Nubank

Founded Year

2013Stage

Corporate Minority - P2P - II | IPOTotal Raised

$2.547BMarket Cap

52.44BStock Price

11.28Revenue

$0000About Nubank

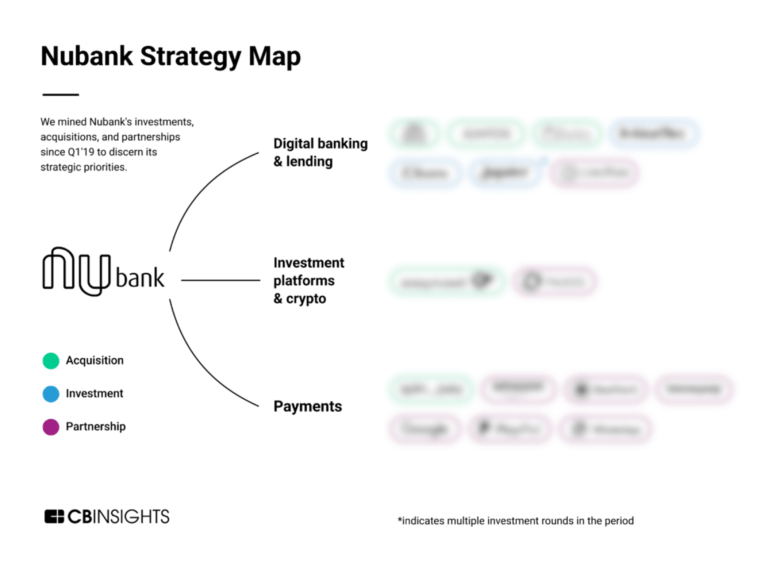

Nubank is a digital banking platform focusing on financial services for individuals and SMEs. The company offers products including credit cards, digital accounts, personal loans, investment options, and insurance. It was founded in 2013 and is based in Sao Paulo, Brazil.

Loading...

Loading...

Research containing Nubank

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Nubank in 9 CB Insights research briefs, most recently on Aug 7, 2023.

Expert Collections containing Nubank

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Nubank is included in 5 Expert Collections, including Fintech 100.

Fintech 100

998 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

Digital Lending

2,334 items

This collection contains companies that provide alternative means for obtaining a loan for personal or business use and companies that provide software to lenders for the application, underwriting, funding or loan collection process.

Conference Exhibitors

5,302 items

Fintech

13,559 items

Excludes US-based companies

Digital Banking

1,059 items

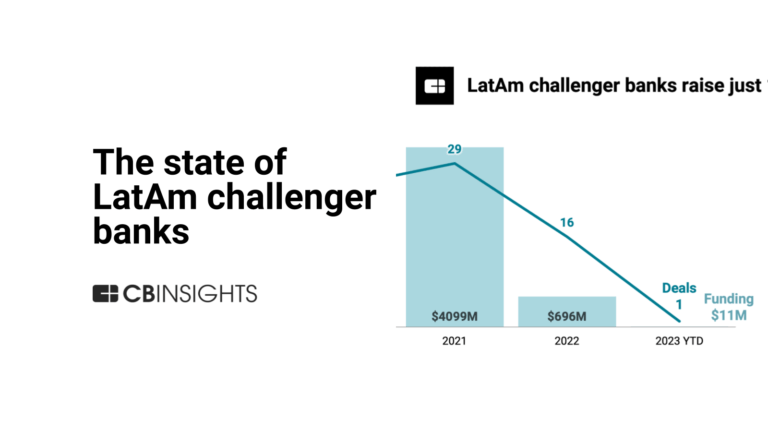

Challenger bank offer digitally native banking products (checking and savings account at the most basic) and either leverage partner banks or are fully-licensed banks themselves.

Latest Nubank News

Jan 16, 2025

AdvisorNet Financial Inc Increases Stock Position in Nu Holdings Ltd. (NYSE:NU) Posted by MarketBeat News on Jan 16th, 2025 AdvisorNet Financial Inc raised its holdings in shares of Nu Holdings Ltd. ( NYSE:NU – Free Report ) by 85.8% during the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 42,612 shares of the company’s stock after purchasing an additional 19,675 shares during the period. AdvisorNet Financial Inc’s holdings in NU were worth $441,000 at the end of the most recent quarter. A number of other institutional investors and hedge funds have also modified their holdings of NU. Massmutual Trust Co. FSB ADV grew its stake in shares of NU by 287.9% in the third quarter. Massmutual Trust Co. FSB ADV now owns 1,916 shares of the company’s stock worth $26,000 after acquiring an additional 1,422 shares during the period. Carolina Wealth Advisors LLC bought a new stake in NU in the 3rd quarter worth approximately $44,000. Toth Financial Advisory Corp purchased a new stake in NU during the 3rd quarter valued at $55,000. GAMMA Investing LLC lifted its holdings in shares of NU by 81.9% during the 3rd quarter. GAMMA Investing LLC now owns 4,119 shares of the company’s stock valued at $56,000 after buying an additional 1,855 shares during the period. Finally, Huntington National Bank boosted its stake in shares of NU by 86.3% in the 3rd quarter. Huntington National Bank now owns 4,601 shares of the company’s stock worth $63,000 after buying an additional 2,131 shares during the last quarter. Institutional investors own 84.02% of the company’s stock. Get NU alerts: Wall Street Analyst Weigh In NU has been the subject of a number of research reports. Susquehanna upped their price objective on NU from $16.00 to $18.00 and gave the company a “positive” rating in a research report on Thursday, November 14th. KeyCorp upped their price target on shares of NU from $15.00 to $17.00 and gave the company an “overweight” rating in a research report on Thursday, November 14th. Itau BBA Securities downgraded shares of NU from an “outperform” rating to a “market perform” rating in a report on Thursday, November 14th. Citigroup cut shares of NU from a “neutral” rating to a “sell” rating and reduced their target price for the company from $14.60 to $11.00 in a report on Monday, December 2nd. Finally, The Goldman Sachs Group lifted their price target on shares of NU from $17.00 to $19.00 and gave the stock a “buy” rating in a research note on Thursday, November 14th. One analyst has rated the stock with a sell rating, four have assigned a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat, NU presently has an average rating of “Hold” and a consensus target price of $15.63. Want More Great Investing Ideas? NU Stock Up 4.7 % Shares of NU stock opened at $11.42 on Thursday. The company has a market capitalization of $54.43 billion, a price-to-earnings ratio of 31.72, a PEG ratio of 0.59 and a beta of 1.05. The company has a debt-to-equity ratio of 0.20, a current ratio of 0.44 and a quick ratio of 0.44. The company’s fifty day moving average price is $12.28 and its 200-day moving average price is $13.19. Nu Holdings Ltd. has a one year low of $8.51 and a one year high of $16.15. About NU Nu Holdings Ltd. provides digital banking platform and digital financial services in Brazil, Mexico, Colombia, and internationally. It offers Nu credit and debit cards; Ultraviolet credit and debit cards; and mobile payment solutions for NuAccount customers to make and receive transfers, pay bills, and make everyday purchases through their mobile phones. Further Reading

Nubank Frequently Asked Questions (FAQ)

When was Nubank founded?

Nubank was founded in 2013.

Where is Nubank's headquarters?

Nubank's headquarters is located at Rua Capote Valente, 39, Sao Paulo.

What is Nubank's latest funding round?

Nubank's latest funding round is Corporate Minority - P2P - II.

How much did Nubank raise?

Nubank raised a total of $2.547B.

Who are the investors of Nubank?

Investors of Nubank include SoftBank Latin America Fund, Berkshire Hathaway, Sequoia Capital, Sands Capital, MSA Capital and 27 more.

Who are Nubank's competitors?

Competitors of Nubank include Agibank, Uala, Albo, Sicredi, Neon and 7 more.

Loading...

Compare Nubank to Competitors

Neon is a fintech company that provides digital banking services. The company offers a digital account, a credit card, CDBs, personal loans, and rewards, which can be accessed through a mobile application. Neon serves individual consumers and microentrepreneurs with its products. Neon was formerly known as ControlY. It was founded in 2016 and is based in Sao Paulo, Brazil.

Banco Original specializes in providing digital banking services for both individual and corporate clients. The bank offers a range of financial products including online account opening, personalized credit solutions, and specialized services for the agribusiness sector. It caters to large enterprises and the agricultural industry with tailored financial services and support. It was founded in 2001 and is based in Sao Paulo, Brazil.

Uala is a financial technology company operating in the digital payment services sector. It offers a mobile application that allows users to manage their finances by purchasing, transferring, investing, and earning interest on their funds. Uala primarily serves consumers looking for financial services. It was founded in 2017 and is based in Caba, Argentina.

Agibank is a financial institution that operates in the banking sector. The company offers a range of financial services including personal loans, consigned loans, and investment services, all designed to facilitate the economic lives of its customers. It primarily serves individuals, offering solutions for various financial needs. It was founded in 1999 and is based in Campinas, Brazil.

Klar is a financial services company that offers credit card services, personal savings, and investment products. The company provides credit cards with no annual fees, savings accounts with daily growth, and flexible investment options with competitive returns. Klar's offerings are designed to cater to individuals seeking accessible financial products and tools for managing their finances. It was founded in 2019 and is based in Mexico City, Mexico.

Bnext operates as a financial technology company that offers a range of financial management services. The company provides an online banking platform with features such as international money transfers, virtual cards, expense tracking, and a marketplace for various financial products. Bnext also supports cryptocurrency transactions and integrates with mobile payment services. It was founded in 2016 and is based in Madrid, Spain.

Loading...