providing an augmented experience for customers. The announcement comes shortly after Sift updated its account takeover fraud solution, with the company improving fraud risk protection throughout the entire consumer journey. Among the added capabilities, the company mentions identity-centric accuracy, optimised integrations, and advanced controls, among others. Also, Sift launched new behaviour tracking features and a VIP Fast Pass for industries with high transaction volumes. Making car renting more secure and optimised Since the start of their partnership, which was initially announced in 2023, Hertz and Sift received increased visibility into fraud patterns and ATOs, which in turn allowed them to minimise theft and fraud while advancing their commitment to customer security and satisfaction. When commenting on the announcement, representatives from Hertz underline that joining forces with Sift improved how their company manages fraudulent activities and protects its customers and assets. Moreover, through Sift’s AI-powered fraud decisioning platform, Hertz is set to continue to scale its operations, having the assurance that tools are implemented to help safeguard its physical property and its customers and their accounts. Besides working with Sift, Hertz also teamed up with Stripe in March 2024 to support payments for its car rental brands. The partnership enabled Hertz to merge the majority of its in-person and online payment volume onto Stripe, with the move being part of the company’s digital rental strategy. Also, the alliance assists Hertz in offering its customers additional digital payment methods that could equip them with more efficient and optimised rental experiences.

Sift Frequently Asked Questions (FAQ)

When was Sift founded?

Sift was founded in 2011.

Where is Sift's headquarters?

Sift's headquarters is located at 525 Market Street, San Francisco.

What is Sift's latest funding round?

Sift's latest funding round is Secondary Market.

How much did Sift raise?

Sift raised a total of $156.52M.

Who are the investors of Sift?

Investors of Sift include Fabrica Ventures, Union Square Ventures, Insight Partners, Stripes Group, Spark Capital and 18 more.

Who are Sift's competitors?

Competitors of Sift include Justt, Behavox, ClearSale, ComplyAdvantage, Fenergo and 7 more.

Loading...

Compare Sift to Competitors

Signifyd provides e-commerce fraud protection and prevention services. The company offers services, including revenue protection, abuse prevention, and payment compliance, all aimed at maximizing conversion and eliminating fraud and consumer abuse. Its services primarily cater to the e-commerce industry. Signifyd was founded in 2011 and is based in San Jose, California.

Forter specializes in identity intelligence for digital commerce, focusing on fraud prevention and customer security across digital platforms. The company provides services including fraud management, payment optimization, chargeback recovery, identity protection, and abuse prevention, aimed at improving security and efficiency in online transactions. Forter's solutions are utilized by sectors within the digital commerce industry to support processes for businesses and consumers. Forter was formerly known as Ryzyco. It was founded in 2013 and is based in New York, New York.

Ravelin specializes in fraud prevention and payment security within the online business sector. The company offers a suite of solutions that utilize machine learning and human insights, aiming to protect against online payment fraud, account takeovers, policy abuse, marketplace fraud, and optimization of three-dimensional secure transactions. Ravelin primarily serves online merchants looking to secure their transactions and enhance the customer journey. It was founded in 2014 and is based in London, United Kingdom.

BioCatch specializes in behavioral biometrics for fraud prevention and digital identity verification within the financial services sector. The company offers solutions that analyze online user behavior to detect and prevent fraud, money laundering, and various cyber threats. It was founded in 2011 and is based in Tel Aviv, Israel.

Shield is a device-first risk AI platform that specializes in fraud prevention and risk intelligence within the digital business sector. The company offers solutions to identify and eliminate fraudulent activities through global standard device identification and actionable risk intelligence. Shield primarily serves industries such as ride-hailing, social media, e-commerce, digital banking, and gaming. Shield was formerly known as CashShield. It was founded in 2008 and is based in Singapore.

ComplyAdvantage offers artificial intelligence-driven solutions for fraud and anti-money laundering (AML) risk detection within the financial services industry. The company provides services including customer and company screening, ongoing monitoring, transaction and payment screening, and fraud detection. It serves sectors such as banking, cryptocurrency, insurance, lending, and wealth management. The company was founded in 2014 and is based in London, United Kingdom.

Loading...