PhotoRoom

Founded Year

2019Stage

Series B | AliveTotal Raised

$63.33MValuation

$0000Last Raised

$43M | 1 yr agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

+22 points in the past 30 days

About PhotoRoom

PhotoRoom specializes in artificial intelligence (AI) photo editing within the technology and photography sectors. The company offers a suite of tools that enable users to remove and change image backgrounds, retouch photos, and create visual content with ease. PhotoRoom primarily serves businesses in industries such as beauty, clothing, entertainment, furniture, and jewelry, providing solutions for ad asset creation and e-commerce. It was founded in 2019 and is based in Paris, France.

Loading...

PhotoRoom's Product Videos

ESPs containing PhotoRoom

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

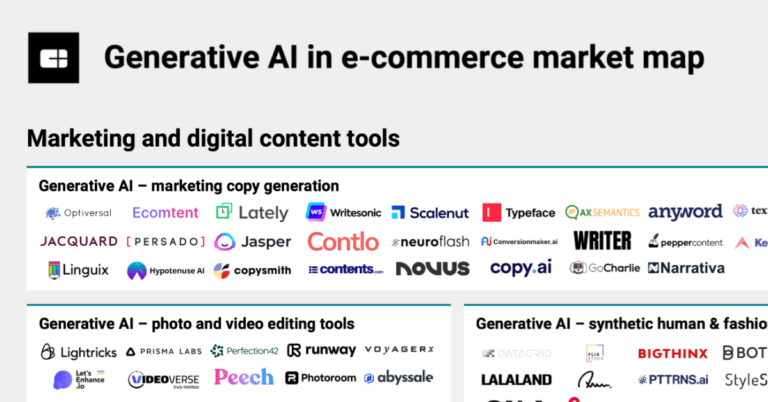

The generative AI — photo & video tools market utilizes machine learning algorithms to revolutionize the generating and editing processes. Vendors in this market offer tools that can automatically create images and videos, recover missing details, remove compression, increase image resolution, correct colors and tones, and process photos up to 10 times faster than traditional editing companies. Th…

PhotoRoom named as Leader among 10 other companies, including Runway, Pika, and Lightricks.

PhotoRoom's Products & Differentiators

Remove Background

PhotoRoom uses AI to automatically delete the background from your photo, allowing you to easily customize and edit your images.

Loading...

Research containing PhotoRoom

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned PhotoRoom in 4 CB Insights research briefs, most recently on Oct 17, 2024.

Oct 17, 2024

The generative AI for e-commerce market mapExpert Collections containing PhotoRoom

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

PhotoRoom is included in 3 Expert Collections, including Artificial Intelligence.

Artificial Intelligence

9,386 items

Companies developing artificial intelligence solutions, including cross-industry applications, industry-specific products, and AI infrastructure solutions.

Digital Content & Synthetic Media

1,771 items

The Digital Content collection includes companies that use technology to create, manage, and distribute digital content under all forms, including images, videos, audio, and text, among others.

Generative AI

1,298 items

Companies working on generative AI applications and infrastructure.

Latest PhotoRoom News

Jan 14, 2025

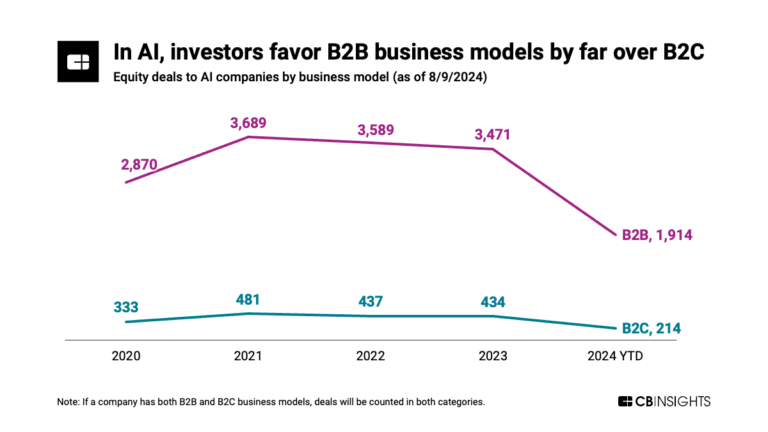

4:21 AM PST · January 14, 2025 Alex Dewez , a partner at 20VC , just released its highly anticipated State of the French tech ecosystem report. This is a nice followup to Atomico’s State of European Tech report, with a more granular view on French startups in particular. As a reminder, the bottom line of Atomico’s report is that European startups raised $45 billion in 2024 compared to $47 billion in 2023. That number is only down by $2 billion, but it represents a 50%+ drop compared to 2022 numbers . In France, the overarching themes are more or less similar. According to Dewez, with €7.1 billion in venture funding in 2024, that metric is slightly up compared to 2023 (€6.8 billion). However, in 2022, French startups raised as much as €11.8 billion. Of course, data on private companies vary from one source to another. For instance, according to EY and as reported by Les Échos , venture funding is slightly down in 2024 compared to 2023 (€7.8 billion vs. €8.3 billion). The bottom line is similar. Venture funding is more or less stable year over year, with artificial intelligence representing a bigger chunk of the total amount. There are two ways to look at it. The pessimistic take would be that if it weren’t for artificial intelligence, we would be in a startup funding slowdown. AI now represents 27% of the total funding amount in French startups. AI startups have raised 82% more money in 2024 compared to 2023. And non-AI funding is down 11% year over year. The optimistic take is that artificial intelligence represents the next big opportunity for startups, more tech funders choosing to focus on this vertical in particular. It’s possible that some AI founders would have started a non-AI startup in a different environment. The tech industry is made out of porous verticals, with many investors adopting an opportunistic approach without any specific investment vertical in mind. As a result of those metrics, France is still the third-largest tech ecosystem in Europe, behind the U.K. and Germany based on total funding amounts. However, as Germany is a more decentralized country, Paris is the second European city, ahead of Berlin and behind London. There are now 45 unicorns in France — although some of them are only unicorns on paper and might not keep that label for long. Three new startups joined the group in 2024 — accounting software startup Pennylane , business planning platform Pigment and AI-powered software dev tool Poolside . 2024 has also been a year of large-scale bankruptcies. Some companies that have been in trouble include Ynsect, Cubyn, Masteos, Luko and Cityscoot. The changing macroeconomic landscape has made it harder to raise growth rounds without a strong financial performance to justify the investment. In addition to Poolside, other promising AI startups based in France include foundation model maker Mistral AI , AI-based drug discovery companies Owkin and Aqemia , as well as AI applications PhotoRoom and Dust . Dewez believes there are a handful of late-stage companies that could be ready to go public because they generate more than $300 million in annual recurring revenue, grow by 20 to 30% year over year, and are profitable or about to become profitable. Companies that tick all those boxes include Back Market, Dataiku, Doctolib, Qonto and Content Square. And yet, just like in the U.K., France remains a tepid market when it comes to IPOs. Most French tech companies are likely to consider listing their companies in the U.S. But that sounds like a difficult task for companies that don’t already have customers in the U.S. (Doctolib and Qonto, for instance). When it comes to exits, while the total number of exits is down 14% year over year, Dewez believes that the total exit amount has remained stable for the past three years, hovering around €12 billion. One last interesting tidbit that could be worrisome for the next wave of startup founders, U.K. funds have been investing at a lower pace in French startups. It’s going to be interesting to see if this trend will have wider implications for the overall health of the French tech ecosystems in the coming years. Topics

PhotoRoom Frequently Asked Questions (FAQ)

When was PhotoRoom founded?

PhotoRoom was founded in 2019.

Where is PhotoRoom's headquarters?

PhotoRoom's headquarters is located at 12 Rue Charlot, Ile-de-France, Paris.

What is PhotoRoom's latest funding round?

PhotoRoom's latest funding round is Series B.

How much did PhotoRoom raise?

PhotoRoom raised a total of $63.33M.

Who are the investors of PhotoRoom?

Investors of PhotoRoom include Y Combinator, Balderton Capital, Aglae Ventures, Adjacent, FJ Labs and 10 more.

Who are PhotoRoom's competitors?

Competitors of PhotoRoom include Bria, Blend, Runway, Terra, MWM and 7 more.

What products does PhotoRoom offer?

PhotoRoom's products include Remove Background and 3 more.

Who are PhotoRoom's customers?

Customers of PhotoRoom include Wolt, Warner Bros, Selency and Campsider.

Loading...

Compare PhotoRoom to Competitors

Alpaca is a company that focuses on the intersection of artificial intelligence and art, operating within the technology and creative industries. The company offers a suite of AI tools designed to assist artists in their creative process, enabling them to generate images, refine concepts, and experiment with style and composition. Alpaca primarily serves the creative industry, particularly artists and designers. It is based in California, United States.

Let's Enhance provides AI-driven image enhancement and optimization within the technology sector. The company offers services, including photo upscaling, quality improvement, background removal, and image sharpening, along with tools for AI art generation and API solutions for businesses. Let's Enhance serves sectors that require quality imagery, such as e-commerce, printing, and creative professionals. It was founded in 2017 and is based in San Francisco, California.

Bria specializes in visual generative AI within the technology sector. The company offers a comprehensive solution for creating and modifying visuals, including foundation models, APIs, and web integration, all designed for commercial use. It primarily serves sectors such as digital content platforms, creative agencies and marketers, eCommerce and retail, and digital asset management platforms. It was founded in 2020 and is based in Tel Aviv, Israel.

Runway is an applied AI research company that focuses on advancing creativity within the art and entertainment sectors. The company offers a suite of creative tools powered by multimodal AI systems that facilitate the generation and manipulation of audiovisual content, making it accessible and empowering for storytellers and creatives. Runway primarily sells to the creative industry, offering solutions that enhance the capabilities of filmmakers, artists, and content creators. It was founded in 2018 and is based in New York, New York.

Topaz Labs develops software for photo and video editing. The company offers tools for denoising, sharpening, and upscaling images, as well as stabilizing and processing video content. Topaz Labs' products are used by photographers and videographers, including professionals in the tech, entertainment, and aerospace sectors. It was founded in 2006 and is based in Addison, Texas.

Neural Love is a company that focuses on artificial intelligence tools for creators and businesses across various sectors. The company's offerings include image generation and enhancement tools, as well as a collection of public domain images. It was founded in 2020 and is based in Harju maakond, Estonia.

Loading...