OneCard

Founded Year

2019Stage

Bridge | AliveTotal Raised

$261.52MValuation

$0000Last Raised

$25.5M | 3 mos agoRevenue

$0000Mosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-12 points in the past 30 days

About OneCard

OneCard specializes in offering a metal credit card with a focus in the financial services sector. The company provides a co-branded credit card that allows users to manage various aspects through a mobile app, including transaction limits and payment types, and offers a digital on-boarding process. OneCard's products are designed to cater to individual and family financial management needs, with features like shared credit limits and rewards on spending. It was founded in 2019 and is based in Pune, India.

Loading...

Loading...

Research containing OneCard

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned OneCard in 3 CB Insights research briefs, most recently on Jul 20, 2022.

Expert Collections containing OneCard

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

OneCard is included in 4 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

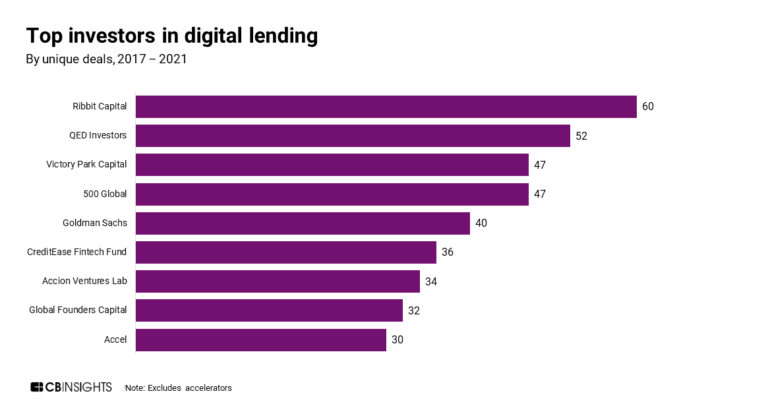

Digital Lending

2,334 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Payments

3,082 items

Companies in this collection provide technology that enables consumers and businesses to pay, collect, automate, and settle transfers of currency, both online and at the physical point-of-sale.

Fintech

13,559 items

Excludes US-based companies

Latest OneCard News

Jan 7, 2025

Five winners have been announced for solving a set of problem statements. FPL Technologies Pvt Ltd was judged the winner for coming out with a solution for real time prediction, detection and prevention of fraud in financial transactions using alternate sources of data including publicly available information. It came up with a solution called 'OneRadar'. It is an app which uses a visual colour-coded screen for alerting customers and capturing their feedback, a decision strategy model to process these signals and an expert platform to review feedback by humans and further enhance the model. The solu...

OneCard Frequently Asked Questions (FAQ)

When was OneCard founded?

OneCard was founded in 2019.

Where is OneCard's headquarters?

OneCard's headquarters is located at West Bay, Survey No. 278, Hissa No. 4/3 Pallod Farm, Phase II, Baner, Taluka Haveli Baner Gaon, Pune.

What is OneCard's latest funding round?

OneCard's latest funding round is Bridge.

How much did OneCard raise?

OneCard raised a total of $261.52M.

Who are the investors of OneCard?

Investors of OneCard include Peak XV Partners, Z47, QED Investors, Better Tomorrow Ventures, Alteria Capital and 10 more.

Who are OneCard's competitors?

Competitors of OneCard include Slice and 7 more.

Loading...

Compare OneCard to Competitors

Slice operates as a financial technology company. The company offers a digital prepaid account for everyday payments, a fast and simple way to make payments via credit or UPI. The company primarily serves the financial services industry. Slice was formerly known as Slice Pay. It was founded in 2016 and is based in Bengaluru, India.

Uni is a fintech company that focuses on redefining the credit card experience within the financial services industry. The company offers credit cards with features such as cashback rewards, zero foreign exchange markup, and a user-friendly mobile application for managing finances. Uni primarily serves the consumer finance sector with its innovative credit card solutions. It was founded in 2020 and is based in Bengaluru, India.

Stashfin is a financial services platform. It provides instant personal loans to borrowers in India. Stashfin offers a variety of repayment options, including equated monthly installments (EMIs), lump sum payments, and flexible repayments. Stashfin was founded in 2016 and is based in New Delhi, India.

KB NBFC serves as a financial services provider focused on credit solutions for students in India. The company offers a range of products, including financing for online purchases, loans for two-wheelers, and college tuition, as well as cash loans, all tailored to the needs of college students with flexible repayment options. It was founded in 2016 and is based in Bangalore, India.

CRED offers a members-only platform that offers financial and lifestyle progress for creditworthy individuals in the financial services sector. The company provides tools for managing credit cards, improving credit scores, and rewarding financial decisions with exclusive perks and privileges. CRED's services cater to individuals looking for secure financial management and lifestyle benefits. It was founded in 2018 and is based in Bengaluru, India.

CheQ operates a customer-first platform that focuses on improving the credit health of customers.The platform platform makes it easier for users to track, manage and make all their credit payments on one platform. It was founded in 2022 and is based in Bengaluru, India.

Loading...