Papaya Global

Founded Year

2016Stage

Series D | AliveTotal Raised

$438.01MValuation

$0000Last Raised

$250M | 3 yrs agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-83 points in the past 30 days

About Papaya Global

Papaya Global operates as a financial technology company. The company offers a global payroll technology platform to automate payroll processes, ensuring compliance, and providing flexibility and security. It primarily serves global enterprises, helping them manage workforce spending and payments. It was founded in 2016 and is based in New York, New York.

Loading...

Papaya Global's Product Videos

ESPs containing Papaya Global

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

The global payroll market is a space that provides payroll processing and management services to organizations worldwide. It encompasses software solutions, outsourcing services, and consulting firms specializing in payroll functions. The market is driven by the increasing complexity of payroll regulations and the need for organizations to ensure compliance and accuracy in paying their employees. …

Papaya Global named as Outperformer among 15 other companies, including Automatic Data Processing, Deel, and Workday.

Papaya Global's Products & Differentiators

Papaya Onboarding

Automated onboarding experience. Frictionless for all employment models (Payroll, EOR, Contractors),Consolidate all workers onto one streamlined platform, capturing a system of record that enables payroll impact.

Loading...

Research containing Papaya Global

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Papaya Global in 11 CB Insights research briefs, most recently on Jan 3, 2024.

Nov 7, 2022

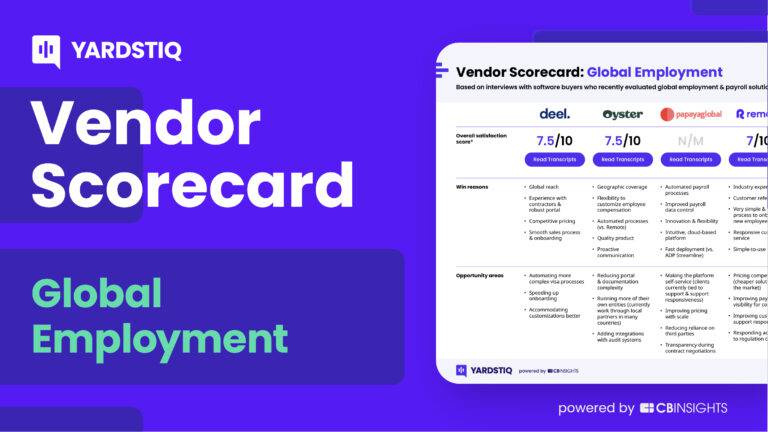

The Transcript from Yardstiq: See ya, ADP

Nov 7, 2022 report

Top global employment & payroll companies — and why customers chose themExpert Collections containing Papaya Global

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Papaya Global is included in 5 Expert Collections, including HR Tech.

HR Tech

5,910 items

The HR tech collection includes software vendors that enable companies to develop, hire, manage, and pay their workforces. Focus areas include benefits, compensation, engagement, EORs & PEOs, HRIS & HRMS, learning & development, payroll, talent acquisition, and talent management.

Unicorns- Billion Dollar Startups

1,257 items

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Fintech 100

749 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Papaya Global Patents

Papaya Global has filed 2 patents.

The 3 most popular patent topics include:

- honeycombs (geometry)

- house types

- light machine guns

Application Date | Grant Date | Title | Related Topics | Status |

|---|---|---|---|---|

9/28/2021 | 7/16/2024 | Light machine guns, House types, Technical drawing, Lomanotidae, Honeycombs (geometry) | Grant |

Application Date | 9/28/2021 |

|---|---|

Grant Date | 7/16/2024 |

Title | |

Related Topics | Light machine guns, House types, Technical drawing, Lomanotidae, Honeycombs (geometry) |

Status | Grant |

Latest Papaya Global News

Jan 2, 2025

TechBullion More and more companies are transitioning to remote work models. This shift brings numerous benefits, including access to a global talent pool and reduced overhead costs. However, managing a remote team introduces new challenges, particularly when it comes to payroll. Paying employees in different countries with varying regulations can become a complex, time-consuming process. Fortunately, payment platforms for remote teams are revolutionizing the way businesses handle global payroll. These platforms simplify the process and provide a seamless, efficient solution for paying employees worldwide . The Growing Need for Remote Team Payments Remote work has been on the rise for years, but it gained significant traction during the COVID-19 pandemic. Businesses that once operated in traditional office settings were forced to adopt remote work, and many have chosen to maintain these models. As a result, global teams have become more common. Employees are no longer confined to a specific location, and companies can hire talent from anywhere in the world. However, this expanded workforce creates payroll challenges. Different countries have different tax systems, currency requirements, and employment laws. Managing payroll across borders can lead to confusion and inefficiency, especially for companies without the proper tools. This is where payment platforms come in. These platforms enable businesses to pay their remote teams quickly, securely, and in compliance with local regulations, making them essential for modern companies. How Payment Platforms Simplify Global Payroll Payment platforms are designed to streamline payroll management for companies with international teams. These platforms offer several key benefits: Simplified Currency Conversion One of the biggest hurdles in paying remote teams is dealing with different currencies. A business might have employees in countries that use various currencies, and handling these conversions manually can be a daunting task. Payment platforms for remote teams make this process simple. They automatically convert payments into the local currency, ensuring that employees are paid the correct amount without any additional effort from the employer. This eliminates the need for manual conversions and minimizes the risk of errors. Compliance with Local Tax and Employment Laws Every country has its own set of tax regulations and employment laws. Managing compliance across borders is a complex task that requires an in-depth understanding of each jurisdiction’s requirements. Payment platforms help businesses navigate these complexities by staying up-to-date with the latest tax and legal changes in different countries. They automatically calculate tax withholdings, ensure that social security contributions are made, and generate the necessary paperwork for tax filings. This makes it easier for businesses to remain compliant, reducing the risk of legal issues. Faster Payments Remote teams often operate in different time zones, and waiting for international payments to clear can be frustrating. Traditional banking systems can take several days or even weeks to process cross-border payments. However, payment platforms for remote teams significantly speed up this process. These platforms offer faster payment solutions, allowing businesses to pay their employees promptly and efficiently. This ensures that remote workers are paid on time, enhancing job satisfaction and maintaining a positive relationship between employer and employee. Reduced Administrative Costs Managing payroll manually is a time-consuming and costly process. Without the right tools, businesses may need to hire payroll experts or dedicate a significant portion of their HR department’s time to processing payments. Payment platforms reduce these administrative costs by automating the payroll process. With features like automatic tax calculations, payment conversions, and direct deposits, businesses can reduce the need for manual intervention. This frees up time for HR teams to focus on other tasks, such as employee development and team engagement. Scalability As businesses grow, so does their payroll. What starts as a small team of remote workers can quickly expand to include employees from all over the world. Payment platforms are scalable, meaning they can handle payroll for companies of any size. Whether a business has five employees or 500, the platform can accommodate the growing payroll needs, ensuring that payments continue to be processed efficiently. This scalability makes payment platforms an ideal solution for businesses looking to expand their remote workforce. Key Features to Look for in Payment Platforms for Remote Teams When selecting a payment platform for remote teams, it’s important to consider several key features. These features can make the difference between an efficient, streamlined payroll process and one that’s riddled with issues. Here are some key features to look for: Global Reach The ideal payment platform should support payments in multiple countries and currencies. Since remote teams can be located anywhere, it’s crucial that the platform allows businesses to pay employees in diverse locations without complications. User-Friendly Interface A platform’s interface should be intuitive and easy to navigate. Complex systems can slow down payroll processing and lead to mistakes. A simple, user-friendly design ensures that HR teams can process payroll quickly and without unnecessary training. Automated Tax Compliance As mentioned earlier, staying compliant with local tax laws is essential. A good payment platform should automate tax calculations and filings, ensuring that businesses remain compliant with both local and international tax regulations. Security and Data Protection Security is a top concern when it comes to payroll and financial transactions. The payment platform should have strong security measures in place to protect sensitive employee information, such as bank details, tax IDs, and social security numbers. Look for platforms that offer encryption and secure data storage to ensure that your employees’ personal data is safe. Flexible Payment Methods Different employees may prefer different payment methods. Some may prefer bank transfers, while others may opt for digital wallets or even cryptocurrency. A flexible payment platform should allow employees to choose their preferred payment method, enhancing convenience and satisfaction. Customizable Reporting Customizable reports are essential for businesses that need to track payroll data, expenses, and tax filings. Look for platforms that offer customizable reports, allowing businesses to generate detailed reports that meet their specific needs. Popular Payment Platforms for Remote Teams Several payment platforms have emerged to address the growing need for seamless payroll processing for remote teams. Some of the most popular platforms include: Payoneer Payoneer is a well-known payment platform that offers global payment solutions. It allows businesses to send payments to contractors, employees, and vendors in over 200 countries. Payoneer supports multiple currencies and offers competitive exchange rates, making it a popular choice for companies with international teams. TransferWise (Wise) TransferWise, now known as Wise, is another payment platform that simplifies global payments. It offers transparent pricing and low transaction fees. Wise is known for its fast international payments, making it ideal for remote teams that need to receive payments quickly. Deel Deel is a comprehensive payment platform designed specifically for remote teams. It offers features such as automatic tax compliance, global payroll, and the ability to pay employees in over 90 countries. Deel also allows businesses to create customized contracts for remote employees, ensuring that both parties are clear on payment terms. Gusto Gusto is a cloud-based payroll platform that offers solutions for both small and large businesses. Gusto’s global payroll feature allows companies to manage international teams and ensure tax compliance across borders. With features like direct deposit, automated tax filings, and customizable reports, Gusto simplifies payroll processing for remote teams. Papaya Global Papaya Global is a cloud-based platform that offers end-to-end payroll solutions for remote teams. The platform supports over 140 countries and automates the payroll process, including tax calculations, compliance checks, and payment processing. Papaya Global also provides real-time reporting and analytics, making it easier for businesses to track payroll expenses and performance. Conclusion As remote work continues to shape the future of the workforce, businesses need efficient solutions to manage payroll for their global teams. Payment platforms designed for remote teams simplify the complexities of international payroll by automating tax compliance, currency conversions, and payment processing . These platforms help businesses save time, reduce administrative costs, and ensure that employees are paid promptly and accurately. By choosing the right payment platform, companies can focus on growing their remote teams and scaling their operations, knowing that their payroll is in good hands.

Papaya Global Frequently Asked Questions (FAQ)

When was Papaya Global founded?

Papaya Global was founded in 2016.

Where is Papaya Global's headquarters?

Papaya Global's headquarters is located at 1460 Broadway, New York.

What is Papaya Global's latest funding round?

Papaya Global's latest funding round is Series D.

How much did Papaya Global raise?

Papaya Global raised a total of $438.01M.

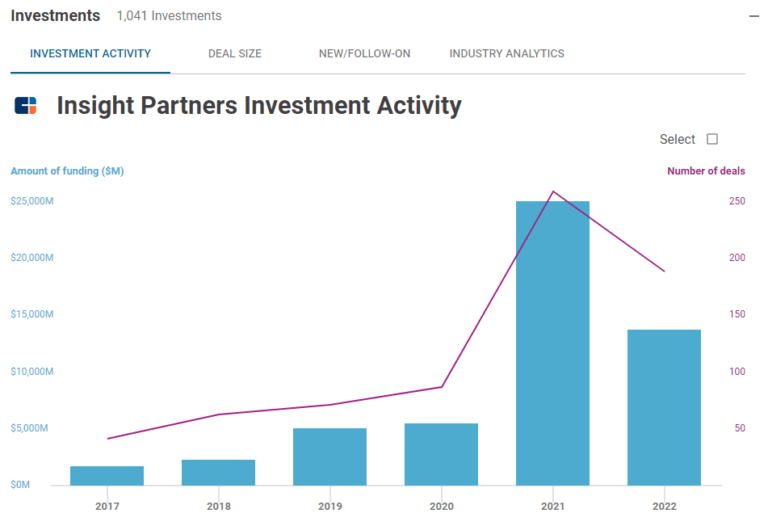

Who are the investors of Papaya Global?

Investors of Papaya Global include Insight Partners, Bessemer Venture Partners, Group 11, Scale Venture Partners, Workday Ventures and 14 more.

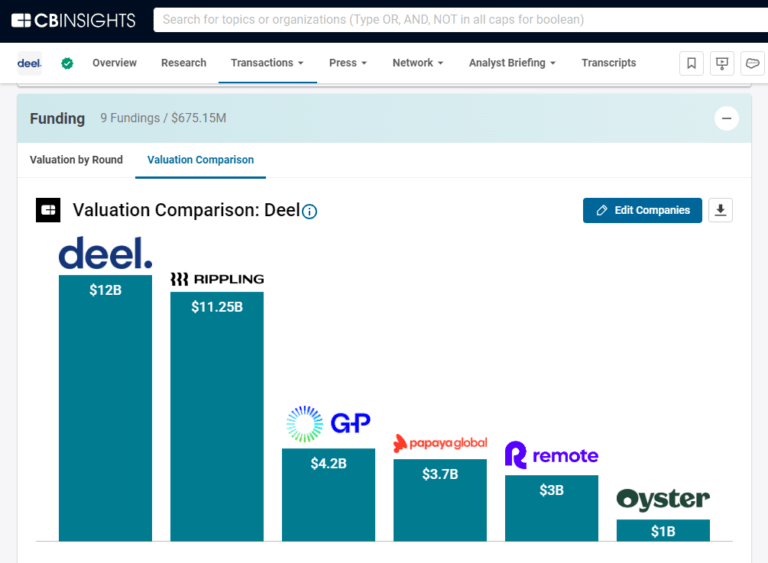

Who are Papaya Global's competitors?

Competitors of Papaya Global include Deel, Beamery, Rise, Factorial, Skuad and 7 more.

What products does Papaya Global offer?

Papaya Global's products include Papaya Onboarding and 4 more.

Loading...

Compare Papaya Global to Competitors

Remote is a global HR platform that specializes in providing comprehensive human resource solutions for distributed teams. The company offers services such as employer of record, contractor management, payroll processing, and HR management to facilitate the hiring, management, and payment of global teams. Remote also provides tools for talent acquisition and HR data consolidation, with a focus on ensuring global compliance and seamless integration with other systems. It was founded in 2019 and is based in Amsterdam, Netherlands.

Deel specializes in global payroll and HR solutions for businesses. The company offers services that assist with onboarding, compliance, and management of teams, including payroll processing, contractor management, HRIS integration, and immigration support. It serves sectors that require international workforce management, such as technology, finance, and professional services. Deel was formerly known as Lifeslice. It was founded in 2019 and is based in San Francisco, California.

Globalization Partners provides global employment solutions within the human resources and legal compliance sectors. The company offers services including employer of record (EOR) solutions, global payroll processing, and contractor management for international hiring and team management. Globalization Partners serves startups, mid-market companies, and enterprises. It was founded in 2012 and is based in Boston, Massachusetts.

Multiplier provides a workforce management platform. It offers payroll, employment, consulting, human resources, hiring, and other professional services. It also provides services for taxes, social contributions, and local insurance policies. The company was founded in 2020 and is based in Singapore.

Velocity Global develops human resource (HR) solutions. The company offers services such as hiring, payroll management, and employee benefits administration, all designed to facilitate the management of distributed teams. It also provides immigration services and office spaces, enabling businesses to expand and operate in multiple countries. It was founded in 2014 and is based in Denver, Colorado.

Gloroots provides comprehensive employment solutions. The company offers services such as global payroll management, contractor management, and employer of record services, which simplify the process of hiring and managing employees in different countries. Its services eliminate the need for businesses to establish local entities, thereby making it easier to employ international teams. It was founded in 2022 and is based in New York, New York.

Loading...