Next Insurance

Founded Year

2016Stage

Series F | AliveTotal Raised

$1.146BLast Raised

$265M | 1 yr agoMosaic Score The Mosaic Score is an algorithm that measures the overall financial health and market potential of private companies.

-4 points in the past 30 days

About Next Insurance

Next Insurance focuses on providing insurance services, specifically tailored to the needs of small businesses. The company offers a range of insurance products, including general liability insurance, workers’ compensation insurance, professional liability insurance, commercial auto insurance, and commercial property insurance, among others. The company primarily serves sectors such as retail, food and beverage, construction, consulting, education, entertainment, fitness, financial services, real estate, and more. It was founded in 2016 and is based in Palo Alto, California.

Loading...

ESPs containing Next Insurance

The ESP matrix leverages data and analyst insight to identify and rank leading companies in a given technology landscape.

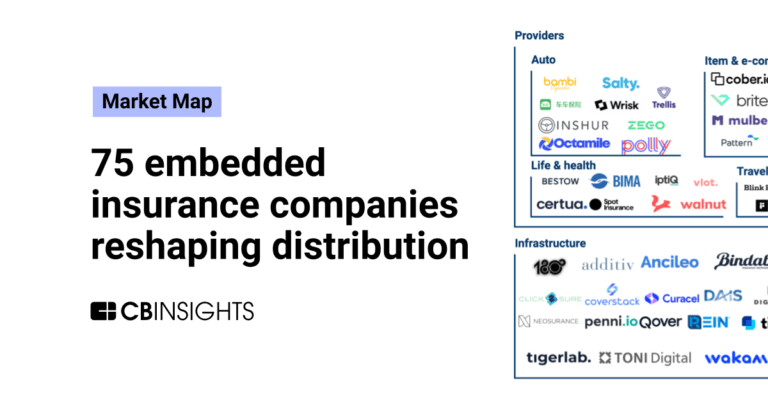

The full-stack insurtech carriers — commercial lines property & casualty market comprises insurtech carriers that underwrite commercial property & casualty (P&C) insurance. These lines of business may include (but are not limited to) cyber, errors & omissions, general liability, property, and workers’ compensation. As with established carriers, insurtech carriers will typically also be licensed by…

Next Insurance named as Leader among 6 other companies, including Coalition, Cowbell Cyber, and At-Bay.

Next Insurance's Products & Differentiators

General Liability

General liability insurance, also known as commercial general liability (CGL), covers the risks that affect almost every business, no matter what your industry. It is the most common insurance for small businesses and self-employed professionals, and it’s typically the first policy purchased by new businesses.

Loading...

Research containing Next Insurance

Get data-driven expert analysis from the CB Insights Intelligence Unit.

CB Insights Intelligence Analysts have mentioned Next Insurance in 8 CB Insights research briefs, most recently on Aug 28, 2024.

Aug 28, 2024 report

Insurtech 50: The most promising insurtech startups of 2024

Feb 23, 2024

The B2C US insurtech market map

Feb 9, 2024 report

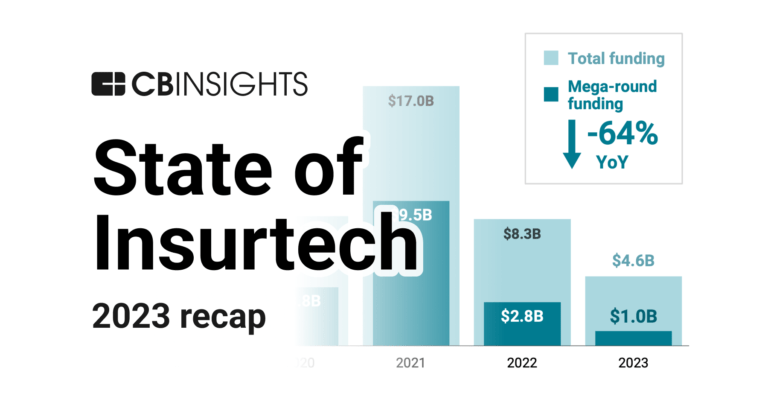

State of Insurtech 2023 Report

Oct 4, 2022 report

The Fintech 250: The most promising fintech companies of 2022Expert Collections containing Next Insurance

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

Next Insurance is included in 9 Expert Collections, including Unicorns- Billion Dollar Startups.

Unicorns- Billion Dollar Startups

1,257 items

Fintech 100

1,247 items

250 of the most promising private companies applying a mix of software and technology to transform the financial services industry.

SMB Fintech

1,586 items

Insurtech

4,417 items

Companies and startups that use technology to improve core and ancillary insurance operations. Companies in this collection are creating new product architectures, improving underwriting models, accelerating claims and creating a better customer experience

Tech IPO Pipeline

282 items

Track and capture company information and workflow.

Fintech

9,394 items

Companies and startups in this collection provide technology to streamline, improve, and transform financial services, products, and operations for individuals and businesses.

Latest Next Insurance News

Dec 2, 2024

TechBullion In the rapidly evolving world of entrepreneurship, small business owners face a myriad of challenges daily. Among these, securing the right insurance coverage stands out as a critical yet often complicated task. Next Insurance is reshaping this narrative by offering a seamless, tailored, and technology-driven approach to small business insurance. A New Approach to Business Insurance Traditional insurance models often involve lengthy paperwork, confusing jargon, and prolonged waiting periods. Next Insurance breaks away from this outdated mold by providing an entirely online platform where business owners can obtain quotes, purchase policies, and manage their coverage with ease. This digital-first approach not only saves time but also enhances transparency throughout the insurance process. Tailored Coverage for Diverse Industries One size does not fit all, especially in insurance. Next Insurance understands that each business has unique needs and risks. Whether you’re a personal trainer, a photographer, a contractor, or run a cleaning service, Next Insurance offers customized policies that cater specifically to your industry. This specialization ensures that you pay only for the coverage you need, without unnecessary add-ons that inflate costs. Simplified Policy Management Gone are the days of sifting through piles of documents to find your insurance details. With Next Insurance, all your policy information is accessible through a user-friendly online portal. Need to provide proof of insurance to a client or update your coverage? It can be done instantly, from anywhere, at any time. This level of accessibility empowers business owners to stay on top of their insurance needs without the hassle. Competitive and Transparent Pricing Affordability is a key concern for small businesses. Next Insurance addresses this by offering competitive rates without sacrificing the quality of coverage. Their transparent pricing model ensures there are no hidden fees or surprise charges. By leveraging technology to streamline operations, they pass the savings onto customers, making comprehensive insurance more accessible than ever. Exceptional Customer Support While Next Insurance excels in digital convenience, they haven’t overlooked the importance of human interaction. Their customer support team is readily available to assist with any questions or concerns. Whether you prefer email, phone, or live chat, knowledgeable representatives are on hand to provide personalized assistance, ensuring you feel supported every step of the way. Streamlined Claims Process Filing a claim can be a stressful experience. Recognizing this, Next Insurance has developed a straightforward claims process designed to minimize stress and expedite resolutions. Claims can be filed online with just a few clicks, and dedicated claims professionals work diligently to process them promptly. This efficiency helps business owners get back on track quickly after an unforeseen event. Building Trust Through Innovation Next Insurance is more than just an insurance provider; they’re a partner invested in the success of your business. By embracing innovation and prioritizing customer needs, they have built a reputation for reliability and trustworthiness. Their commitment to continuous improvement means they are always seeking new ways to enhance their services and support small businesses effectively. The Future of Small Business Insurance As the business landscape continues to change, insurance needs will evolve alongside it. Next Insurance is at the forefront of this evolution, offering solutions that are not only relevant today but are adaptable for the future. Their emphasis on technology, customization, and customer service positions them as a leader in the small business insurance sector. Discover How Next Insurance Can Support Your Business Protecting your business doesn’t have to be complicated or costly. If you’re seeking an insurance provider that understands the unique challenges of small businesses and offers tailored, affordable solutions, it’s time to explore what next insurance has to offer.

Next Insurance Frequently Asked Questions (FAQ)

When was Next Insurance founded?

Next Insurance was founded in 2016.

Where is Next Insurance's headquarters?

Next Insurance's headquarters is located at 975 California Avenue, Palo Alto.

What is Next Insurance's latest funding round?

Next Insurance's latest funding round is Series F.

How much did Next Insurance raise?

Next Insurance raised a total of $1.146B.

Who are the investors of Next Insurance?

Investors of Next Insurance include Allstate Strategic Ventures, Allianz X, Mitsui Sumitomo Insurance, Group 11, Zeev Ventures and 16 more.

Who are Next Insurance's competitors?

Competitors of Next Insurance include Amwins, Vouch, Thimble, Superscript, Pie Insurance and 7 more.

What products does Next Insurance offer?

Next Insurance's products include General Liability and 4 more.

Loading...

Compare Next Insurance to Competitors

Pie Insurance operates a platform for workers' compensation insurance. It matches price with risk across a broad spectrum of small business types that offer sustainable insurance to small business owners. The company was founded in 2017 and is based in Washington, District of Columbia.

Nationwide Mutual Insurance Company operates as a diversified insurance and financial services organization. The company offers a range of insurance products including vehicle, property, personal, and business insurance, as well as financial services such as retirement plans, annuities, and mutual funds. Nationwide primarily serves individuals and businesses seeking insurance and financial planning solutions. Nationwide Mutual Insurance Company was formerly known as Farm Bureau Mutual Automobile Insurance Company. It was founded in 1926 and is based in Columbus, Ohio.

AmTrust Financial Services is a multinational property and casualty insurance company with a focus on small commercial business insurance, specialty risk and extended warranty, and specialty middle-market property and casualty program insurance. The company offers a range of insurance products including workers' compensation, businessowners policy, commercial package, cyber insurance, and general liability. AmTrust serves various industries such as auto repair, contractors, financial institutions, healthcare, and retail, among others. It was founded in 1998 and is based in New York, New York.

Frontline Insurance provides home and commercial property insurance. The company offers insurance solutions focused on state-specific coverage options. Frontline Insurance serves coastal homeowners and commercial property owners in the Southeast United States. It was founded in 1998 and is based in Lake Mary, Florida.

Galaxy Finco operates as a special-purpose entity. The Company was formed for the purpose of issuing debt securities, repaying existing credit facilities, refinancing indebtedness, and for acquisition purposes. The company was founded in 2013 and is based in Jersey, United Kingdom.

Liberty Mutual Insurance is a provider of insurance products and services in the property and casualty insurance sector. The company offers personal and commercial insurance, including automobile, homeowners, renters, and business insurance. Additionally, Liberty Mutual provides life, pet, flood, and identity theft protection insurance. Liberty Mutual Insurance was formerly known as Massachusetts Employees Insurance Association. It was founded in 1912 and is based in Boston, Massachusetts.

Loading...