Poolside

Founded Year

2023Stage

Series B | AliveTotal Raised

$626MValuation

$0000Last Raised

$500M | 5 mos agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+12 points in the past 30 days

About Poolside

Poolside is a technology company that focuses on the development of artificial intelligence (AI) for software development. The company's main service is creating an AI system that assists in software development. Poolside primarily serves the software development industry. It was founded in 2023 and is based in Paris, France.

Loading...

Loading...

Research containing Poolside

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Poolside in 3 CB Insights research briefs, most recently on Feb 4, 2025.

Feb 4, 2025 report

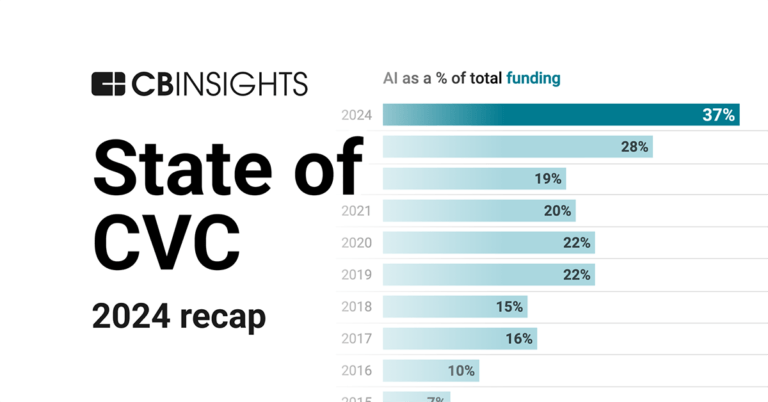

State of CVC 2024 Report

Dec 10, 2024 report

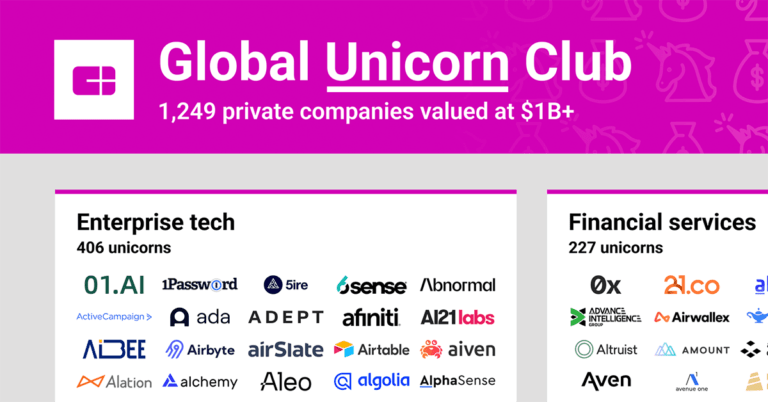

$1B+ Market Map: The world’s 1,249 unicorn companies in one infographic

Aug 7, 2024

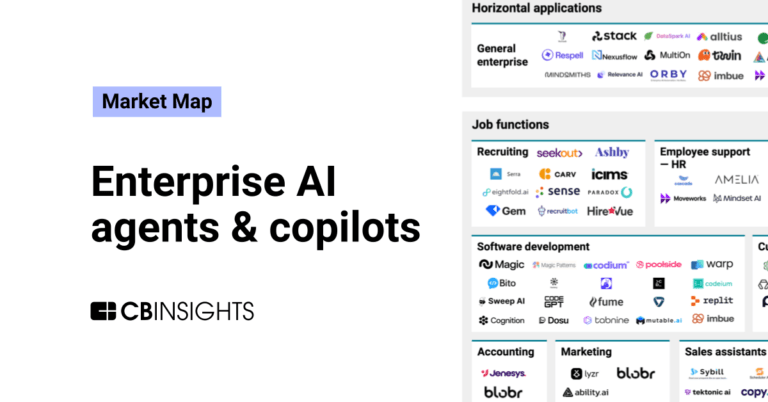

The enterprise AI agents & copilots market mapExpert Collections containing Poolside

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Poolside is included in 4 Expert Collections, including Artificial Intelligence.

Artificial Intelligence

9,504 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Unicorns- Billion Dollar Startups

1,261 items

Generative AI

1,298 items

Companies working on generative AI applications and infrastructure.

AI Agents & Copilots Market Map (August 2024)

322 items

Corresponds to the Enterprise AI Agents & Copilots Market Map: https://app.cbinsights.com/research/enterprise-ai-agents-copilots-market-map/

Poolside Patents

Poolside has filed 6 patents.

The 3 most popular patent topics include:

- fluid dynamics

- fluid mechanics

- computational fluid dynamics

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

3/23/2021 | 12/13/2022 | Fluid dynamics, Fluid mechanics, Hydrology, Aerodynamics, Trees (data structures) | Grant |

Application Date | 3/23/2021 |

|---|---|

Grant Date | 12/13/2022 |

Title | |

Related Topics | Fluid dynamics, Fluid mechanics, Hydrology, Aerodynamics, Trees (data structures) |

Status | Grant |

Latest Poolside News

Feb 20, 2025

Tech.eu Tech.eu Insights creates insight and guides strategies with its comprehensive content and reports. Browse popular Insights content. The French tech ecosystem: Innovation, investment, and expansion France’s tech ecosystem raised €10.8 billion in 2024 (14.5% of Europe’s total). Transportation led, followed by AI and fintech. France’s tech ecosystem continues to expand, with companies raising €10.8 billion in 2024, representing 14.5 per cent of the total funding secured across Europe. The transportation sector led the way, attracting €5 billion, largely driven by €4.4 billion in debt financing secured by Automotive Cells Company to develop three gigafactories for lithium-ion battery cell production. Following closely, artificial intelligence companies raised €1.3 billion, while fintech secured €831 million in funding. In recent years, France has secured its position as one of Europe’s most dynamic tech hubs, thanks to strong government support, financial incentives, and a thriving startup culture. The country is now home to a growing list of unicorns , including Poolside , Pigment , and Pennylane , which have reached their billion-dollar valuation in 2024. Sectors such as AI, fintech, health tech, and deeptech continue to drive innovation, backed by increasing venture capital interest and international expansion efforts. While challenges remain, France’s commitment to innovation, talent development, and infrastructure investment underscores its ambitions to become a global leader in technology. As the country refines its strategies and attracts more international investors, it is poised to shape the future of tech in Europe. Here are ten companies to watch in 2025. 1 Amount raised in 2024: €615M Mistral AI is a leading innovator in open-weight generative AI models, empowering developers with high-performance, customizable AI tools. Their models, including Mistral Large and Mixtral, are designed for seamless deployment across cloud platforms and on-premises environments. With a strong emphasis on openness, flexibility, and value, Mistral AI enables businesses to build unique AI-powered applications. Trusted by both startups and large enterprises, its models deliver cutting-edge, cost-efficient AI capabilities. In 2024, the company secured €615 million in funding across two rounds to further accelerate its growth and innovation. 2 Amount raised in 2024: €500M HR Path is a global leader in human resources consulting, offering expertise in HR strategy, HRIS implementation, payroll management, and talent management. Operating in over 22 countries, HR Path supports businesses of all sizes, from startups to multinational corporations. Renowned for its industry knowledge and innovative solutions, the company helps organizations streamline and enhance their HR processes. In 2024, HR Path secured a €500 million investment to drive growth and expand its market presence through strategic acquisitions. 3 Amount raised in 2024: $400M Poolside.ai specializes in developing advanced AI models tailored for software engineering. Its customizable AI solutions seamlessly integrate with codebases and business workflows, enabling the creation of proprietary models that enhance developer productivity over time. With foundation models like Malibu and powerful tools such as code completion engines, Poolside.ai accelerates software development while ensuring security and privacy—making it an ideal choice for regulated industries. In 2024, the company raised $400 million to fuel growth, enhance its technology, and expand its market reach. 4 Amount raised in 2024: €304M Electra is a leading European provider of fast-charging solutions for electric vehicles, committed to accelerating EV adoption by building a high-performance charging network across Europe. With a team of 160 experts and a strong focus on operational excellence, Electra strives to make EV charging as quick and convenient as refueling with petrol. Positioned at the crossroads of technology, infrastructure, and mobility, the company continuously innovates its services and partnerships to meet the demands of a rapidly evolving market. In January, Electra secured €304 million to support its goal of deploying 15,000 charging points across Europe by 2030. 5 HYSETCO is a pioneering startup dedicated to hydrogen mobility, supporting the transition to zero-emission transportation. In just three years, the company has built France’s first hydrogen distribution network and provides integrated hydrogen vehicle rental services. With rapid expansion, HYSETCO now distributes over 23 tons of hydrogen per month and manages a fleet of more than 550 hydrogen-powered vehicles, establishing itself as a leader in sustainable mobility. In 2024, HYSETCO partnered with clean hydrogen investor Hy24, secured nearly €200 million in funding to accelerate the adoption of sustainable transportation solutions. 6 Amount raised in 2024: $220M H Company is an artificial intelligence startup specializing in the development of advanced AI agents to enhance worker productivity. The company focuses on creating "frontier action models" that automate tasks traditionally performed by humans, aiming to improve efficiency across various industries. The company is committed to leveraging artificial intelligence to transform business processes, reduce manual workloads, and drive innovation in task automation and decision-making. In 2024, H Company secured $220 million in seed funding to advance its research and development efforts. 7 Amount raised in 2024: €173M Alan is a French company that started by providing health insurance to complement the national healthcare system, helping businesses offer coverage to their employees. By optimizing its insurance services, Alan delivers a seamless user experience, automating claim management for rapid reimbursements—sometimes within minutes. Over time, it has expanded its offerings to include doctor consultations, prescription glasses ordering, and preventive care resources for mental health and overall wellness, all accessible through its mobile app. The company also integrated AI to further enhance efficiency and productivity. In 2024, Alan secured a €173 million investment to support its continued growth. 8 Lockall is a company specializing in flexible storage solutions for individuals and businesses. The company provides hassle-free storage with no commitments or security deposits, ensuring convenience with parking, unloading areas, and handling tools. Security is a priority, with encrypted digital key access for seamless and safe entry. Lockall also offers “Maisons des Artisans,” dedicated spaces designed for artisans and entrepreneurs. These facilities combine storage, workshops, workspaces, and offices, fostering collaboration and business growth. The company has raised €155 million in 2024 to support its expansion and innovation. 9 Amount raised in 2024: $145M Pigment is a powerful financial planning and analysis platform that helps businesses make informed, data-driven decisions. With an intuitive and collaborative interface, Pigment allows teams to model, forecast, and visualize complex business data in real-time. By combining flexibility, ease of use, and advanced analytics, it streamlines financial processes, enhances performance, and supports strategic growth. Pigment secured $145 million in a Series D funding round in 2024, bringing its valuation to over $1 billion. 10

Poolside Frequently Asked Questions (FAQ)

When was Poolside founded?

Poolside was founded in 2023.

Where is Poolside's headquarters?

Poolside's headquarters is located at 9, Rue des Colonnes, Quartier Vivienne, 2nd Arrondissement, Paris.

What is Poolside's latest funding round?

Poolside's latest funding round is Series B.

How much did Poolside raise?

Poolside raised a total of $626M.

Who are the investors of Poolside?

Investors of Poolside include Redpoint Ventures, Felicis, Citi Ventures, Capital One Ventures, Schroders Capital and 20 more.

Loading...

Loading...