Shift Technology

Founded Year

2014Stage

Series D - II | AliveTotal Raised

$319.72MMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+9 points in the past 30 days

About Shift Technology

Shift Technology specializes in AI decision-making solutions for the insurance industry. The company offers a suite of products that automate and optimize decisions in areas such as fraud detection, claims processing, and underwriting risk assessment. Its AI-driven tools are designed to enhance operational efficiency and improve the policyholder experience. It was founded in 2014 and is based in Paris, France.

Loading...

Shift Technology's Product Videos

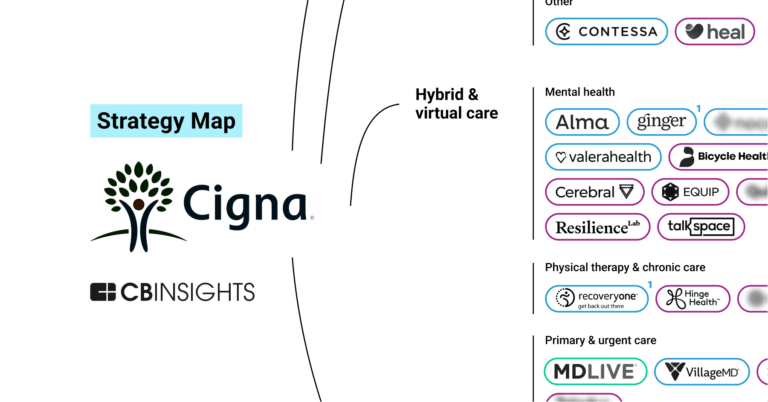

ESPs containing Shift Technology

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The fraud, waste, and abuse (FWA) detection platforms market refers to the use of technology to identify instances of fraud, waste, and abuse in the healthcare industry. These platforms use artificial intelligence to detect patterns that may indicate fraudulent activity. This can include billing for services that were not actually provided or billing for unnecessary services. The goal is to identi…

Shift Technology named as Leader among 7 other companies, including EvolutionIQ, 4L Data Intelligence, and Leapstack.

Shift Technology's Products & Differentiators

Shift Claims Fraud Detection

Designed to help claims professionals find hidden fraud in the claims process.

Loading...

Research containing Shift Technology

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Shift Technology in 5 CB Insights research briefs, most recently on Dec 18, 2023.

Dec 18, 2023

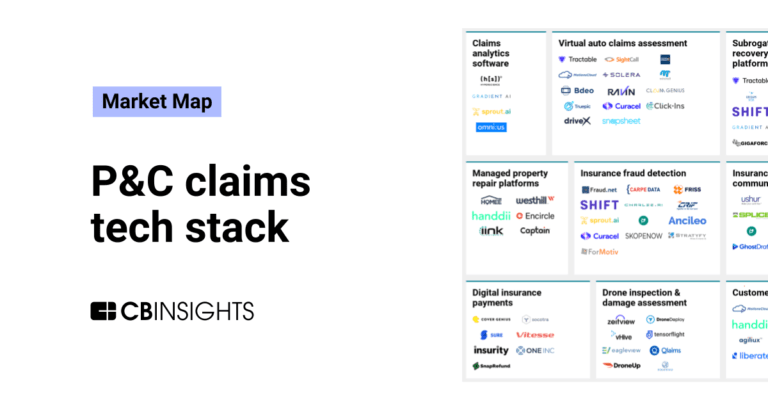

The P&C claims tech stack market map

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Shift Technology

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Shift Technology is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

AI 100

99 items

Winners of CB Insights' annual AI 100, a list of the 100 most promising AI startups in the world.

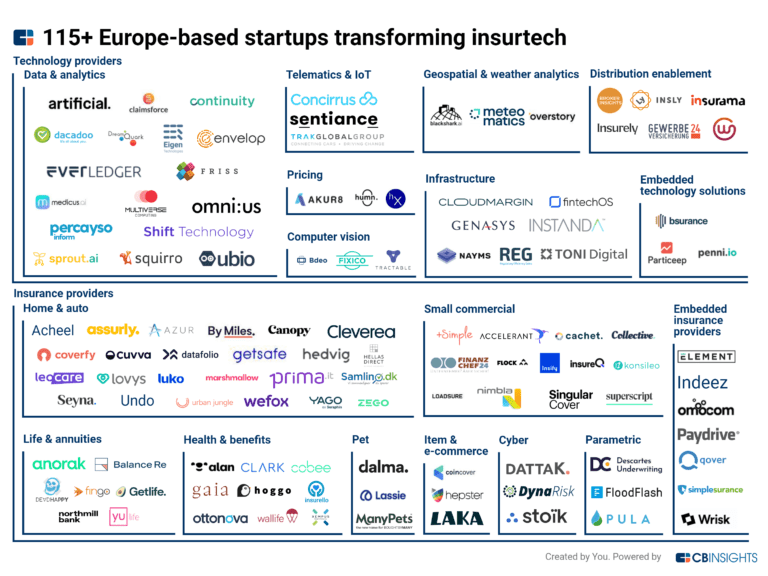

Insurtech

4,417 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Artificial Intelligence

9,386 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

499 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Shift Technology News

Dec 2, 2024

Guidewire Deepens Relationship With Shift Technology, Naming Shift Its Strategic Partner To Help Mitigate Insurance Fraud San Mateo, CA & Paris (BUSINESS WIRE) - Guidewire (NYSE: GWRE) announced Shift Technology as its strategic partner for insurance-based decisioning solutions. Shift’s products enable artificial intelligence (AI) powered fraud detection and investigation, underwriting risk detection, and subrogation detection. The expanded partnership will deliver a joint solution that will enable the rapid integration of Shift’s fraud detection technology with Guidewire’s solutions, improving efficiency and claims handler productivity. A PartnerConnect Technology Premier partner and leader in AI-driven decisioning for the insurance industry, Shift delivers solutions to insurers that help automate and optimize critical insurance decisions. Shift has been a pioneer of AI-powered fraud detection since its establishment in 2014 and was an early adopter of large language models and generative AI in 2020, making it a leading-edge fraud detection solution provider for insurers. “We are honored that Guidewire has expanded the scope of our successful partnership,” said Drew Whitmore, Global Head of Partnerships, Shift Technology. “In deepening our relationship, we can continue to meet the evolving needs of insurers around the world and improve the claims process through the integration of two of the P&C insurance industry’s leading solutions.” Named a ‘Luminary’ by Celent for Insurance Fraud-Detection Solutions in 2024, with the trust of over 115 insurance customers across 25 countries and a 100% focus on the insurance industry, Shift has a proven track record of delivering a positive impact for P&C insurers. Shift’s global presence, along with Guidewire's investment in Shift's Series D financing, supports ongoing technological innovation and accelerates go-to-market efforts, enabling continued growth. “Shift offers a robust suite of fraud-detection solutions across key insurance functions and important data science and AI expertise,” said Will Murphy, Vice President, Global Technology Alliances, Guidewire. “Over the past five years of collaboration between Guidewire and Shift, Shift was among the first to develop a cloud-based integration and has been an influential resource as we develop the fraud module for Guidewire Autopilot Workflow Service. We are pleased to enhance our partnership by offering an easily deployed Shift integration for our cloud customers.” Shift is a Guidewire Connections 2024 Silver level sponsor. For more information on its technology, Guidewire integrations, and the Guidewire/Shift partnership, please visit Shift’s booth PD S3 at Connections or the Guidewire Marketplace . About Shift Technology Shift Technology delivers AI-powered decisioning solutions to benefit the global insurance industry and its customers. Our products enable the world’s leading insurers to improve combined ratios by optimizing and automating critical decisions across the policy lifecycle. Shift solutions help mitigate fraud and risk, increase operational efficiency, and deliver superior customer experiences. Learn more at www.shift-technology.com . About Guidewire PartnerConnect ecosystem and Ready for Guidewire Guidewire’s technology ecosystem is the largest in the P&C industry, with over 210 technology partners providing over 250 integrations in the Guidewire Marketplace. Guidewire PartnerConnect Technology partners provide software, technology, and data solutions as well as insurance support services. Our Technology partners help drive business value and innovation for insurers by developing and delivering integrations, extensions, apps, and other complementary solutions for Guidewire products. All of our Ready for Guidewire partner solutions are validated for security, quality, and compatibility with Guidewire, and can be found on the Guidewire Marketplace . For more information about Guidewire PartnerConnect, please visit http://www.guidewire.com/partners . About Guidewire Software Guidewire is the platform P&C insurers trust to engage, innovate, and grow efficiently. More than 570 insurers in 42 countries, from new ventures to the largest and most complex in the world, rely on Guidewire products. With core systems leveraging data and analytics, digital, and artificial intelligence, Guidewire defines cloud platform excellence for P&C insurers. We are proud of our unparalleled implementation track record, with 1,700+ successful projects supported by the industry’s largest R&D team and SI partner ecosystem. Our marketplace represents the largest solution partner community in P&C, where customers can access hundreds of applications to accelerate integration, localization, and innovation. For more information, please visit www.guidewire.com and follow us on X (formerly known as Twitter) and LinkedIn . NOTE: For information about Guidewire’s trademarks, visit https://www.guidewire.com/legal-notices . © 2024 Business Wire Got it!

Shift Technology Frequently Asked Questions (FAQ)

When was Shift Technology founded?

Shift Technology was founded in 2014.

Where is Shift Technology's headquarters?

Shift Technology's headquarters is located at 2-14 rue Gerty Archimede, Paris.

What is Shift Technology's latest funding round?

Shift Technology's latest funding round is Series D - II.

How much did Shift Technology raise?

Shift Technology raised a total of $319.72M.

Who are the investors of Shift Technology?

Investors of Shift Technology include Guidewire, Iris Capital, Accel, General Catalyst, Bessemer Venture Partners and 10 more.

Who are Shift Technology's competitors?

Competitors of Shift Technology include Qantev, Gradient AI, Sprout.ai, Curacel, Charlee.ai and 7 more.

What products does Shift Technology offer?

Shift Technology's products include Shift Claims Fraud Detection and 4 more.

Who are Shift Technology's customers?

Customers of Shift Technology include Markerstudy Insurance Services Limited , Insurance Fraud Bureau, Economical and First Central.

Loading...

Compare Shift Technology to Competitors

FRISS focuses on risk assessment automation for property and casualty (P&C) insurance carriers. The company offers a platform that provides real-time analytics to understand and evaluate the inherent risks in customer interactions, aiming to enhance trust and efficiency in insurance processes. FRISS's solutions enable insurers to automate underwriting, accelerate claims processing, and conduct structured investigations into suspicious activities. It was founded in 2006 and is based in Mason, Ohio.

Carpe Data provides predictive data analytics and artificial intelligence solutions for the insurance industry. The company offers services for fraud detection, claims processing, and small commercial underwriting using data science techniques and AI. Carpe Data serves the insurance sector with products aimed at improving the efficiency and accuracy of claims and underwriting operations. It was founded in 2016 and is based in Santa Barbara, California.

Qantev specializes in AI-driven claims management for the health and life insurance sectors. Its main offerings include an automated claims platform that streamlines processing, detects fraud, waste, and abuse, and optimizes healthcare provider networks. It was founded in 2018 and is based in Paris, France.

Charlee.ai specializes in artificial intelligence and predictive analytics within the insurance sector. The company offers solutions that analyze claims and predict litigation and severity, utilizing natural language processing to enhance claims workflows and manage reserves effectively. Charlee.ai's predictive analytics solutions are tailored to the insurance industry, including personal, commercial, and workers' compensation sectors. Charlee.ai was formerly known as Infinilytics. It was founded in 2016 and is based in Pleasanton, California.

omni:us specializes in artificial intelligence-powered end-to-end insurance claim automation within the insurance sector. The company offers a digital claims adjuster that integrates with existing insurance core systems and legacy applications, providing automated claims processing for property and casualty lines of business. omni:us primarily serve the insurance industry, offering solutions that aim at process costs and customer satisfaction through claims handling. omni:us was formerly known as SearchInk. It was founded in 2015 and is based in Berlin, Germany.

CLARA Analytics provides insurance services. It develops artificial intelligence (AI) technology for insurance claims optimization in front of their workers’ compensation claims. It helps predictive insights from the claims data to provide key signals to the claims team for claim outcomes. It was founded in 2017 and is based in Sunnyvale, California.

Loading...