Ro

Founded Year

2017Stage

Series D - II | AliveTotal Raised

$1.027BValuation

$0000Last Raised

$150M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-38 points in the past 30 days

About Ro

Ro is a healthcare company that provides telehealth services and healthcare products across various sectors. The company offers online consultations and treatments for weight loss, sexual health, hair loss, fertility, and skin care, using Food and Drug Administration (FDA) approved medications. Ro serves individuals seeking healthcare solutions without the need for insurance. Ro was formerly known as Roman. It was founded in 2017 and is based in New York, New York.

Loading...

Ro's Products & Differentiators

Roman / Rory / Plenity / Zero

Ro first started with three digital health clinics to offer patients end-to-end telehealth treatment for over 20 conditions. Roman which offers treatments for men’s health conditions from sexual health, to hair loss to daily vitamin supplements. Rory, a clinic for women offering treatments for conditions from skincare to menopause to sexual wellness. And Zero, a clinic to help patients quit smoking. Ro also offers Plenity, an offering that provides patients with safe and effective options to manage their weight and tackle obesity.

Loading...

Research containing Ro

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Ro in 6 CB Insights research briefs, most recently on Mar 28, 2024.

Mar 28, 2024

The femtech market map

Jan 3, 2024

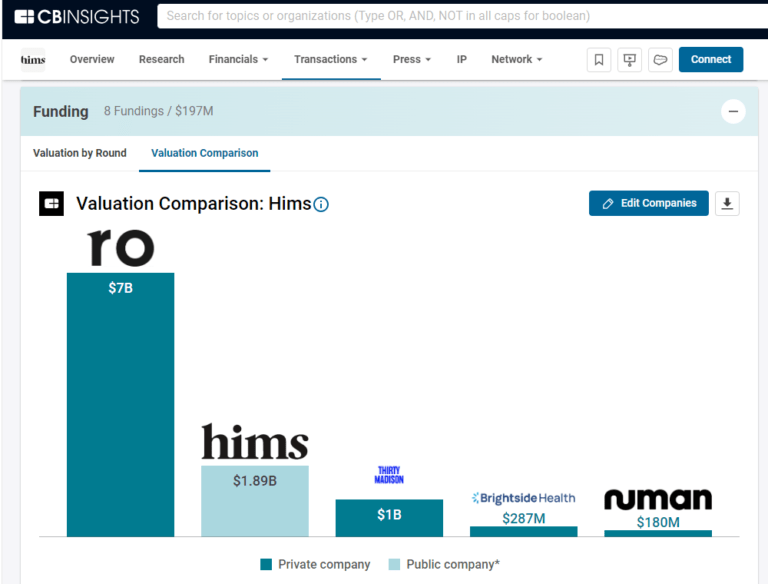

2024 prediction: Hims merges with Ro

Nov 11, 2022 report

How tech is making women’s healthcare more equitable and accessible

Aug 22, 2022 report

State of Biopharma Tech Q2’22 ReportExpert Collections containing Ro

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Ro is included in 7 Expert Collections, including E-Commerce.

E-Commerce

11,146 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,261 items

Digital Health 50

300 items

The most promising digital health startups transforming the healthcare industry

Tech IPO Pipeline

539 items

Track and capture company information and workflow.

Digital Health

11,295 items

The digital health collection includes vendors developing software, platforms, sensor & robotic hardware, health data infrastructure, and tech-enabled services in healthcare. The list excludes pureplay pharma/biopharma, sequencing instruments, gene editing, and assistive tech.

Telehealth

3,114 items

Companies developing, offering, or using electronic and telecommunication technologies to facilitate the delivery of health & wellness services from a distance. *Columns updated as regularly as possible; priority given to companies with the most and/or most recent funding.

Ro Patents

Ro has filed 11 patents.

The 3 most popular patent topics include:

- eyewear

- eyewear brands

- conservation and restoration

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

5/20/2024 | 11/12/2024 | Eyewear brands, Eyewear, Petroleum geology, Corrective lenses, Seismology measurement | Grant |

Application Date | 5/20/2024 |

|---|---|

Grant Date | 11/12/2024 |

Title | |

Related Topics | Eyewear brands, Eyewear, Petroleum geology, Corrective lenses, Seismology measurement |

Status | Grant |

Latest Ro News

Jan 31, 2025

One of his sponsors took advantage of the moment: the telehealth company Ro, which sells a variety of prescription medicines for erectile dysfunction and hair and weight loss. The company revved up a social media campaign on the social platform X for an ad in which Sharpe boasted about his experience with the company’s erectile dysfunction medications, a company spokesperson confirmed. The ads were more than just a passing attempt to hitch a corporate caboose to a runaway social media locomotive. A group of direct-to-consumer telehealth companies have become omnipresent across just about all media formats, seeking patients interested in their low-stigma, low-fuss, low-touch, high-convenience health products. They’re on your favorite podcasts and in the background on the cable TV in your gym. Thirteen telehealth entities spent a combined $111 million in 2023 on television ads, more than double the sum in 2019, according to an analysis from iSpot.tv , a television ad-tracking company, provided to KFF Health News. The ads feature high-wattage celebrities such as Jennifer Lopez as well as lesser-known influencers who are paid four figures to post a snapshot or short video to Instagram, according to interviews with marketers. Three publicly traded telehealth companies spent a total of more than $1.4 billion on advertising, sales, and marketing in 2023, according to financial reports filed with the Securities and Exchange Commission, categories that reflect the extent of their online efforts. The companies’ advertising typically emphasizes convenience in a health care system that’s often just the opposite. They promise judgment-free birth control or care for conditions like erectile dysfunction and hair loss that have traditionally been stigmatized. As the companies expand, they’re venturing into more complex kinds of medicine, such as care for mental health conditions and obesity. Services that telehealth companies offer, critics warn, may shortchange patients in need of close, sensitive attention. Researchers differ on telehealth services’ quality, with some saying telehealth companies offer little follow-up and inconsistent care from a revolving cast of doctors. Still, they agree the care is fundamentally different from the traditional style. A company’s model can “kind of flip what you’re taught at medical school on its head,” said Ateev Mehrotra, a Brown University professor of public health who studies telehealth. Typically, he said, a patient goes to the doctor with a complaint; there, the parties figure out a diagnosis and, if appropriate, a medication. By contrast, he said, telehealth companies’ advertising invites patients to make their own diagnoses, while pairing them with clinicians who, if they confirm their conditions, prescribe medicines the patients already think they want. Under this style of medicine, the clinician is “now a screener, and you just want to make sure that that medication is safe for that patient,” Mehrotra said. The model may work for certain kinds of care, Mehrotra said, such as birth control. He and some colleagues conducted a study in which they recruited patients with standardized backstories to patronize startups offering contraceptive medicines over the internet. Generally, the study found, the services performed well. Harley Diamond, a patient at Nurx, a startup offering birth control prescriptions and other services, offers an example of how these companies can work well in some circumstances. After she saw an Instagram ad, she signed up to get birth control. She lives in Tennessee, a red state where it can be difficult to access contraception: Local clinics have closed and an arsonist burned down a Planned Parenthood. (The facility recently reopened .) But when she turned to Nurx for her mental health, she found the service confounding and its convenience lacking. The company’s app sends her frequent questionnaires about symptoms and reactions to drugs, she said. “There is no comforting face to validate you,” she wrote in an email to KFF Health News. The questions were the same each time, and she said she spoke with a new doctor in every interaction. “It can feel like you’re having to start from scratch explaining yourself to someone new every month,” she said. When she expressed concerns — for example, about side effects of an antidepressant she was taking — it would take “days, generally,” to hear back, with no change in her protocol, she said. Often, she said, her messages would get no response at all. Rajani Rao, senior vice president at Nurx, said the company is “constantly working” to improve response times, “especially as we experience a high volume of patient care requests.” In mental health, the majority of Nurx’s patients experience elimination of symptoms after six months of treatment, she said. Rao also referred to Nurx as providing an “integrated care team,” using language echoed across the industry. Ro, for example, says its care is available in the time and format of its patient’s preference and that it audits the quality of its services. Continuous care is crucial to make sure mental health patients are on the right doses of medications and that they’re not experiencing side effects, said Reshma Ramachandran, an assistant professor of medicine at Yale who has conducted her own secret-shopper study of telehealth sites. What’s more, research shows many mental health medications are best paired with therapy, Ramachandran said. Ramachandran thinks frustrations like Diamond’s might be widespread, based on her team’s research. She said she’s frustrated at the “very groovy, glossy” picture painted by telehealth ads. Ramachandran said her study is still under consideration for publication in medical journals. But she provided preliminary results to congressional offices examining the telehealth sector. Last year, Sen. Dick Durbin, an Illinois Democrat, and former Sen. Mike Braun, an Indiana Republican, introduced legislation to regulate some telehealth advertising practices. A spokesperson for Durbin said he intends to reintroduce the bill this year.

Ro Frequently Asked Questions (FAQ)

When was Ro founded?

Ro was founded in 2017.

Where is Ro's headquarters?

Ro's headquarters is located at 625 6th Avenue, New York.

What is Ro's latest funding round?

Ro's latest funding round is Series D - II.

How much did Ro raise?

Ro raised a total of $1.027B.

Who are the investors of Ro?

Investors of Ro include General Catalyst, Initialized Capital, FirstMark Capital, BoxGroup, TQ Ventures and 28 more.

Who are Ro's competitors?

Competitors of Ro include Blink Health, Hone Health, Piction Health, Simple Health, Redesign Health and 7 more.

What products does Ro offer?

Ro's products include Roman / Rory / Plenity / Zero and 4 more.

Loading...

Compare Ro to Competitors

Maven serves as a virtual clinic that specializes in women's and family health within the healthcare sector. The clinic offers continuous, holistic care services, including fertility and family building, maternity, parenting, pediatrics, and menopause management. Maven primarily serves employers and health plans, aiming to improve health outcomes and reduce healthcare costs. It was founded in 2014 and is based in New York, New York.

Thirty Madison focuses on providing virtual-first specialized healthcare services. The company offers accessible and effective treatments for people with ongoing conditions, emphasizing a lifetime of care without the need for in-person visits. It was founded in 2017 and is based in New York, New York.

HealthTap is a digital health company. It offers a mobile application that connects doctors with patients, giving patients access to medical experts and health advice anytime and anywhere. It was founded in 2010 and is based in Sunnyvale, California.

DoctorBox is a digital health platform operating in the healthcare industry. The company offers an application that centralizes all important health data, providing various digital services for diagnostics, pharmaceuticals, and therapy. It primarily serves individuals seeking to manage their daily health. It was founded in 2016 and is based in Berlin, Germany.

98point6 Technologies specializes in digital health solutions and focuses on telehealth and healthcare technology. The company offers a virtual care platform that provides asynchronous and real-time telehealth services, designed to streamline administrative tasks for clinicians and enhance patient-provider interactions. Their platform serves the healthcare industry by increasing provider efficiency and patient satisfaction through technology that supports various care modalities. 98point6 Technologies was formerly known as 98point6. It was founded in 2017 and is based in Seattle, Washington. 98point6 Technologies operates as a subsidiary of Transcarent.

Rezilient provides healthcare services. It combines telehealth services with in-person care capabilities. The company offers primary and urgent care services, accessible through both virtual and physical examinations, including labs and imaging. It provides individuals and families with convenient healthcare solutions. Rezilient was formerly known as DynamicSurgical. It was founded in 2016 and is based in Saint Louis, Missouri.

Loading...