Plug and Play Ventures

Investments

2161Portfolio Exits

236Funds

4Partners & Customers

10About Plug and Play Ventures

Plug and Play Ventures is a global technology accelerator and venture fund. Plug and Play Ventures participates in Seed, Angel and Series A funding where they often co-invest with strategic partners. Through years of experience and as part of its network, the firm has put together a world-class group of serial entrepreneurs, strategic investors, and industry leaders who actively assist the firm with successful and growing investment portfolio.

Expert Collections containing Plug and Play Ventures

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Find Plug and Play Ventures in 2 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

56 items

Startups aiming work with retailers to improve brick-and-mortar retail operations.

Travel Technology (Travel Tech)

39 items

Tech-enabled companies offering services and products focused on tourism. This collection includes booking services, search platforms, on-demand travel and recommendation sites, among others.

Research containing Plug and Play Ventures

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plug and Play Ventures in 5 CB Insights research briefs, most recently on Oct 24, 2024.

Oct 24, 2024 report

Fintech 100: The most promising fintech startups of 2024

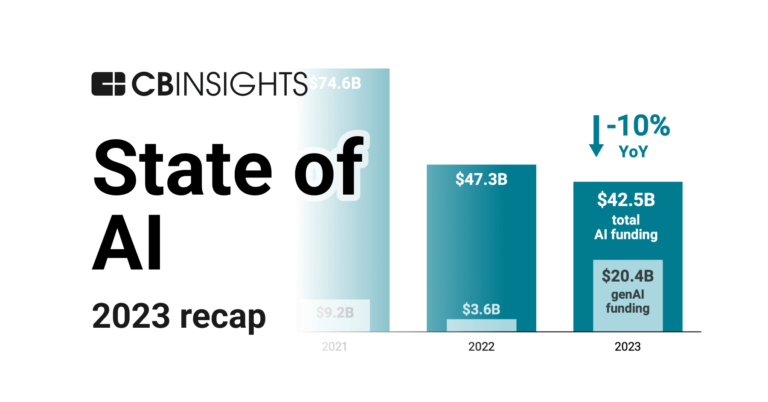

Feb 1, 2024 report

State of AI 2023 Report

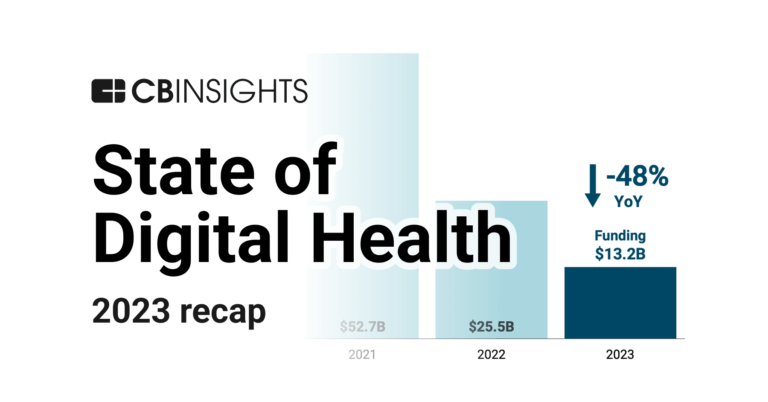

Jan 25, 2024 report

State of Digital Health 2023 Report

Jan 4, 2024 report

State of Venture 2023 ReportLatest Plug and Play Ventures News

Nov 6, 2024

Research Grid , a NYC-based AI startup that helps medical research institutions automate back-office admin for clinical trials, raised $6.5M in funding. The round was led by Fuel Ventures, with participation from Arve Capital, Ada Ventures, Morgan Stanley Inclusive Ventures Lab, Arāya Ventures, Ascension Ventures, Plug and Play Ventures, and Atomico Angels. The company intends to use the funds to invest in R&D, developing more AI automations and building out its engineering teams. They also plan to grow its marketing and sales functions as Research Grid expands its presence in US and Asian markets. Led by CEO and Founder Dr Amber Hill, Research Grid provides Inclusive, a patient recruitment and engagement platform offering instant access to a vetted network of more than 91,000 global communities covering 2,050 medical conditions. It also automates all the admin, such as patient outreach, payments, and data management. Its TrialEngine product, which connects with Inclusive, handles the administration, data, and reporting workflows during the trial itself. It leverages the company’s AI algorithms to automate tasks such as protocol generation and data extraction. FinSMEs

Plug and Play Ventures Investments

2,161 Investments

Plug and Play Ventures has made 2,161 investments. Their latest investment was in Fincart as part of their Pre-Seed - II on January 27, 2025.

Plug and Play Ventures Investments Activity

Date | Round | Company | Amount | New? | Co-Investors | Sources |

|---|---|---|---|---|---|---|

1/27/2025 | Pre-Seed - II | Fincart | Yes | Jedar Capital, Orbit Startups, Plus VC, and Undisclosed Investors | 1 | |

12/10/2024 | Seed VC - II | Concentro | $3M | Yes | 1 | |

11/19/2024 | Series A | ANAFLASH | No | 2 | ||

11/14/2024 | Seed VC | |||||

11/12/2024 | Seed VC |

Date | 1/27/2025 | 12/10/2024 | 11/19/2024 | 11/14/2024 | 11/12/2024 |

|---|---|---|---|---|---|

Round | Pre-Seed - II | Seed VC - II | Series A | Seed VC | Seed VC |

Company | Fincart | Concentro | ANAFLASH | ||

Amount | $3M | ||||

New? | Yes | Yes | No | ||

Co-Investors | Jedar Capital, Orbit Startups, Plus VC, and Undisclosed Investors | ||||

Sources | 1 | 1 | 2 |

Plug and Play Ventures Portfolio Exits

236 Portfolio Exits

Plug and Play Ventures has 236 portfolio exits. Their latest portfolio exit was Ion Mobility on January 16, 2025.

Date | Exit | Companies | Valuation Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model. | Acquirer | Sources |

|---|---|---|---|---|---|

1/16/2025 | Acquired | TVS Motor Company | 2 | ||

1/14/2025 | Acquired | 3 | |||

1/13/2025 | Acquired | SuperDial | 3 | ||

Date | 1/16/2025 | 1/14/2025 | 1/13/2025 | ||

|---|---|---|---|---|---|

Exit | Acquired | Acquired | Acquired | ||

Companies | |||||

Valuation | |||||

Acquirer | TVS Motor Company | SuperDial | |||

Sources | 2 | 3 | 3 |