Pine Labs

Founded Year

1998Stage

Unattributed - IV | AliveTotal Raised

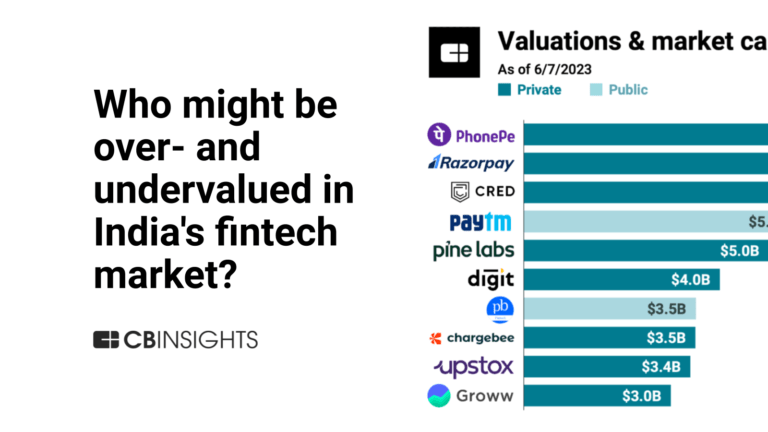

$1.127BValuation

$0000Last Raised

$50M | 3 yrs agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-21 points in the past 30 days

About Pine Labs

Pine Labs is a merchant platform that provides payment solutions across various business sectors. The company offers services, including in-store and online payment processing, customer loyalty programs, prepaid and gifting services, and analytics. Pine Labs serves sectors such as electronics, lifestyle, automobile, grocery, healthcare, and hospitality. It was founded in 1998 and is based in Noida, India.

Loading...

ESPs containing Pine Labs

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

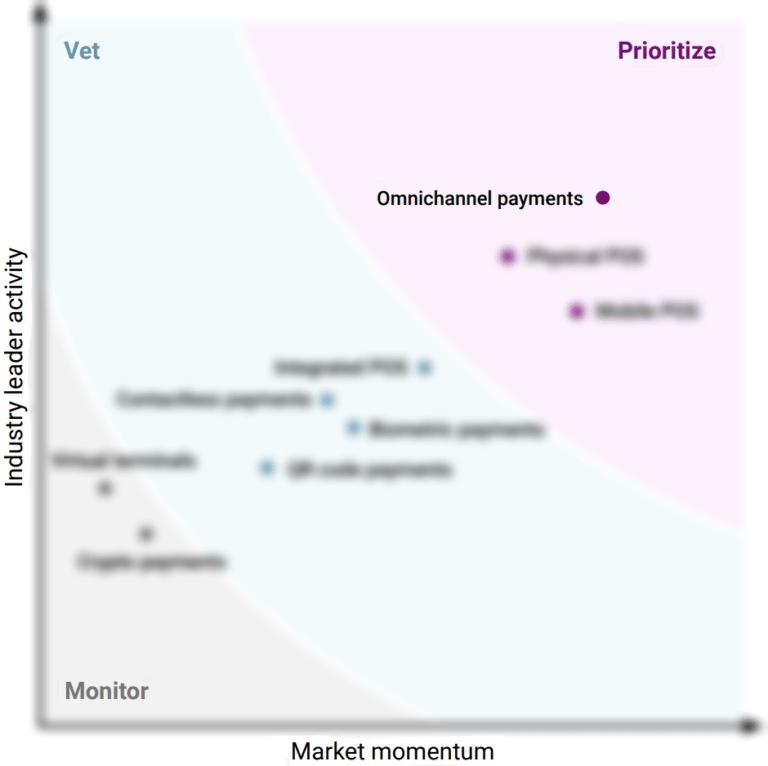

The omnichannel point-of-sale (POS) market, also called unified POS, provides integrated payment acceptance across digital and physical retail sales channels. These solutions provide the hardware and software to sync sales data, allowing for centralized transaction and inventory visibility. Some providers also offer customer service, shopper marketing, or sales analytics features. As more shopping…

Pine Labs named as Outperformer among 15 other companies, including Stripe, Fiserv, and Shopify.

Loading...

Research containing Pine Labs

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Pine Labs in 5 CB Insights research briefs, most recently on Jun 14, 2023.

May 20, 2022 report

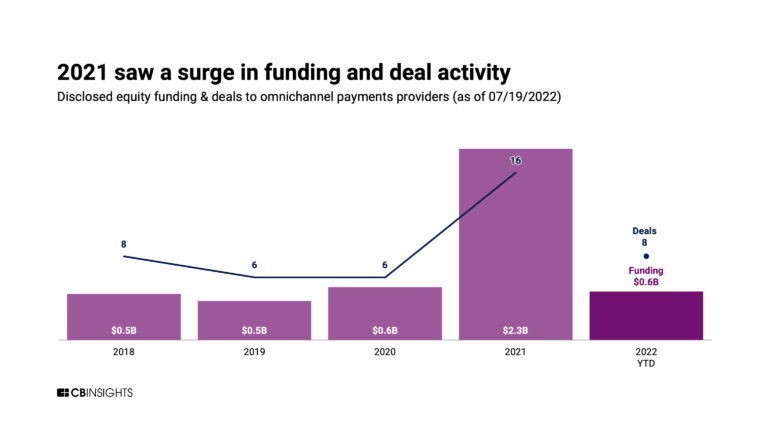

Why vendors are prioritizing omnichannel paymentsExpert Collections containing Pine Labs

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Pine Labs is included in 8 Expert Collections, including Store tech (In-store retail tech).

Store tech (In-store retail tech)

1,773 items

Companies that make tech solutions to enable brick-and-mortar retail store operations.

Unicorns- Billion Dollar Startups

1,257 items

SMB Fintech

1,648 items

Payments

3,281 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech 100

999 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Fintech

13,559 items

Excludes US-based companies

Latest Pine Labs News

Jan 2, 2025

Following last year's startup IPO frenzy, with 13 firms going public, the number of new-age public listings is expected to nearly double in 2025. This growth is expected across sectors, including fintech, e-commerce and quick commerce, logistics, and even edtech. Startup IPOs in 2025 After a series of successful public listings in 2024, the startup initial public offering (IPO) party is set to carry over into the new year, buoyed by healthy public market activity and the strong performance of already-listed startups. At least 25 new-age companies are expected to go public in 2025, according to a list compiled by Moneycontrol, a significant increase from 13 in 2024. Should all these listings materialise, it would mark the highest number of startup IPOs in a single calendar year, setting a new record. Story continues below Advertisement New-age companies like Ather Energy, ArisInfra, Avanse, Aye Finance, BoAt, Bluestone, Cardekho, Captain Fresh, DevX, Ecom Express and Fractal are likely to IPO in 2025. Infra.market, Innoviti, InCred, Indiqube, Ofbusiness, PhysicsWallah, PayU, Pine Labs, Ullu Digital, Shadowfax, Smartworks, Zappfresh, Zepto and Zetwerk are the others that are also likely to join the list. "We will probably see another 10-20 companies, or even more, go public from the startup ecosystem (in 2025),” Sandeep Singhal, co-founder and Managing Partner, WestBridge Capital, told Moneycontrol in an interview. "This will be the year of maturity. Today, there are maybe 15 venture-backed companies that are public. But when that number triples, and these companies start to show credible financials quarter-on-quarter, the whole ecosystem will get strengthened," he added. Related stories Last year, 13 startup IPOs collectively raised over over Rs 29,000 crore ($3.4 billion , with bumper listings from Swiggy, Ola Electric, and FirstCry. In 2025, the total fundraise amount is likely to increase further as more companies line up to tap the public markets. List of startup IPOs likely in 2025. This marks a notable recovery from the subdued years of 2022 and 2023, when just two and five startups, respectively, made their stock market debuts. As many as 10 of these newly-listed venture-backed IPOs have since been trading over their issue price, as realistic valuations have attracted retail investors, data showed. Story continues below Advertisement The biggest draws The largest IPOs of 2025 are expected to come from startups such as contract manufacturer Zetwerk , SoftBank-backed OfBusiness , and fintech unicorn Pine Labs , each looking to raise $1 billion. Quick commerce leader Zepto, construction materials platform Infra.market , AI unicorn Fractal , and edtech startup PhysicsWallah are also among the major IPOs expected, with each targeting around $500 million. The fintech sector is set to dominate the IPO landscape, with as many as six companies set to go public. Aye Finance and Avanse Financial Services have already filed their IPO papers, while PayU , Pine Labs, and InCred are expected to list later in the year. Investors suggest that IPO-bound companies that demonstrate strong financial performance – including profitability, strong governance, and market leadership – will have a distinct advantage in generating investor interest. “The path to an IPO has become more deterministic for startups, with a clear list of dos and don’ts for all to follow. Controlled burn, improving margins, greater operating cashflows, seasoned team members, disciplined forecasting and budgeting are hygiene factors for any startup looking to IPO,” said Siddarth Pai, Founding Partner, 3one4 Capital, an early-stage venture capital firm. While companies like Infra.market, Aye Finance, Fractal, and OfBusiness, have reported strong financials recently, firms including Ather Energy , and ArisInfra – which have witnessed flat growth and mounting losses – may have to do more before going ahead with their listing plans so they can be rewarded by public market investors. Other notable names headed for stock market debuts include logistics firms Ecom Express and Shadowfax, apart from brands like Bluestone, BoAt, and CarDekho. Given the success of smaller-scale IPOs in 2024, like that of Unicommerce, Mobikwik, and Awfis, and impressive small and medium enterprise (SME) listings from TAC Security and Menhood, companies headed for modest IPOs – such as Zappfresh, and Smartworks – may also find themselves doing well. Rise of pre-IPO rounds As startups head towards the public markets, pre-IPO funding and secondary transactions, which drove a big chunk of the funding growth in 2024, are set to rise in parallel. Several IPO-bound firms, including Zepto, PhysicsWallah, Rebel Foods, and Oyo, among others, raised large rounds last year . Pre-IPO rounds are typically priced at a discount compared to the IPO price, enabling investors to buy shares at a more favourable valuation, allowing for greater gains. Over the past year, these rounds have unlocked newer pools of capital for startups in the form of HNIs and family offices, say bankers. “Pre-IPO activity is likely to rise (in 2025), serving not just as a valuation benchmark but as a strategic opportunity for investors to pare stakes and optimize IPO size,” said said Gaurav Sood, Managing Director and Head – Equity Capital Markets, Avendus Capital. “These rounds are attracting new capital pools, with HNIs and family offices actively taking concentrated positions due to strong alpha generation, enhancing cap tables and reducing post-listing stock overhang,” he added. Pick-up in funding After strong public market activity buoyed funding activity among startups last year, funding is set to surpass the levels of 2024, as macroeconomic headwinds subside. Companies, whether IPO-bound or at an early stage, exhibiting improved financial performance will be able to raise funds, say investors. Industry watchers are of the view that India’s long-term macroeconomic stability will be a driving force behind venture capital and private equity investments in startups. “For patient capital, India offers a rare combination of systemic growth and a policy environment designed to amplify entrepreneurial activity, making it an essential locus for long-term investment strategies," said David Wilton, Chief Investment Officer (CIO) at homegrown investment firm Oister Global. Regardless, for new-age companies to keep up the current momentum, the key will be to concentrate on “building sustainable businesses while reducing the dependency on external capital,” said Pai. Invite your friends and family to sign up for MC Tech 3, our daily newsletter that breaks down the biggest tech and startup stories of the day DAILY-EVENING

Pine Labs Frequently Asked Questions (FAQ)

When was Pine Labs founded?

Pine Labs was founded in 1998.

Where is Pine Labs's headquarters?

Pine Labs's headquarters is located at Candor TechSpace, 4th & 5th Floor, Noida.

What is Pine Labs's latest funding round?

Pine Labs's latest funding round is Unattributed - IV.

How much did Pine Labs raise?

Pine Labs raised a total of $1.127B.

Who are the investors of Pine Labs?

Investors of Pine Labs include Vitruvian Partners, Alpha Wave Global, State Bank of India, Invesco, BlackRock and 24 more.

Who are Pine Labs's competitors?

Competitors of Pine Labs include Satispay, Klarna, Resal, Innoviti, Stripe and 7 more.

Loading...

Compare Pine Labs to Competitors

Stripe is a financial infrastructure platform that provides services for businesses to manage online and in-person payments. The company offers products including payment processing Application Programming Interface (APIs), payment tools, and solutions for handling subscriptions, invoicing, and financial reports. Stripe serves sectors such as ecommerce, Software as a Service (SaaS), platforms, marketplaces, and the creator economy. Stripe was formerly known as DevPayments. It was founded in 2010 and is based in South San Francisco, California.

PayNearMe develops technology to facilitate the end-to-end customer payment experience. It offers a billing and payment platform. Its platform helps users pay with cash for a range of goods and services from companies in e-commerce, property management, consumer finance, and transportation, enabling businesses and government agencies as well as retail stores to digitize cash collection processes. PayNearMe was formerly known as Handle Financial. The company was founded in 2009 and is based in Santa Clara, California.

TouchBistro focuses on providing an all-in-one point of sale (POS) and restaurant management system in the restaurant industry. The company offers a range of services, including front-of-house, back-of-house, and guest engagement solutions, which help restaurateurs streamline their operations, manage their menu, sales, staff, and more. Its services are designed to increase sales, improve guest experiences, and save time and money. It was founded in 2011 and is based in Toronto, Canada.

Lemonway is a payment institution that specializes in providing payment processing and wallet management solutions for marketplaces, crowdfunding platforms, and e-commerce websites. The institution offers a modular payment system that enables clients to handle transactions, from collection to disbursement, with a focus on KYC/AML regulatory compliance. Lemonway primarily serves the e-commerce industry, crowdfunding platforms, and other online marketplaces. It was founded in 2007 and is based in Paris, France.

ToneTag specializes in soundwave-based communication and payment technologies within the financial and retail sectors. The company offers a range of products that facilitate contactless payments, voice-assisted transactions, and sound-based data communication for businesses and customers, ensuring secure and convenient interactions. ToneTag's solutions cater to various business types, including grocery, food and beverage, and banking services, providing them with tools for in-store and online operations. It was founded in 2013 and is based in Bengaluru, India.

Klarna is a financial technology company that provides payment solutions and shopping services. The company offers price comparison, installment payments, and consumer financing for online shopping. Klarna serves the ecommerce industry, providing services to both consumers and retailers. It was founded in 2005 and is based in Stockholm, Sweden.

Loading...