SEON Technologies

Founded Year

2017Stage

Incubator/Accelerator - II | AliveTotal Raised

$106.62MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-35 points in the past 30 days

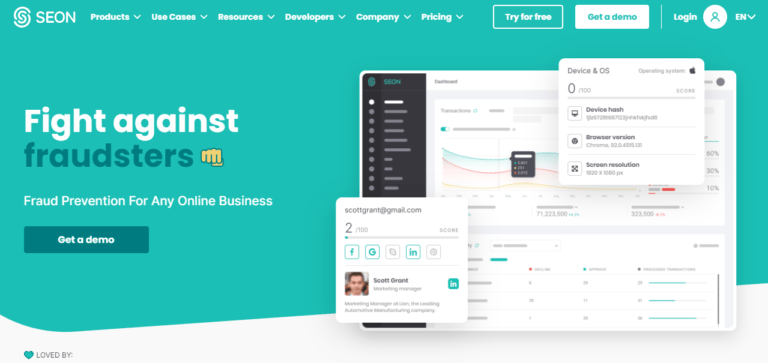

About SEON Technologies

SEON Technologies specializes in fraud prevention and risk management within various business sectors. The company offers a suite of tools designed to help businesses detect and prevent fraudulent activities, leveraging technologies such as machine learning, device fingerprinting, and real-time data analysis. It primarily serves sectors such as banking, insurance, eCommerce, online lending, and the gambling industry. It was founded in 2017 and is based in Budapest, Hungary.

Loading...

SEON Technologies's Product Videos

_thumbnail.png?w=3840)

ESPs containing SEON Technologies

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The anti-money laundering (AML) software market helps detect, prevent, and mitigate the risks associated with money laundering and financial crimes. Solutions in this market analyze large volumes of data and identify suspicious activity for further investigation. This allows financial institutions and other regulated entities to monitor transactions, screen customers and counterparties, and conduc…

SEON Technologies named as Challenger among 15 other companies, including NICE, Onfido, and TrueLayer.

SEON Technologies's Products & Differentiators

Intelligence Tool

Immediate enrichment of the most basic data points that a merchant will collect in their customer’s digital interaction - a user’s email, IP (internet protocol) and phone number. Real-time checks of their digital footprint via the most popular 35+ social media sites, online platforms & messengers to help verify their identity with in-depth metadata including data breaches, type of domain, risky ports, geolocation mismatches and more to support.

Loading...

Research containing SEON Technologies

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned SEON Technologies in 6 CB Insights research briefs, most recently on Mar 14, 2024.

Mar 14, 2024

The retail banking fraud & compliance market map

Aug 14, 2023

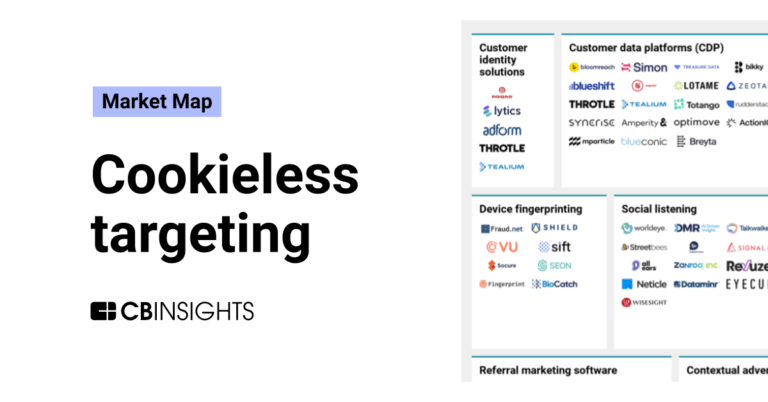

The cookieless targeting market map

Feb 27, 2023 report

Top fraud prevention companies — and why customers chose themExpert Collections containing SEON Technologies

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

SEON Technologies is included in 5 Expert Collections, including Regtech.

Regtech

1,721 items

Technology that addresses regulatory challenges and facilitates the delivery of compliance requirements. Regulatory technology helps companies and regulators address challenges ranging from compliance (e.g. AML/KYC) automation and improved risk management.

Digital Lending

2,437 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Artificial Intelligence

9,386 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Cybersecurity

9,920 items

These companies protect organizations from digital threats.

Fintech

13,559 items

Excludes US-based companies

SEON Technologies Patents

SEON Technologies has filed 1 patent.

The 3 most popular patent topics include:

- chemical bonding

- copolymers

- polymer chemistry

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/27/2020 | 11/12/2024 | Polymers, Copolymers, Thermoplastics, Polymer chemistry, Chemical bonding | Grant |

Application Date | 3/27/2020 |

|---|---|

Grant Date | 11/12/2024 |

Title | |

Related Topics | Polymers, Copolymers, Thermoplastics, Polymer chemistry, Chemical bonding |

Status | Grant |

Latest SEON Technologies News

Nov 15, 2024

News provided by Share this article Share toX NEW YORK, Nov. 15, 2024 /PRNewswire/ -- Report with the AI impact on market trends - The global fraud detection and prevention market size is estimated to grow by USD 86.68 billion from 2024-2028, according to Technavio. The market is estimated to grow at a CAGR of 27.17% during the forecast period. Increase in adoption of cloud-based services is driving market growth, with a trend towards technological advancement in fraud detection and prevention solutions and services. However, complex it infrastructure poses a challenge.Key market players include ACI Worldwide Inc., BAE Systems Plc, Besedo Ltd., Consultadoria e Inovacao Tecnologica S.A., Dell Technologies Inc., Equifax Inc., Experian Plc, Fair Isaac Corp., Fiserv Inc., Forter Ltd., Global Payments Inc., International Business Machines Corp., NICE Ltd., Oracle Corp., RELX Plc, SAP SE, SAS Institute Inc., SEON Technologies Kft., Software AG, and Visa Inc.. Technavio has announced its latest market research report titled Global fraud detection and prevention market 2024-2028 AI-Powered Market Evolution Insights. Our comprehensive market report ready with the latest trends, growth opportunities, and strategic analysis- View Free Sample Report PDF Forecast period Key companies profiled ACI Worldwide Inc., BAE Systems Plc, Besedo Ltd., Consultadoria e Inovacao Tecnologica S.A., Dell Technologies Inc., Equifax Inc., Experian Plc, Fair Isaac Corp., Fiserv Inc., Forter Ltd., Global Payments Inc., International Business Machines Corp., NICE Ltd., Oracle Corp., RELX Plc, SAP SE, SAS Institute Inc., SEON Technologies Kft., Software AG, and Visa Inc. Key Market Trends Fueling Growth Nuclear medicine using radiopharmaceuticals offers significant diagnostic and therapeutic benefits with minimal long-term side effects. Occasional injection-site reactions are the primary health hazards. In the fraud detection and prevention market, various sectors including finance, insurance, and healthcare face risks from security breaches, ad fraud, ATM fraud, and insider fraud. Advanced technologies like ML, pattern recognition, and biometrics aid in fraud prevention. Regulatory pressures and technological advancements drive market growth. Despite this, a lack of professionals in fraud analytics poses a challenge. Insights on how AI is driving innovation, efficiency, and market growth- Request Sample! Market Challenges • The US FDA and American College of Radiology rigorously evaluate new radiopharmaceuticals through comparisons with standard molecules, ensuring safety and efficacy before approval. Extensive toxicology testing and potential clinical trials increase costs, resulting in few nuclear medicines being authorized. In contrast, the fraud detection and prevention market employs advanced technologies like artificial intelligence, machine learning, and real-time fraud detection to combat financial, identity, and cybercrimes in industries such as banking, IoT devices, and online platforms. Insights into how AI is reshaping industries and driving growth- Download a Sample Report Segment Overview 3.5 Middle East and Africa 1.1 Solutions- The global Fraud Detection and Prevention Market is experiencing significant growth due to increasing threats to IT security, particularly in sectors like insurance claims, money laundering, electronic payments, travel and transportation, energy and utilities, media and entertainment. Component Insights reveal that Authentication solutions dominate, with Cloud and on-premise solutions offering flexibility. Service Insights show Professional services and Managed services in high demand. Application Insights highlight Payment fraud applications as major revenue losses due to chargebacks. Digital technologies, including Risk-based authentication solutions, Advanced technologies like Batch analytics, Streaming analytics, Predictive analytics, Real-time fraud detection, are essential. Economic uncertainty, pandemic, and cybercrimes such as phishing scams, identity theft, financial fraud, require proactive measures. SMEs and individuals are increasingly targeted. Digital transformation brings new challenges, including fake websites, scams on online platforms, banking applications, websites, and IoT devices. Privacy concerns add complexity. AI and Machine Learning are crucial tools for prevention. Businesses and individuals must stay informed and vigilant. Download complimentary Sample Report to gain insights into AI's impact on market dynamics, emerging trends, and future opportunities- including forecast (2024-2028) and historic data (2018 - 2022) Research Analysis In the dynamic business landscape, the Fraud Detection and Prevention Market plays a pivotal role for BFSI, healthcare, manufacturing, end-use enterprises, governments, and various other sectors. Leveraging advanced technologies such as cloud-based solutions, Big Data, blockchain technology, and authentication solutions, this market offers fraud analytics to mitigate risks from payment fraud applications, real-time fraud detection, and phishing scams. SMEs and large enterprises alike benefit from this market's offerings, which include professional services, managed services, and IT and telecom solutions. Additionally, sectors like travel and transportation, energy and utilities, media and entertainment, and even governments, can prevent identity theft and money laundering through these innovative fraud prevention solutions. Market Research Overview The Fraud Detection and Prevention Market is a significant and growing industry, driven by the increasing need to safeguard against financial losses and maintain security in various sectors. This market encompasses solutions and services that utilize advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Big Data Analytics to identify and mitigate fraudulent activities. These technologies enable the detection of patterns and anomalies in large datasets, allowing for swift and effective intervention. The market caters to diverse industries, including banking and finance, healthcare, insurance, and e-commerce, among others. The global Fraud Detection and Prevention Market is projected to expand at a CAGR during the forecast period, fueled by the rising adoption of digital transactions and the continuous evolution of fraudster tactics. Table of Contents: About Technavio Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio's report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio's comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios. Contacts

SEON Technologies Frequently Asked Questions (FAQ)

When was SEON Technologies founded?

SEON Technologies was founded in 2017.

Where is SEON Technologies's headquarters?

SEON Technologies's headquarters is located at Rákóczi út 42. 7. em, Budapest.

What is SEON Technologies's latest funding round?

SEON Technologies's latest funding round is Incubator/Accelerator - II.

How much did SEON Technologies raise?

SEON Technologies raised a total of $106.62M.

Who are the investors of SEON Technologies?

Investors of SEON Technologies include AWS ISV Accelerate Program, PortfoLion, Creandum, Plug and Play Ventures, Institutional Venture Partners and 17 more.

Who are SEON Technologies's competitors?

Competitors of SEON Technologies include iDenfy, Featurespace, Jeff App, Fraud.net, FUGU and 7 more.

What products does SEON Technologies offer?

SEON Technologies's products include Intelligence Tool and 1 more.

Who are SEON Technologies's customers?

Customers of SEON Technologies include FairMoney, Air France, Xcoins, Patreon and Albo.

Loading...

Compare SEON Technologies to Competitors

Signifyd provides e-commerce fraud protection and prevention services. The company offers services, including revenue protection, abuse prevention, and payment compliance, all aimed at maximizing conversion and eliminating fraud and consumer abuse. Its services primarily cater to the e-commerce industry. Signifyd was founded in 2011 and is based in San Jose, California.

Resistant AI works in fraud prevention and detection within the financial technology sector. The company provides services for detecting document fraud, automating document workflows, and improving transaction monitoring systems with artificial intelligence. It serves the fintech and financial services industry, focusing on risk and compliance teams within these sectors. Resistant AI was formerly known as Bulletproof AI. The company was founded in 2019 and is based in Prague, Czech Republic.

DataVisor focuses on fraud and risk management within the financial technology sector. It offers an AI-powered SaaS platform that provides enterprise-level fraud prevention and AML compliance solutions. The company primarily serves financial institutions and large organizations, offering a suite of tools to combat various types of fraud and financial crimes. It was founded in 2013 and is based in Mountain View, California.

Shield is a device-first risk AI platform that specializes in fraud prevention and risk intelligence within the digital business sector. The company offers solutions to identify and eliminate fraudulent activities through global standard device identification and actionable risk intelligence. Shield primarily serves industries such as ride-hailing, social media, e-commerce, digital banking, and gaming. Shield was formerly known as CashShield. It was founded in 2008 and is based in Singapore.

Accertify focuses on digital identity and financial fraud risk management, operating within the financial technology sector. The company offers services such as digital identity verification, fraud prevention, chargeback management, and payment gateway solutions. Its primary customer base includes organizations seeking to protect their digital identities and mitigate financial fraud risks. It was founded in 2007 and is based in Schaumburg, Illinois.

Qlarant focuses on quality improvement, fraud detection, and data science within the healthcare, human services, government, and insurance & financial services sectors. The company offers services such as quality improvement programs, fraud, waste, abuse prevention, advanced data analytics, and predictive modeling to identify and resolve risks. Qlarant also supports underserved communities through grant awards from its foundation. It was founded in 1973 and is based in Easton, Maryland.

Loading...