Plaid

Founded Year

2013Stage

Series D - II | AliveTotal Raised

$734.8MRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-38 points in the past 30 days

About Plaid

Plaid is a fintech company that connects users to financial data and services. The company provides products that link users' financial accounts to applications, verify identities, and support secure money movement. Plaid's solutions include fraud prevention, credit underwriting, and personal finance insights. Plaid was formerly known as Plaid Technologies. It was founded in 2013 and is based in San Francisco, California.

Loading...

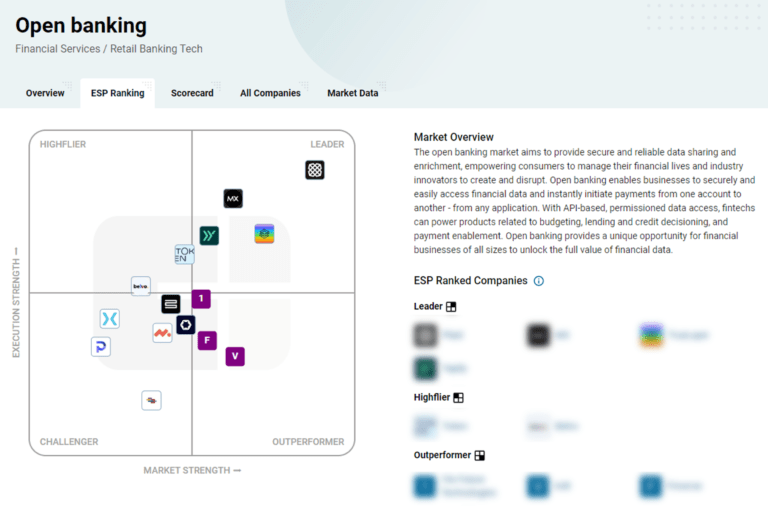

ESPs containing Plaid

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The lending APIs & infrastructure market provides end-to-end solutions for lending operations, including loan management systems, risk management tools, and compliance management capabilities. The market for lending APIs and infrastructure is driven by factors such as increasing demand for digital lending platforms, the need for improved efficiency and automation in lending operations, and the gro…

Plaid named as Leader among 15 other companies, including Mambu, Q2, and Cross River.

Plaid's Products & Differentiators

Transacttions

Retrieve typically 24 months of transaction data, including enhanced geolocation, merchant, and category information. Stay up-to-date by receiving notifications via a webhook whenever there are new transactions associated with linked accounts.

Loading...

Research containing Plaid

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Plaid in 17 CB Insights research briefs, most recently on Sep 27, 2024.

May 8, 2024

The embedded banking & payments market map

Jan 4, 2024

The core banking automation market map

Expert Collections containing Plaid

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Plaid is included in 8 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,258 items

Wealth Tech

2,335 items

Companies and startups in this collection digitize & streamline the delivery of wealth management. Included: Startups that offer technology-enabled tools for active and passive wealth management for retail investors and advisors.

Fintech 100

997 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,437 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Tech IPO Pipeline

825 items

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Plaid Patents

Plaid has filed 65 patents.

The 3 most popular patent topics include:

- data management

- payment systems

- banking technology

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

1/16/2024 | 11/19/2024 | Financial data vendors, Financial markets, Investment, Web crawlers, Business intelligence | Grant |

Application Date | 1/16/2024 |

|---|---|

Grant Date | 11/19/2024 |

Title | |

Related Topics | Financial data vendors, Financial markets, Investment, Web crawlers, Business intelligence |

Status | Grant |

Latest Plaid News

Jan 14, 2025

By PYMNTS | January 14, 2025 | Plaid’s revenue reportedly rose more than 25% in 2024 as more consumers encountered its tech. In fact, at least half of all Americans used the company’s services in some way, Bloomberg News reported Tuesday (Jan. 14), citing a source familiar with the matter. The report notes that the company’s growth occurred despite an otherwise harsh funding and borrowing environment for FinTechs after interest rates rose following the COVID pandemic. Use of Plaid’s identity verification product jumped more than 400% last year, the report said, while use of its payment product more than tripled. “There’s just this truly renewed sense of optimism going into 2025,” Plaid CEO Zach Perret told Bloomberg. “It’s way more fun to operate in FinTech spring than it was to operate in FinTech winter.” The report notes that banks — after years of only grudgingly working with FinTech rivals — have now seen the benefit of collaborating with the likes of Plaid as their customers seek financial products online. In fact, Plaid last year teamed with PNC to let that bank’s customers more securely share their data with third-party financial apps and services. The data access agreement between the companies allows PNC customers to safely and securely grant their financial data to Plaid-powered apps and services. Plaid, which recently opened a new office in Raleigh, North Carolina, said the number of banks that became customers surged by 50% last year, the Bloomberg report said. The news comes as the world of bank-FinTech partnerships faces some upheaval, as PYMNTS wrote last month, with the potential for a new regulatory regime in Washington. In an interview with PYMNTS’ Karen Webster on the topic, Ingo Payments CEO Drew Edwards said the main drivers prioritized by investors and startups in this space have been “the customer experience and customer acquisition.” The key strategy has focused on taking down barriers to growth while making it quick and easy to set up accounts, with less of a focus on the principles of safe banking . Companies that focus only on growth and customer acquisition have struggled, he said, while those focused on the tenets of safe banking will enjoy healthy customer acquisition. “The operating rules that keep you out of trouble and mean success versus failure are different now,” Edwards told PYMNTS, adding that “what’s changing are the rules around how banks play with FinTechs.” Recommended

Plaid Frequently Asked Questions (FAQ)

When was Plaid founded?

Plaid was founded in 2013.

Where is Plaid's headquarters?

Plaid's headquarters is located at San Francisco.

What is Plaid's latest funding round?

Plaid's latest funding round is Series D - II.

How much did Plaid raise?

Plaid raised a total of $734.8M.

Who are the investors of Plaid?

Investors of Plaid include American Express Ventures, J.P. Morgan Private Bank, Spark Capital, New Enterprise Associates, Andreessen Horowitz and 24 more.

Who are Plaid's competitors?

Competitors of Plaid include Solaris, Finix, Nymbus, Bud, Aeropay and 7 more.

What products does Plaid offer?

Plaid's products include Transacttions and 4 more.

Loading...

Compare Plaid to Competitors

Yapily is an open banking infrastructure platform that specializes in providing secure connectivity between customers and banks across Europe. The company offers services that enable access to financial data and the initiation of payments, aiming to facilitate the creation of personalized financial experiences. Yapily primarily serves industries such as payment services, i-gaming, accounting, lending and credit, crypto, property technology (PropTech), investing, and digital banking. Yapily was formerly known as Acacia Connect. It was founded in 2017 and is based in London, United Kingdom.

Railsr is a global embedded finance platform that operates within the financial services sector. The company provides financial services, including digital wallets, payment processing, and card issuance, all facilitated through API integration. Railsr's platform is designed to integrate into a brand's digital journey, offering rewards programs, loyalty points, and various types of cards. Railsr was formerly known as Railsbank. It was founded in 2016 and is based in London, United Kingdom.

Budget Insight focuses on open finance and embedded finance solutions. The company offers a range of services including instant money transfers, real-time revenue checking, automated bank identity verifications, and a platform for aggregating financial data from various institutions. Its services primarily cater to sectors such as banking, insurance, technology companies, and utilities. It was founded in 2012 and is based in Roubaix, France.

TrueLayer is an open banking platform that specializes in the financial services industry. The company offers a suite of products that enable instant bank payments, fast and verified payouts, streamlined user onboarding, and variable recurring payments, all designed to facilitate safer and more efficient financial transactions. TrueLayer primarily serves sectors such as e-commerce, gaming, financial services, travel, and cryptocurrency markets. TrueLayer was formerly known as Finport. It was founded in 2016 and is based in London, United Kingdom.

Fabrick is a open finance platform. The company offers payment solutions that enable and foster a fruitful exchange between players that discover, collaborate, and create solutions for end customers. Fabrick was founded in 2018 and is based in Biella, Italy.

Seyula.io is a technology company focused on the financial services sector. The company provides a unified banking API that allows customers to securely connect their bank accounts to various applications. Seyula.io primarily serves businesses in the lending, personal finance, consumer payments, banking & brokerage, and business finances sectors. It is based in United Arab Emirates.

Loading...