Rapyd

Founded Year

2016Stage

Series E | AliveTotal Raised

$775MValuation

$0000Last Raised

$300M | 4 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+26 points in the past 30 days

About Rapyd

Rapyd is a fintech company. It specializes in global payment processing and financial technology solutions. The company offers a platform for businesses to accept payments online, send payouts, and manage multi-currency accounts, with a focus on simplifying financial transactions across borders. Rapyd's services cater to various sectors, including eCommerce, marketplaces, and the gig economy. Rapyd was formerly known as CashDash. It was founded in 2016 and is based in London, United Kingdom.

Loading...

Rapyd's Product Videos

ESPs containing Rapyd

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The cross-border payments infrastructure & enablement market allows businesses to send and accept global payments on their own websites and payment platforms. The companies in this market offer APIs that allow businesses to process payments across currencies and platforms (such as mobile), make payouts, verify user identities, issue credit cards, and more. Some companies also enable businesses to …

Rapyd named as Challenger among 15 other companies, including FIS, Nium, and Checkout.com.

Rapyd's Products & Differentiators

Rapyd Collect

A single integration that connects your business to hundreds of payment methods worldwide.

Loading...

Research containing Rapyd

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Rapyd in 13 CB Insights research briefs, most recently on May 8, 2024.

May 8, 2024

The embedded banking & payments market map

Dec 14, 2023

Cross-border payments market map

Jan 23, 2023 report

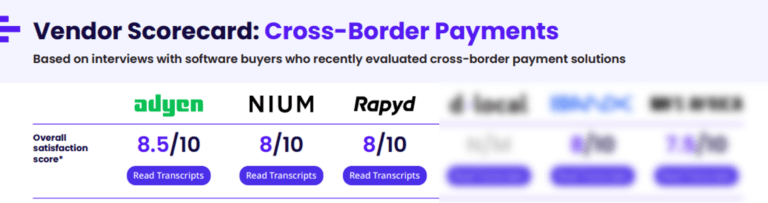

Top cross-border payments companies — and why customers chose themExpert Collections containing Rapyd

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Rapyd is included in 9 Expert Collections, including E-Commerce.

E-Commerce

11,359 items

Companies that sell goods online (B2C), or enable the selling of goods online via tech solutions (B2B).

Unicorns- Billion Dollar Startups

1,258 items

SMB Fintech

1,648 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Latest Rapyd News

Jan 11, 2025

Israelis may get new credit cards – media 23 This is due to the active promotion of the fintech company Rapyd. The company intends to enter the credit card market, challenging established leaders such as Isracard , MAX and CAL . According to Calcalist, to realize its ambitions, Rapyd has submitted an application to the Israel Securities Authority for an expanded acquiring license , which will allow it to issue its own credit cards. The company is optimistic, albeit with some caution. Rapyd’s success is supported by partnerships with large local businesses, which strengthens its position in the competition for a license. This initiative was made possible by regulatory changes: the responsibility for issuing acquiring licenses was recently transferred from the Bank of Israel to the Securities Authority. However, the Bank of Israel continues to supervise traditional financial companies. If the license is approved, Rapyd will be the first organization to receive such a license from the new regulator. The market breakthrough is a continuation of Rapyd’s aggressive expansion strategy. In 2022, the company acquired PayU GPO from Prosus for $610 million. This acquisition provides access to a broad payment solutions market in more than 30 countries across Europe, Africa, the Middle East and Latin America, excluding key regions such as India, Turkey and Southeast Asia. PayU GPO specializes in services for small and medium-sized businesses, especially in developing countries, which has strengthened Rapyd’s global expansion. Another major deal was the acquisition of Icelandic company Valitor in 2021 for $100 million. Later in 2022, Rapyd was valued at $15 billion, confirming its leadership in the fintech sector. The company currently has around 120 employees in its Icelandic division. Previously, “Cursor” reported which companies’ products will increase in price from January 1st. Share this:

Rapyd Frequently Asked Questions (FAQ)

When was Rapyd founded?

Rapyd was founded in 2016.

Where is Rapyd's headquarters?

Rapyd's headquarters is located at Parsonage Road, London.

What is Rapyd's latest funding round?

Rapyd's latest funding round is Series E.

How much did Rapyd raise?

Rapyd raised a total of $775M.

Who are the investors of Rapyd?

Investors of Rapyd include Target Global, General Catalyst, Tal Capital, Durable Capital Partners, Spark Capital and 20 more.

Who are Rapyd's competitors?

Competitors of Rapyd include Conduit, Colleen AI, Nium, Alviere, Tazapay and 7 more.

What products does Rapyd offer?

Rapyd's products include Rapyd Collect and 3 more.

Who are Rapyd's customers?

Customers of Rapyd include Uber, Google, Hotmart, Rappi and GoTrade (TR8 Securities).

Loading...

Compare Rapyd to Competitors

Stripe provides services for businesses to manage online and in-person payments. The company offers products including payment processing Application Programming Interfaces (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as e-commerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

Checkout.com allows companies to accept payments around the world through one application program interface. It facilitates an integrated payment processing platform allowing the processing of payments in real-time, sending payouts, issuing, processing, and managing card payments. It also offers fraud prevention and secure authentication. The company was formerly known as Opus Payments. It was founded in 2012 and is based in London, United Kingdom.

BlueSnap provides flexible payment solutions and delivers a customizable platform to global online businesses such as software publishers, web hosting companies, and online retailers. BlueSnap builds and manages online businesses for software publishers, web hosting companies, and online retailers. A business can choose the BlueSnap hosted application that spans the entire e-commerce lifecycle, or it can deploy the BlueSnap API, which allows retailers to integrate the technology with existing solutions. Using BlueSnap software, retailers can deliver newsletters to customers, coupons and promotions, real-time reporting, and live chat, amongst other features. It was formerly known as Plimus. It was founded in 2001 and is based in Waltham, Massachusetts.

Nium specializes in modern money movement within the financial technology sector. Its main offerings include a platform for cross-border payments, card issuance services, and banking-as-a-service solutions, designed to facilitate global financial transactions for businesses. Nium primarily serves financial institutions, travel companies, payroll providers, spend management platforms, and global marketplaces. Nium was formerly known as InstaReM. It was founded in 2014 and is based in Singapore.

EBANX specializes in cross-border payment solutions within the financial technology (fintech) industry, providing payment services for companies looking to operate in rising markets. The company offers a platform for processing online purchases, managing funds from pay-ins to payouts, and facilitating transactions in various currencies and payment methods, including alternative options. It serves e-commerce, gaming, and digital advertising sectors, helping businesses operate in Latin America, Africa, and India. It was founded in 2012 and is based in Curitiba, Brazil.

Payall operates as a cross-border payment processor for banks operating in the financial technology sector. The company offers automated compliance and risk management solutions to facilitate international transactions. Payall's technology provides a global platform with accounts and special-purpose payment processing for global payments, along with payout options for recipients. It was founded in 2018 and is based in Miami Beach, Florida.

Loading...