Revolut

Founded Year

2015Stage

Secondary Market | AliveTotal Raised

$1.716BValuation

$0000Revenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-39 points in the past 30 days

About Revolut

Revolut is a financial technology company focused on providing digital banking services. The company offers a range of products including personal finance management tools, multicurrency accounts, cryptocurrency and stock trading, insurance products, and financial analytics. Revolut primarily serves individuals seeking enhanced control and flexibility over their finances. It was founded in 2015 and is based in London, United Kingdom.

Loading...

ESPs containing Revolut

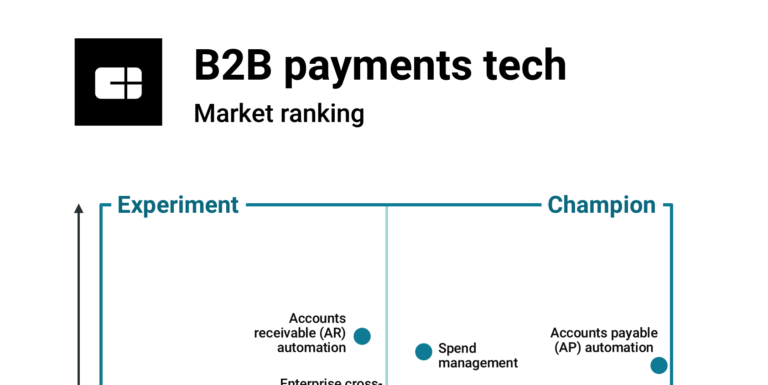

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

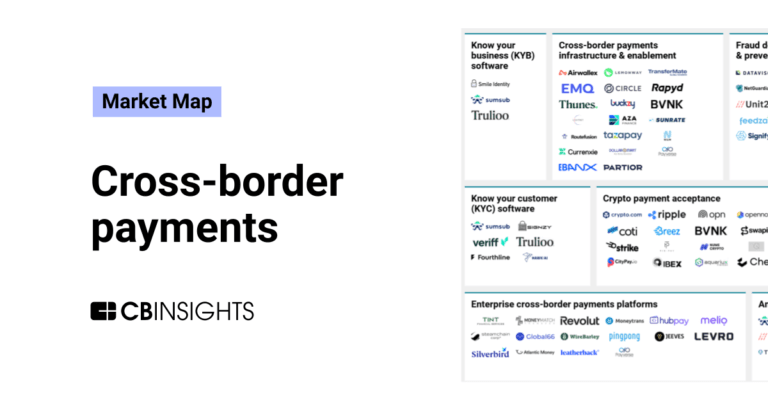

The enterprise cross-border payments platforms market enables businesses to send and collect payments globally. Companies in this market offer currency exchange solutions that help users monitor exchange rates and hedge currency risk. Some companies also provide specialized solutions for different industries. In addition to enterprise solutions, many providers in this market also offer consumer-sp…

Revolut named as Leader among 15 other companies, including Payoneer, Wise, and OFX Group.

Loading...

Research containing Revolut

Get data-driven expert analysis from the CB Insights Intelligence Unit.

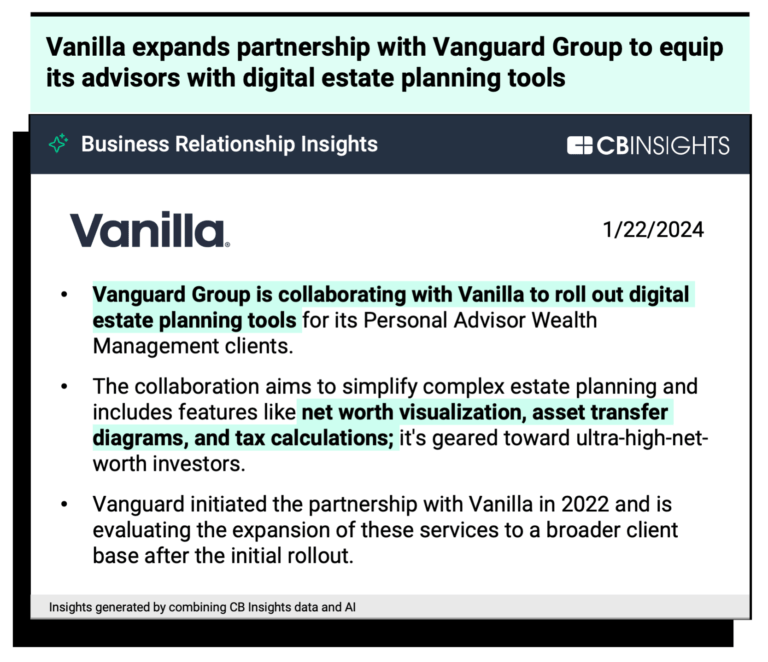

CB Insights Intelligence Analysts have mentioned Revolut in 10 CB Insights research briefs, most recently on Oct 9, 2024.

Aug 30, 2024

The financial planning market map

Dec 14, 2023

Cross-border payments market map

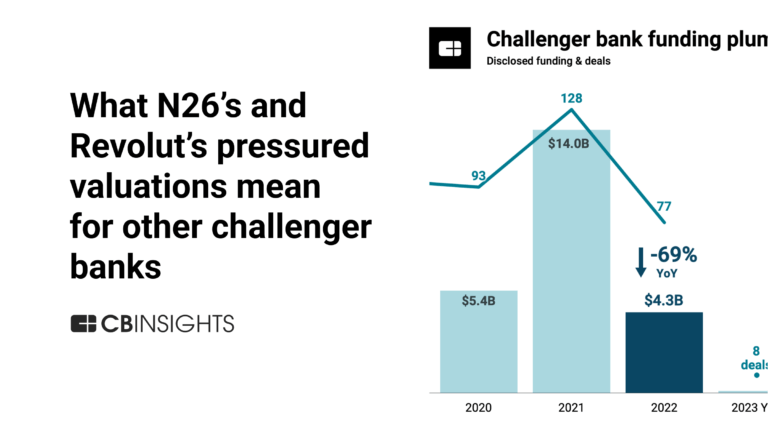

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Revolut

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

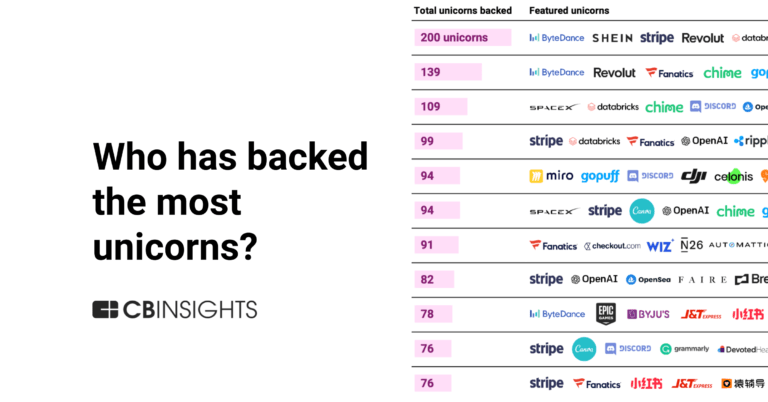

Revolut is included in 7 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Digital Banking

1,059 items

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Tech IPO Pipeline

257 items

The tech companies we think could hit the public markets next, according to CB Insights data.

Revolut Patents

Revolut has filed 1 patent.

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

11/21/2014 | Payment systems, Payment service providers, Credit cards, Online payments, Debit cards | Application |

Application Date | 11/21/2014 |

|---|---|

Grant Date | |

Title | |

Related Topics | Payment systems, Payment service providers, Credit cards, Online payments, Debit cards |

Status | Application |

Latest Revolut News

Jan 22, 2025

Revolut Launches Robo-Advisor in Singapore The robo-advisor requires a minimum investment of US$ 100 and charges an annual portfolio management fee of 0.75%. Get the hottest Fintech Singapore News once a month in your Inbox Revolut, a global neobank with over 50 million users, has introduced a robo-advisor service in Singapore. This new feature automates investing for Revolut customers by creating and managing a diversified portfolio customised to their individual needs, financial goals, and risk tolerance. The robo-advisor requires a minimum investment of US$ 100 and charges an annual portfolio management fee of 0.75%. Users who purchase a robo-advisor portfolio before 31 March 2025, will not be charged management fees until 30 April 2025. Revolut’s robo-advisor reportedly automatically rebalances portfolios based on market performance and conducts periodic reviews to ensure alignment with customer risk tolerance and target allocations. Customers can set up recurring transfers from US$ 10 and utilise a “spare change round-up” feature that automatically invests the difference from rounded-up purchases made with their Revolut debit card. This feature allows users to seamlessly integrate investing into their daily spending habits. This launch follows Revolut’s introduction of Flexible Accounts in Singapore last year, which offer customers another way to invest and manage their finances. Flexible Accounts allow customers to earn interest on their deposits, which are invested in USD-denominated Money Market Funds managed by Fidelity International. Raymond Ng Raymond Ng, Chief Executive Officer, Revolut Singapore said, “We are excited to add a robo-advisor to our existing suite of wealth and trading products. We know that many of our customers do not have the time to manage a portfolio or invest in individual securities. Built to make investing more accessible, we want to give our customers the ability to make their money work for them in what we believe will be a tailored and stress-free solution. We’re now actively working to broaden the range of investment opportunities available through our robo-advisor, and to integrate even more financial planning tools.” Featured image credit: Edited from Freepik

Revolut Frequently Asked Questions (FAQ)

When was Revolut founded?

Revolut was founded in 2015.

Where is Revolut's headquarters?

Revolut's headquarters is located at 7 Westferry Circus, London.

What is Revolut's latest funding round?

Revolut's latest funding round is Secondary Market.

How much did Revolut raise?

Revolut raised a total of $1.716B.

Who are the investors of Revolut?

Investors of Revolut include Tiger Global Management, D1 Capital Partners, Mubadala, Coatue, Schroders and 36 more.

Who are Revolut's competitors?

Competitors of Revolut include CloudWalk, Atlantic Money, Allica Bank, Qonto, Nium and 7 more.

Loading...

Compare Revolut to Competitors

Monzo operates as a digital banking platform that focuses on personal finance management. The company offers personal and joint accounts, allowing users to track income, manage spending, and save money through an integrated mobile app. Monzo primarily serves individuals looking for an easy-to-use banking solution. Monzo was formerly known as Mondo. It was founded in 2015 and is based in London, United Kingdom.

Starling Bank is a digital bank that focuses on providing a range of banking services within the financial sector. The company offers personal and business banking solutions, including current accounts, overdrafts, loans, and money transfer services, all accessible through an intuitive mobile app. Starling Bank primarily serves individuals and businesses looking for modern, mobile-first banking experiences. It was founded in 2014 and is based in London, United Kingdom.

N26 is a digital bank that offers mobile banking services in the financial sector. The company provides a platform for personal finance management, enabling users to manage their money and conduct financial transactions. N26 primarily serves individual consumers. It was founded in 2013 and is based in Berlin, Germany.

Atom Bank is a financial institution that provides an online banking platform focusing on personal and business banking services. The company offers savings accounts, residential and commercial mortgages, and business loans. It primarily serves individuals looking for savings options and businesses seeking financing solutions. Atom Bank was founded in 2014 and is based in Durham, United Kingdom.

Moven provides digital banking experiences within the financial technology sector. The company offers digital banking solutions, including financial wellness tools, customer engagement analytics, and personalized insights for financial institutions. Moven primarily serves banks, credit unions, and fintech companies aiming at their digital offerings and customer engagement. It was founded in 2010 and is based in New York, New York.

Ant Group focuses on creating infrastructure and platforms for the service industry. Ant Group was formerly known as Zhejiang Ant Small and Micro Financial Services. It was founded in 2014 and is based in Hangzhou, China.

Loading...